To ensure VAT invoice compliance, essential documents include a detailed invoice containing the seller's name, address, VAT number, and the buyer's details, along with a clear description of goods or services provided. The invoice must also specify the VAT rate applied and the total amount payable, including the VAT amount. Proper record-keeping of these invoices and related transaction documents is crucial for audit and tax reporting purposes.

What Documents are Needed for VAT Invoice Compliance?

| Number | Name | Description |

|---|---|---|

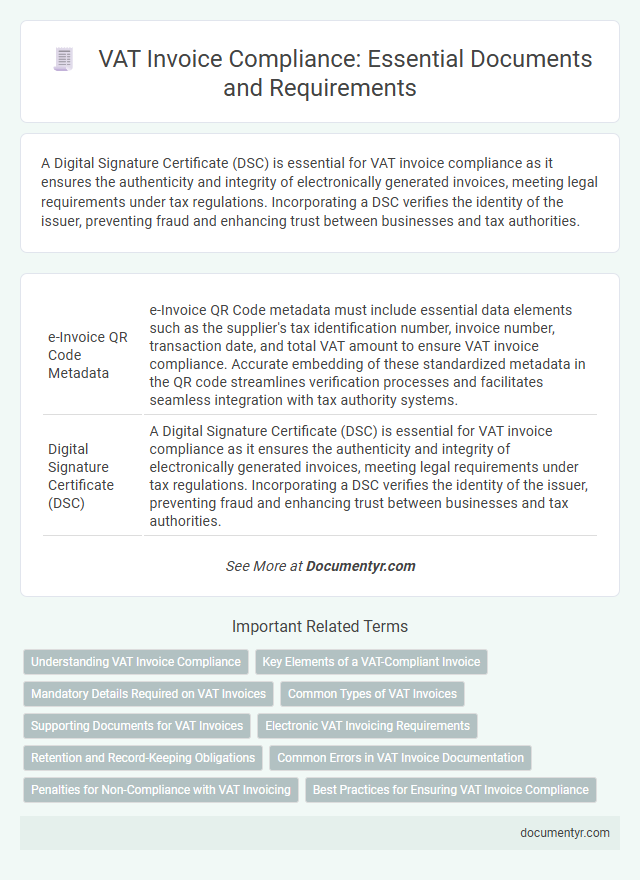

| 1 | e-Invoice QR Code Metadata | e-Invoice QR Code metadata must include essential data elements such as the supplier's tax identification number, invoice number, transaction date, and total VAT amount to ensure VAT invoice compliance. Accurate embedding of these standardized metadata in the QR code streamlines verification processes and facilitates seamless integration with tax authority systems. |

| 2 | Digital Signature Certificate (DSC) | A Digital Signature Certificate (DSC) is essential for VAT invoice compliance as it ensures the authenticity and integrity of electronically generated invoices, meeting legal requirements under tax regulations. Incorporating a DSC verifies the identity of the issuer, preventing fraud and enhancing trust between businesses and tax authorities. |

| 3 | Invoice Reference Number (IRN) | The Invoice Reference Number (IRN) is a unique, 64-character hash generated by the GST portal to ensure the authenticity and compliance of VAT invoices. It must be included on all VAT invoices along with details such as supplier GSTIN, invoice number, date, and tax amounts to meet regulatory requirements and facilitate seamless tax filing and verification. |

| 4 | B2B Transaction Mapping Sheet | A B2B Transaction Mapping Sheet for VAT invoice compliance must include detailed buyer and seller information, transaction date, VAT registration numbers, invoice number, description of goods or services, unit prices, quantities, VAT rates applied, and the total VAT amount. Accurate documentation ensures compliance with tax regulations and facilitates smooth audits and cross-border trade verification. |

| 5 | HSN/SAC Code Annexure | Accurate HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) code annexure must be included in VAT invoices to ensure proper classification of goods or services for tax compliance. This annexure is essential for verifying tax rates and exemptions, enabling seamless input tax credit claims and avoiding penalties. |

| 6 | Buyer-Supplier GSTIN Reconciliation | Accurate VAT invoice compliance requires submitting invoices containing both buyer and supplier GSTINs, ensuring these details match the GST returns filed by each party. Proper GSTIN reconciliation prevents mismatches during audits and facilitates seamless input tax credit claims. |

| 7 | Self-Billing Agreement | A Self-Billing Agreement requires clear documentation including a signed contract between the buyer and supplier, detailing the invoicing process and responsibilities for VAT reporting. Essential documents also include the issued self-billed invoices containing accurate VAT amounts, supplier identification, and purchase details to ensure compliance with tax authorities. |

| 8 | Real-Time Invoice Validation Report | A Real-Time Invoice Validation Report requires accurate details such as the supplier's VAT registration number, invoice date, unique invoice number, description of goods or services, and the corresponding VAT amounts. This document ensures compliance by verifying the authenticity and accuracy of VAT invoices in real-time, reducing errors and preventing fraud in tax reporting. |

| 9 | Dynamic QR Code for B2C Invoices | To ensure VAT invoice compliance for B2C transactions, documents must include a dynamic QR code that encodes invoice details such as invoice number, date, tax amount, and seller's tax identification number. This dynamic QR code enables quick verification by tax authorities, streamlining audit processes and enhancing fraud prevention. |

| 10 | Electronic Transportation Bill (e-Way Bill) Integration | Accurate VAT invoice compliance requires integration with the Electronic Transportation Bill (e-Way Bill) system to ensure seamless tracking of goods movement and verification of transaction authenticity. Essential documents include the digitally generated e-Way Bill number, invoice details, GSTIN of both supplier and recipient, and transport vehicle information linked within the GST portal for real-time reconciliation. |

Understanding VAT Invoice Compliance

| Understanding VAT Invoice Compliance | |

|---|---|

| Legal Identification | Your VAT invoice must include the seller's registered business name and VAT registration number to ensure legal validity and traceability. |

| Invoice Date | The date the invoice is issued is essential for VAT accounting periods and compliance with tax regulations. |

| Invoice Number | A unique and sequential invoice number is required for record-keeping and audit purposes. |

| Buyer Details | Accurate identification of the buyer, including their name and VAT number when applicable, is necessary for valid VAT invoicing. |

| Description of Goods or Services | Detailed description including quantity and price helps verify the transaction and correct VAT calculation. |

| Taxable Amount and VAT Rate | The taxable base amount and the applicable VAT rate must be clearly stated to demonstrate accurate VAT application. |

| VAT Amount | The total VAT charged should be distinctly presented to separate tax from the net price. |

| Currency | The currency in which the invoice is issued should be specified to avoid confusion in international transactions. |

Key Elements of a VAT-Compliant Invoice

A VAT-compliant invoice must include the supplier's name, address, and VAT registration number to ensure proper identification and tax tracking. It is essential to list the invoice date, a unique invoice number, and the client's details for accurate record-keeping and audit purposes. You should also clearly state the description of goods or services, the quantity, the unit price, the VAT rate applied, and the total VAT amount charged to meet legal requirements.

Mandatory Details Required on VAT Invoices

A VAT invoice must include specific mandatory details to ensure compliance with tax regulations. Understanding these requirements helps your business avoid penalties and maintain accurate financial records.

- Supplier Information - The invoice must display the full name, address, and VAT registration number of the supplier issuing the invoice.

- Customer Details - It is essential to include the buyer's full name, address, and VAT number if applicable, to validate the transaction.

- Invoice Date and Number - Each invoice should have a unique sequential number and the issuance date for clear identification and record-keeping.

Common Types of VAT Invoices

Common types of VAT invoices include standard VAT invoices, simplified VAT invoices, and self-billing invoices. Each type must contain specific details such as the seller's and buyer's VAT identification numbers, a unique invoice number, the date of issue, a clear description of goods or services, and the applicable VAT rate and amount. Ensuring these documents meet local tax authority requirements is essential for VAT compliance and successful input tax recovery.

Supporting Documents for VAT Invoices

Supporting documents for VAT invoices are essential to validate the transaction and ensure compliance with tax regulations. These documents include purchase orders, delivery receipts, and proof of payment, which corroborate the details on the VAT invoice.

Proper documentation helps businesses avoid disputes during audits and ensures accurate VAT reporting to tax authorities. Maintaining complete records supports claim legitimacy and facilitates seamless VAT recovery processes.

Electronic VAT Invoicing Requirements

What documents are needed for VAT invoice compliance under electronic VAT invoicing requirements? An electronic VAT invoice must include the supplier's and customer's VAT identification numbers, invoice date, and a unique invoice serial number. You also need to ensure the digital signature and electronic format comply with the tax authority's regulations to validate authenticity and integrity.

Retention and Record-Keeping Obligations

VAT invoice compliance requires maintaining proper documentation to ensure accuracy and legality. You must understand the retention and record-keeping obligations to meet VAT regulations effectively.

- Retention Period - VAT invoices and supporting documents should be retained for a minimum of 5 to 7 years depending on local tax laws.

- Organized Record-Keeping - Maintaining well-organized records facilitates quick retrieval during audits and tax assessments.

- Digital and Physical Copies - Both digital and physical copies of VAT invoices must be securely stored to comply with electronic record mandates.

Common Errors in VAT Invoice Documentation

Accurate VAT invoice documentation is essential for compliance with tax regulations and to ensure proper tax credit claims. Common errors include missing seller or buyer details, incorrect VAT numbers, and inaccurate invoice dates.

Another frequent mistake involves incorrect or incomplete description of goods and services, which can lead to disputes or rejection of VAT claims. Ensuring all mandatory fields such as invoice number, VAT rate, and total amount are correctly filled helps avoid compliance issues.

Penalties for Non-Compliance with VAT Invoicing

VAT invoice compliance requires specific documentation to avoid legal issues and financial penalties. Understanding the penalties for non-compliance helps protect your business from unnecessary risks.

- Accurate Invoice Details - Missing or incorrect invoice details can lead to fines and disallowed VAT claims.

- Timely Submission - Failure to issue or submit VAT invoices within the legal timeframe may result in penalties or interest charges.

- Proper Record Keeping - Inadequate record retention can cause audits and potential penalties from tax authorities.

Ensuring all required documents are complete and accurate prevents costly penalties and maintains VAT compliance.

What Documents are Needed for VAT Invoice Compliance? Infographic