Freelancers need to send an invoice that includes essential details such as their name, contact information, and tax identification number. The invoice must clearly outline the services provided, the date of service, payment terms, and the total amount due. Including a purchase order or contract reference can help ensure accuracy and facilitate timely payment from the client.

What Documents Does a Freelancer Need to Send a Client Invoice?

| Number | Name | Description |

|---|---|---|

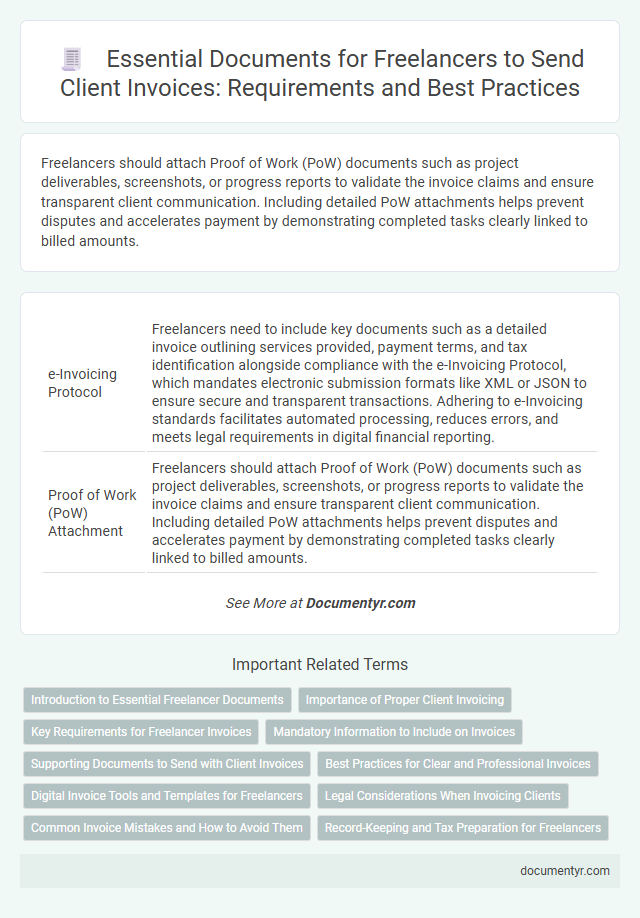

| 1 | e-Invoicing Protocol | Freelancers need to include key documents such as a detailed invoice outlining services provided, payment terms, and tax identification alongside compliance with the e-Invoicing Protocol, which mandates electronic submission formats like XML or JSON to ensure secure and transparent transactions. Adhering to e-Invoicing standards facilitates automated processing, reduces errors, and meets legal requirements in digital financial reporting. |

| 2 | Proof of Work (PoW) Attachment | Freelancers should attach Proof of Work (PoW) documents such as project deliverables, screenshots, or progress reports to validate the invoice claims and ensure transparent client communication. Including detailed PoW attachments helps prevent disputes and accelerates payment by demonstrating completed tasks clearly linked to billed amounts. |

| 3 | GSTIN Inclusion (for GST compliance) | Freelancers must include their GSTIN on invoices to ensure GST compliance, enabling clients to claim input tax credits and maintain accurate tax records. The invoice should also contain essential details such as the freelancer's name, address, invoice number, date, description of services, and the applicable GST rate and amount. |

| 4 | Digital Identity Verification Sheet | A Digital Identity Verification Sheet is essential for freelancers to confirm their authenticity and establish trust when sending client invoices, often including government-issued IDs and proof of address. This document ensures compliance with financial regulations and helps prevent fraud by verifying the freelancer's identity before payment processing. |

| 5 | Milestone Completion Certificate | A Milestone Completion Certificate serves as a crucial document for freelancers to validate the completion of specific project phases before invoicing clients. This certificate ensures transparency and agreement on deliverables, enabling smoother payment processes and reducing disputes. |

| 6 | Blockchain Invoice Ledger | Freelancers need to send client invoices that include detailed transaction records securely stored in a Blockchain Invoice Ledger to ensure transparency and immutability. Essential documents include the invoice itself, proof of work or service delivered, and a cryptographic hash confirming the invoice's authenticity on the blockchain. |

| 7 | Timesheet Traceability Report | A freelancer must include a Timesheet Traceability Report with a client invoice to provide detailed records of hours worked and tasks completed, ensuring transparency and accuracy in billing. This document supports invoice verification by linking billed amounts directly to tracked work periods and deliverables. |

| 8 | Digital Signature Compliance | Freelancers must include a valid digital signature that complies with e-signature laws such as the ESIGN Act or eIDAS regulation, ensuring the invoice's authenticity and legal acceptance. Properly integrated digital signatures enhance security, prevent tampering, and streamline the invoicing process for client transactions. |

| 9 | Smart Contract Reference Document | Freelancers must attach a Smart Contract Reference Document to their client invoice to validate the terms and conditions agreed upon in the decentralized agreement, ensuring transparency and automated compliance verification. This document serves as a verifiable record linking the invoice to blockchain-executed contract parameters such as payment milestones and deliverables. |

| 10 | PDF/A Archival Format Invoice | Freelancers must send client invoices in PDF/A archival format to ensure document integrity, long-term preservation, and compliance with legal and tax regulations. This format supports digital archiving by embedding all required fonts and metadata, preventing alterations and improving retrieval accuracy. |

Introduction to Essential Freelancer Documents

Sending an invoice is a critical step in the freelancer-client transaction process. Proper documentation ensures clarity and professionalism in financial dealings.

Essential freelancer documents include a detailed invoice outlining services rendered, payment terms, and contact information. Supporting documents like contracts, work agreements, or timesheets may be necessary to validate the invoice. Keeping these documents organized helps maintain transparent communication and smooth payment processing.

Importance of Proper Client Invoicing

Proper client invoicing ensures clear communication and timely payments for freelance work. Essential documents include an itemized invoice, proof of deliverables, and any agreed-upon contracts or work orders. You enhance professionalism and avoid payment delays by providing accurate and complete invoicing materials.

Key Requirements for Freelancer Invoices

Freelancers must include essential details such as their full name, business address, and contact information on the invoice. Client information, including the recipient's name and address, is equally important for accurate record-keeping.

The invoice should contain a unique invoice number and the date of issue to ensure proper tracking. Payment terms, including due date and preferred payment methods, help clarify expectations and facilitate timely payment.

Mandatory Information to Include on Invoices

| Mandatory Information | Description |

|---|---|

| Freelancer's Full Name and Contact Details | Legal name, address, phone number, and email to identify the service provider clearly. |

| Client's Full Name and Contact Details | Complete name and contact details of the client to ensure proper delivery and record keeping. |

| Invoice Number | Unique, sequential identifier for tracking and record management. |

| Invoice Date | Date when the invoice is issued, important for payment terms and accounting. |

| Detailed Description of Services | Clear and itemized list of services rendered or products supplied, including quantity and rate. |

| Payment Terms and Due Date | Conditions of payment, such as net 30 days, and the final date payment is expected. |

| Total Amount Due | Sum payable by the client, including any taxes or discounts. |

| Tax Identification Number (if applicable) | Freelancer's VAT or tax registration number required by tax authorities in many jurisdictions. |

| Bank or Payment Information | Details for payment transfer, such as bank account number or payment platform details. |

Supporting Documents to Send with Client Invoices

Freelancers must include essential supporting documents when sending client invoices to ensure transparency and prompt payment. These documents validate the billed services and simplify the client's approval process.

- Timesheets - Detailed records of hours worked that justify the billed time on the invoice.

- Project Deliverables - Completed work files or summaries that demonstrate the fulfillment of agreed tasks.

- Expense Receipts - Proof of reimbursable costs incurred during the project, such as travel or materials.

Best Practices for Clear and Professional Invoices

What documents does a freelancer need to send a client invoice? A freelancer should include a detailed invoice document specifying services rendered, payment terms, and contact information. Attaching a signed contract or agreement can further clarify the scope and expectations.

How can freelancers ensure their invoices are clear and professional? Using consistent formatting, clear itemization of services, and precise dates helps avoid confusion. Incorporating a unique invoice number and payment instructions enhances organization and facilitates timely payments.

Why is including a payment timeline important on a freelancer's invoice? Defining due dates reduces delays and helps manage cash flow effectively. Specifying late payment fees encourages prompt settlement of invoices.

Should freelancers attach additional documentation with their invoices? Including timesheets, receipts, or work approvals supports transparency and verifies the billed work. These documents increase client trust and reduce the chances of disputes.

How does branding impact a freelancer's invoice presentation? Incorporating a professional logo, consistent color scheme, and clear fonts reinforces brand identity. This attention to design reflects professionalism and makes invoices easily recognizable to clients.

Digital Invoice Tools and Templates for Freelancers

Freelancers require specific documents to create accurate client invoices. Digital invoice tools and templates streamline this process efficiently.

- Invoice Template - Pre-designed templates provide a consistent and professional format.

- Contract or Work Agreement - Details the scope of work and payment terms to include on the invoice.

- Digital Invoice Software - Automates calculations, tracking, and sending invoices directly to clients.

Legal Considerations When Invoicing Clients

Freelancers must ensure their invoices comply with local tax regulations and include essential details such as their legal business name, tax identification number, and client information. Accurate documentation supports proper record-keeping and helps avoid legal disputes related to payment and taxation.

Including payment terms, invoice date, and unique invoice numbers is crucial to meet legal requirements and facilitate payment tracking. Properly formatted invoices protect freelancers from non-compliance penalties and enhance professional credibility with clients.

Common Invoice Mistakes and How to Avoid Them

Freelancers must ensure their invoices include essential documents such as a detailed service description, payment terms, and their tax identification number to maintain transparency and professionalism. Common invoice mistakes include missing client information, unclear payment instructions, and incorrect amount calculations, which can delay payments. To avoid these errors, freelancers should double-check all invoice details, use professional invoicing software, and clearly specify deadlines and payment methods.

What Documents Does a Freelancer Need to Send a Client Invoice? Infographic