Invoice reconciliation requires essential documents such as the original invoice, purchase order, and delivery receipt to ensure accuracy. These records help verify that billed items match the ordered and received goods or services. Maintaining organized documentation streamlines the reconciliation process and prevents payment discrepancies.

What Documents are Necessary for Invoice Reconciliation Basics?

| Number | Name | Description |

|---|---|---|

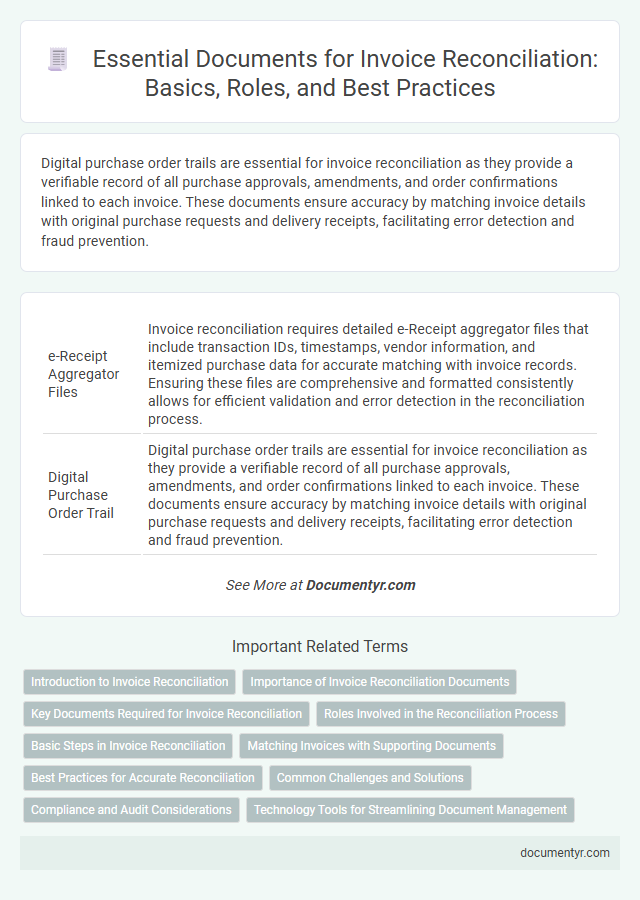

| 1 | e-Receipt Aggregator Files | Invoice reconciliation requires detailed e-Receipt aggregator files that include transaction IDs, timestamps, vendor information, and itemized purchase data for accurate matching with invoice records. Ensuring these files are comprehensive and formatted consistently allows for efficient validation and error detection in the reconciliation process. |

| 2 | Digital Purchase Order Trail | Digital purchase order trails are essential for invoice reconciliation as they provide a verifiable record of all purchase approvals, amendments, and order confirmations linked to each invoice. These documents ensure accuracy by matching invoice details with original purchase requests and delivery receipts, facilitating error detection and fraud prevention. |

| 3 | Blockchain-Stamped Delivery Notes | Blockchain-stamped delivery notes provide tamper-proof proof of goods received, ensuring accuracy and authenticity in invoice reconciliation. These documents are crucial alongside purchase orders and invoices to verify transaction details and prevent disputes. |

| 4 | OCR-Extracted Payment Advices | OCR-extracted payment advices provide essential transaction details such as payment date, amount, and reference numbers, facilitating accurate invoice reconciliation by matching payments against outstanding invoices. These documents reduce manual errors, improve data accuracy, and accelerate the verification process in accounts payable workflows. |

| 5 | API-Linked Supplier Statements | API-linked supplier statements enable real-time access to transaction data, streamlining the verification and matching process during invoice reconciliation. Essential documents include purchase orders, delivery receipts, and the API-integrated supplier statements that provide automated, accurate billing details for efficient discrepancy resolution. |

| 6 | Smart Contract Verification Logs | Smart contract verification logs provide detailed records of transaction execution, ensuring accuracy and transparency in invoice reconciliation processes. These logs serve as essential documentation to validate contract terms, automate dispute resolution, and confirm payment obligations. |

| 7 | Dynamic Remittance Confirmations | Dynamic remittance confirmations streamline invoice reconciliation by providing real-time, detailed transaction data linked to specific invoices, enhancing accuracy and reducing errors. Essential documents include purchase orders, invoices, payment advices, and the dynamic remittance confirmations that contain up-to-date payment status and allocation details. |

| 8 | Real-time Discrepancy Flags | Invoice reconciliation requires essential documents such as purchase orders, delivery receipts, and vendor invoices to verify accuracy and ensure consistency. Real-time discrepancy flags automatically highlight mismatches between these documents, enabling prompt resolution and preventing payment errors. |

| 9 | AI-Generated Proof of Delivery | AI-generated Proof of Delivery documents are essential for invoice reconciliation, providing accurate, time-stamped verification of goods receipt that minimizes disputes and accelerates payment processing. Integrating AI-generated POD with purchase orders, delivery notes, and invoices ensures seamless cross-verification and enhances audit trail reliability. |

| 10 | Embedded Metadata Ledger | Invoice reconciliation basics require essential documents such as the original invoice, purchase order, and payment proof, with embedded metadata ledger providing a tamper-proof audit trail for each transaction. This metadata ledger enhances accuracy by securely linking invoice details, timestamps, and approval workflows for streamlined verification and dispute resolution. |

Introduction to Invoice Reconciliation

What documents are necessary for invoice reconciliation basics? Invoice reconciliation requires accurate and complete documentation to verify the correctness of invoices. Common documents include purchase orders, delivery receipts, and payment records.

Importance of Invoice Reconciliation Documents

Invoice reconciliation requires essential documents such as purchase orders, vendor invoices, and payment receipts to ensure accurate financial records. These documents validate the authenticity of transactions and help identify discrepancies between billed and received amounts. Maintaining proper invoice reconciliation documents is crucial for effective auditing, financial compliance, and avoiding payment errors.

Key Documents Required for Invoice Reconciliation

Invoice reconciliation requires careful verification of several key documents to ensure accuracy and compliance. Understanding the necessary paperwork is essential for smooth financial processing.

- Invoice Copy - This document serves as the primary reference detailing the billed amounts and services or products provided.

- Purchase Order (PO) - The PO confirms the authorized purchase details and pricing agreed upon before the transaction.

- Delivery Receipt or Goods Receipt Note - It verifies that the ordered items were received in full and in good condition.

Your ability to gather and cross-check these documents streamlines the invoice reconciliation process effectively.

Roles Involved in the Reconciliation Process

| Document Type | Description | Role Responsible |

|---|---|---|

| Purchase Order (PO) | Official document issued by the buyer detailing the products or services requested, quantities, and agreed prices. | Buyer / Procurement Team |

| Invoice | Supplier-generated document requesting payment, including detailed descriptions, quantities, prices, and total amount due. | Supplier / Accounts Payable |

| Goods Receipt Note (GRN) / Delivery Note | Confirmation of goods or services received, specifying quantities and condition. | Warehouse / Receiving Department |

| Payment Records | Proof of payment such as bank statements, remittance advice, or transaction receipts. | Accounts Payable / Finance Team |

| Contract or Agreement | Defines terms and conditions, pricing, and service levels agreed between buyer and supplier. | Legal / Procurement Team |

| Discrepancy Reports | Documents outlining any mismatches or issues found during reconciliation between PO, invoice, and delivery records. | Accounts Payable / Procurement Team |

Basic Steps in Invoice Reconciliation

Invoice reconciliation requires several key documents to ensure accuracy and proper payment processing. Essential documents include the original invoice, purchase order, and goods receipt or delivery note.

Begin the reconciliation process by matching the invoice details with the purchase order to verify quantities, prices, and terms. Next, compare the goods receipt to confirm the products or services were delivered as stated.

Matching Invoices with Supporting Documents

Invoice reconciliation requires accurate matching of invoices with their supporting documents to ensure payment accuracy and prevent discrepancies. Key documents include purchase orders, delivery receipts, and payment authorization forms, which validate the invoice details. You must cross-check these items to verify quantities, prices, and terms before approving payment.

Best Practices for Accurate Reconciliation

Invoice reconciliation requires accurate documentation to ensure proper matching of payments and billed amounts. Essential documents include the original invoice, purchase order, and delivery receipts.

Best practices for accurate reconciliation involve cross-checking these documents against payment records and resolving discrepancies promptly. Maintaining organized records supports efficient audits and financial clarity for your business.

Common Challenges and Solutions

Invoice reconciliation requires accurate documentation to ensure financial accuracy and payment validation. Key documents include purchase orders, delivery receipts, and vendor invoices, which form the basis for matching and verification.

Common challenges involve discrepancies between invoice details and purchase orders, missing documentation, and delayed approvals, which can disrupt the reconciliation process. Solutions include implementing automated matching systems, maintaining organized records, and establishing clear approval workflows. You can reduce errors and streamline reconciliation by regularly training staff on documentation requirements and reconciliation best practices.

Compliance and Audit Considerations

Invoice reconciliation requires the collection and verification of specific documents to ensure accuracy and maintain compliance. Proper documentation supports audit readiness and helps prevent financial discrepancies.

- Purchase Orders (POs) - They serve as formal authorization for purchases, linking invoices to approved transactions for audit verification.

- Invoices - Invoices provide detailed billing information and must match the purchase orders and delivery receipts for compliance.

- Delivery or Receiving Reports - These confirm the receipt of goods or services, validating the accuracy of the invoiced items and quantities.

What Documents are Necessary for Invoice Reconciliation Basics? Infographic