For VAT invoice audits in the EU, businesses must provide original VAT invoices that clearly show the supplier's and customer's details, VAT identification numbers, invoice date, description of goods or services, and the VAT amount charged. Supporting documentation such as delivery notes, contracts, and payment receipts are essential to verify the legitimacy of the transaction. Accurate record-keeping and timely submission of these documents ensure compliance with EU VAT regulations and facilitate smooth audit processes.

What Documents are Needed for VAT Invoice Audits in the EU?

| Number | Name | Description |

|---|---|---|

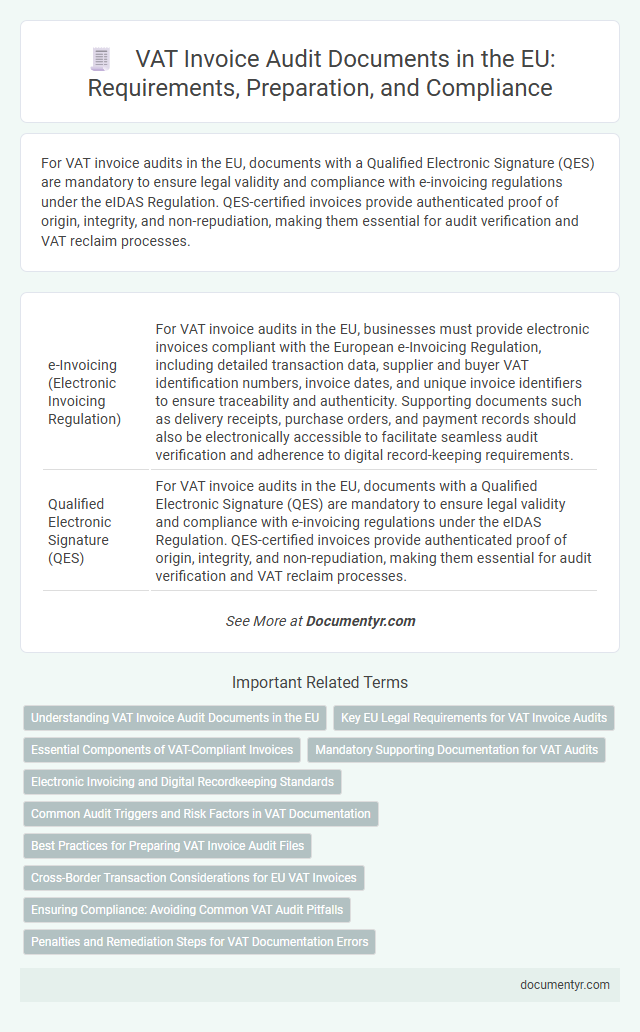

| 1 | e-Invoicing (Electronic Invoicing Regulation) | For VAT invoice audits in the EU, businesses must provide electronic invoices compliant with the European e-Invoicing Regulation, including detailed transaction data, supplier and buyer VAT identification numbers, invoice dates, and unique invoice identifiers to ensure traceability and authenticity. Supporting documents such as delivery receipts, purchase orders, and payment records should also be electronically accessible to facilitate seamless audit verification and adherence to digital record-keeping requirements. |

| 2 | Qualified Electronic Signature (QES) | For VAT invoice audits in the EU, documents with a Qualified Electronic Signature (QES) are mandatory to ensure legal validity and compliance with e-invoicing regulations under the eIDAS Regulation. QES-certified invoices provide authenticated proof of origin, integrity, and non-repudiation, making them essential for audit verification and VAT reclaim processes. |

| 3 | Structured Data Format (UBL, XML EN 16931) | For VAT invoice audits in the EU, documents must be provided in a structured data format such as UBL (Universal Business Language) or XML compliant with EN 16931 to ensure interoperability and adherence to electronic invoicing regulations. These formats facilitate automated validation and efficient cross-border VAT compliance by standardizing invoice data elements required by tax authorities. |

| 4 | Continuous Transaction Controls (CTC) Compliance | Invoices subject to VAT audits in the EU require detailed transactional data, including supplier and customer VAT identification numbers, invoice date and number, taxable amounts, and VAT rates applied, all aligned with Continuous Transaction Controls (CTC) compliance standards. Electronic transmission of these documents to tax authorities via certified platforms ensures real-time validation and reduces errors in VAT reporting during audit processes. |

| 5 | Audit Trail Documentation (Digital VAT Ledger) | Audit trail documentation for VAT invoice audits in the EU requires a comprehensive digital VAT ledger that records every transaction detail including invoice numbers, dates, VAT amounts, and customer identification to ensure data integrity and compliance. Maintaining a secure, timestamped digital VAT ledger facilitates traceability, supports real-time verification, and meets EU tax authority regulations during audit procedures. |

| 6 | SII (Suministro Inmediato de Información) Data Files | SII (Suministro Inmediato de Informacion) data files are essential documents for VAT invoice audits in the EU, providing real-time submission of detailed VAT records including invoice issuance and reception data. These files enable tax authorities to cross-verify transactions swiftly, reducing discrepancies and enhancing compliance with EU VAT regulations. |

| 7 | SAF-T (Standard Audit File for Tax) Reports | SAF-T (Standard Audit File for Tax) reports are essential documents for VAT invoice audits in the EU, providing a standardized digital format of accounting data to ensure compliance and facilitate tax authority reviews. These reports typically include detailed transaction records, invoice information, and VAT specifics required to verify tax accuracy and adherence to EU VAT regulations. |

| 8 | Real-Time Reporting Receipts | Real-time reporting receipts are essential documents for VAT invoice audits in the EU, providing immediate transaction data to tax authorities to ensure compliance and prevent fraud. These receipts must include detailed invoice information such as supplier and buyer VAT numbers, transaction amounts, tax rates, and timestamps to meet EU regulatory requirements. |

| 9 | Peppol Network Access Evidence | VAT invoice audits in the EU require comprehensive documentation including VAT invoices, purchase orders, delivery receipts, and proof of Peppol Network access to verify electronic invoicing compliance. Evidence of Peppol Network access typically involves digital certificates or participant records that confirm the secure exchange of invoices within the Peppol framework. |

| 10 | Time-Stamping Authority (TSA) Certificates | VAT invoice audits in the EU require Time-Stamping Authority (TSA) certificates to verify the authenticity and integrity of electronic documents, ensuring compliance with legal time-stamping regulations. TSA certificates provide a trusted timestamp that confirms the exact date and time the invoice was issued, preventing tampering or fraud during the audit process. |

Understanding VAT Invoice Audit Documents in the EU

Understanding the essential documents required for VAT invoice audits in the EU is crucial for compliance and accurate tax reporting. Proper documentation ensures transparency and helps avoid penalties during VAT inspections.

- Valid VAT Invoice - This document must include supplier and customer VAT numbers, invoice date, and detailed description of goods or services.

- Proof of Supply - Delivery notes, contracts, or shipping documents showing the transaction occurred as invoiced.

- Payment Records - Bank statements or payment confirmations verifying that the invoice amount was settled.

Maintaining these documents in accordance with EU VAT regulations facilitates smooth VAT invoice audits and supports tax compliance.

Key EU Legal Requirements for VAT Invoice Audits

VAT invoice audits in the EU require specific documentation to verify compliance with tax regulations. Key documents include the original VAT invoice, proof of goods or services delivery, and records of payment transactions.

EU legal requirements mandate that VAT invoices must contain essential details such as the supplier's VAT identification number, invoice date, and a clear description of goods or services. Auditors also examine supporting documents like purchase orders and contracts to ensure accurate VAT reporting.

Essential Components of VAT-Compliant Invoices

A VAT invoice audit in the EU requires specific documentation to ensure compliance with tax regulations. Essential components of VAT-compliant invoices include the supplier's and customer's full names and addresses, the VAT identification numbers, the invoice date and unique invoice number. The invoice must also detail the quantity and description of goods or services provided, the taxable amount, applicable VAT rates, and the total VAT amount charged.

Mandatory Supporting Documentation for VAT Audits

VAT invoice audits in the EU require precise documentation to ensure compliance with tax regulations. Understanding the mandatory supporting documents helps streamline the audit process and avoid penalties.

- Original VAT Invoices - These serve as primary evidence of transactions and must include accurate VAT details and supplier information.

- Proof of Supply - Delivery notes, contracts, or shipment documents confirm that goods or services were provided as stated in the invoice.

- Accounting Records - Detailed bookkeeping and payment records verify that the invoiced amounts were recorded and settled properly.

Electronic Invoicing and Digital Recordkeeping Standards

VAT invoice audits in the EU require strict adherence to electronic invoicing and digital recordkeeping standards. Businesses must maintain accurate electronic copies of all invoices for a specified retention period according to EU regulations.

Your electronic invoices should comply with the EU Directive 2014/55/EU, which mandates the use of the European standard for electronic invoicing. Records must be stored in a secure and accessible digital format to ensure audit readiness and legal compliance.

Common Audit Triggers and Risk Factors in VAT Documentation

VAT invoice audits in the EU require specific documentation to verify tax compliance and accuracy. Understanding common audit triggers and risk factors in VAT documentation helps you prepare and avoid penalties.

- Missing or Incomplete VAT Invoices - Incomplete invoices or those lacking mandatory details such as VAT number or invoice date often trigger audits.

- Inconsistent VAT Rates - Applying incorrect or inconsistent VAT rates on invoices raises red flags during compliance checks.

- Unusual Transaction Patterns - Frequent high-value transactions or irregular invoice issuance can signal risk factors prompting further investigation.

Best Practices for Preparing VAT Invoice Audit Files

VAT invoice audits in the EU require a comprehensive set of documents to ensure compliance with local tax regulations. Proper organization of these documents facilitates a smooth audit process.

Best practices for preparing VAT invoice audit files include maintaining original invoices with clearly visible VAT numbers, transaction dates, and supplier details. You should also keep accurate records of payment confirmations and any related contracts or purchase orders. Ensuring that all documents are chronologically ordered and digitally backed up enhances audit readiness and reduces the risk of discrepancies.

Cross-Border Transaction Considerations for EU VAT Invoices

For VAT invoice audits in the EU, essential documents include the original VAT invoice, proof of supply, and relevant shipping or transport documents when dealing with cross-border transactions. Your records must clearly detail the VAT number of both the supplier and recipient, the transaction value, and the nature of goods or services provided, complying with EU VAT Directive requirements. Accurate documentation ensures proper VAT treatment and facilitates smooth audits across member states involved in cross-border trade.

Ensuring Compliance: Avoiding Common VAT Audit Pitfalls

| Document Type | Description | Importance for VAT Invoice Audits |

|---|---|---|

| Original VAT Invoices | Invoices must include supplier and customer VAT numbers, invoice date, description of goods or services, quantity, unit price, and VAT amount. | Essential to verify VAT charged and ensure correct tax treatment. Missing or incomplete invoices can lead to audit penalties. |

| Proof of Delivery or Service | Delivery notes, shipping documents, or service acceptance confirmations that link the invoice to actual goods or services provided. | Supports the legitimacy of transactions. Helps avoid disputes about VAT eligibility and fraudulent claims. |

| Contract Agreements | Contracts or purchase orders detailing terms of sale, pricing, and VAT obligations agreed upon by both parties. | Clarifies VAT treatment and supports invoice accuracy. Prevents misunderstandings during VAT audits. |

| Payment Records | Bank statements, payment confirmations, or receipts demonstrating settled invoices. | Confirms transaction completion and VAT liability. Helps avoid VAT reclaim or deduction errors. |

| VAT Registration Certificates | Official documentation proving VAT registration status of supplier and customer within the EU. | Validates VAT reporting and compliance. Crucial to confirm cross-border transactions. |

| Internal Accounting Records | Accounting ledgers, bookkeeping journals, and electronic invoice management systems. | Ensures traceability of VAT transactions and supports audit trail consistency. |

| Reconciliation Statements | Summary reports that reconcile supplier invoices, purchase orders, and payments made. | Helps identify discrepancies and prevent common audit pitfalls like duplicate claims or omitted invoices. |

Ensuring compliance with VAT invoice documentation requirements reduces the risk of audit penalties and facilitates smooth tax inspections across the EU. Maintaining thorough and organized records is key to avoiding common VAT audit pitfalls. You should verify that all the necessary documents are accurate, complete, and readily accessible to support your VAT returns and audits effectively.

What Documents are Needed for VAT Invoice Audits in the EU? Infographic