Freelancers need to submit an invoice that includes essential documents such as a detailed description of services provided, the agreed-upon payment terms, and the freelancer's tax identification information. Including a unique invoice number and the date of issue is crucial for proper record-keeping and payment tracking. Clear contact details for both the freelancer and the client ensure smooth communication and reduce the chance of payment delays.

What Documents Does a Freelancer Need to Submit an Invoice?

| Number | Name | Description |

|---|---|---|

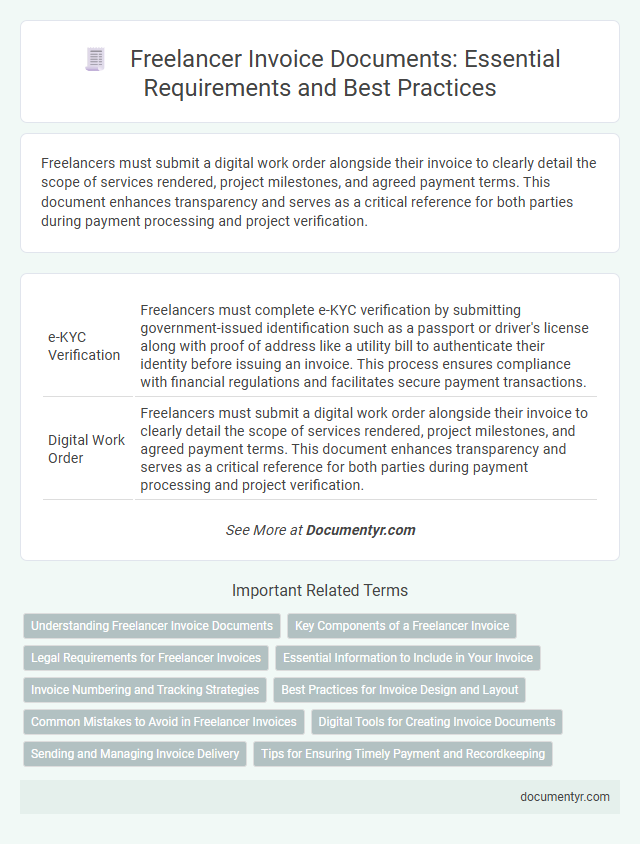

| 1 | e-KYC Verification | Freelancers must complete e-KYC verification by submitting government-issued identification such as a passport or driver's license along with proof of address like a utility bill to authenticate their identity before issuing an invoice. This process ensures compliance with financial regulations and facilitates secure payment transactions. |

| 2 | Digital Work Order | Freelancers must submit a digital work order alongside their invoice to clearly detail the scope of services rendered, project milestones, and agreed payment terms. This document enhances transparency and serves as a critical reference for both parties during payment processing and project verification. |

| 3 | Smart Contract Agreement | Freelancers need to submit a Smart Contract Agreement alongside their invoice to ensure clear terms of service, payment milestones, and deliverables are legally acknowledged and enforced. This document streamlines payment processing by automatically triggering transactions once contract conditions are met, reducing disputes and enhancing transparency. |

| 4 | E-signature Authorization | Freelancers need to include an e-signature authorization on their invoices to ensure legal validity and secure client approval digitally. This electronic authorization verifies identity and consent, streamlining payment processing while maintaining compliance with digital transaction regulations. |

| 5 | Vendor Onboarding Form | Freelancers must submit a completed Vendor Onboarding Form along with their invoice to ensure accurate vendor information and payment processing. This form typically includes essential details such as tax identification, banking information, and contact data required by the client for compliance and record-keeping. |

| 6 | PO (Purchase Order) Reference | A freelancer needs to include a Purchase Order (PO) reference on the invoice to link the billing to the client's authorized purchase agreement, ensuring accurate payment processing and contract compliance. The PO number acts as a crucial identifier for both parties, streamlining invoice verification and reducing payment delays. |

| 7 | Timesheet Blockchain Log | Freelancers need to submit a detailed timesheet blockchain log as part of their invoice documentation to provide verifiable proof of hours worked, ensuring transparency and trust in payment processes. This blockchain-based timesheet securely records time entries and project milestones, enhancing accuracy and reducing disputes with clients. |

| 8 | Virtual Bank Account Details | Freelancers must include virtual bank account details such as the account number, bank name, and branch code on their invoices to ensure accurate and timely payment processing. Clear presentation of these details reduces payment errors and supports smooth financial transactions between clients and freelancers. |

| 9 | Electronic Service Report | Freelancers need to submit an Electronic Service Report alongside their invoice to provide detailed documentation of the completed work, including hours logged and specific tasks performed. This report ensures transparency and serves as proof of service for both the freelancer and the client, facilitating accurate payment processing. |

| 10 | QR Code Payment Request | Freelancers need to include a detailed invoice containing their tax identification number, client information, service description, payment terms, and a QR code payment request to facilitate seamless and secure transactions. The QR code enables clients to quickly scan and complete payments using compatible banking or payment apps, enhancing efficiency and reducing manual errors. |

Understanding Freelancer Invoice Documents

Freelancers must submit specific documents to create a valid invoice, including a detailed service description and the agreed payment terms. These documents ensure clarity between the freelancer and the client regarding the work performed and compensation.

Essential documents include the freelancer's contact information, tax identification number, and the client's details. Proper documentation helps streamline payment processing and maintain accurate financial records for both parties.

Key Components of a Freelancer Invoice

What documents does a freelancer need to submit an invoice? A detailed invoice must include essential components such as your name or business name, contact information, and the client's details. Clear descriptions of services provided, dates, rates, and the total amount due ensure the invoice is professional and complete.

Legal Requirements for Freelancer Invoices

Freelancers must comply with legal requirements to ensure their invoices are valid and enforceable. Proper documentation supports prompt payment and maintains financial transparency.

- Tax Identification Number - Essential for tax reporting and must be included on every invoice to comply with local tax laws.

- Detailed Service Description - Clearly outlines the work performed to avoid disputes and meet legal standards for transparency.

- Invoice Number and Date - Provides a unique reference and timeline, which are legally required for record-keeping and audit purposes.

Submitting an invoice with these documents ensures legal compliance and facilitates smooth business transactions.

Essential Information to Include in Your Invoice

Freelancers must include key documents and essential information when submitting an invoice to ensure timely payment and clear communication. Properly detailed invoices establish professionalism and help avoid disputes.

Essential information includes the freelancer's full name or business name, contact details, and a unique invoice number for tracking. The invoice should also list the client's information, detailed description of services provided, dates, payment terms, and the total amount due including taxes if applicable.

Invoice Numbering and Tracking Strategies

Freelancers need to ensure proper invoice numbering and tracking to maintain organized financial records and streamline payment processes. Effective strategies prevent errors and facilitate easy reference for both parties involved.

- Sequential Invoice Numbering - Assigning invoices in a continuous numerical order helps track each transaction chronologically and avoids duplication.

- Incorporating Date Codes - Including the date within the invoice number enhances clarity and simplifies retrieval based on specific billing periods.

- Utilizing Invoice Management Software - Automated tools generate unique invoice numbers and monitor payment statuses, improving accuracy and efficiency.

Best Practices for Invoice Design and Layout

| Document | Purpose | Best Practices for Design and Layout |

|---|---|---|

| Invoice Template | Provides a structured format to present billing details | Use a clean, professional template with clear sections and consistent fonts. Include your logo and contact information prominently. |

| Client Information | Identifies the invoice recipient for accurate processing | List client's full name, company name, and contact details near the top to ensure easy recognition and clarity. |

| Itemized Service List | Details the services or products provided with corresponding costs | Break down services with descriptions, quantities, rates, and totals in a well-organized table format with clear headings. |

| Payment Terms | Specifies payment due dates and acceptable methods | Highlight payment terms such as due date, late fees, and methods using bold or color to catch attention without clutter. |

| Tax and Legal Information | Ensures compliance with regulations and tax reporting | Include tax identification numbers, applicable VAT or sales tax, and any relevant legal disclaimers, formatted concisely at the bottom. |

| Invoice Number and Date | Tracks invoice uniquely for accounting and reference | Place invoice number and issue date consistently at the top right or left corner for quick accessibility. |

| Notes Section | Offers space for additional instructions or gratitude | Use this area for polite reminders, thank-you messages, or special payment instructions in a distinctive but unobtrusive style. |

Common Mistakes to Avoid in Freelancer Invoices

Freelancers must submit essential documents such as a detailed invoice, proof of work completion, and any agreed-upon contracts or purchase orders. Common mistakes to avoid include missing invoice numbers, unclear descriptions of services, and incorrect client details. Ensuring accuracy in these elements helps prevent payment delays and maintains professional credibility.

Digital Tools for Creating Invoice Documents

Submitting an invoice requires accurate and professional documentation for smooth payment processing. Digital tools simplify the creation and management of these essential invoice documents.

- Invoice Generators - Online platforms like FreshBooks and Invoicely offer customizable templates to produce clear and organized invoices swiftly.

- Accounting Software - Programs such as QuickBooks and Xero integrate invoicing with financial tracking to maintain accurate records.

- PDF Editors - Tools like Adobe Acrobat enable freelancers to create, edit, and secure invoice documents before sending them to clients.

Sending and Managing Invoice Delivery

When sending an invoice, attaching a clear, itemized document detailing services rendered is essential for smooth processing. Including your contact information and payment terms in the invoice ensures timely responses and reduces misunderstandings. Managing invoice delivery through reliable channels, such as email or invoicing platforms, helps track receipts and follow up efficiently.

What Documents Does a Freelancer Need to Submit an Invoice? Infographic