To verify invoice authenticity, essential documents include the original invoice, proof of payment, and purchase order matching the invoice details. Supporting documents such as delivery receipts and vendor authorization letters help confirm transaction legitimacy. Cross-checking these with internal records ensures the invoice is accurate and valid.

What Documents are Required to Verify Invoice Authenticity?

| Number | Name | Description |

|---|---|---|

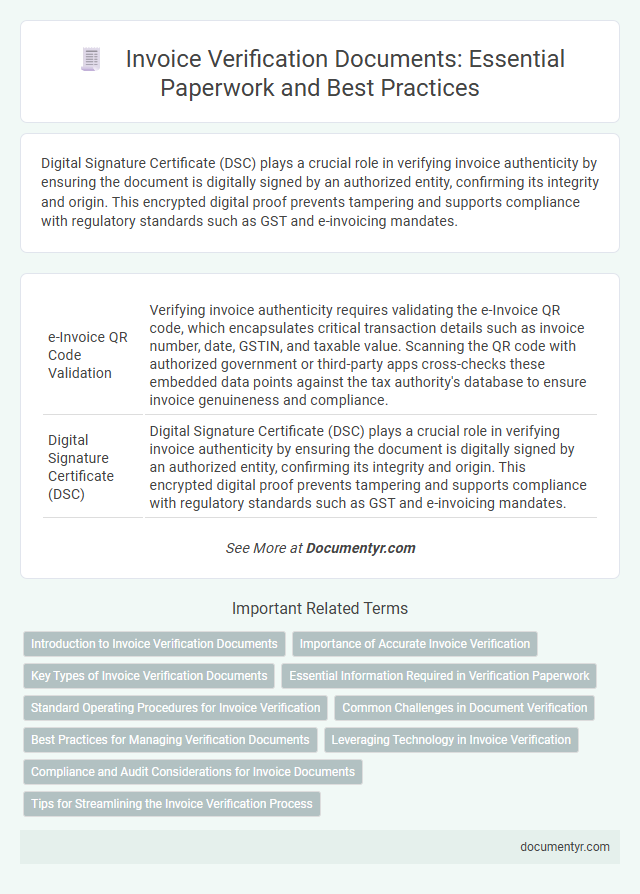

| 1 | e-Invoice QR Code Validation | Verifying invoice authenticity requires validating the e-Invoice QR code, which encapsulates critical transaction details such as invoice number, date, GSTIN, and taxable value. Scanning the QR code with authorized government or third-party apps cross-checks these embedded data points against the tax authority's database to ensure invoice genuineness and compliance. |

| 2 | Digital Signature Certificate (DSC) | Digital Signature Certificate (DSC) plays a crucial role in verifying invoice authenticity by ensuring the document is digitally signed by an authorized entity, confirming its integrity and origin. This encrypted digital proof prevents tampering and supports compliance with regulatory standards such as GST and e-invoicing mandates. |

| 3 | Blockchain Stamp Verification | Verifying invoice authenticity through blockchain stamp verification requires the original invoice document, a corresponding digital hash stored on the blockchain, and access to the blockchain ledger to confirm the timestamp and cryptographic signature. This method ensures tamper-proof validation by matching the invoice details against the immutable blockchain record. |

| 4 | Dynamic Invoice Reference Number (IRN) | Verifying invoice authenticity requires the Dynamic Invoice Reference Number (IRN), a unique 64-character digital signature generated by the government's Invoice Registration Portal (IRP) that ensures the invoice is valid and unaltered. Alongside the IRN, access to the digitally signed e-invoice and the corresponding QR code further confirms the document's integrity and compliance with tax regulations. |

| 5 | ISO 20022 Compliance Certificate | Verification of invoice authenticity requires the ISO 20022 Compliance Certificate, which ensures standardized electronic data interchange and secure transaction validation. This certificate confirms adherence to global messaging standards, reducing fraud risk and enhancing transparency in financial documents. |

| 6 | Machine-Readable Invoice (MRI) File | Verifying invoice authenticity requires a Machine-Readable Invoice (MRI) file containing standardized XML or UBL formats with embedded digital signatures and unique invoice identifiers. Supporting documents include purchase orders, delivery receipts, and payment confirmations linked through blockchain or electronic data interchange (EDI) systems to enhance traceability and reduce fraud. |

| 7 | Government Invoice Registration Portal (IRP) Acknowledgement | The Government Invoice Registration Portal (IRP) Acknowledgement serves as a critical document to verify invoice authenticity, containing a unique Invoice Reference Number (IRN) and a digital signature that ensures the invoice is registered and compliant with tax regulations. This acknowledgement must be cross-verified alongside the invoice copy and the seller's GST details to guarantee legitimacy in financial and tax audits. |

| 8 | Two-Factor Authentication (2FA) Proof for Invoice Access | Verification of invoice authenticity requires documents such as the original invoice, purchase order, and delivery receipt, alongside Two-Factor Authentication (2FA) proof for secure invoice access, including OTPs or biometric verification logs. Employing 2FA enhances protection against unauthorized modifications and ensures that only verified personnel can approve or view the invoice details. |

| 9 | e-Invoicing API Validation Report | The e-Invoicing API Validation Report is essential to verify invoice authenticity, providing detailed validation of invoice data against tax authority standards for accuracy and compliance. Key documents required include the original invoice, the API validation report confirming schema conformity, and digital signatures to ensure data integrity and prevent fraud. |

| 10 | Third-Party Invoice Authenticity Attestation | Third-party invoice authenticity attestation requires submission of official certification documents such as a notarized affidavit, vendor-issued verification letters, and digital signatures authenticated by recognized authorities. Verification often involves cross-referencing these documents with purchase orders, delivery receipts, and validated digital timestamps to ensure invoice legitimacy. |

Introduction to Invoice Verification Documents

Verifying invoice authenticity is crucial to prevent fraud and ensure accurate financial records. Key documents required include the original invoice, purchase order, and delivery receipt. These documents collectively confirm the legitimacy of the transaction and the accuracy of billing details.

Importance of Accurate Invoice Verification

| Document Type | Purpose | Key Details |

|---|---|---|

| Original Invoice | Primary proof of transaction | Contains date, invoice number, seller and buyer information, itemized list, quantities, and prices |

| Purchase Order (PO) | Confirms the agreed terms of the purchase | References product or service details, quantities, agreed pricing, and approval signatures |

| Delivery Receipt | Verifies receipt of goods or services | Includes delivery date, items delivered, quantities, and receiver's signature |

| Payment Confirmation | Proof of payment processing | Bank statements, payment receipts, or electronic transfer confirmations with date and amount |

| Tax Documents | Ensures compliance with tax regulations | Tax identification numbers, VAT or GST details, and tax invoices where applicable |

| Supplier's Business License | Validates legitimacy of the seller | Official business registration documents and licenses |

| Importance of Accurate Invoice Verification |

|---|

| Accurate invoice verification prevents financial discrepancies, reduces fraud risk, and ensures compliance with accounting standards and tax laws. It supports efficient cash flow management and strengthens business relationships by fostering trust. Verification guarantees that payments correspond to actual goods or services received, avoiding overpayments or duplicate payments. Maintaining thorough records aids in audits and financial reporting accuracy. |

Key Types of Invoice Verification Documents

Verifying invoice authenticity is essential for preventing fraud and ensuring accurate financial records. Key documents help confirm the legitimacy and accuracy of the invoice details.

- Purchase Order - Confirms the buyer's request and agreement for the goods or services invoiced.

- Delivery Receipt - Provides evidence that the goods or services were delivered as stated on the invoice.

- Payment Records - Validates that payments made match the invoiced amounts and terms.

Essential Information Required in Verification Paperwork

Verifying invoice authenticity requires specific documents to ensure the transaction's legitimacy and accuracy. Essential paperwork includes the original invoice, purchase order, and proof of delivery or service completion.

The original invoice must detail the seller's and buyer's information, invoice number, date, description of goods or services, quantities, prices, and total amount. A matching purchase order confirms that the goods or services were authorized and ordered by the buyer. Proof of delivery, such as signed delivery receipts or service completion certificates, validates that the transaction was fulfilled as stated.

Standard Operating Procedures for Invoice Verification

Verifying invoice authenticity requires a clear set of standard operating procedures to ensure accuracy and prevent fraud. Proper documentation plays a critical role in maintaining compliance and audit readiness.

- Purchase Order (PO) - Confirms that the invoice matches the originally approved procurement request.

- Goods Receipt Note - Verifies that the items or services billed were actually received.

- Supplier's Tax Identification Documents - Validates the legitimacy and tax compliance of the invoice issuer.

Common Challenges in Document Verification

Verifying invoice authenticity requires key documents such as the original invoice, purchase order, and delivery receipt. These documents help confirm the legitimacy of the transaction and ensure accuracy in billing.

Common challenges in document verification include identifying forged or altered invoices and matching invoice details with purchase orders. Discrepancies in vendor information or missing approvals can further complicate the validation process.

Best Practices for Managing Verification Documents

Verifying invoice authenticity requires specific documents to ensure accuracy and prevent fraud. Proper management of these verification documents enhances your financial reliability and compliance.

- Original Invoice Copy - Provides the primary evidence of the transaction and contains essential details like vendor information and payment terms.

- Purchase Order - Confirms the buyer's authorization and matches the order details with the invoice.

- Delivery Receipt or Proof of Service - Validates that goods or services were received as invoiced.

Organizing and securely storing these documents supports efficient audit trails and promotes transparent financial practices.

Leveraging Technology in Invoice Verification

Verifying invoice authenticity requires key documents such as the purchase order, delivery receipt, and payment proof. These documents establish a clear audit trail and confirm the legitimacy of transactions.

Leveraging technology in invoice verification enhances accuracy by using AI-powered software to cross-check these documents against company records. Automated systems reduce human error, detect fraud, and speed up the validation process efficiently.

Compliance and Audit Considerations for Invoice Documents

Verifying invoice authenticity requires key documents such as the original invoice, purchase order, and proof of delivery. Compliance demands accurate matching of these documents to avoid discrepancies during audits. Your records must include vendor details and payment confirmations to ensure thorough audit trails.

What Documents are Required to Verify Invoice Authenticity? Infographic