Invoice submission to government agencies requires essential documents such as the original invoice, purchase order, and proof of delivery or service completion. Accurate tax identification information and any relevant licenses or permits must also be included to ensure compliance with regulatory standards. Digital copies should be properly formatted and accompanied by authorization signatures to facilitate smooth processing.

What Documents are Necessary for Invoice Submission to Government Agencies?

| Number | Name | Description |

|---|---|---|

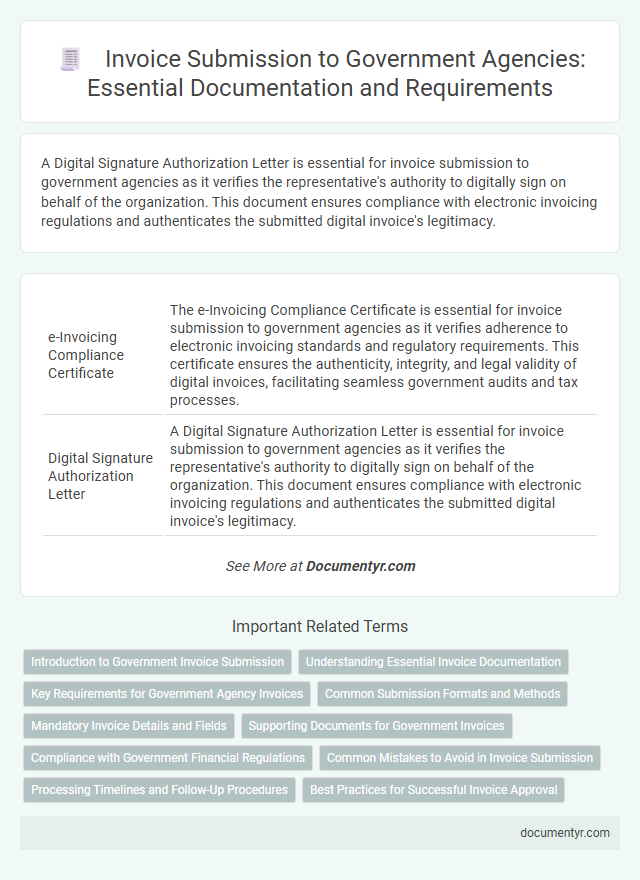

| 1 | e-Invoicing Compliance Certificate | The e-Invoicing Compliance Certificate is essential for invoice submission to government agencies as it verifies adherence to electronic invoicing standards and regulatory requirements. This certificate ensures the authenticity, integrity, and legal validity of digital invoices, facilitating seamless government audits and tax processes. |

| 2 | Digital Signature Authorization Letter | A Digital Signature Authorization Letter is essential for invoice submission to government agencies as it verifies the representative's authority to digitally sign on behalf of the organization. This document ensures compliance with electronic invoicing regulations and authenticates the submitted digital invoice's legitimacy. |

| 3 | GST e-Way Bill Attachment | Submission of invoices to government agencies requires a GST e-Way Bill attachment to ensure compliance with tax regulations and facilitate the transportation of goods. Essential documents include the invoice itself, the generated e-Way Bill containing transportation details, and relevant GST payment proofs to validate the transaction. |

| 4 | Unique Invoice Reference Number (IRN) | Submitting invoices to government agencies requires a Unique Invoice Reference Number (IRN) generated through the Invoice Registration Portal (IRP), which ensures the authenticity and traceability of the invoice. Along with the IRN, essential documents include the signed e-invoice, Goods and Services Tax Network (GSTN) registration details, and supporting transaction proofs to comply with regulatory standards. |

| 5 | Tax Deducted at Source (TDS) Declaration Form | The Tax Deducted at Source (TDS) Declaration Form is a crucial document for invoice submission to government agencies to ensure accurate tax compliance and avoid unnecessary deductions. It verifies the PAN details and applicable TDS rates, facilitating smooth processing and timely reimbursement of payments. |

| 6 | Vendor Onboarding KYC Documentation | Accurate vendor onboarding KYC documentation for invoice submission to government agencies includes a valid business registration certificate, tax identification number, bank account details, and authorized signatory identification. Ensuring these documents comply with government regulations facilitates smooth vendor verification and timely payment processing. |

| 7 | PFMS Mandate Form (Public Financial Management System) | The PFMS Mandate Form is essential for invoice submission to government agencies as it enables direct electronic fund transfers and integrates payment processing within the Public Financial Management System. Alongside the invoice, submitting this mandate form ensures compliance with PFMS guidelines for timely and secure payment disbursements. |

| 8 | Beneficiary Bank Account Mapping Sheet | The Beneficiary Bank Account Mapping Sheet is essential for invoice submission to government agencies as it verifies the recipient's bank details, ensuring accurate payment processing and compliance with financial regulations. This document must be accurately completed with the beneficiary's bank name, account number, IFSC code, and authorization signatures to prevent delays in invoice approval and fund disbursement. |

| 9 | Reverse Charge Mechanism (RCM) Statement | For invoice submission under the Reverse Charge Mechanism (RCM) to government agencies, it is essential to include a clearly stated RCM declaration referencing the applicable GST provisions, along with the original invoice indicating the supplier's details and GSTIN. Supporting documents such as purchase orders, payment receipts, and compliance certificates should also accompany to ensure validation and adherence to statutory requirements. |

| 10 | Procurement Digital Workflow Log | The Procurement Digital Workflow Log is essential for invoice submission to government agencies, as it documents each step and approval in the procurement process, ensuring compliance and traceability. This log must be accompanied by the invoice, purchase order, delivery receipts, and any contract agreements to validate the transaction and facilitate audit trails. |

Introduction to Government Invoice Submission

Submitting an invoice to government agencies requires strict adherence to specific documentation guidelines to ensure timely processing and payment. Government entities often mandate detailed paperwork, including purchase orders, tax identification numbers, and proof of service or delivery. Understanding these requirements helps you prepare accurate invoices that comply with regulatory standards and avoid payment delays.

Understanding Essential Invoice Documentation

Submitting an invoice to government agencies requires specific documentation to ensure compliance and prompt payment. Essential documents typically include the original invoice, a purchase order, and any relevant tax identification numbers.

Proof of delivery or service completion is often necessary to validate the invoice. Additionally, contracts or agreements related to the billing may be requested to support the transaction details.

Key Requirements for Government Agency Invoices

What documents are necessary for invoice submission to government agencies? Government agencies typically require a detailed invoice including the purchase order number, vendor identification, and a clear description of goods or services provided. Proof of delivery and tax compliance certificates are also essential to ensure proper processing and payment.

Common Submission Formats and Methods

Invoice submission to government agencies typically requires a formal invoice document, proof of delivery or service completion, and relevant tax identification certificates. Common submission formats include PDF, XML, and sometimes Excel files, ensuring compatibility with agency systems. Submission methods often involve online portals, email, or physical mail, depending on the specific government agency requirements.

Mandatory Invoice Details and Fields

Invoice submission to government agencies requires specific mandatory details to ensure compliance with legal and financial regulations. These details facilitate accurate record-keeping and smooth transaction verification by the authorities.

Essential fields include the invoice number, issue date, and the full legal name and tax identification number of both the supplier and the recipient. The description of goods or services provided, quantity, unit price, and total amount payable must be clearly stated. Additionally, applicable taxes such as VAT or GST must be itemized, along with payment terms and authorized signatures if required.

Supporting Documents for Government Invoices

Supporting documents are crucial for the successful submission of invoices to government agencies. These documents verify the authenticity and accuracy of the invoice details.

Common required documents include purchase orders, delivery receipts, and contracts. Tax identification and compliance certificates are often mandatory for government invoice processing.

Compliance with Government Financial Regulations

Submitting an invoice to government agencies requires strict adherence to financial regulations to ensure compliance and prevent processing delays. Proper documentation validates transactions and aligns with government auditing standards.

- Invoice Copy - A detailed invoice outlining goods or services provided, including dates, quantities, and pricing, is mandatory for verification.

- Tax Identification Documentation - Government agencies require businesses to submit their tax ID or registration number to confirm legal tax compliance.

- Purchase Order Reference - Including an official purchase order or contract reference links the invoice to authorized government procurement and budget approval.

Common Mistakes to Avoid in Invoice Submission

Submitting invoices to government agencies requires accuracy and completeness to ensure timely processing. Understanding common mistakes helps avoid delays and rejections.

- Incomplete Documentation - Missing essential documents such as purchase orders or contracts can result in invoice rejection.

- Incorrect Invoice Details - Errors in vendor information, invoice numbers, or payment terms lead to processing delays.

- Failure to Comply with Government Standards - Ignoring specific format requirements or missing authorized signatures can cause non-compliance issues.

Carefully reviewing all documentation and adhering to government agency requirements ensures smooth invoice submission.

Processing Timelines and Follow-Up Procedures

| Required Documents for Invoice Submission | Invoice Copy, Purchase Order, Delivery Receipt, Tax Identification Number (TIN), Authorization Letter (if applicable) |

|---|---|

| Processing Timelines | Standard processing takes 15 to 30 business days; expedited processing available upon request may reduce this to 7-10 business days |

| Follow-Up Procedures | Check submission status online or via agency contact points; submit written inquiries after 15 business days; maintain a copy of all documents for verification |

| Tips for Efficient Processing | Ensure all documents are complete and accurately filled; adhere to agency-specific guidelines; submit documents within the designated deadlines to avoid delays |

| You Should Remember | Your prompt attention to document accuracy and follow-up can streamline approval and payment timelines. |

What Documents are Necessary for Invoice Submission to Government Agencies? Infographic