Accurate invoice payment processing requires essential documents such as the original invoice, purchase order, and proof of delivery or service completion. These documents verify the transaction details, ensuring compliance with company policies and facilitating timely payment. Proper documentation minimizes errors and accelerates the overall invoice approval process.

What Documents are Necessary for Invoice Payment Processing?

| Number | Name | Description |

|---|---|---|

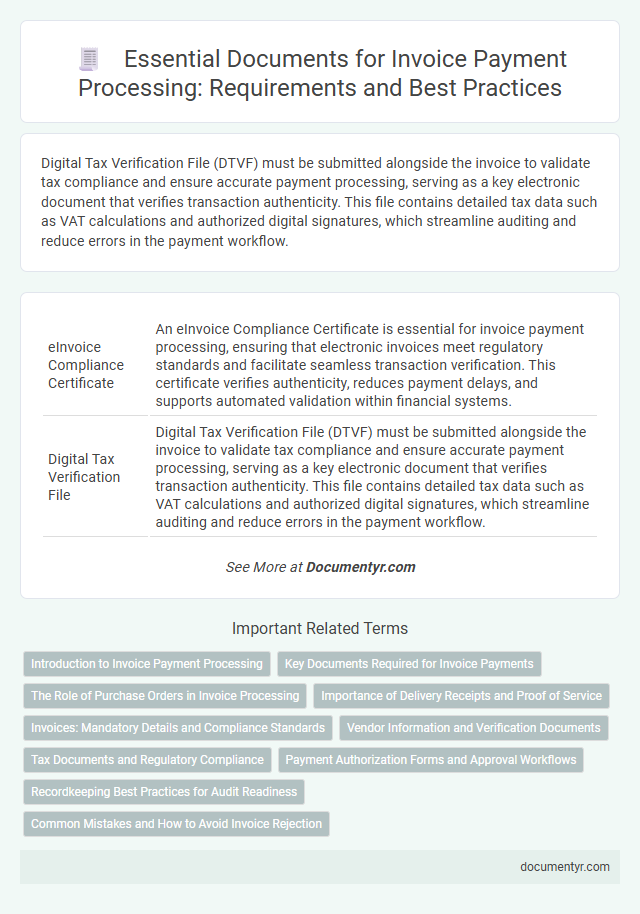

| 1 | eInvoice Compliance Certificate | An eInvoice Compliance Certificate is essential for invoice payment processing, ensuring that electronic invoices meet regulatory standards and facilitate seamless transaction verification. This certificate verifies authenticity, reduces payment delays, and supports automated validation within financial systems. |

| 2 | Digital Tax Verification File | Digital Tax Verification File (DTVF) must be submitted alongside the invoice to validate tax compliance and ensure accurate payment processing, serving as a key electronic document that verifies transaction authenticity. This file contains detailed tax data such as VAT calculations and authorized digital signatures, which streamline auditing and reduce errors in the payment workflow. |

| 3 | Blockchain Audit Trail Report | A Blockchain Audit Trail Report is essential for invoice payment processing as it provides a tamper-proof, transparent record of every transaction and approval step, ensuring authenticity and compliance. This report integrates with invoice documents to verify payment legitimacy, reduce fraud risk, and streamline audit procedures through immutable data trails. |

| 4 | Real-Time Payment Authorization Sheet | A Real-Time Payment Authorization Sheet is essential for invoice payment processing as it verifies transaction details and confirms approval instantly, reducing delays and errors. This document ensures compliance with company policies and regulatory standards while providing an auditable trail for financial accountability. |

| 5 | E-Signature Authentication Log | E-Signature Authentication Logs are crucial documents for invoice payment processing as they provide verifiable proof of authorized approvals and confirm the identity of signatories, ensuring compliance with legal and audit requirements. These logs track time stamps, IP addresses, and authentication methods, enhancing the security and validity of the electronic transaction workflow. |

| 6 | PEPPOL Access Point Confirmation | PEPPOL Access Point Confirmation is essential for verifying the legitimacy and connectivity of the trading parties involved in invoice payment processing. This document ensures secure, standardized transmission of electronic invoices, facilitating compliance with regulatory requirements and streamlining cross-border payment workflows. |

| 7 | Automated Clearing House (ACH) Remittance Advice | For efficient invoice payment processing via Automated Clearing House (ACH), remittance advice must include detailed transaction data such as payer and payee information, invoice numbers, payment amounts, and payment dates to ensure accurate reconciliation. This document enables seamless electronic funds transfer by providing essential payment instructions and confirming the origin and purpose of the payment. |

| 8 | Supplier Onboarding KYC Document | Supplier onboarding KYC documents essential for invoice payment processing include valid government-issued identification, proof of business registration, tax identification numbers, and banking details to verify legitimacy and facilitate payments. Accurate collection and verification of these documents ensure compliance with financial regulations and prevent payment delays. |

| 9 | Dynamic Discounting Approval Note | The Dynamic Discounting Approval Note is essential for invoice payment processing as it authorizes early payment discounts based on agreed terms, ensuring accurate financial records and compliance. This document must clearly specify discount rates, approval signatures, and applicable invoice details to validate and expedite payment adjustments. |

| 10 | AI-Based Invoice Matching Report | AI-based invoice matching reports streamline payment processing by automatically verifying purchase orders, delivery receipts, and vendor invoices against payment requests, minimizing manual errors and accelerating approval cycles. These reports ensure all necessary documents are accurately cross-referenced, enhancing compliance and reducing payment delays in accounts payable workflows. |

Introduction to Invoice Payment Processing

Invoice payment processing involves verifying and approving invoices before releasing payment to vendors. Essential documents include the original invoice, purchase order, and proof of goods or services delivery. Proper documentation ensures accurate payment, reduces errors, and improves financial record-keeping.

Key Documents Required for Invoice Payments

Invoice payment processing requires specific documents to ensure accuracy and compliance. Key documents facilitate verification and authorization steps.

The essential documents include a properly issued invoice, a purchase order matching the invoice details, and a receipt or proof of delivery. These documents confirm the transaction and validate the payment request. Your payment processing team relies on these records to prevent errors and fraud.

The Role of Purchase Orders in Invoice Processing

| Document | Purpose | Role in Invoice Payment Processing |

|---|---|---|

| Invoice | Itemized list of goods or services provided | Serves as the primary request for payment, detailing amounts, dates, and payment terms |

| Purchase Order (PO) | Formal authorization of a purchase agreement | Acts as a critical control document verifying that the invoice matches the approved purchase, ensuring accuracy and preventing fraudulent payments |

| Receipt or Delivery Note | Proof of receipt of goods or services | Confirms that the items invoiced were received as ordered, supporting invoice validation |

| Payment Authorization | Internal approval for releasing funds | Ensures accountability and compliance with company policies before payment is processed |

The role of purchase orders in invoice processing is foundational. Your invoice payment processing relies on matching the invoice with the corresponding purchase order. This alignment verifies that the goods or services billed were actually requested and approved. Purchase orders minimize errors, reduce payment delays, and uphold financial controls by holding payments to predetermined terms and conditions. Ensuring all necessary documents, especially the PO, are accurate and complete expedites the payment workflow effectively.

Importance of Delivery Receipts and Proof of Service

What documents are necessary for invoice payment processing? Delivery receipts and proof of service play a crucial role in validating the completion of goods or services. These documents ensure accuracy, prevent payment disputes, and provide a clear audit trail.

Invoices: Mandatory Details and Compliance Standards

Invoices require mandatory details such as the invoice number, date of issue, and a clear description of goods or services provided. Compliance standards mandate inclusion of the seller's and buyer's contact information, tax identification numbers, and payment terms. Ensuring these elements are present helps streamline your invoice payment processing and avoids delays.

Vendor Information and Verification Documents

Accurate vendor information and verification documents are essential for smooth invoice payment processing. These documents ensure the legitimacy of the vendor and compliance with accounting standards.

- Vendor Identification Details - Includes the vendor's legal name, address, and tax identification number to confirm their identity.

- Proof of Business Registration - Documents such as business licenses or certificates verify the vendor's legal operation status.

- Bank Account Information - Verified banking details are required to securely process payments to the correct vendor account.

Tax Documents and Regulatory Compliance

Invoice payment processing requires careful verification of tax documents and adherence to regulatory compliance to ensure accuracy and legality. Your submission must include all necessary paperwork to avoid delays and facilitate smooth transactions.

- Tax Identification Documents - These include VAT certificates or tax registration numbers necessary to verify the legitimacy of the vendor's tax status.

- Tax Invoices - Properly formatted invoices must detail the tax amounts charged to comply with local tax laws and enable accurate tax reporting.

- Regulatory Compliance Certificates - Certifications such as business licenses or industry-specific permits ensure the invoice aligns with applicable legal requirements and standards.

Payment Authorization Forms and Approval Workflows

Payment Authorization Forms are essential documents required to verify and approve the release of funds for invoice payment processing. These forms ensure that only authorized personnel can approve payments, reducing the risk of fraud and errors.

Approval Workflows streamline the invoice payment process by defining a sequence of approval steps within an organization. Your invoice payment processing depends on well-structured workflows to ensure timely and accurate payments while maintaining compliance and accountability.

Recordkeeping Best Practices for Audit Readiness

Invoice payment processing requires accurate and complete documentation to ensure timely and error-free transactions. Essential documents include the original invoice, purchase order, delivery receipts, and payment authorization forms.

Maintaining organized records of these documents supports audit readiness and compliance with financial regulations. Implementing digital recordkeeping systems enhances accessibility and reduces the risk of document loss during audits.

What Documents are Necessary for Invoice Payment Processing? Infographic