International invoice compliance requires essential documents such as a commercial invoice detailing the product description, quantity, price, and terms of sale. A packing list specifying the contents and weight of each package ensures accurate customs processing. Customs declaration forms and any necessary certificates of origin or licenses validate the legality and origin of the goods.

What Documents are Needed for International Invoice Compliance?

| Number | Name | Description |

|---|---|---|

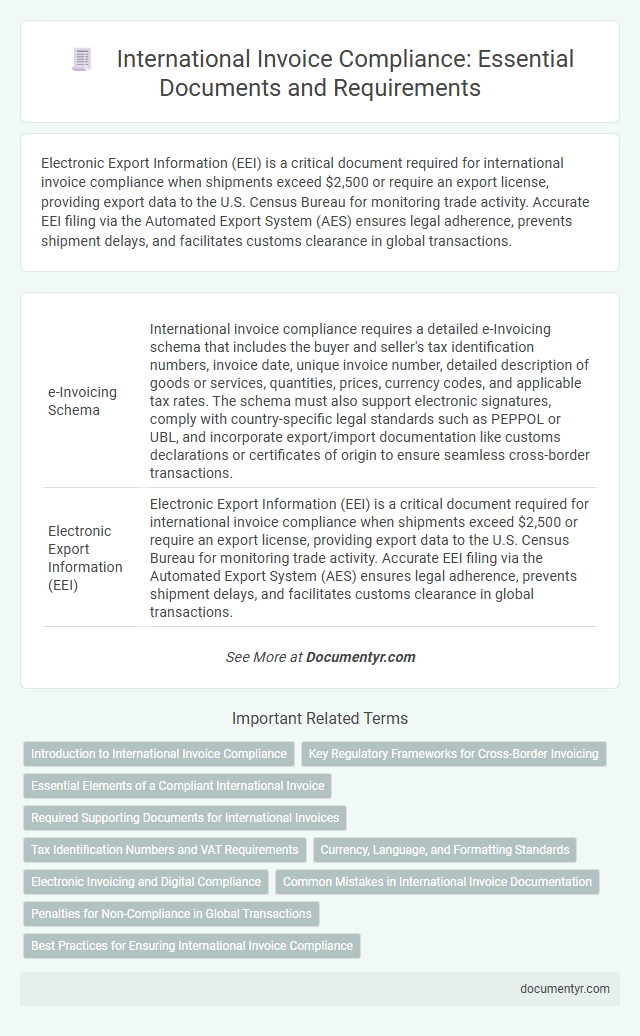

| 1 | e-Invoicing Schema | International invoice compliance requires a detailed e-Invoicing schema that includes the buyer and seller's tax identification numbers, invoice date, unique invoice number, detailed description of goods or services, quantities, prices, currency codes, and applicable tax rates. The schema must also support electronic signatures, comply with country-specific legal standards such as PEPPOL or UBL, and incorporate export/import documentation like customs declarations or certificates of origin to ensure seamless cross-border transactions. |

| 2 | Electronic Export Information (EEI) | Electronic Export Information (EEI) is a critical document required for international invoice compliance when shipments exceed $2,500 or require an export license, providing export data to the U.S. Census Bureau for monitoring trade activity. Accurate EEI filing via the Automated Export System (AES) ensures legal adherence, prevents shipment delays, and facilitates customs clearance in global transactions. |

| 3 | Commercial Invoice Blockchain Tag | A Commercial Invoice Blockchain Tag is essential for ensuring international invoice compliance by securely verifying the authenticity and integrity of transaction data through immutable ledger records. This digital tag facilitates seamless cross-border customs clearance and reduces fraud risk by providing transparent, tamper-proof documentation for export and import transactions. |

| 4 | Digital Signature Certificate (DSC) | A Digital Signature Certificate (DSC) is essential for verifying the authenticity and integrity of international invoices, ensuring compliance with digital transaction regulations across borders. It acts as a secure electronic key that encrypts the invoice, facilitating legal acceptance and preventing fraud in global trade documentation. |

| 5 | Global Trade Item Number (GTIN) | International invoice compliance requires accurate inclusion of the Global Trade Item Number (GTIN) to ensure product identification across global supply chains. Supporting documents must contain the GTIN to facilitate customs clearance, reduce shipment delays, and maintain traceability in international trade. |

| 6 | Single Administrative Document (SAD) | The Single Administrative Document (SAD) is a crucial customs form required for international invoice compliance, facilitating goods declaration and ensuring accurate customs valuations. This document must accompany shipments to meet legal requirements, verify import-export data, and streamline cross-border trade processes. |

| 7 | Importer Security Filing (ISF) | The Importer Security Filing (ISF) requires detailed shipment information including the seller, buyer, ship to, container stuffing location, consolidator, and manufacturer data to ensure international invoice compliance. Accurate ISF submission to U.S. Customs and Border Protection must include six key data elements to avoid penalties and facilitate smooth import clearance. |

| 8 | eAWB (Electronic Air Waybill) | International invoice compliance requires essential documents such as the commercial invoice, packing list, export license, and notably the eAWB (Electronic Air Waybill), which streamlines air cargo shipment by digitally replacing the traditional paper airway bill. The eAWB enhances tracking accuracy, reduces paperwork errors, and ensures adherence to IATA regulations for seamless global trade transactions. |

| 9 | EORI (Economic Operators Registration and Identification) | International invoice compliance requires including the EORI (Economic Operators Registration and Identification) number to ensure smooth customs clearance and trade across EU borders. This unique identifier links businesses to customs authorities, facilitating efficient tracking and verification of shipments in the global supply chain. |

| 10 | Customs Data Interchange File (CDIF) | Customs Data Interchange File (CDIF) is essential for international invoice compliance as it standardizes the electronic transmission of customs declarations, ensuring accurate and efficient processing of goods across borders. Accurate CDIF documentation includes detailed product descriptions, HS codes, origin information, and value declarations that comply with customs regulations and reduce the risk of delays or penalties. |

Introduction to International Invoice Compliance

Introduction to International Invoice Compliance |

|

|---|---|

| Definition | International invoice compliance refers to the adherence to laws, regulations, and standards governing invoices used in cross-border trade. |

| Purpose | Ensures accurate taxation, customs clearance, and payment processes, reducing the risk of delays and penalties. |

| Key Compliance Requirements | Invoices must include buyer and seller details, description of goods or services, quantities, unit prices, total amounts, currency, tax information, and applicable export/import codes. |

| Relevant Regulations | Local tax laws, international trade agreements, customs regulations, and standards such as the World Customs Organization (WCO) guidelines. |

| Importance for Businesses | Proper documentation safeguards against legal issues, streamlines customs processing, and facilitates smooth international transactions. |

| Common Documents Needed for Compliance | Commercial invoice, packing list, bill of lading, certificate of origin, export license, and insurance certificate. |

| Challenges | Varying country-specific requirements, changes in trade policies, language barriers, and ensuring data accuracy. |

Key Regulatory Frameworks for Cross-Border Invoicing

International invoice compliance requires precise documentation to meet various regulatory frameworks. Essential documents include the commercial invoice, packing list, certificate of origin, and relevant customs declarations. Compliance with frameworks such as the World Customs Organization (WCO) standards, Incoterms, and the European Union VAT Directive ensures smooth cross-border transactions and legal adherence.

Essential Elements of a Compliant International Invoice

What documents are needed for international invoice compliance? A compliant international invoice must include the commercial invoice, packing list, and bill of lading. These documents ensure accurate customs processing and shipment tracking.

What are the essential elements of a compliant international invoice? Key elements include the seller and buyer's full details, invoice number, and clear description of goods. Accurate declaration of value, currency, and payment terms is also critical for compliance.

Why is it important to include Harmonized System (HS) codes on an international invoice? HS codes classify traded products and facilitate customs clearance worldwide. Including these codes reduces delays and prevents costly penalties.

How do certificates of origin contribute to international invoice compliance? Certificates of origin verify the product's country of manufacture and may affect tariffs. Providing this document helps meet import regulations and trade agreements.

What role does correct shipment documentation play in invoice compliance? Documents such as the bill of lading or airway bill link the invoice to shipped goods. Proper shipment documents confirm delivery details and support customs verification.

Required Supporting Documents for International Invoices

International invoice compliance demands accurate and complete documentation to ensure smooth customs clearance and legal adherence. Proper supporting documents prevent delays and penalties during cross-border transactions.

- Commercial Invoice - Serves as the primary document detailing the transaction, including buyer, seller, description of goods, and price.

- Packing List - Provides detailed information about the shipment's contents, weight, and packaging, aiding customs inspection.

- Certificate of Origin - Verifies the country where the goods were manufactured, essential for tariff and trade agreement purposes.

Tax Identification Numbers and VAT Requirements

Ensuring international invoice compliance requires specific documentation, particularly your Tax Identification Numbers (TINs) from both the issuing and receiving countries. These numbers authenticate the transaction and are essential for customs and tax authorities.

Value Added Tax (VAT) requirements vary by country but generally mandate clear inclusion of VAT numbers and applicable rates on the invoice. Properly displaying VAT details prevents delays and ensures smooth cross-border trade.

Currency, Language, and Formatting Standards

International invoice compliance requires careful attention to currency, language, and formatting standards to ensure clear communication and legal validity across borders. Proper documentation supports smooth customs clearance and accurate payment processing.

- Currency Specification - Invoices must clearly state the currency used for all financial amounts, often adhering to the ISO 4217 currency codes to avoid exchange rate discrepancies.

- Language Requirements - The invoice should be issued in the language(s) accepted by both the exporting and importing countries, commonly English or the local official language for clarity and legal compliance.

- Formatting Standards - Standardized invoice formatting including invoice number, date, supplier and buyer details, product descriptions, and tax information is essential for meeting international trade regulations and facilitating customs procedures.

Electronic Invoicing and Digital Compliance

International invoice compliance requires specific documents to meet legal and digital standards. Electronic invoicing plays a vital role in ensuring accuracy and traceability across borders.

Key documents include the digital invoice file in the required format, such as XML or UBL, and the associated electronic signature for authenticity. Customs declarations and proof of export may also be necessary to comply with international regulations. Ensuring your invoicing system supports these electronic documents guarantees smoother transactions and legal adherence.

Common Mistakes in International Invoice Documentation

International invoice compliance requires precise documentation to avoid customs delays and legal penalties. Many exporters overlook critical details that can invalidate their invoices.

- Missing Essential Information - Invoices often lack key data such as buyer and seller details, shipment terms, or item descriptions, causing customs clearance issues.

- Incorrect Harmonized System Codes - Using wrong or vague HS codes can lead to misclassification of goods and incorrect duties or taxes applied.

- Currency and Payment Terms Errors - Ambiguities in currency specification and payment conditions create confusion, delaying payment settlements and shipment processing.

Ensuring accurate and complete documentation fosters smoother international trade and regulatory compliance.

Penalties for Non-Compliance in Global Transactions

International invoice compliance requires documents such as a commercial invoice, packing list, and certificate of origin to ensure accurate customs clearance. Failure to provide these documents can result in severe penalties, including fines, shipment delays, and potential seizure of goods. Businesses engaging in global transactions must adhere to these requirements to avoid costly legal and financial consequences.

What Documents are Needed for International Invoice Compliance? Infographic