Invoice auditing requires essential documents such as the original invoice, purchase order, and delivery receipt to verify accuracy and legitimacy. Supporting documents like payment records, contract agreements, and correspondence between parties help ensure compliance and resolve discrepancies. Detailed documentation enables auditors to cross-check transaction details and confirm that charges align with agreed terms.

What Documents are Needed for Invoice Auditing?

| Number | Name | Description |

|---|---|---|

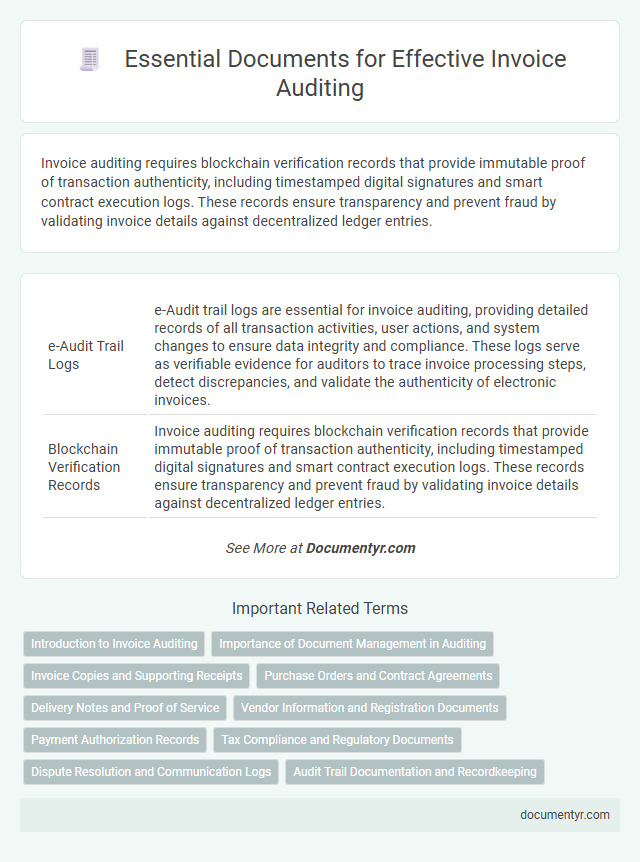

| 1 | e-Audit Trail Logs | e-Audit trail logs are essential for invoice auditing, providing detailed records of all transaction activities, user actions, and system changes to ensure data integrity and compliance. These logs serve as verifiable evidence for auditors to trace invoice processing steps, detect discrepancies, and validate the authenticity of electronic invoices. |

| 2 | Blockchain Verification Records | Invoice auditing requires blockchain verification records that provide immutable proof of transaction authenticity, including timestamped digital signatures and smart contract execution logs. These records ensure transparency and prevent fraud by validating invoice details against decentralized ledger entries. |

| 3 | Digital Twin Invoices | Digital Twin invoices require detailed supporting documentation such as purchase orders, delivery receipts, contract agreements, and payment confirmations to ensure accuracy during invoice auditing. Integration of digital records with physical transaction data enhances verification processes and reduces discrepancies in financial audits. |

| 4 | ESG Compliance Certificates | ESG compliance certificates are essential documents for invoice auditing, verifying that the goods or services meet environmental, social, and governance standards. Auditors require these certificates alongside financial records to ensure vendor accountability and adherence to sustainable business practices. |

| 5 | AI-Generated Discrepancy Reports | AI-generated discrepancy reports require supporting documents such as original purchase orders, delivery receipts, payment records, and contract terms to validate invoice accuracy. These reports analyze data anomalies by cross-referencing transactional documents to detect errors, fraud, or compliance issues during invoice auditing. |

| 6 | Dynamic QR Code Attachments | Dynamic QR code attachments in invoice auditing enable instant access to linked documents such as purchase orders, delivery receipts, and payment confirmations, ensuring accurate verification and reducing fraud risks. These QR codes streamline the audit process by consolidating all relevant files into a single scannable source, enhancing efficiency and traceability. |

| 7 | Invoice OCR Validation Sheets | Invoice OCR validation sheets are critical documents for invoice auditing, capturing extracted data such as vendor details, invoice numbers, dates, and line item descriptions to ensure accuracy and compliance. These sheets streamline the verification process by cross-referencing scanned invoice data with original records, reducing errors and facilitating efficient audit trails. |

| 8 | API Transaction Ledgers | API transaction ledgers serve as critical documents for invoice auditing by providing detailed, timestamped records of every transaction, enabling accurate verification of invoice entries. These ledgers include data such as transaction IDs, amounts, timestamps, and status codes, essential for cross-referencing and ensuring compliance during the audit process. |

| 9 | Real-time Vendor Master Data Snapshots | Real-time vendor master data snapshots are essential documents for invoice auditing as they provide accurate and up-to-date information on vendor details, payment terms, and historical transaction records. These dynamic data captures enable auditors to verify invoice authenticity, ensure compliance with contractual agreements, and detect discrepancies in vendor information promptly. |

| 10 | E-invoice PEPPOL Access Points Logs | E-invoice PEPPOL Access Points logs are essential documents for invoice auditing as they provide detailed transaction records, ensuring compliance with electronic invoicing standards and traceability of invoice exchanges. These logs verify the authenticity and integrity of transmitted invoices by capturing timestamps, sender and receiver identification, and message status within the PEPPOL network. |

Introduction to Invoice Auditing

Invoice auditing involves a thorough examination of your financial documents to ensure accuracy and compliance. Key documents needed include the original invoice, purchase orders, delivery receipts, and payment records. These materials help verify the legitimacy of charges and detect any discrepancies during the audit process.

Importance of Document Management in Auditing

Efficient document management is crucial for accurate invoice auditing. Proper organization and accessibility of audit documents ensure compliance and accuracy in financial reporting.

- Invoice Copies - These are essential as primary evidence for verifying billed transactions.

- Purchase Orders - They help confirm that the invoiced items or services were authorized and requested.

- Payment Receipts - These documents provide proof of payment and help reconcile accounts during the audit process.

Invoice Copies and Supporting Receipts

Invoice auditing requires precise documentation to verify the accuracy and legitimacy of transactions. Essential documents include invoice copies and supporting receipts that substantiate the billed items or services.

Invoice copies provide a detailed account of charges and payment terms, serving as the primary reference in the audit process. Supporting receipts confirm the actual expenses incurred, ensuring the invoice details align with financial records.

Purchase Orders and Contract Agreements

Invoice auditing requires thorough verification of Purchase Orders to ensure that the billed items match the authorized purchases. Contract Agreements play a crucial role in confirming the agreed terms, prices, and conditions between parties. You must gather both documents to validate the accuracy and legitimacy of each invoice.

Delivery Notes and Proof of Service

What documents are needed for invoice auditing? Delivery notes are essential as they confirm the goods or services were received as specified. Proof of service verifies that the tasks or services billed were completed according to contract terms.

Vendor Information and Registration Documents

Invoice auditing requires accurate vendor information to verify the legitimacy of each transaction. Proper vendor details ensure compliance and facilitate smooth processing.

Registration documents are essential to authenticate the vendor's legal status and tax identification. These documents typically include business licenses, tax registration certificates, and corporate identification numbers. You must provide these records to maintain transparency and streamline the audit process.

Payment Authorization Records

Payment authorization records are critical documents required for invoice auditing. These records verify the approval and legitimacy of payments made.

- Authorization Signatures - Signatures confirm that authorized personnel have approved the payment.

- Approval Dates - Dates indicate when the payment authorization was granted, ensuring timely validation.

- Payment Limits - Documentation of authorized spending limits prevents unauthorized or excessive payments.

Accurate payment authorization records help maintain compliance and financial accountability during invoice audits.

Tax Compliance and Regulatory Documents

Invoice auditing requires specific documents to ensure tax compliance and meet regulatory standards. Proper documentation helps verify the accuracy and legitimacy of financial transactions.

- Tax Registration Certificates - These documents confirm the vendor's legal registration for tax purposes, ensuring legitimate tax reporting.

- Tax Invoices - Official invoices containing detailed transaction information are essential for validating tax deductions and compliance.

- Compliance Reports - Regulatory compliance reports verify adherence to government tax laws and financial regulations during auditing.

Dispute Resolution and Communication Logs

| Document Type | Description |

|---|---|

| Invoice Copies | Original and revised invoices related to the transaction under audit. |

| Purchase Orders | Authorized purchase orders that correspond with invoiced items or services. |

| Dispute Resolution Records | Documents detailing disagreements over invoices including claims, counterclaims, and resolution outcomes. |

| Communication Logs | Emails, letters, or recorded conversations that capture dialogue between involved parties to clarify invoice issues. |

| Approval Signatures | Verified signatures confirming review and acceptance of invoices and resolutions to disputes. |

| Payment Records | Proof of payments made, including remittance advices and bank statements, to verify invoice settlement. |

What Documents are Needed for Invoice Auditing? Infographic