Freelancers must include key documents such as a valid tax identification number, detailed service descriptions, and the agreed payment terms to issue a tax-compliant invoice. Each invoice should feature the freelancer's name, address, and contact information alongside the client's details to ensure transparency. Accurate VAT registration information and unique invoice numbering are essential to meet legal tax requirements and facilitate smooth financial audits.

What Documents Does a Freelancer Need to Issue a Tax-Compliant Invoice?

| Number | Name | Description |

|---|---|---|

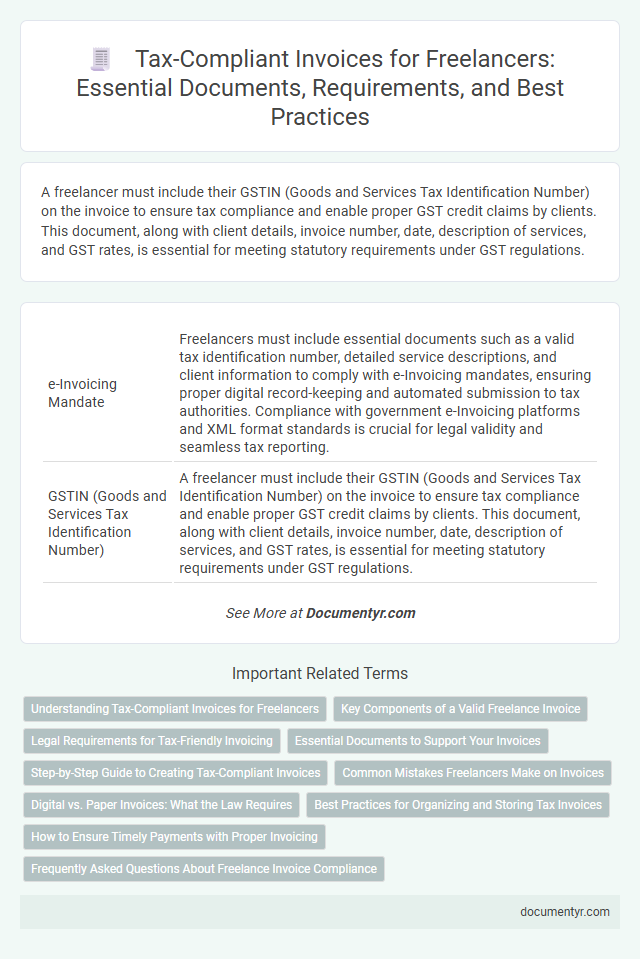

| 1 | e-Invoicing Mandate | Freelancers must include essential documents such as a valid tax identification number, detailed service descriptions, and client information to comply with e-Invoicing mandates, ensuring proper digital record-keeping and automated submission to tax authorities. Compliance with government e-Invoicing platforms and XML format standards is crucial for legal validity and seamless tax reporting. |

| 2 | GSTIN (Goods and Services Tax Identification Number) | A freelancer must include their GSTIN (Goods and Services Tax Identification Number) on the invoice to ensure tax compliance and enable proper GST credit claims by clients. This document, along with client details, invoice number, date, description of services, and GST rates, is essential for meeting statutory requirements under GST regulations. |

| 3 | UPI Integration Statement | Freelancers must include a UPI Integration Statement on their invoices to ensure seamless digital payment processing and compliance with tax regulations. This statement should feature the freelancer's UPI ID along with a declaration confirming the acceptance of payments via the Unified Payments Interface system. |

| 4 | Reverse Charge Mechanism Note | A freelancer issuing a tax-compliant invoice under the Reverse Charge Mechanism must include a clear note specifying the application of reverse charge VAT, along with their VAT identification number and the client's VAT number. This note ensures the VAT liability shifts to the recipient, complying with local tax regulations and avoiding invoicing errors. |

| 5 | Dynamic QR Code Link | A freelancer must include a dynamic QR code link on their tax-compliant invoice to enable real-time verification and ensure authenticity by linking to the official tax authority's database. This dynamic QR code contains essential invoice details such as invoice number, date, amount, and tax identification, streamlining tax reporting and compliance processes. |

| 6 | E-Signature Authentication | Freelancers must include an electronic signature authentication on invoices to verify identity and ensure compliance with tax regulations. This e-signature acts as a digital seal, preventing fraud and enabling secure, legally recognized invoice transmission. |

| 7 | TDS Certificate Attachment | Freelancers must attach a TDS (Tax Deducted at Source) certificate to their invoices to ensure compliance with tax regulations, as this document verifies the tax deducted by the client on the payment made. Including the TDS certificate with the invoice not only facilitates accurate tax reporting but also helps freelancers claim the deducted amount while filing their returns. |

| 8 | Place of Supply Declaration | Freelancers must include a clear Place of Supply declaration on their invoices to comply with tax regulations, specifying where the service was provided or goods delivered. This information is crucial for determining the applicable VAT rate and ensuring accurate tax reporting. |

| 9 | HSN/SAC Code Disclosure | Freelancers must include the appropriate HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) code on invoices to ensure GST compliance and accurate tax reporting. Proper disclosure of these codes facilitates seamless tax filing and helps avoid penalties during audits. |

| 10 | Self-Billing Agreement | Freelancers using a Self-Billing Agreement require a formal contract signed by both parties authorizing the client to issue invoices on their behalf, ensuring compliance with tax regulations. This agreement must detail the invoicing process, include the freelancer's tax identification number, and maintain accurate records for audit purposes. |

Understanding Tax-Compliant Invoices for Freelancers

| Document | Description | Importance |

|---|---|---|

| Tax Identification Number (TIN) | A unique number assigned by the tax authority used to identify the freelancer for tax purposes. | Essential for legitimacy and legal compliance on all invoices. |

| Invoice Template | A standardized format that includes all mandatory elements such as freelancer details, client information, service description, date, and amount. | Ensures clarity and meets regulatory requirements. |

| Service Description | Detailed explanation of services provided, including dates and scope of work. | Critical for accurate tax reporting and client transparency. |

| Pricing and Tax Breakdown | Itemized list showing the cost of services and applicable taxes like VAT or sales tax. | Facilitates correct tax calculation and compliance with tax laws. |

| Client's Contact Details | Name, address, and tax identification of the client receiving the invoice. | Required for record keeping and audits. |

| Payment Terms | Conditions under which payment is expected, including due date and method. | Helps avoid payment delays and legal disputes. |

| Invoice Number | Unique, sequential number assigned to each invoice for tracking purposes. | Important for accounting and audit trails. |

| Date of Issue | The exact date when the invoice is created and sent to the client. | Determines tax period and payment deadlines. |

Key Components of a Valid Freelance Invoice

A tax-compliant invoice is essential for freelancers to ensure proper documentation and legal adherence in their financial transactions. This invoice must contain specific elements to meet tax regulations and maintain transparency with clients.

Key components guarantee the invoice's validity and help in smooth accounting and tax reporting.

- Freelancer's Full Name and Contact Information - Include your legal name, address, phone number, and email to establish the invoice origin.

- Client's Details - Name and contact details of the client or business receiving the service must be clearly stated.

- Unique Invoice Number and Date - Assign a sequential invoice number and specify the issuance date to track transactions easily.

- Description of Services Provided - Clearly describe the work performed, including quantities, hourly rates, or fixed fees.

- Payment Terms and Total Amount Due - Specify the payment due date, accepted payment methods, and the total sum including applicable taxes.

- Tax Identification Number and VAT Information - Display your tax ID or VAT number to comply with tax authorities' requirements.

- Signature or Digital Authentication - Add a signature or electronic verification to authenticate the invoice legally.

Legal Requirements for Tax-Friendly Invoicing

Freelancers must include specific information on their invoices to comply with tax regulations, such as their full name, tax identification number, and the client's details. A clear description of the services rendered, along with the invoice date and a unique invoice number, is essential for legal validation.

Tax-compliant invoices must also specify the applicable tax rates and the total amount due, including taxes. Proper record-keeping of these documents ensures adherence to local tax laws and simplifies the filing of tax returns for freelancers.

Essential Documents to Support Your Invoices

Issuing a tax-compliant invoice requires several essential documents to ensure accuracy and legality. Typically, these include a valid tax identification number, proof of business registration, and detailed records of the services provided. Properly maintaining these documents supports your invoices and facilitates smooth tax reporting and audit processes.

Step-by-Step Guide to Creating Tax-Compliant Invoices

Freelancers must issue tax-compliant invoices to ensure legal and financial accuracy. Proper documentation supports transparent transactions and compliance with tax authorities.

Start by including essential information such as your full name, business name, and tax identification number. Add the client's details, invoice date, and a unique invoice number for tracking. Clearly list services provided, quantities, rates, and the total amount with applicable taxes.

Common Mistakes Freelancers Make on Invoices

Freelancers must include specific documents to issue a tax-compliant invoice properly. Missing or incorrect information on invoices can lead to legal complications and payment delays.

- Omitting Tax Identification Number (TIN) - Including your TIN ensures that the invoice is valid for tax reporting and compliance.

- Lack of Detailed Service Description - A clear description of services prevents misunderstandings and supports tax deductions.

- Incorrect Invoice Date or Numbering - Accurate dates and sequential invoice numbers maintain proper accounting records and avoid audits.

Ensuring all mandatory details are correctly listed on your invoice supports smooth financial and tax processes.

Digital vs. Paper Invoices: What the Law Requires

Freelancers must understand the legal requirements for issuing tax-compliant invoices, which vary between digital and paper formats. Digital invoices must include secure electronic signatures or unique identifiers to ensure authenticity and integrity as per tax regulations. Your paper invoices require handwritten signatures and must be stored for a specified period to comply with tax authorities' guidelines.

Best Practices for Organizing and Storing Tax Invoices

Freelancers must maintain organized and accessible records to ensure tax compliance when issuing invoices. Proper documentation minimizes errors and facilitates smooth audits by tax authorities.

- Keep Digital and Physical Copies - Store invoices both electronically and in printed form to safeguard against data loss and ensure easy retrieval.

- Use Consistent Naming Conventions - Apply standardized file names based on date and client name to quickly locate specific invoices.

- Maintain Backup Systems - Regularly back up all invoice data on secure cloud platforms or external drives to prevent accidental deletion or corruption.

How to Ensure Timely Payments with Proper Invoicing

What documents does a freelancer need to issue a tax-compliant invoice? A tax-compliant invoice must include your business identification number, client details, and a clear description of the services provided. Including payment terms and a unique invoice number helps ensure accuracy and legal compliance.

How can proper invoicing ensure timely payments? Clear invoicing with specified due dates, payment methods, and detailed service descriptions reduces payment delays and disputes. Providing all necessary documentation along with the invoice builds trust and accelerates the payment process.

What Documents Does a Freelancer Need to Issue a Tax-Compliant Invoice? Infographic