To submit an invoice for freelance services, you need a detailed invoice document including your name, contact information, and payment details. Include a clear description of the services provided, the date of service, and the agreed-upon rate or total amount due. Attaching any relevant contracts, purchase orders, or timesheets can help verify the work and streamline payment processing.

What Documents are Needed to Submit an Invoice for Freelance Services?

| Number | Name | Description |

|---|---|---|

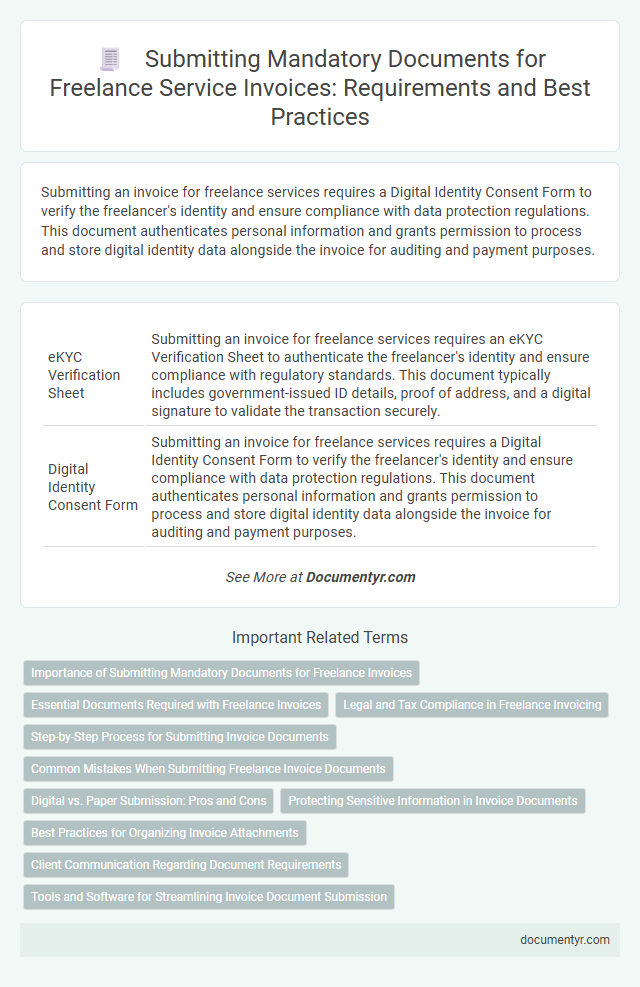

| 1 | eKYC Verification Sheet | Submitting an invoice for freelance services requires an eKYC Verification Sheet to authenticate the freelancer's identity and ensure compliance with regulatory standards. This document typically includes government-issued ID details, proof of address, and a digital signature to validate the transaction securely. |

| 2 | Digital Identity Consent Form | Submitting an invoice for freelance services requires a Digital Identity Consent Form to verify the freelancer's identity and ensure compliance with data protection regulations. This document authenticates personal information and grants permission to process and store digital identity data alongside the invoice for auditing and payment purposes. |

| 3 | Smart Contract Invoice Token | Submitting an invoice for freelance services using a Smart Contract Invoice Token requires a detailed service agreement, the generated token representing the invoice, and verification receipts of completed work embedded within the smart contract. This digital documentation ensures transparency, automatic payment execution, and immutable records on the blockchain, streamlining the invoicing process for freelancers. |

| 4 | Blockchain Transaction Reference | To submit an invoice for freelance services with blockchain payment, include the blockchain transaction reference as proof of payment alongside the detailed invoice specifying services rendered, rates, and total amount. This blockchain transaction ID ensures transparent and verifiable payment tracking, enhancing trust and auditability for both freelancers and clients. |

| 5 | PSD2 Payment Authorization | Submitting an invoice for freelance services requires including PSD2 payment authorization details to ensure compliance with the Revised Payment Services Directive, which mandates secure customer authentication and explicit consent for payment processing. Essential documents include the invoice itself, proof of PSD2 authorization such as a signed mandate or consent form, and transaction details verifying PSD2-compliant payment initiation. |

| 6 | E-invoicing Schema (Peppol/BIS) | Submitting an invoice for freelance services using the E-invoicing Schema (Peppol/BIS) requires a digitally signed invoice document compliant with the Peppol Business Interoperability Specification (BIS) format, including essential data elements such as supplier and customer details, invoice number, date, description of services, and payment terms. Supporting documents like a signed contract or purchase order may be attached in the XML file to ensure validation and facilitate automated processing within the Peppol network. |

| 7 | Multi-currency Bank Mandate | Submitting an invoice for freelance services requires attaching a multi-currency bank mandate to accurately process payments in various currencies, ensuring compliance with international banking standards. This document must include the freelancer's bank details, currency codes (ISO 4217), and authorization signatures to facilitate seamless cross-border transactions. |

| 8 | GDPR Compliance Acknowledgement | Submitting an invoice for freelance services requires a GDPR compliance acknowledgement document to ensure the protection of personal data processed during the transaction. This includes proof of consent from clients for data handling, data processing agreements, and clear records of how personal information is stored and used in accordance with GDPR regulations. |

| 9 | UBO (Ultimate Beneficial Owner) Declaration | Submitting an invoice for freelance services requires attaching a UBO (Ultimate Beneficial Owner) Declaration to verify the identity of the individual who ultimately owns or controls the business, ensuring compliance with anti-money laundering regulations. This declaration includes detailed information about the freelancer's ownership structure, personal identification, and any entities exerting control, facilitating transparent financial transactions. |

| 10 | Digital Work Order Confirmation | Submitting an invoice for freelance services requires a digital work order confirmation that clearly outlines the agreed-upon tasks, deadlines, and payment terms to ensure accurate processing and approval. This document serves as essential proof of contract and project scope, linking the invoice to the specific services rendered and facilitating timely payment. |

Importance of Submitting Mandatory Documents for Freelance Invoices

Submitting the correct documents with your freelance invoice is essential for smooth payment processing. These mandatory documents ensure your services are verified and comply with financial regulations.

Typically, you need to include a detailed invoice, proof of service delivery, and any agreed-upon contracts or work orders. Providing these documents prevents payment delays and disputes with clients. Ensuring accuracy and completeness in your submission protects your professional reputation and cash flow.

Essential Documents Required with Freelance Invoices

Submitting an invoice for freelance services requires essential documents to ensure timely payment. Key items include a detailed invoice, proof of service delivery, and any agreements or contracts.

Invoices should clearly list your name, contact information, itemized services, rates, and total amount due. Contracts or work orders confirm the scope of work, while proof of delivery validates the services rendered.

Legal and Tax Compliance in Freelance Invoicing

Submitting an invoice for freelance services requires essential documents to ensure legal and tax compliance. Accurate documentation protects your rights and meets governmental regulations for financial transactions.

Key documents include a detailed invoice outlining services rendered, payment terms, and client information. Tax identification numbers and proof of business registration may also be necessary for validation and reporting purposes.

Step-by-Step Process for Submitting Invoice Documents

Submitting an invoice for freelance services requires specific documentation to ensure timely payment and proper record keeping. Understanding each step helps streamline the process and avoid delays.

- Prepare a detailed invoice - Include your contact information, client's details, service description, hours worked, rate, and total amount due.

- Attach supporting documents - Provide contracts, work reports, or delivery confirmations to validate the services rendered.

- Submit through the designated platform - Use the client's preferred invoicing system or email protocol to send your invoice and related documents securely.

Common Mistakes When Submitting Freelance Invoice Documents

Submitting accurate invoice documents is crucial for freelance service payments. Common mistakes include missing key details like client information, service descriptions, or payment terms. Ensuring all necessary documents comply with client requirements prevents delays and disputes in the payment process.

Digital vs. Paper Submission: Pros and Cons

What documents are needed to submit an invoice for freelance services when choosing between digital and paper submission? Essential documents include the invoice itself, proof of service delivery, and any applicable contracts or agreements. Digital submission offers faster processing and easy tracking, while paper submission provides a tangible record but can delay payment.

Protecting Sensitive Information in Invoice Documents

When submitting an invoice for freelance services, essential documents include a detailed invoice outlining the services provided, payment terms, and client information. Protecting sensitive information in invoice documents is crucial to prevent unauthorized access to your personal and financial data. Ensure that sensitive details such as your tax identification number and bank account information are securely encrypted or shared through trusted platforms only.

Best Practices for Organizing Invoice Attachments

Submitting an invoice for freelance services requires careful organization of your invoice attachments to ensure clarity and prompt payment. Proper documentation supports verification and smooth processing by clients or accounting teams.

- Include a Detailed Invoice - Clearly outline services provided, hours worked, rates, and totals to avoid confusion.

- Attach Relevant Supporting Documents - Provide timesheets, contracts, or email approvals that validate the billed work.

- Use Consistent File Naming Conventions - Label all attachments with descriptive and standardized names for easy retrieval and reference.

Client Communication Regarding Document Requirements

| Document Type | Description | Client Communication Tips |

|---|---|---|

| Invoice | Detailed bill listing services, rates, dates, and total amount due. | Confirm preferred invoice format and required details with the client before submission. |

| Purchase Order (PO) | Official document from the client authorizing the service and payment. | Request a copy of the PO early in the process to ensure compliance. |

| Contract or Service Agreement | Agreement outlining the scope, deliverables, and payment terms. | Clarify any documentation expectations related to the contract during initial discussions. |

| Timesheets or Work Logs | Records proving hours worked or milestones completed. | Ask the client if timesheets are required to validate billed hours or tasks. |

| Expense Receipts | Proof of reimbursable expenses incurred during service delivery. | Verify which expenses need receipts and their preferred submission format. |

| Tax Identification Numbers | Relevant tax details needed for processing payments and compliance. | Confirm if the client requires tax information such as VAT or EIN to complete payment. |

What Documents are Needed to Submit an Invoice for Freelance Services? Infographic