Electronic invoice submission to government agencies requires several key documents to ensure compliance and successful processing. These typically include the electronic invoice file in the specified format, the original purchase order or contract reference, and proof of delivery or service completion. Supporting identification documents such as the vendor's tax identification number and digital signature certificates are also essential for authentication and validation.

What Documents are Necessary for Electronic Invoice Submission to Government Agencies?

| Number | Name | Description |

|---|---|---|

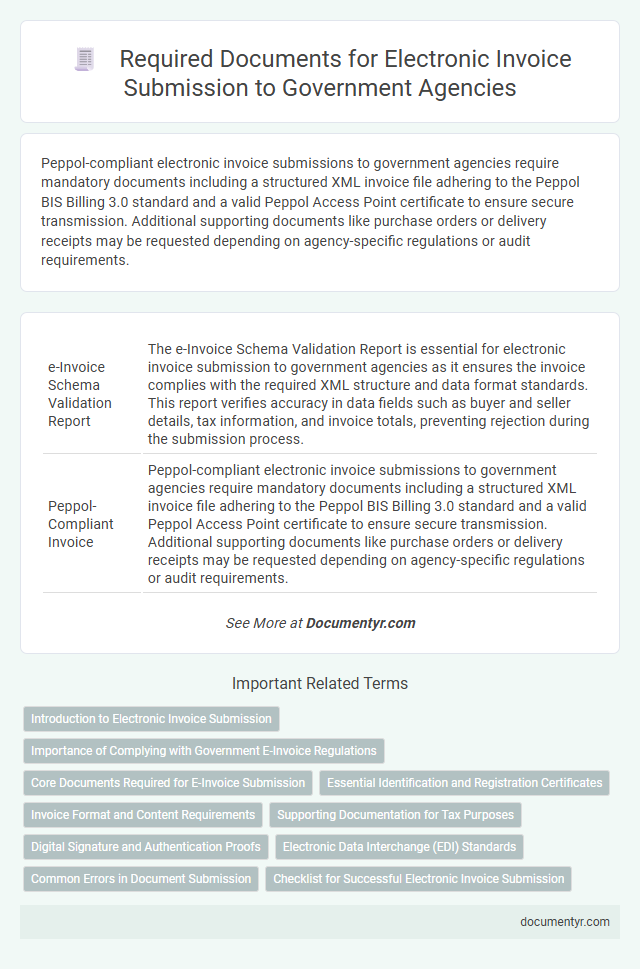

| 1 | e-Invoice Schema Validation Report | The e-Invoice Schema Validation Report is essential for electronic invoice submission to government agencies as it ensures the invoice complies with the required XML structure and data format standards. This report verifies accuracy in data fields such as buyer and seller details, tax information, and invoice totals, preventing rejection during the submission process. |

| 2 | Peppol-Compliant Invoice | Peppol-compliant electronic invoice submissions to government agencies require mandatory documents including a structured XML invoice file adhering to the Peppol BIS Billing 3.0 standard and a valid Peppol Access Point certificate to ensure secure transmission. Additional supporting documents like purchase orders or delivery receipts may be requested depending on agency-specific regulations or audit requirements. |

| 3 | QR Code Embedded Invoice | Electronic invoice submission to government agencies requires a clear, scannable QR code embedded within the invoice containing encrypted transaction details for quick verification. Essential documents include the original digital invoice file in XML or PDF format with embedded QR code, taxpayer identification information, and a digital signature to ensure authenticity and compliance with government standards. |

| 4 | Digital Signature Certificate | A Digital Signature Certificate (DSC) is mandatory for electronic invoice submission to government agencies, as it authenticates the identity of the sender and ensures the integrity of the invoice data. Alongside the DSC, essential documents include the invoice in the prescribed format, taxpayer identification number (TIN), and relevant business registration credentials. |

| 5 | e-Invoice Reference Number (IRN) | The Electronic Invoice Reference Number (IRN) is a unique identifier generated by the government's Invoice Registration Portal (IRP) and must be included in electronic invoice submissions to authenticate the document. Along with the IRN, essential documents include the digitally signed invoice in JSON format, the seller's GST details, and transaction-specific data to ensure compliance and proper validation during the submission process. |

| 6 | Supplier Onboarding Certificate | Supplier Onboarding Certificates are essential documents for electronic invoice submission to government agencies, verifying the supplier's registration and compliance status. These certificates streamline the approval process by confirming the supplier's legitimacy and eligibility within government procurement systems. |

| 7 | Tax Authority API Authorization Token | Submitting electronic invoices to government agencies requires a valid Tax Authority API Authorization Token to authenticate and enable secure data exchange. This token ensures compliance with tax regulations and facilitates real-time invoice verification and validation through the government's electronic invoicing system. |

| 8 | Government Unique Invoice Number (GUIN) | The Government Unique Invoice Number (GUIN) is a mandatory document for electronic invoice submission to government agencies, ensuring invoice authenticity and traceability. This unique identifier links the invoice to the issuing entity and facilitates efficient verification within government financial systems. |

| 9 | Electronic Remittance Advice (ERA) | Electronic Remittance Advice (ERA) is essential for verifying payment details and must accompany the electronic invoice submission to government agencies, ensuring accurate processing and reconciliation of transactions. Required documents also typically include the digital invoice itself, taxpayer identification, and authorization codes compliant with government e-invoicing standards. |

| 10 | Real-Time Invoice Acknowledgment Receipt | Electronic invoice submission to government agencies requires the original invoice file in standardized XML or UBL format alongside a digital signature to ensure authenticity. Real-time invoice acknowledgment receipts are essential for confirming successful transmission and legal validity within government tax systems. |

Introduction to Electronic Invoice Submission

Electronic invoice submission to government agencies streamlines tax reporting and compliance. Understanding the required documents ensures accurate and timely filing.

- Invoice Document - The digital invoice must include detailed transaction data, such as supplier and buyer information, item descriptions, and amounts.

- Tax Identification Numbers - Both parties' tax IDs are essential for validating the tax obligations and facilitating verification by government systems.

- Supporting Attachments - Additional documents like purchase orders or delivery receipts may be required to substantiate the transaction and support compliance audits.

Importance of Complying with Government E-Invoice Regulations

Electronic invoice submission to government agencies requires specific documents such as the original invoice, a valid digital signature, and relevant tax identification numbers. Proper documentation ensures accuracy and legal compliance during the submission process.

Complying with government e-invoice regulations is crucial to avoid penalties and delays in payment processing. Your adherence to these standards supports seamless transactions and maintains transparency in financial reporting.

Core Documents Required for E-Invoice Submission

Core documents required for electronic invoice submission to government agencies include the invoice itself, proof of transaction such as purchase orders or contracts, and taxpayer identification information. These documents ensure accurate processing and compliance with regulatory standards. You must prepare these essential records to facilitate smooth e-invoice validation and approval.

Essential Identification and Registration Certificates

Essential identification and registration certificates are crucial for electronic invoice submission to government agencies. These documents verify the legitimacy of your business and enable compliance with regulatory requirements.

Key documents include a valid business registration certificate, tax identification number (TIN), and relevant licenses or permits. A certified digital signature may also be necessary to authenticate the electronic invoice. Ensuring these documents are up-to-date facilitates seamless submission and approval by government portals.

Invoice Format and Content Requirements

What documents are necessary for electronic invoice submission to government agencies? Government agencies require electronic invoices to adhere to specific format and content requirements. Your invoice must be in a standardized electronic format, such as XML or JSON, and include mandatory data fields like invoice number, date, supplier details, buyer information, item descriptions, quantities, prices, taxes, and total amounts.

Supporting Documentation for Tax Purposes

Electronic invoice submission to government agencies requires specific supporting documents to ensure compliance with tax regulations. These documents validate the authenticity of transactions and facilitate accurate tax reporting.

- Invoice Copy - A detailed copy of the electronic invoice showing itemized charges and tax amounts must be included for verification.

- Taxpayer Identification Documentation - Valid identification such as tax ID or business registration certificates must accompany the invoice for authenticity confirmation.

- Proof of Payment - Payment receipts or bank transaction records are necessary to demonstrate that the invoiced amount has been settled.

Digital Signature and Authentication Proofs

Submitting electronic invoices to government agencies requires specific documents to ensure authenticity and legal compliance. Digital signatures and authentication proofs play a crucial role in this process.

- Digital Signature - A legally recognized electronic signature that verifies the identity of the sender and ensures the integrity of the invoice.

- Authentication Proof - Documents or certificates that confirm the legitimacy of the digital signature used on the invoice.

- Invoice Metadata - Structured data embedded within the invoice to comply with government standards and facilitate verification.

Providing these documents guarantees secure and accepted electronic invoice submission to government agencies.

Electronic Data Interchange (EDI) Standards

Electronic invoice submission to government agencies requires compliance with specific Electronic Data Interchange (EDI) standards such as EDIFACT, ANSI X12, or XML-based schemas. Essential documents include the invoice file formatted according to these standards, a digital signature for authentication, and any required supporting documents like purchase orders or delivery receipts. Adhering to these protocols ensures accurate data exchange, legal compliance, and streamlined processing within government systems.

Common Errors in Document Submission

| Required Documents for Electronic Invoice Submission |

|

|---|---|

| Common Errors in Document Submission |

|

| Important Reminder | You must ensure all electronic invoice documents comply with government agency specifications to avoid submission errors. |

What Documents are Necessary for Electronic Invoice Submission to Government Agencies? Infographic