Invoice factoring applications require key documents such as copies of outstanding invoices, proof of delivery or service completion, and the credit history of the customers involved. Lenders also typically request business financial statements, including balance sheets and income statements, to assess the company's financial health. Providing accurate and complete documentation accelerates the approval process and ensures smoother access to factoring funds.

What Documents are Needed for Invoice Factoring Applications?

| Number | Name | Description |

|---|---|---|

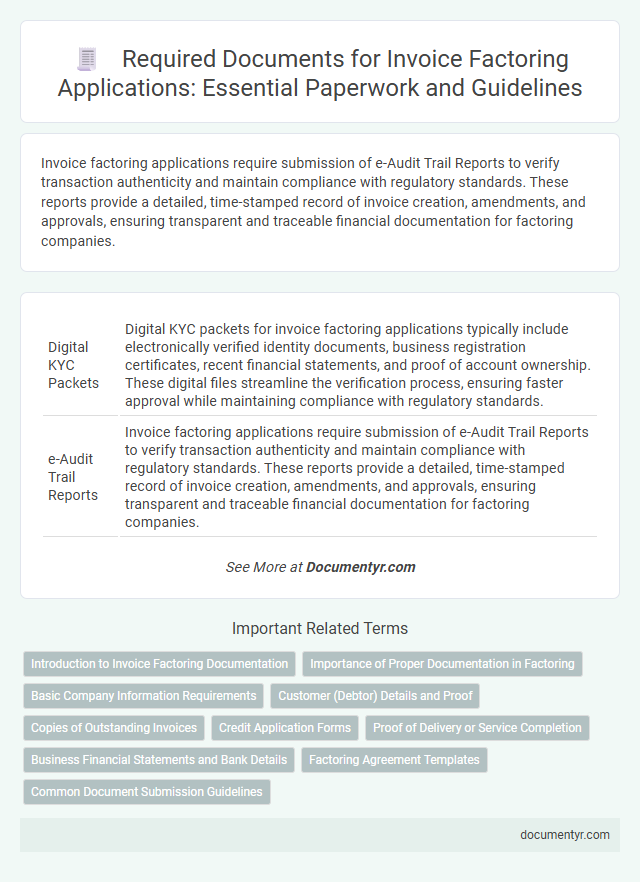

| 1 | Digital KYC Packets | Digital KYC packets for invoice factoring applications typically include electronically verified identity documents, business registration certificates, recent financial statements, and proof of account ownership. These digital files streamline the verification process, ensuring faster approval while maintaining compliance with regulatory standards. |

| 2 | e-Audit Trail Reports | Invoice factoring applications require submission of e-Audit Trail Reports to verify transaction authenticity and maintain compliance with regulatory standards. These reports provide a detailed, time-stamped record of invoice creation, amendments, and approvals, ensuring transparent and traceable financial documentation for factoring companies. |

| 3 | UBL Format Invoices | Invoice factoring applications require UBL format invoices that adhere to standardized XML schema, ensuring accurate data exchange and compliance with electronic invoicing regulations. Essential documents include the original UBL invoice files, proof of delivery, and receivables aging reports to validate the authenticity and payment terms of the invoices. |

| 4 | Automated Receivables Aging List | An automated receivables aging list is essential for invoice factoring applications, providing a detailed breakdown of outstanding invoices by due date to assess payment risk and cash flow status. This document enables factoring companies to verify the aging of receivables accurately, facilitating faster approval and funding decisions. |

| 5 | e-Signature Verification Sheet | An e-Signature Verification Sheet is essential for invoice factoring applications as it authenticates the digital signatures on submitted documents, ensuring legal compliance and reducing fraud risk. This verification report must include signer identity details, timestamp, and certification authority information to validate the authenticity of electronic endorsements. |

| 6 | Blockchain-Stamped Transaction Logs | Blockchain-stamped transaction logs provide immutable proof of payment history and secure verification of transaction authenticity, essential for invoice factoring applications. These logs enhance transparency and reduce fraud risk, ensuring factoring companies can confidently assess invoice validity and debtor reliability. |

| 7 | Real-Time Payment Reconciliation Files | Real-time payment reconciliation files provide detailed transaction data essential for validating invoice payments and accelerating approval in invoice factoring applications. Accurate reconciliation files reduce discrepancies, ensuring faster funding and improved cash flow management for businesses engaging in factoring. |

| 8 | API-Generated Debtor Confirmation | Invoice factoring applications require key documents including API-generated debtor confirmations that verify outstanding invoices directly from clients' accounting systems, ensuring real-time accuracy and reducing fraud risk. Validating debtor information through robust API integrations accelerates approval processes and enhances trust between factoring companies and sellers. |

| 9 | Cloud-Based Purchase Order Extracts | Cloud-based purchase order extracts streamline the invoice factoring application process by providing accurate, real-time transaction data directly from digital systems, reducing manual errors and verification time. These extracts serve as essential documents alongside invoices, proof of delivery, and contracts, enhancing transparency and speeding up funding decisions in invoice factoring services. |

| 10 | ESG Compliance Certificates | Invoice factoring applications require submission of ESG compliance certificates to validate a company's adherence to environmental, social, and governance standards, ensuring responsible business practices. These certificates strengthen the applicant's credibility and are crucial for investors seeking sustainable and ethical financial partnerships. |

Introduction to Invoice Factoring Documentation

Invoice factoring requires specific documentation to initiate the application process effectively. Proper paperwork ensures transparency and facilitates quicker approval by the factoring company.

Key documents typically include purchase orders, invoices, and accounts receivable aging reports. Proof of delivery and business financial statements are also essential for verifying the legitimacy of the invoices. Having these documents organized and accurate streamlines the factoring process and minimizes delays.

Importance of Proper Documentation in Factoring

Invoice factoring applications require accurate and complete documentation to ensure a smooth approval process. Proper paperwork verifies the legitimacy of receivables and enhances trust between your business and the factoring company.

Essential documents include invoices, purchase orders, and proof of delivery or completed services. Maintaining organized records reduces delays and improves cash flow efficiency through faster factoring approvals.

Basic Company Information Requirements

Invoice factoring applications require essential documentation to verify your business details. Proper submission of these documents ensures a smooth evaluation process.

- Business Registration Documents - Proof of your company's legal existence, such as articles of incorporation or a business license, is mandatory.

- Tax Identification Number - Providing your employer identification number (EIN) or equivalent tax ID is necessary for tax purposes and identity verification.

- Ownership and Management Information - Details of the company owners and key management personnel help verify authority and operational control.

Customer (Debtor) Details and Proof

Invoice factoring applications require detailed customer (debtor) information to verify the legitimacy and creditworthiness of the accounts receivable. Essential documents include the debtor's full legal name, contact information, and proof of their business operations, such as business licenses or registration certificates. Proof of the outstanding invoice, like purchase orders or delivery receipts, is also necessary to ensure the authenticity of the debt for factoring approval.

Copies of Outstanding Invoices

Copies of outstanding invoices are crucial documents in invoice factoring applications. They serve as proof of receivables and validate the amount to be factored.

- Proof of Sales Transactions - Copies of outstanding invoices confirm that the goods or services have been delivered and billed to the customer.

- Verification of Invoice Amounts - These documents verify the exact amounts owed by clients, ensuring accurate factoring calculations.

- Tracking Payment Status - Outstanding invoice copies help the factoring company monitor which invoices are unpaid and identify potential payment risks.

Credit Application Forms

Invoice factoring requires submitting specific documents to evaluate your business creditworthiness. Credit application forms play a crucial role in this process by providing detailed financial information.

- Credit Application Forms - These forms collect your business and financial details necessary for assessing credit risk.

- Verification of Business Information - Accurate contact and financial history verification ensures the validity of your credit application.

- Authorization for Credit Checks - Permission to perform credit checks is mandatory to evaluate your eligibility for invoice factoring.

Providing complete and accurate credit application forms streamlines the invoice factoring approval process.

Proof of Delivery or Service Completion

What documents are essential to support your invoice factoring application? Proof of delivery or service completion stands out as a critical requirement. These documents verify that the goods or services have been received or fulfilled, ensuring the invoice's legitimacy.

Business Financial Statements and Bank Details

Invoice factoring applications require comprehensive business financial statements to evaluate the company's fiscal health and creditworthiness. Key documents include profit and loss statements, balance sheets, and cash flow statements, which provide insights into revenue streams and operational stability. Bank details such as account numbers and transaction histories verify financial authenticity and facilitate smooth fund transfers during the factoring process.

Factoring Agreement Templates

| Document Type | Description | Importance for Invoice Factoring |

|---|---|---|

| Factoring Agreement Template | A standardized contract outlining the terms between your business and the factoring company, including payment terms, fees, and responsibilities. | Essential for establishing legal obligations and ensuring transparency in the factoring relationship. |

| Invoices | Detailed billing statements issued to customers, specifying goods or services provided, amounts due, and payment deadlines. | Serve as primary assets for factoring and proof of receivables for the factoring company. |

| Business Financial Statements | Documents such as balance sheets and income statements that display the financial health of your business. | Help factoring companies assess credit risk and approve your application. |

| Accounts Receivable Aging Report | A report listing all outstanding invoices categorized by their due dates. | Provides factoring companies with insights into the collectibility and age of your receivables. |

| Customer Credit Information | Data related to the creditworthiness of your customers who owe invoices. | Used by factoring companies to evaluate risk before purchasing your invoices. |

What Documents are Needed for Invoice Factoring Applications? Infographic