Freelancers need several essential documents for invoice tax filing, including detailed invoices that specify services rendered, payment receipts, and a record of business expenses. Maintaining accurate financial statements and proof of tax deductions helps ensure compliance with tax regulations. Keeping these documents organized streamlines the filing process and supports accurate income reporting.

What Documents Does a Freelancer Need for Invoice Tax Filing?

| Number | Name | Description |

|---|---|---|

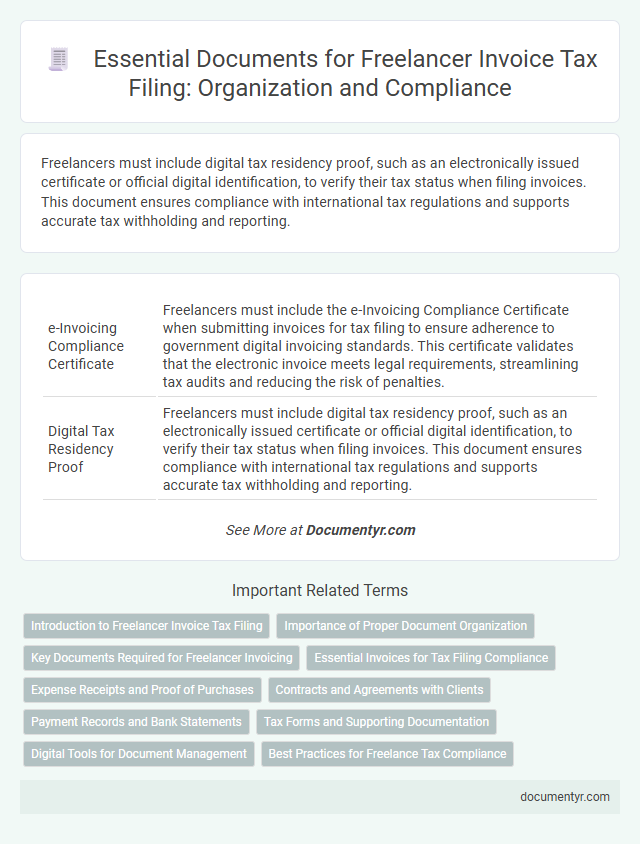

| 1 | e-Invoicing Compliance Certificate | Freelancers must include the e-Invoicing Compliance Certificate when submitting invoices for tax filing to ensure adherence to government digital invoicing standards. This certificate validates that the electronic invoice meets legal requirements, streamlining tax audits and reducing the risk of penalties. |

| 2 | Digital Tax Residency Proof | Freelancers must include digital tax residency proof, such as an electronically issued certificate or official digital identification, to verify their tax status when filing invoices. This document ensures compliance with international tax regulations and supports accurate tax withholding and reporting. |

| 3 | Payment Gateway Transaction Logs | Freelancers must retain payment gateway transaction logs as essential documents for invoice tax filing, as these records provide detailed information on payment dates, amounts, and client details crucial for accurate income reporting and audit verification. Maintaining organized transaction logs from platforms like PayPal, Stripe, or Square ensures compliance with tax regulations and facilitates smooth reconciliation of reported earnings. |

| 4 | Self-Billing Agreements | Freelancers using self-billing agreements must keep copies of the self-billing authorization form, issued invoices generated by the client, and detailed records of all payments received under the agreement for accurate tax filing. Maintaining these documents ensures compliance with tax regulations and facilitates proper reporting of income and VAT obligations. |

| 5 | Reverse Charge Mechanism Statements | Freelancers must include Reverse Charge Mechanism (RCM) statements on invoices when applicable, specifying the GST amount payable by the recipient to comply with tax filing regulations. Essential documents include the invoice itself, GST registration certificate, and proof of service delivery to validate the reverse charge transaction during tax assessments. |

| 6 | GSTIN-Specific Invoice Templates | Freelancers must use GSTIN-specific invoice templates that include the GST Identification Number, itemized tax details, and applicable GST rates to comply with tax regulations. Maintaining these standardized invoices ensures accurate filing, claiming input tax credits, and audit readiness. |

| 7 | Withholding Tax Deduction Certificates | Freelancers must collect Withholding Tax Deduction Certificates to accurately report withheld taxes on invoices for tax filing. These certificates serve as official proof of tax deductions made by clients, ensuring compliance with tax authorities and preventing double taxation. |

| 8 | Freelancer KYC Verification Files | Freelancers must provide essential KYC verification documents such as government-issued ID (passport, driver's license), proof of address (utility bill, bank statement), and tax identification number for accurate invoice tax filing. These documents ensure compliance with tax authorities and facilitate seamless income reporting and tax deduction claims. |

| 9 | Electronic Signature Audit Trail | Freelancers must maintain an electronic signature audit trail to ensure compliance during invoice tax filing, capturing detailed records of signature timestamps, IP addresses, and user authentication. This audit trail provides verifiable evidence of consent and transaction integrity, crucial for tax audits and legal validation. |

| 10 | AIS (Annual Information Statement) Extract | Freelancers must obtain the AIS (Annual Information Statement) Extract, which provides a comprehensive summary of all financial transactions and tax-related documents filed during the year, essential for accurate invoice tax filing. This extract includes details such as income summaries, GST credits, and TDS deductions, ensuring compliance and easing the audit process with the tax authorities. |

Introduction to Freelancer Invoice Tax Filing

Freelancers must organize specific documents to accurately file taxes related to their invoices. Proper documentation ensures compliance with tax regulations and smooth financial management.

- Invoices - Detailed records of services rendered and payments received are essential for income reporting.

- Expense Receipts - Proof of business-related expenses helps in claiming deductions and reducing taxable income.

- Tax Identification Number - Official identification ensures proper filing and verification with tax authorities.

Importance of Proper Document Organization

| Document Type | Description | Importance for Tax Filing |

|---|---|---|

| Invoice Copies | Records of all issued invoices indicating services provided, amounts charged, and payment terms. | Essential for verifying income and matching payments received during the tax period. |

| Receipts | Proof of expenses related to business operations such as supplies, software subscriptions, or travel. | Crucial for claiming deductions and reducing taxable income accurately. |

| Bank Statements | Documents showing deposits and withdrawals related to freelance earnings and expenses. | Supports reconciling invoice payments and business expenses with declared income. |

| Tax Identification Documents | Official records such as Social Security Number (SSN) or Taxpayer Identification Number (TIN). | Required for proper reporting and filing of taxes with government authorities. |

| Contracts and Agreements | Written agreements detailing freelance job scope, payment rates, and deadlines. | Helps establish the legitimacy of income and contractual obligations. |

| Expense Logs | Detailed records tracking daily business expenses and purchases. | Enhances accuracy of deductions by providing evidence of business-related costs. |

Proper organization of these documents ensures efficient tax filing and minimizes errors. Maintaining an organized system reduces the risk of missing important papers, facilitates easier audit preparation, and supports compliance with tax regulation requirements. Freelancers benefit from streamlined workflows and clear financial records by categorizing and securely storing these essential documents.

Key Documents Required for Freelancer Invoicing

Freelancers must gather essential documents to ensure accurate invoice tax filing. Key documents include completed invoices, receipts for business expenses, and proof of payments received. Maintaining organized records of these helps streamline tax reporting and compliance for Your freelancing activities.

Essential Invoices for Tax Filing Compliance

```htmlWhat documents does a freelancer need for invoice tax filing? Freelancers require detailed invoices that include client information, service descriptions, dates, and payment terms. These invoices serve as essential proof of income and expenses for accurate tax reporting.

Which types of invoices are essential for tax filing compliance? Issued invoices, expense receipts, and payment confirmations are crucial for verifying revenue and deductible costs. Maintaining organized and accurate records ensures compliance with tax regulations and simplifies the filing process.

```Expense Receipts and Proof of Purchases

Freelancers must keep detailed expense receipts and proof of purchases to support their invoice tax filings. These documents serve as crucial evidence for deductible business expenses during tax assessments.

- Expense Receipts - Receipts validate the cost of goods or services bought for business use and help justify expense claims.

- Proof of Purchases - Invoices, bills, or payment confirmations demonstrate ownership and transaction details of business-related acquisitions.

- Organized Records - Keeping these documents well-organized ensures easier retrieval and accuracy during tax filing and auditing processes.

Maintain your receipts and proof of purchases carefully to streamline your tax filing and avoid discrepancies.

Contracts and Agreements with Clients

Contracts and agreements with clients are essential documents for freelancer invoice tax filing. These documents outline the scope of work, payment terms, and deadlines, serving as proof of income and business transactions.

Maintaining signed contracts helps verify the legitimacy of earnings during tax audits. Proper documentation of agreements supports accurate reporting and reduces the risk of disputes with tax authorities.

Payment Records and Bank Statements

Payment records are essential documents for invoice tax filing, as they provide proof of income received from clients. These records help verify the amounts billed and paid, ensuring accurate tax reporting.

Bank statements complement payment records by showing the actual deposits and withdrawals related to freelance work. Keeping organized bank statements supports the reconciliation of invoices and verifies the flow of funds for tax purposes.

Tax Forms and Supporting Documentation

Freelancers must gather specific tax forms and supporting documentation to ensure accurate invoice tax filing. Proper record-keeping helps in compliance and simplifies the tax submission process.

- Form 1099-NEC - This form reports nonemployee compensation received by freelancers from clients throughout the tax year.

- Invoices and Receipts - Detailed invoices and payment receipts provide evidence of income and expenses related to freelance work.

- Expense Records - Documentation such as receipts for business-related purchases, mileage logs, and other costs support deductible expense claims on tax returns.

Digital Tools for Document Management

Freelancers need essential documents such as detailed invoices, proof of payment, and expense receipts for accurate tax filing. Digital tools like accounting software and cloud storage streamline organization and ensure easy access to these records. Utilizing apps designed for invoice management enhances accuracy and simplifies document retrieval during tax season.

What Documents Does a Freelancer Need for Invoice Tax Filing? Infographic