International invoices require essential documents such as a commercial invoice, packing list, and bill of lading or airway bill to ensure proper shipment tracking and customs clearance. Export licenses, certificates of origin, and insurance documents may also be necessary depending on the destination country and product type. Accurate and complete documentation helps prevent delays and facilitates smooth cross-border transactions.

What Documents are Needed for an International Invoice?

| Number | Name | Description |

|---|---|---|

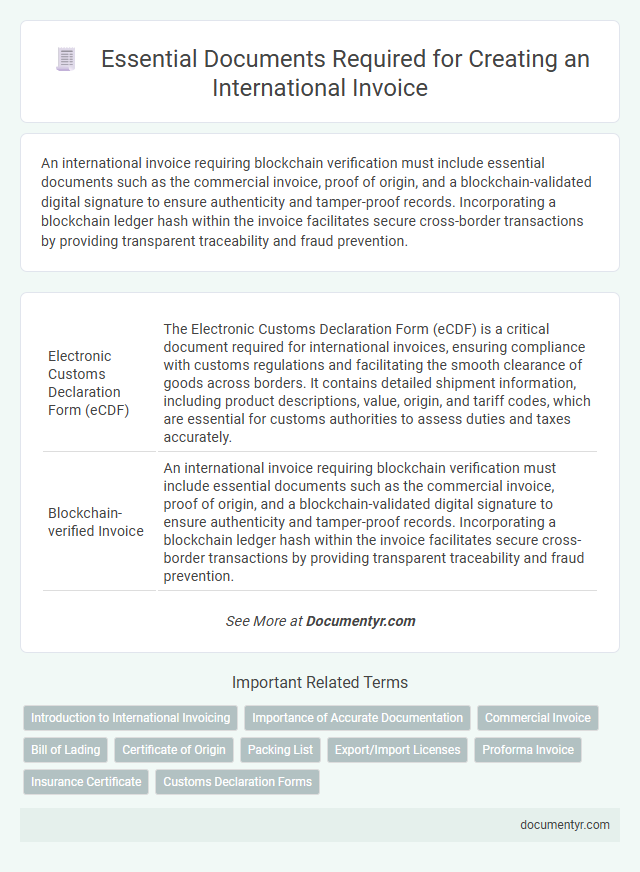

| 1 | Electronic Customs Declaration Form (eCDF) | The Electronic Customs Declaration Form (eCDF) is a critical document required for international invoices, ensuring compliance with customs regulations and facilitating the smooth clearance of goods across borders. It contains detailed shipment information, including product descriptions, value, origin, and tariff codes, which are essential for customs authorities to assess duties and taxes accurately. |

| 2 | Blockchain-verified Invoice | An international invoice requiring blockchain verification must include essential documents such as the commercial invoice, proof of origin, and a blockchain-validated digital signature to ensure authenticity and tamper-proof records. Incorporating a blockchain ledger hash within the invoice facilitates secure cross-border transactions by providing transparent traceability and fraud prevention. |

| 3 | Digital Certificate of Origin (eCO) | An international invoice requires a Digital Certificate of Origin (eCO) to verify the product's country of manufacture, ensuring compliance with customs regulations and facilitating tariff benefits. This electronic document enhances authenticity, reduces processing time, and secures smoother cross-border trade transactions. |

| 4 | Harmonized System (HS) Code Documentation | An international invoice requires accurate Harmonized System (HS) Code documentation to classify goods for customs and tariff purposes, enabling efficient cross-border trade compliance. Proper inclusion of HS Codes ensures proper duty calculation and reduces delays in customs clearance by providing standardized product identification. |

| 5 | e-Waybill | An international invoice requires essential documents such as a commercial invoice, bill of lading, and packing list, with the e-Waybill serving as a crucial transport document for goods movement under GST compliance. The e-Waybill contains detailed information about the consignment, including item description, quantity, invoice value, and transporter details, ensuring seamless verification and tracking across borders. |

| 6 | Incoterms® 2020 Statement | An international invoice must include an Incoterms(r) 2020 statement specifying the agreed terms of delivery, defining responsibilities for costs, risks, and customs clearance between buyer and seller. Essential documents often accompanying the invoice are the commercial invoice, packing list, certificate of origin, and bill of lading, all referencing the Incoterms(r) 2020 to ensure clarity in international trade compliance. |

| 7 | Automated Export System (AES) Filing Receipt | An Automated Export System (AES) Filing Receipt is essential for international invoices as it confirms the electronic submission of export information to U.S. Customs, ensuring compliance with export regulations. This document verifies that shipment data is accurately reported, facilitating smooth customs clearance and preventing shipment delays. |

| 8 | Cross-Border eCommerce Compliance Sheet | The Cross-Border eCommerce Compliance Sheet outlines essential documents for an international invoice, including the commercial invoice, packing list, certificate of origin, and customs declaration forms. Accurate documentation ensures smooth customs clearance, reduces delays, and complies with import-export regulations across global markets. |

| 9 | Data Privacy Consent Form (GDPR/CCPA-Compliant) | A Data Privacy Consent Form compliant with GDPR and CCPA is essential for international invoices to ensure lawful processing of personal data across borders. This document protects both the issuer and recipient by explicitly authorizing data use and maintaining transparency in cross-jurisdictional transactions. |

| 10 | Multi-Currency FX Reconciliation Statement | An international invoice requires a Multi-Currency FX Reconciliation Statement to accurately track currency conversions, exchange rates, and transaction dates for seamless financial audits. This document ensures transparency in cross-border payments by detailing foreign exchange gains or losses and aligning invoice amounts with actual received funds. |

Introduction to International Invoicing

International invoicing requires specific documentation to ensure smooth cross-border trade and compliance with customs regulations. Proper documentation helps avoid delays and facilitates accurate financial transactions between parties.

- Commercial Invoice - Details the goods sold, including description, quantity, price, and terms of sale for customs and payment purposes.

- Packing List - Lists the contents of each shipment package to assist customs officials and the recipient in verifying the shipment.

- Certificate of Origin - Confirms the country where the goods were manufactured, which may affect tariffs and trade agreements.

Importance of Accurate Documentation

Accurate documentation is essential for processing an international invoice efficiently, ensuring compliance with customs regulations and avoiding delays. Key documents include the commercial invoice, packing list, and bill of lading, each providing critical details about the shipment.

Supporting documents such as certificates of origin and export licenses further validate the transaction and facilitate smooth border clearance. Precise and complete paperwork minimizes risks of fines, shipment holds, and payment complications in global trade.

Commercial Invoice

International invoices require specific documentation to ensure smooth customs clearance and compliance. A commercial invoice is a critical document that provides detailed information about the transaction between the buyer and seller.

- Commercial Invoice - This document lists the goods, their value, and terms of sale, serving as a legal contract and proof of sale for international shipments.

- Packing List - Details the contents, weight, and packaging of the shipment to assist customs authorities in inspection and verification.

- Certificate of Origin - Verifies the country where the goods were manufactured, which can affect duties and trade agreements.

Bill of Lading

What documents are needed for an international invoice? A Bill of Lading is a crucial document that acts as proof of shipment and receipt of goods. This document details the type, quantity, and destination of the shipment, ensuring smooth customs clearance.

Certificate of Origin

When preparing an international invoice, several key documents are essential to ensure smooth customs clearance and compliance. One of the most critical documents is the Certificate of Origin, which verifies the country where the goods were manufactured.

- Certificate of Origin authenticity - This document provides proof of the product's origin, influencing tariffs and import regulations.

- Customs requirement - Many countries require a Certificate of Origin to validate shipments and apply relevant duties.

- Trade agreement benefits - Certificates of Origin help exporters and importers take advantage of preferential tariffs under trade agreements.

Including a properly completed Certificate of Origin with an international invoice facilitates faster customs processing and compliance with global trade laws.

Packing List

A Packing List is a crucial document for an international invoice, detailing the contents, quantity, and weight of each package. It ensures customs officials and recipients can verify the shipment against the invoice accurately. This document helps prevent delays and facilitates smooth customs clearance by providing clear packaging information.

Export/Import Licenses

Export and import licenses are essential documents for an international invoice. These licenses authorize the shipment of specific goods across borders and ensure legal compliance with trade regulations.

You must include valid export and import licenses to avoid delays or penalties. These documents verify that your shipment meets the destination country's regulatory requirements. Maintaining accurate licenses supports smooth customs clearance and facilitates international trade transactions.

Proforma Invoice

| Document | Description | Importance for International Invoice |

|---|---|---|

| Proforma Invoice | A preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It outlines the items, quantities, and prices agreed upon. | Crucial for customs clearance and verifying the shipment's value. It helps You prepare for payment and ensures transparency in your international transaction. |

| Commercial Invoice | The official invoice that finalizes the transaction details after shipment, used for payment and customs processing. | Serves as the primary source document for customs duties and taxation in the importing country. |

| Packing List | Details the contents, packaging, and weight of the shipment. | Facilitates inspection and helps customs verify the cargo. |

| Bill of Lading | Acts as a shipment receipt issued by the carrier to the shipper. | Essential for transferring ownership and claiming the goods. |

| Certificate of Origin | Certifies the country where the goods were manufactured. | May affect customs duties and import restrictions in the destination country. |

Insurance Certificate

An Insurance Certificate is a crucial document required for an international invoice. It verifies that the goods being shipped are insured against potential damages or losses during transit. This certificate provides assurance to both exporters and importers about the financial protection of the shipment.

What Documents are Needed for an International Invoice? Infographic