Electronic invoice submission to government agencies requires specific documents to ensure compliance and smooth processing. Typically, businesses must provide the electronic invoice file in the prescribed XML or PDF format, along with a valid digital signature to authenticate the sender. Supporting documents such as purchase orders, delivery receipts, and tax identification numbers may also be necessary to validate the transaction and fulfill regulatory requirements.

What Documents Are Needed for Electronic Invoice Submission to Government Agencies?

| Number | Name | Description |

|---|---|---|

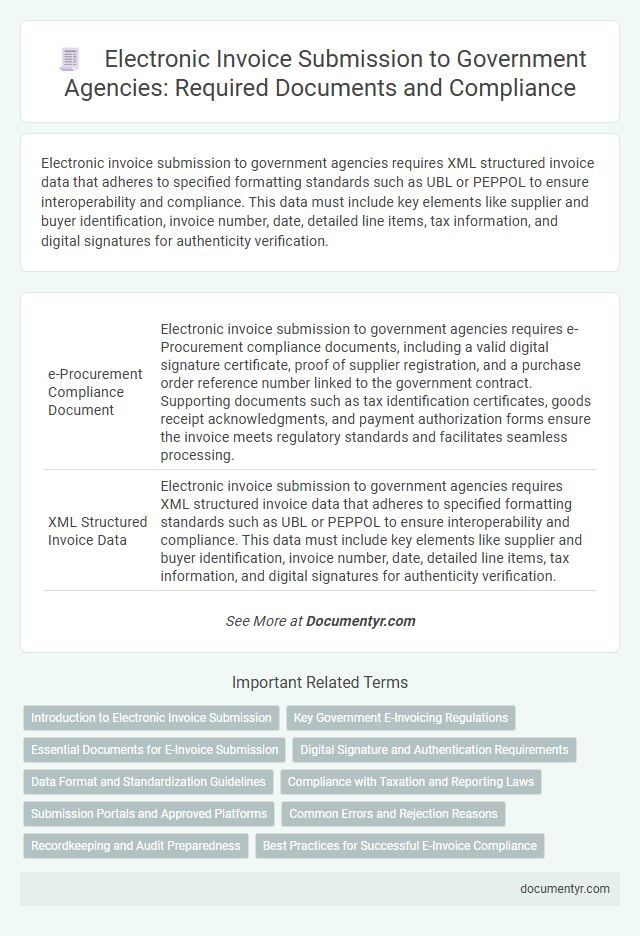

| 1 | e-Procurement Compliance Document | Electronic invoice submission to government agencies requires e-Procurement compliance documents, including a valid digital signature certificate, proof of supplier registration, and a purchase order reference number linked to the government contract. Supporting documents such as tax identification certificates, goods receipt acknowledgments, and payment authorization forms ensure the invoice meets regulatory standards and facilitates seamless processing. |

| 2 | XML Structured Invoice Data | Electronic invoice submission to government agencies requires XML structured invoice data that adheres to specified formatting standards such as UBL or PEPPOL to ensure interoperability and compliance. This data must include key elements like supplier and buyer identification, invoice number, date, detailed line items, tax information, and digital signatures for authenticity verification. |

| 3 | PEPPOL BIS Billing 3.0 Format | Electronic invoice submission to government agencies using the PEPPOL BIS Billing 3.0 format requires a validated XML invoice file adhering to the specific data structure, including mandatory fields such as invoice number, issue date, supplier and buyer details, tax information, and line item descriptions. Supporting documents like purchase orders, delivery receipts, and digital signatures may be required to ensure compliance with regulatory standards and facilitate seamless processing within government e-invoicing frameworks. |

| 4 | Digital Signature Certificate | A valid Digital Signature Certificate (DSC) is required for electronic invoice submission to government agencies, ensuring authentication, data integrity, and non-repudiation. This certificate must be issued by a trusted Certifying Authority (CA) recognized under the Information Technology Act to comply with legal standards. |

| 5 | QR-Code Embedded Invoice | Electronic invoice submission to government agencies requires a digitally signed invoice file, typically in XML or PDF format, embedded with a QR code containing key transaction details for verification. Supporting documents such as the purchase order, delivery note, and proof of payment must be uploaded alongside the QR-code embedded invoice to ensure compliance with regulatory standards. |

| 6 | Unique Invoice Reference Number (IRN) | The Unique Invoice Reference Number (IRN) is a critical document required for electronic invoice submission to government agencies, serving as a distinctive identifier for each invoice. It must be generated through a standardized process and included alongside the invoice to ensure compliance with regulatory frameworks and facilitate accurate tracking and validation. |

| 7 | Government e-Marketplace (GeM) Registration Proof | Government agencies require proof of Government e-Marketplace (GeM) registration as a mandatory document for electronic invoice submission to ensure authorized vendor participation. This registration certificate must be uploaded along with the digital invoice to validate the supplier's credentials and facilitate seamless processing. |

| 8 | Invoice Value Declaration Sheet | The Invoice Value Declaration Sheet is a crucial document for electronic invoice submission to government agencies, detailing the total invoice amount and itemized values for accurate tax assessment. This sheet ensures compliance with regulatory standards by providing a transparent breakdown of charges, facilitating seamless validation and approval processes. |

| 9 | GST e-Invoice JSON File | The GST e-Invoice JSON file is a mandatory document for electronic invoice submission to government agencies, containing detailed transaction data such as invoice number, supplier and recipient GSTIN, item descriptions, tax values, and transaction date. This structured file ensures compliance with GST regulations by enabling seamless validation and real-time data exchange between businesses and tax authorities. |

| 10 | API Integration Report | API integration reports for electronic invoice submission to government agencies must include transaction logs, authentication certificates, invoice payloads, and error response details to ensure compliance with regulatory requirements. These documents facilitate seamless data validation, audit trails, and real-time monitoring of invoice transmissions within government e-invoicing systems. |

Introduction to Electronic Invoice Submission

Electronic invoice submission is a digital process that allows businesses to send invoices directly to government agencies through authorized platforms. This method improves accuracy, speeds up processing times, and ensures compliance with regulatory requirements.

You need specific documents to complete your electronic invoice submission successfully. Essential documents typically include a valid electronic invoice in the prescribed format, proof of business registration, and any relevant tax identification numbers. Providing all required files ensures smooth verification and faster approval from government agencies.

Key Government E-Invoicing Regulations

Submitting an electronic invoice to government agencies requires adherence to key regulations such as the inclusion of a valid tax identification number, invoice date, and unique invoice number. Regulatory bodies mandate that the invoice format complies with standardized XML schemas to ensure data consistency and validation.

Essential documents include the original purchase order, proof of delivery or service completion, and the electronic invoice file signed with a digital certificate. Compliance with local e-invoicing mandates, such as mandatory archiving periods and secure data transmission protocols, ensures your submission is accepted without delays.

Essential Documents for E-Invoice Submission

What documents are essential for electronic invoice submission to government agencies? Electronic invoice submission requires specific documents to ensure compliance and verification. These documents typically include the invoice itself, proof of goods or services delivered, and taxpayer identification details.

Digital Signature and Authentication Requirements

Electronic invoice submission to government agencies requires essential documents such as the invoice file in the prescribed digital format and proof of the supplier's registration. A valid digital signature, created using an accredited certificate authority, is mandatory to ensure the authenticity and integrity of the invoice. Your submission must comply with authentication requirements, including secure login credentials and two-factor authentication, to guarantee authorized access and data protection.

Data Format and Standardization Guidelines

Submitting electronic invoices to government agencies requires strict adherence to specific data formats and standardization guidelines to ensure accuracy and compliance. Understanding these requirements streamlines the approval process and minimizes errors.

- XML Data Format - Most government agencies require invoices to be submitted in XML format, which structures invoice data in a machine-readable way for automated processing.

- Standardized Invoice Schema - Agencies often mandate the use of standardized schemas such as UBL (Universal Business Language) or Peppol, which define consistent fields and data validation rules.

- Digital Signature Requirements - Electronic invoices must include digital signatures or certificates to verify authenticity and integrity following government security protocols.

Compliance with Taxation and Reporting Laws

Electronic invoice submission to government agencies requires accurate documentation to ensure compliance with taxation laws. Essential documents include the electronic invoice file in the prescribed format and the associated tax identification details of the issuer and recipient.

Supporting documents such as purchase orders, delivery receipts, and payment confirmations may also be required to meet reporting standards. Proper adherence to local electronic invoicing regulations ensures timely processing and avoids penalties or legal issues.

Submission Portals and Approved Platforms

Electronic invoice submission to government agencies requires specific documents and adherence to designated platforms. Utilizing approved submission portals ensures compliance with regulatory standards.

- Invoice Document - A detailed electronic invoice in the approved format such as XML or PDF is mandatory for submission.

- Submission Portal Access - Access to government-authorized portals like Peppol, ClearTax, or GSTN is required for uploading invoices.

- Authentication Credentials - Secure login credentials or digital signatures authenticate the sender's identity during the submission process.

Using these approved platforms guarantees the invoices meet legal requirements and facilitates timely processing by government agencies.

Common Errors and Rejection Reasons

Electronic invoice submission to government agencies requires accurate documents such as the invoice itself, tax identification numbers, and purchase order references. Common errors include mismatched data between the invoice and purchase order, missing mandatory fields, and incorrect formatting. These issues often lead to rejection, delaying payment processing and compliance verification.

Recordkeeping and Audit Preparedness

| Document Type | Description | Purpose for Recordkeeping and Audit Preparedness |

|---|---|---|

| Original Invoice | Digital or scanned copy of the invoice issued to the customer | Serves as primary proof of transaction and ensures compliance with government regulations |

| Transaction Logs | Records of invoice issuance dates, amounts, and recipient details | Facilitates tracking and validation of all electronic invoices submitted |

| Tax Compliance Certificates | Documentation verifying adherence to applicable tax laws and registrations | Supports accuracy in tax reporting and verification during audits |

| Payment Receipts | Proof of payment related to the invoice, either digital or scanned copies | Confirms settlement of invoiced amounts and supports financial audit trails |

| Electronic Submission Receipts | Acknowledgement of invoice receipt from government electronic systems | Provides evidence of timely and accurate submission for compliance |

| Audit Trail Documentation | Comprehensive logs and metadata showing invoice lifecycle and modifications | Ensures traceability and transparency during government audits |

What Documents Are Needed for Electronic Invoice Submission to Government Agencies? Infographic