To submit a digital invoice, you need the original invoice document in a compatible electronic format such as PDF or XML. Essential details include the seller's and buyer's information, itemized list of goods or services, total amount, tax identification numbers, and the invoice date. Compliance with local tax authority requirements and digital signature verification are critical for successful submission.

What Documents are Necessary for Submitting a Digital Invoice?

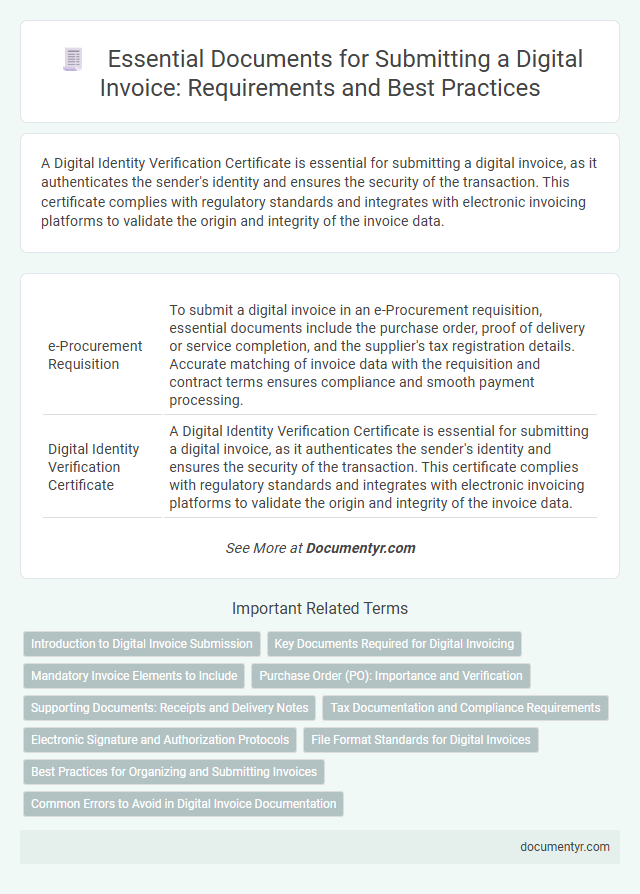

| Number | Name | Description |

|---|---|---|

| 1 | e-Procurement Requisition | To submit a digital invoice in an e-Procurement requisition, essential documents include the purchase order, proof of delivery or service completion, and the supplier's tax registration details. Accurate matching of invoice data with the requisition and contract terms ensures compliance and smooth payment processing. |

| 2 | Digital Identity Verification Certificate | A Digital Identity Verification Certificate is essential for submitting a digital invoice, as it authenticates the sender's identity and ensures the security of the transaction. This certificate complies with regulatory standards and integrates with electronic invoicing platforms to validate the origin and integrity of the invoice data. |

| 3 | Machine-Readable Purchase Order | A machine-readable purchase order is essential for submitting a digital invoice, enabling seamless data exchange between buyer and supplier systems. This document must include standardized formats such as XML or EDI to ensure accurate parsing and automated processing of invoice details. |

| 4 | e-Delivery Confirmation Receipt | The e-Delivery Confirmation Receipt serves as a crucial document verifying the successful transmission and receipt of a digital invoice between the sender and recipient. This receipt ensures compliance with legal and accounting standards by providing proof of delivery, which is often required for audit trails and payment processing. |

| 5 | Real-Time Tax Compliance Report | Submitting a digital invoice requires a Real-Time Tax Compliance Report, which ensures the invoice data is instantly validated against tax regulations by the relevant authorities. This report confirms the accuracy of tax calculations and compliance, serving as a crucial document for both businesses and tax agencies during electronic invoicing. |

| 6 | Electronic Signature Metadata | Electronic signature metadata is essential for submitting a digital invoice, as it verifies the authenticity and integrity of the document by embedding details such as the signer's identity, timestamp, and certificate authority information. Ensuring the inclusion of this metadata alongside the invoice file guarantees compliance with regulatory standards and facilitates seamless validation during the invoicing process. |

| 7 | Blockchain Timestamp Record | A blockchain timestamp record provides an immutable and verifiable proof of the invoice's submission date and content, ensuring transparency and reducing the risk of tampering. Including this record alongside the digital invoice and standard identification documents enhances authenticity and compliance with auditing requirements. |

| 8 | Peppol BIS Invoice Attachment | Submitting a digital invoice with Peppol BIS Invoice Attachment requires the inclusion of a properly formatted XML invoice file adhering to the Peppol BIS standards and a PDF or other human-readable document as an attachment for verification purposes. Essential documents include the structured Peppol BIS Invoice XML containing all invoice data fields, and a corresponding attachment that supports compliance and audit trails. |

| 9 | Automated Reconciliation Statement | Submitting a digital invoice requires essential documents such as the invoice itself, purchase order, and proof of delivery, with an emphasis on the Automated Reconciliation Statement that ensures accurate matching of payments and invoices. This statement streamlines financial processes by automatically verifying transaction details, reducing errors, and enhancing audit compliance in digital invoicing systems. |

| 10 | API-Generated Payment Authorization | API-generated payment authorization requires a valid digital invoice containing detailed transaction data, including invoice number, payment amount, payer and payee details, and authorization tokens to ensure secure and compliant processing. This documentation must be formatted according to electronic invoicing standards such as XML or JSON to facilitate seamless integration and validation within digital payment systems. |

Introduction to Digital Invoice Submission

Submitting a digital invoice requires specific documents to ensure accurate processing and compliance. Proper documentation helps streamline verification and payment procedures.

You must provide a detailed invoice file, proof of delivery or service completion, and valid business identification documents. These essential records support the authenticity and legitimacy of your digital invoice submission.

Key Documents Required for Digital Invoicing

Submitting a digital invoice requires specific documents to ensure compliance and accuracy. Proper documentation facilitates smooth processing and validation by the recipient.

- Purchase Order - Confirms the buyer's intent and details the agreed terms of the transaction.

- Invoice Document - Contains itemized billing information, prices, and payment terms in a digital format.

- Tax Identification Information - Validates the tax details of both the supplier and buyer for legal and accounting purposes.

Mandatory Invoice Elements to Include

Submitting a digital invoice requires several mandatory elements to ensure compliance and accurate processing. Your digital invoice must contain specific details that validate the transaction and facilitate payment.

Key documents include the invoice number, date of issue, and the seller's and buyer's full legal names and addresses. It is essential to include a detailed description of goods or services provided, along with quantities and unit prices. The total amount payable, applicable taxes, and payment terms must also be clearly stated to avoid delays.

Purchase Order (PO): Importance and Verification

Submitting a digital invoice requires essential documents that validate the transaction, with the Purchase Order (PO) being a critical component. The PO serves as an official confirmation of the buyer's intent to purchase specific goods or services, ensuring that the invoice details align with agreed terms. You must verify the PO number and match invoice items to avoid discrepancies and facilitate smooth payment processing.

Supporting Documents: Receipts and Delivery Notes

| Supporting Documents | Description | Purpose |

|---|---|---|

| Receipts | Proof of payment or purchase related to the invoiced goods or services. | Verify transaction authenticity and confirm payment details. |

| Delivery Notes | Documents detailing the shipment and receipt of goods, including quantities and delivery dates. | Confirm goods were delivered as specified and support invoice claims. |

Ensure Your digital invoice submission includes these supporting documents to guarantee completeness and facilitate seamless processing.

Tax Documentation and Compliance Requirements

Submitting a digital invoice requires specific tax documentation to ensure compliance with local regulations. Proper adherence to tax laws protects your business from penalties and facilitates smooth transaction processing.

- Tax Identification Number (TIN) - Required for verifying the invoicing party's tax status and enabling tax reporting.

- Invoice Reference Number - A unique identifier ensuring traceability and audit compliance for each digital invoice.

- Tax Rate and Amount Details - Accurate declaration of applicable taxes such as VAT or sales tax to comply with fiscal regulations.

Electronic Signature and Authorization Protocols

Submitting a digital invoice requires specific documents to ensure authenticity and compliance with legal standards. Electronic signature and authorization protocols are critical components in this documentation process.

- Electronic Signature - A digital certificate validates the identity of the invoice issuer, ensuring the invoice's integrity and non-repudiation.

- Authorization Protocols - Regulatory bodies mandate approval protocols to verify that the invoice complies with tax and commerce regulations.

- Digital Invoice Format - Invoices must be structured according to prescribed XML or PDF/A standards to be accepted by electronic invoicing systems.

Ensuring these documents are complete and compliant is essential for successful digital invoice submission and processing.

File Format Standards for Digital Invoices

What file format standards are necessary for submitting a digital invoice? Digital invoices typically require formats such as XML, PDF, or UBL to ensure compatibility with accounting and tax systems. Your digital invoice must adhere to these standards to facilitate seamless processing and verification.

Best Practices for Organizing and Submitting Invoices

To submit a digital invoice successfully, essential documents include the invoice itself, proof of delivery, and a purchase order or contract reference. Accurate details such as invoice number, date, itemized list, and payment terms must be included to ensure smooth processing.

Best practices for organizing and submitting invoices involve maintaining a consistent file naming system and using secure digital formats like PDF. Digital submission portals require clear documentation to prevent delays, so double-check attachments before sending to streamline your workflow.

What Documents are Necessary for Submitting a Digital Invoice? Infographic