Export invoices should include essential documents such as a packing list, bill of lading, and certificate of origin to ensure smooth customs clearance. Attaching the commercial invoice, export license, and insurance certificate verifies the shipment details and regulatory compliance. Proper documentation helps prevent delays, reduces the risk of disputes, and facilitates efficient international trade transactions.

What Documents Should Be Attached to an Export Invoice?

| Number | Name | Description |

|---|---|---|

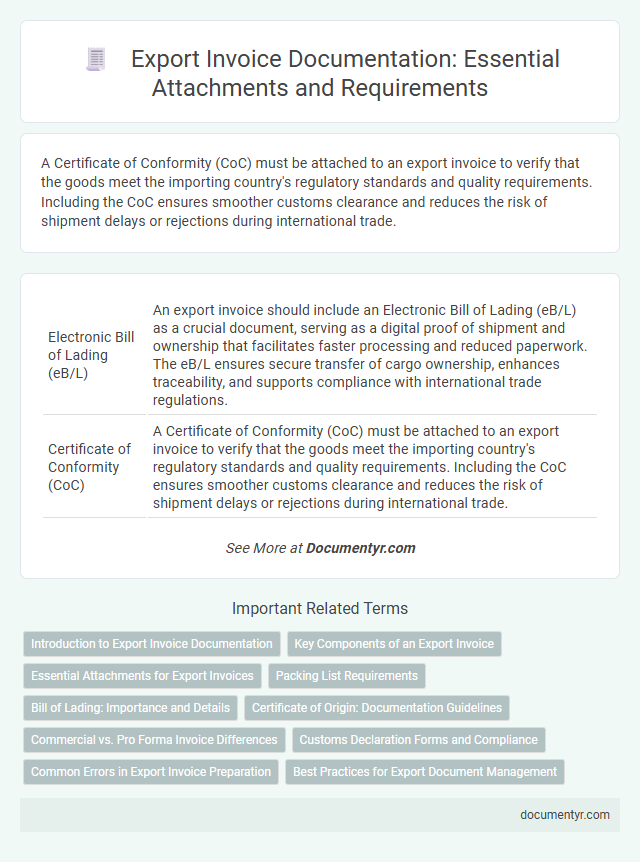

| 1 | Electronic Bill of Lading (eB/L) | An export invoice should include an Electronic Bill of Lading (eB/L) as a crucial document, serving as a digital proof of shipment and ownership that facilitates faster processing and reduced paperwork. The eB/L ensures secure transfer of cargo ownership, enhances traceability, and supports compliance with international trade regulations. |

| 2 | Certificate of Conformity (CoC) | A Certificate of Conformity (CoC) must be attached to an export invoice to verify that the goods meet the importing country's regulatory standards and quality requirements. Including the CoC ensures smoother customs clearance and reduces the risk of shipment delays or rejections during international trade. |

| 3 | Blockchain-verified Certificate of Origin | A Blockchain-verified Certificate of Origin should be attached to an export invoice to authenticate the product's origin, ensuring transparency and reducing fraud risks in international trade. This document enhances trust by providing immutable verification that complies with customs and trade regulations. |

| 4 | E-Invoice QR Code Attachment | An export invoice should include an E-Invoice QR code attachment to facilitate easy verification and enhance transaction security, complying with international digital invoicing standards. This QR code encodes essential details such as invoice number, date, and total amount, ensuring accurate and efficient customs processing. |

| 5 | Authorized Economic Operator (AEO) Certificate | An export invoice should include an Authorized Economic Operator (AEO) certificate to facilitate customs clearance and demonstrate compliance with international trade security standards. Attaching the AEO certificate enhances trust with customs authorities and expedites the export process by verifying the exporter's secure supply chain management. |

| 6 | Export Compliance Self-Certification | Export invoices should include an Export Compliance Self-Certification document to verify that the shipment adheres to all applicable export regulations and restrictions. This certification ensures legal compliance and facilitates smoother customs clearance by confirming that the goods meet destination country requirements. |

| 7 | Digital Packing List with RFID Tags | Export invoices should be accompanied by a digital packing list embedded with RFID tags to enhance inventory tracking and expedite customs clearance. This advanced documentation enables real-time shipment verification, improving accuracy and reducing delays in the international trade process. |

| 8 | ESG (Environmental, Social, Governance) Declaration | An export invoice should include an ESG Declaration outlining compliance with environmental sustainability standards, social responsibility commitments, and governance practices to meet global trade regulations. Attaching certifications such as carbon footprint reports, fair labor practice audits, and corporate governance policies enhances transparency and supports sustainable supply chain practices. |

| 9 | Sanctions Screening Certificate | A Sanctions Screening Certificate must be attached to an export invoice to verify that the goods and parties involved comply with international trade sanctions and embargoes, ensuring the transaction meets global regulatory standards. This document helps prevent illegal trade activities by confirming that the shipment is not linked to restricted or sanctioned entities. |

| 10 | Automated Export System (AES) Filing Confirmation | An export invoice should include the Automated Export System (AES) Filing Confirmation to verify that the shipment has been properly reported to U.S. Customs for export compliance. This document provides a key reference number ensuring seamless customs clearance and accurate export tracking. |

Introduction to Export Invoice Documentation

An export invoice is a critical document in international trade that details the transaction between the exporter and the importer. Proper documentation ensures compliance with customs regulations and facilitates smooth shipment processing. Attaching the correct supporting documents is essential to verify the goods, their value, and origin.

Key Components of an Export Invoice

An export invoice should include the commercial invoice, packing list, and bill of lading as essential attachments. The commercial invoice details the transaction, specifying product descriptions, quantities, unit prices, and total amounts. The packing list provides information about the shipment contents, while the bill of lading serves as proof of carriage and receipt of goods by the carrier.

Essential Attachments for Export Invoices

| Document | Description | Purpose |

|---|---|---|

| Bill of Lading | Official receipt issued by the carrier to the shipper. | Proof of shipment and contract of carriage. |

| Commercial Invoice | Detailed statement of the transaction including product description, quantity, and price. | Serves as the primary document for customs clearance and payment processing. |

| Packing List | Itemizes the contents, dimensions, and weight of each package. | Facilitates inspection and inventory checks by customs authorities. |

| Certificate of Origin | Official document certifying the country where the goods were manufactured. | Determines tariff treatment and quota eligibility. |

| Export License | Government authorization permitting the export of certain products. | Compliance with export control regulations. |

| Insurance Certificate | Proof of insurance coverage for goods during transit. | Mitigates financial risk from damage or loss. |

| Inspection Certificate | Verification by authorized agency confirming product quality and quantity. | Ensures adherence to buyer and regulatory standards. |

Packing List Requirements

Attaching a detailed packing list to an export invoice is essential for smooth customs clearance and accurate shipment verification. The packing list must clearly describe the contents, quantity, and dimensions of each package.

The packing list should include specific information such as package weight, measurements, and identification marks. This document helps customs officials inspect the shipment efficiently and ensures compliance with international trade regulations. A precise packing list minimizes delays and reduces the risk of disputes during the export process.

Bill of Lading: Importance and Details

The Bill of Lading is a crucial document to attach to an export invoice, serving as proof of shipment and ownership of the goods. It provides essential details such as the consignee, shipper, and description of the cargo, ensuring transparent transaction records.

Your export invoice gains legal weight when accompanied by the Bill of Lading, facilitating customs clearance and payment processing. This document also serves as a receipt issued by the carrier, safeguarding both parties involved in the export process.

Certificate of Origin: Documentation Guidelines

The Certificate of Origin is a crucial document that must be attached to an export invoice to verify the country where the goods were manufactured. This certification helps customs authorities determine applicable duties and ensures compliance with international trade regulations.

Issuing the Certificate of Origin typically involves obtaining it from a recognized chamber of commerce or authorized body in the exporter's country. The document should clearly state product details, origin information, and bear official signatures or stamps to validate authenticity.

Commercial vs. Pro Forma Invoice Differences

Export invoices require specific documents to ensure smooth customs clearance and accurate transaction records. Understanding the differences between commercial and pro forma invoices helps determine the necessary attachments.

- Commercial Invoice - A legally binding document used for customs declaration, detailing the actual sale of goods.

- Pro Forma Invoice - A preliminary bill sent to the buyer before shipment, outlining estimated costs and terms without binding sale confirmation.

- Supporting Documents - Commercial invoices typically need packing lists, certificates of origin, and export licenses attached for verification.

Pro forma invoices generally require fewer attachments, primarily serving as quotations rather than final transactional evidence.

Customs Declaration Forms and Compliance

Export invoices must include specific documents to ensure smooth customs processing and regulatory compliance. Proper documentation prevents shipment delays and legal issues during international trade.

- Customs Declaration Forms - These forms provide detailed information about the goods being exported, essential for tariff assessment and border security checks.

- Compliance Certificates - Certificates verify that the shipment meets all relevant export regulations and international standards.

- Packing Lists - Lists itemize the products included in the shipment, aiding customs officials in verifying cargo contents against the invoice.

Common Errors in Export Invoice Preparation

Export invoices require specific documents to ensure smooth customs clearance and payment processing. Common errors in export invoice preparation can cause delays and financial losses.

- Missing Commercial Invoice - A key document detailing the transaction, often omitted or incomplete, leading to customs rejection.

- Incorrect Packing List - Errors in item descriptions or quantities result in shipment inspection delays.

- Lack of Certificate of Origin - Absence of this document can prevent preferential duty treatments and prolong customs clearance.

What Documents Should Be Attached to an Export Invoice? Infographic