Required documents for electronic invoice submission include a valid purchase order, the invoice itself in the specified digital format, and proof of delivery or service completion. Tax identification numbers and payment terms must be clearly stated to ensure compliance with regulatory standards. Properly formatted digital signatures or authentication tokens are often necessary to validate the invoice's authenticity.

What Documents are Necessary for Electronic Invoice Submission?

| Number | Name | Description |

|---|---|---|

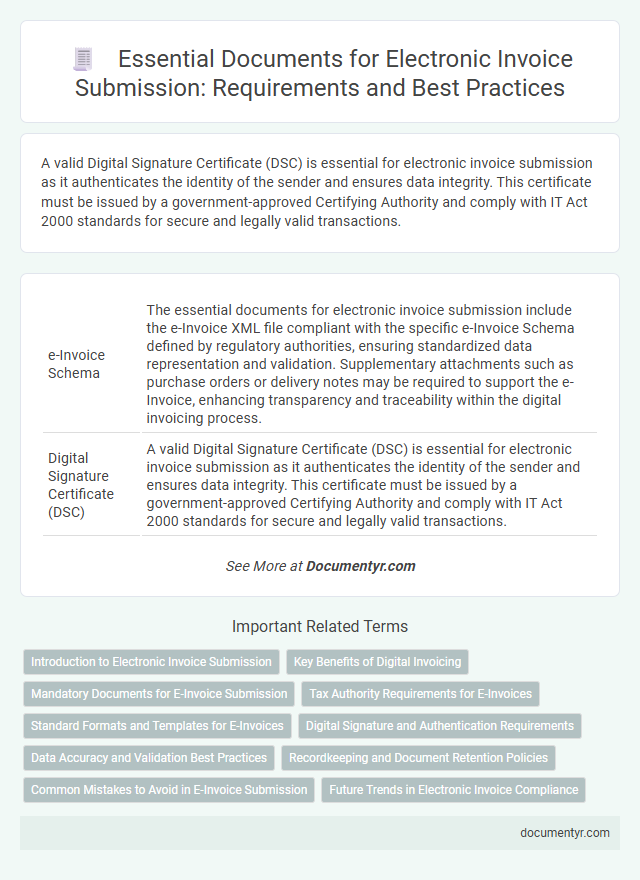

| 1 | e-Invoice Schema | The essential documents for electronic invoice submission include the e-Invoice XML file compliant with the specific e-Invoice Schema defined by regulatory authorities, ensuring standardized data representation and validation. Supplementary attachments such as purchase orders or delivery notes may be required to support the e-Invoice, enhancing transparency and traceability within the digital invoicing process. |

| 2 | Digital Signature Certificate (DSC) | A valid Digital Signature Certificate (DSC) is essential for electronic invoice submission as it authenticates the identity of the sender and ensures data integrity. This certificate must be issued by a government-approved Certifying Authority and comply with IT Act 2000 standards for secure and legally valid transactions. |

| 3 | IRN (Invoice Reference Number) | Electronic invoice submission requires the Invoice Reference Number (IRN), a unique 64-character hash generated by the GST system, to authenticate each invoice. Alongside the IRN, essential documents include the invoice in JSON format, digital signature, and GST-compliant tax details for successful validation and filing. |

| 4 | QR Code Compliance | Electronic invoice submission requires a valid QR code that complies with the latest government standards, embedding essential data such as invoice number, date, total amount, and tax details. Ensuring QR code compliance facilitates swift verification, reduces errors, and supports seamless integration with tax authority systems. |

| 5 | JSON Payload File | The essential document for electronic invoice submission is the JSON payload file, which must contain structured data including invoice number, date, seller and buyer information, itemized details, tax amounts, and total payable. Compliance with the specific schema mandated by tax authorities ensures accurate validation and seamless processing of electronic invoices. |

| 6 | GSP Authorization Letter | A GSP Authorization Letter is a critical document required for electronic invoice submission, as it authorizes a third party to act on behalf of the taxpayer in filing invoices through the Government Service Provider portal. This letter must be duly signed by the taxpayer and include specific details such as taxpayer identification, authorized representative information, and the scope of authorization to ensure compliance with electronic invoicing regulations. |

| 7 | API Access Token | An API access token is essential for electronic invoice submission as it authenticates the user and ensures secure data exchange between systems. This token must be included in the request header to validate identity and authorize access to the invoicing platform's API. |

| 8 | EDI Mapping Document | The EDI Mapping Document is essential for electronic invoice submission as it defines the structure and format required to translate invoice data into standardized Electronic Data Interchange (EDI) formats, ensuring seamless communication between trading partners. It includes details such as segment identifiers, data elements, and transaction sets that align with industry-specific EDI standards like EDIFACT or ANSI X12. |

| 9 | GST Compliance Report | The GST Compliance Report is a crucial document for electronic invoice submission, detailing transaction data to ensure adherence to tax regulations under the Goods and Services Tax framework. Accurate and complete GST Compliance Reports enable seamless validation and processing of electronic invoices by tax authorities, minimizing errors and compliance risks. |

| 10 | Real-Time Validation Receipt | Electronic invoice submission requires the Real-Time Validation Receipt to confirm that the invoice data has been accurately verified and accepted by the tax authority's system. This receipt includes essential information such as the timestamp, validation status, and a unique confirmation code, ensuring compliance with legal and regulatory standards for digital invoicing. |

Introduction to Electronic Invoice Submission

Electronic invoice submission streamlines the billing process by allowing businesses to send and receive invoices digitally. This method enhances efficiency and reduces paper usage, making transactions faster and more environmentally friendly.

To ensure accurate processing, specific documents are required for electronic invoice submission. These documents verify the transaction details and support compliance with legal and financial regulations.

Key Benefits of Digital Invoicing

Submitting an electronic invoice requires specific documents to ensure accuracy and compliance with regulatory standards. These documents streamline the process, enabling faster transaction verification and record-keeping.

- Invoice Document - A detailed digital invoice including product or service descriptions, quantities, prices, and tax information essential for transaction validation.

- Business Registration Proof - Official documentation verifying the identity and legitimacy of the invoicing entity to support legal and tax compliance.

- Payment Terms and Conditions - Clearly defined terms establishing payment deadlines, methods, and penalties to avoid disputes and enhance transparency.

Mandatory Documents for E-Invoice Submission

What documents are mandatory for electronic invoice submission? Mandatory documents for e-invoice submission include the original invoice issued by the supplier and the purchase order received from the buyer. These documents ensure authenticity and compliance with tax regulations.

Tax Authority Requirements for E-Invoices

Electronic invoice submission requires specific documents to ensure compliance with tax authority regulations. These include a valid electronic invoice file in the prescribed XML format, a digital signature certificate for authentication, and supporting transaction details such as purchase orders or delivery notes. Your submission must align with the tax authority's data validation standards to avoid rejection or penalties.

Standard Formats and Templates for E-Invoices

Submitting an electronic invoice requires adherence to specific document standards to ensure accuracy and compliance. Understanding the standard formats and templates for e-invoices is essential for smooth processing and acceptance.

- Standardized XML Format - The XML format is widely used for e-invoices due to its structured data capabilities and compatibility with various accounting systems.

- UBL and CII Templates - Universal Business Language (UBL) and Cross Industry Invoice (CII) are common standardized templates that facilitate interoperability between businesses and tax authorities.

- Digital Signature Requirement - Your e-invoice must include a digital signature to verify authenticity and prevent tampering during electronic submission.

Digital Signature and Authentication Requirements

Electronic invoice submission requires specific documents to ensure authenticity and legal compliance. A digitally signed invoice is essential for verifying the sender's identity and maintaining data integrity.

The digital signature must comply with recognized standards such as XAdES or PAdES, depending on the invoice format. Authentication often involves using secure certificates issued by trusted certificate authorities (CAs). These requirements prevent tampering and guarantee that the invoice is accepted by tax authorities and clients.

Data Accuracy and Validation Best Practices

| Necessary Documents for Electronic Invoice Submission | Data Accuracy and Validation Best Practices |

|---|---|

| Invoice Document (XML or PDF Format) | Ensure the invoice file format complies with system requirements, typically XML for data parsing and PDF for human-readable records. |

| Purchase Order (PO) Reference | Double-check PO numbers against existing records to confirm the invoice corresponds to approved transactions, minimizing discrepancies. |

| Company Tax Identification Number (TIN) | Validate the TIN using government-issued registries to prevent tax-related errors and ensure compliance with tax authorities. |

| Supplier Identification Details | Verify supplier legal names, addresses, and registration numbers against authoritative databases for identity confirmation and fraud reduction. |

| Invoice Amount and Currency Information | Apply automated validation to confirm numerical accuracy, currency codes, and calculations such as totals, taxes, and discounts. |

| Invoice Date and Due Date | Check for valid date formats (ISO 8601: YYYY-MM-DD) and logical consistency in billing cycles and payment terms. |

| Line Item Details (Product/Service Description, Quantity, Unit Price) | Ensure line items reflect exact quantities, pricing units, and descriptions to match purchase agreements and avoid disputes. |

| Digital Signature or Electronic Verification Token | Validate digital signatures using cryptographic methods to verify authenticity and protect against tampering. |

| Supporting Attachments (Delivery Receipts, Contracts) | Include relevant documents with metadata tags linked to invoice references for comprehensive validation and audit trails. |

Recordkeeping and Document Retention Policies

Electronic invoice submission requires specific documentation to ensure compliance with legal and financial standards. Proper recordkeeping and adherence to document retention policies are critical for audit readiness and regulatory compliance.

- Invoice Copies - Digital or scanned copies of all submitted invoices must be securely stored for verification and reference.

- Transaction Records - Detailed records of invoice transactions, including dates and payment status, are essential for financial tracking.

- Retention Periods - Documents must be retained according to jurisdiction-specific retention timelines, typically ranging from 5 to 7 years.

Maintaining organized and accessible electronic invoice records supports efficient audits and legal compliance.

Common Mistakes to Avoid in E-Invoice Submission

Electronic invoice submission requires essential documents such as a valid purchase order, a detailed invoice with itemized charges, and proof of delivery or service completion. Common mistakes to avoid include submitting incomplete invoices, incorrect vendor information, and missing authorization signatures. Ensuring accurate and complete documentation helps prevent processing delays and payment issues.

What Documents are Necessary for Electronic Invoice Submission? Infographic