Invoice financing applications require essential documents such as copies of your unpaid invoices, proof of delivery or service completion, and detailed account receivable reports. Lenders also typically request business financial statements, including balance sheets and income statements, to assess creditworthiness. Providing complete and accurate documentation ensures a smoother approval process and faster access to funds.

What Documents are Necessary for Invoice Financing Applications?

| Number | Name | Description |

|---|---|---|

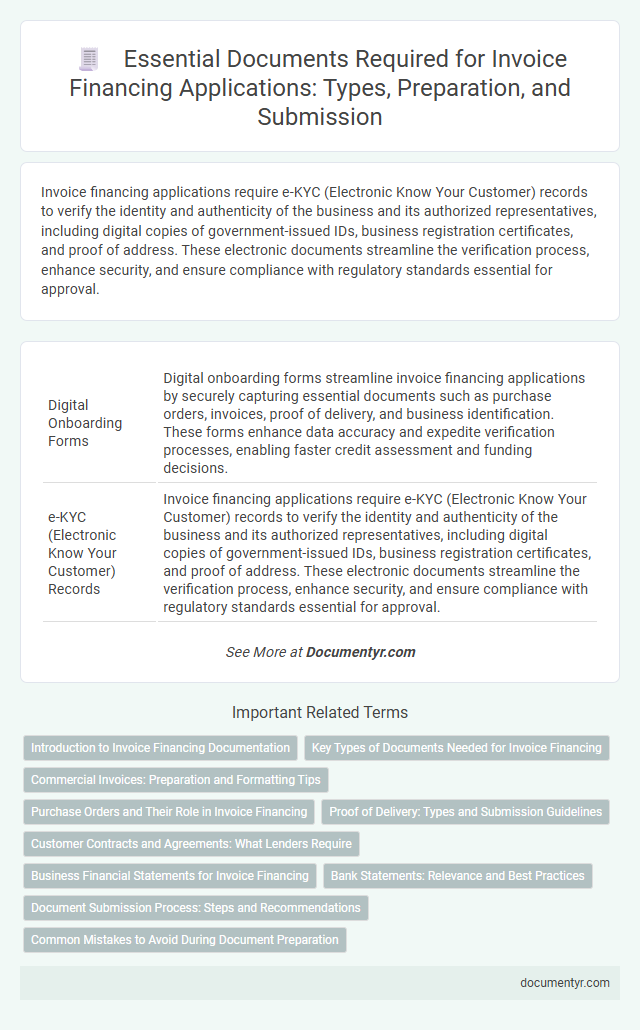

| 1 | Digital Onboarding Forms | Digital onboarding forms streamline invoice financing applications by securely capturing essential documents such as purchase orders, invoices, proof of delivery, and business identification. These forms enhance data accuracy and expedite verification processes, enabling faster credit assessment and funding decisions. |

| 2 | e-KYC (Electronic Know Your Customer) Records | Invoice financing applications require e-KYC (Electronic Know Your Customer) records to verify the identity and authenticity of the business and its authorized representatives, including digital copies of government-issued IDs, business registration certificates, and proof of address. These electronic documents streamline the verification process, enhance security, and ensure compliance with regulatory standards essential for approval. |

| 3 | UBO (Ultimate Beneficial Owner) Declarations | UBO (Ultimate Beneficial Owner) declarations are essential documents in invoice financing applications, providing detailed information about the individuals who ultimately own or control the business. These declarations ensure transparency and compliance with anti-money laundering regulations, helping financiers assess risk and verify the legitimacy of the applicant. |

| 4 | Electronic Receivables Assignment Agreements | Electronic Receivables Assignment Agreements are crucial for invoice financing applications as they legally transfer the rights to payment from the seller to the financier, ensuring clear proof of ownership of the receivables. These agreements must be accompanied by the original invoices, purchase orders, and proof of delivery documents to validate the authenticity and enforceability of the assigned receivables. |

| 5 | API-Integrated Sales Ledger Extracts | API-integrated sales ledger extracts provide real-time, accurate transaction data crucial for validating invoice financing applications, reducing manual errors and speeding up assessment processes. These extracts synchronize directly with accounting systems, ensuring lenders receive comprehensive financial records including invoice details, payment statuses, and customer credit information for informed decision-making. |

| 6 | ESG Compliance Documentation | Invoice financing applications require thorough documentation, including detailed transaction invoices and proof of client creditworthiness, with a growing emphasis on ESG compliance documentation such as sustainability reports, environmental impact assessments, and corporate social responsibility (CSR) policies to demonstrate ethical business practices. Lenders often mandate these ESG documents to evaluate the applicant's adherence to environmental, social, and governance standards, which can influence financing terms and credit approval decisions. |

| 7 | Blockchain-Verified Invoice Copies | Blockchain-verified invoice copies provide tamper-proof authentication essential for invoice financing applications, ensuring the legitimacy of the transaction and enhancing lender confidence. Along with these, applicants typically need to submit purchase orders, delivery receipts, and financial statements to complete the verification and approval process. |

| 8 | Cross-Border Tax Compliance Certificates | Cross-border tax compliance certificates are critical documents for invoice financing applications, ensuring that all international tax obligations are met and verified by relevant authorities. These certificates serve as proof of tax compliance in both the payer's and payee's jurisdictions, reducing the risk of legal complications and facilitating smoother cross-border transactions. |

| 9 | Real-Time Payment Status Statements | Real-time payment status statements provide up-to-date verification of outstanding invoices, enabling lenders to assess credit risk with accurate financial data. Including these statements in invoice financing applications accelerates approval processes by demonstrating reliable cash flow and payment history. |

| 10 | Dynamic Discounting Agreements | Dynamic discounting agreements require submission of the signed contract outlining discount terms, alongside detailed invoices and proof of delivery to validate the receivables for invoice financing applications. Financial statements and credit assessments of both buyer and supplier further support the approval process by demonstrating transaction legitimacy and payment capacity. |

Introduction to Invoice Financing Documentation

Invoice financing requires specific documentation to verify the authenticity and value of outstanding invoices. Providing accurate and complete documents ensures a smooth application process and quicker funding.

- Invoices - Detailed copies of outstanding invoices are essential to demonstrate the amounts owed by customers.

- Proof of Delivery - Documents confirming that goods or services were delivered help validate the invoice claims.

- Business Financial Statements - Recent financial statements provide lenders with insights into the business's overall financial health.

Key Types of Documents Needed for Invoice Financing

| Key Document Type | Description | Importance for Invoice Financing |

|---|---|---|

| Invoices | Copies of unpaid invoices intended as collateral | Proof of receivables and foundation for loan amount calculation |

| Purchase Orders | Documents confirming customer orders related to the invoices | Verifies legitimacy and expected payment on the outstanding invoices |

| Proof of Delivery | Delivery receipts or shipping notices proving goods or services were delivered | Supports validity of the invoice and reduces risk of disputes |

| Accounts Receivable Aging Report | Report detailing unpaid invoices by their due dates | Helps financiers assess the risk and timing of receivable payments |

| Business Financial Statements | Income statements, balance sheets, and cash flow statements | Shows overall financial health and ability to sustain financing arrangements |

| Customer Credit Information | Details on your customers' creditworthiness and payment history | Assists in evaluating the reliability of invoice payments |

| Legal Business Documents | Business registration, licenses, and tax identification numbers | Confirms legitimacy of your business for financing approval |

Commercial Invoices: Preparation and Formatting Tips

Commercial invoices play a crucial role in invoice financing applications as they provide detailed descriptions of goods or services rendered. Proper preparation involves including accurate seller and buyer information, invoice date, payment terms, and a clear breakdown of products with corresponding prices. Formatting tips emphasize clarity, consistency in layout, and the inclusion of unique invoice numbers to facilitate verification and quick processing by financing institutions.

Purchase Orders and Their Role in Invoice Financing

Purchase orders are critical documents in invoice financing applications, serving as proof of an agreement between the buyer and seller. They establish the legitimacy of the transaction and provide detailed information about the goods or services purchased.

Lenders require purchase orders to assess the risk and verify the authenticity of the invoices submitted for financing. Your purchase orders help streamline the approval process, ensuring quicker access to needed funds.

Proof of Delivery: Types and Submission Guidelines

What types of proof of delivery are required for invoice financing applications? Proof of delivery documents include signed delivery receipts, shipping confirmation, and electronic delivery notifications. Submitting clear and accurate proof of delivery helps verify transaction legitimacy and speeds up the financing process.

Customer Contracts and Agreements: What Lenders Require

Customer contracts and agreements play a crucial role in invoice financing applications. Lenders require these documents to verify the authenticity and enforceability of the receivables.

These contracts provide detailed information about the terms of sale, payment schedules, and obligations of the customer. Lenders assess the risk by reviewing the completeness and clarity of these agreements. Clear customer contracts help secure faster approval and better financing terms in invoice financing.

Business Financial Statements for Invoice Financing

Business financial statements are essential documents for invoice financing applications, providing lenders with a clear picture of a company's financial health. These statements typically include the balance sheet, income statement, and cash flow statement, which demonstrate the company's assets, liabilities, revenue, and cash management. Accurate and up-to-date financial statements help lenders assess the risk and determine the financing terms for invoice advances.

Bank Statements: Relevance and Best Practices

Bank statements play a crucial role in invoice financing applications by providing lenders with a clear view of your cash flow and financial stability. They help verify payment history and identify consistent revenue streams, essential for assessing creditworthiness.

Submitting accurate and recent bank statements increases the chances of approval and accelerates the financing process. Ensure statements are complete, legible, and cover a sufficient period, typically three to six months, to reflect reliable financial activity.

Document Submission Process: Steps and Recommendations

Invoice financing requires specific documentation to verify the legitimacy of your invoices. Proper submission of these documents ensures a smoother application process.

- Gather all required documents - Collect invoices, purchase orders, contracts, and proof of delivery to support your financing application.

- Verify document accuracy - Review all paperwork for completeness and correctness before submission to avoid delays.

- Submit documents to the financier - Follow the financier's preferred method, whether online portal, email, or physical delivery, ensuring safe and timely submission.

Following these steps helps streamline your invoice financing application and increases the chances of approval.

What Documents are Necessary for Invoice Financing Applications? Infographic