Small businesses need key documents such as purchase orders, delivery receipts, and client contracts to create legal invoices. Including detailed information like business name, contact details, invoice number, date, itemized list of products or services, payment terms, and tax information ensures compliance. Proper documentation helps avoid disputes and facilitates smooth payment processing.

What Documents Does a Small Business Need to Create Legal Invoices?

| Number | Name | Description |

|---|---|---|

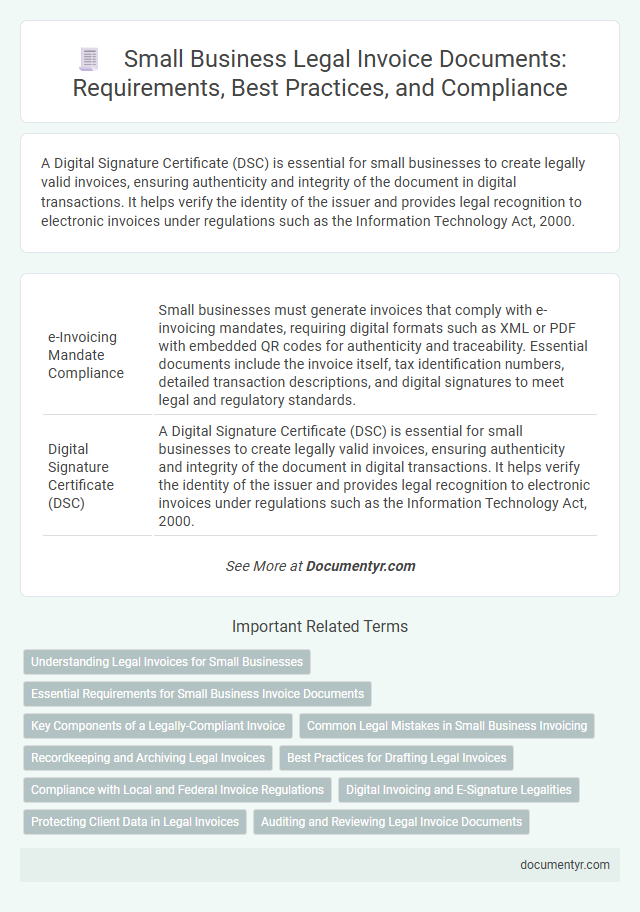

| 1 | e-Invoicing Mandate Compliance | Small businesses must generate invoices that comply with e-invoicing mandates, requiring digital formats such as XML or PDF with embedded QR codes for authenticity and traceability. Essential documents include the invoice itself, tax identification numbers, detailed transaction descriptions, and digital signatures to meet legal and regulatory standards. |

| 2 | Digital Signature Certificate (DSC) | A Digital Signature Certificate (DSC) is essential for small businesses to create legally valid invoices, ensuring authenticity and integrity of the document in digital transactions. It helps verify the identity of the issuer and provides legal recognition to electronic invoices under regulations such as the Information Technology Act, 2000. |

| 3 | QR Code Invoice Authentication | Small businesses need essential documents such as a valid business registration certificate, tax identification number, and bank account details to create legal invoices, while incorporating QR code invoice authentication ensures secure verification and compliance with tax authorities. Integrating QR codes enhances invoice traceability, reduces fraud risk, and streamlines payment processing for seamless financial transactions. |

| 4 | GST-Compliant Invoice Templates | Small businesses need GST-compliant invoice templates that include essential details such as the supplier's GSTIN, invoice number, date of issue, customer details, description of goods or services, HSN or SAC codes, taxable value, GST rates, and total tax amount to ensure legal validity. These documents must conform to government regulations to facilitate accurate tax filing and input credit claims under the Goods and Services Tax system. |

| 5 | Automated Invoice Metadata | Small businesses need automated invoice metadata including invoice number, issue date, payment terms, and tax identification details to create legally compliant invoices efficiently. Incorporating standardized data elements like customer information, itemized services or products, and total amount ensures accuracy and facilitates seamless accounting and tax reporting. |

| 6 | Peer-to-Peer Invoice Validation | Small businesses need legally compliant invoices that include essential details like seller and buyer information, itemized services or products, prices, taxes, and payment terms to enable peer-to-peer invoice validation. This process relies on standardized invoice formats and digital signatures to authenticate transactions, prevent fraud, and ensure accurate record-keeping for both parties involved. |

| 7 | Real-Time Invoice Tracking ID | A real-time invoice tracking ID is essential for small businesses to monitor the status of each invoice, ensuring accurate payment records and timely follow-ups. This unique identifier links the invoice to documentation such as purchase orders, delivery confirmations, and payment receipts, supporting legal compliance and efficient financial management. |

| 8 | Structured Invoice Data Schema | Small businesses need to include structured invoice data schema elements such as invoice number, date, buyer and seller information, itemized list of goods or services, quantities, prices, taxes, and total amount due to ensure legal compliance and facilitate automated processing. Incorporating standardized fields like payment terms, currency, and tax identification numbers in the invoice schema enhances accuracy, traceability, and interoperability with accounting software and regulatory systems. |

| 9 | Invoice Reference Number (IRN) | A Small Business requires an Invoice Reference Number (IRN) generated through the government-approved GST portal or authorized API to create legally valid invoices, ensuring compliance with tax regulations. This unique IRN verifies the invoice's authenticity and helps maintain accurate financial records for audit and reporting purposes. |

| 10 | API-Enabled Invoice Integration | Small businesses need a combination of purchase orders, sales agreements, and client contact details to create legal invoices, while API-enabled invoice integration streamlines the process by automatically pulling data from accounting software and payment systems. Leveraging APIs ensures accurate, real-time synchronization of invoice information, reducing administrative errors and accelerating payment cycles. |

Understanding Legal Invoices for Small Businesses

Understanding legal invoices is essential for small businesses to ensure proper billing and compliance. Legal invoices serve as formal requests for payment that contain specific documentation required by law.

- Business Information - Your company's name, address, and contact details must be clearly stated to identify the invoice source.

- Client Details - The invoice should include the client's name, address, and contact information for accountability.

- Invoice Number and Date - Unique invoice numbers and issue dates are critical for record-keeping and legal tracking.

Maintaining these documents helps you create legally sound invoices that protect your business and streamline financial processes.

Essential Requirements for Small Business Invoice Documents

Creating legal invoices requires specific documents to ensure compliance and clarity. Proper documentation supports your business's financial accuracy and legal protection.

- Business Registration Details - You need official business registration documents to validate the legitimacy of your invoices.

- Tax Identification Number - Include your tax ID to comply with tax regulations and facilitate proper reporting.

- Client Information - Accurate client details are essential for invoice validation and record-keeping.

Key Components of a Legally-Compliant Invoice

Creating a legal invoice requires specific documents that ensure compliance with financial regulations. Small businesses must prepare detailed and accurate records to support each transaction.

Key components of a legally-compliant invoice include the business name, address, and contact details. The invoice must also feature a unique invoice number and the date of issue for proper identification.

The description of goods or services provided is essential, along with the quantity and unit price. Including the total amount due, applicable taxes, and payment terms ensures clarity for both parties.

Additional mandatory elements include the buyer's information and the seller's tax identification number. Clear payment instructions and due dates help avoid disputes and facilitate timely payments.

Common Legal Mistakes in Small Business Invoicing

Creating legal invoices requires key documents such as a purchase order, a detailed invoice template, and proof of delivery. Common legal mistakes in small business invoicing include missing tax identification numbers, unclear payment terms, and lack of proper authorization signatures. Ensuring your invoices contain these elements helps avoid disputes and legal complications.

Recordkeeping and Archiving Legal Invoices

| Document Type | Description | Importance for Recordkeeping |

|---|---|---|

| Invoice Template | Standardized format including business name, contact details, itemized list of services or products, prices, taxes, and total amount due. | Ensures consistency and legal compliance across all invoices issued. |

| Purchase Orders | Documents issued by clients authorizing the purchase, detailing quantity and agreed prices. | Supports verification of transaction authenticity and prevents billing disputes. |

| Payment Receipts | Proof of payment from customers confirming receipt of funds. | Essential for reconciling invoices and financial records. |

| Delivery Notes | Records confirming the delivery of goods or completion of services. | Verifies fulfillment of contractual obligations linked to invoicing. |

| Customer Correspondence | Emails, letters, or messages documenting communication about invoice terms and disputes. | Provides legal evidence in case of disagreements or audits. |

| Archiving System | Physical or digital storage solution for all invoice-related documents. | Supports organized recordkeeping, easy retrieval, and compliance with tax regulations requiring multi-year retention. |

| Tax Compliance Records | Documents related to sales taxes, VAT filings, and relevant tax payments associated with invoices. | Ensures adherence to government tax laws and smooth audit processes. |

| Legal Terms and Conditions | Details outlining payment terms, penalties, and dispute resolution linked to invoicing. | Protects business interests and clarifies contractual agreements legally. |

Best Practices for Drafting Legal Invoices

Small businesses must include essential documents such as client details, itemized services or products, payment terms, and tax information when creating legal invoices. Proper documentation ensures compliance with financial regulations and facilitates smooth accounting processes.

Best practices for drafting legal invoices involve clear descriptions of goods or services, accurate pricing, unique invoice numbers, and explicit payment deadlines. Maintaining consistency in formatting and including contact information helps prevent disputes and accelerates payment recovery.

Compliance with Local and Federal Invoice Regulations

Small businesses must include essential details on invoices to comply with local and federal regulations, such as the business name, address, and tax identification number. Accurate documentation of the invoice date, unique invoice number, and itemized description of goods or services is required to ensure legal validity. Compliance with tax laws, including applicable sales tax rates and payment terms, is critical to avoid penalties and support transparent financial records.

Digital Invoicing and E-Signature Legalities

Small businesses must ensure their invoices comply with legal standards to be valid and enforceable. Digital invoicing paired with e-signature technologies streamlines this process while maintaining legal integrity.

- Invoice Template - A standardized invoice template including business details, itemized charges, and payment terms is essential for legal invoices.

- Proof of Delivery or Service - Documentation confirming that goods or services were delivered supports the invoice's legitimacy and payment claims.

- E-Signature Compliance - E-signatures must meet electronic signature laws such as ESIGN Act or eIDAS to authenticate the document legally in digital invoicing.

Protecting Client Data in Legal Invoices

What documents are essential for a small business to create legal invoices? Small businesses need to prepare accurate invoice templates and maintain records of client contracts. Protecting client data in legal invoices ensures compliance with privacy laws and fosters trust.

How can small businesses protect client data in their legal invoices? Implementing secure invoice software and using encrypted communication channels safeguards sensitive information. Including only necessary client details reduces the risk of data breaches and misuse.

What Documents Does a Small Business Need to Create Legal Invoices? Infographic