Small businesses need to maintain invoices, purchase orders, and receipts to ensure accurate invoice recordkeeping. These documents help track sales, payments, and expenses, providing a clear financial history. Proper organization of invoices supports tax compliance and simplifies audit processes.

What Documents Does a Small Business Need for Invoice Recordkeeping?

| Number | Name | Description |

|---|---|---|

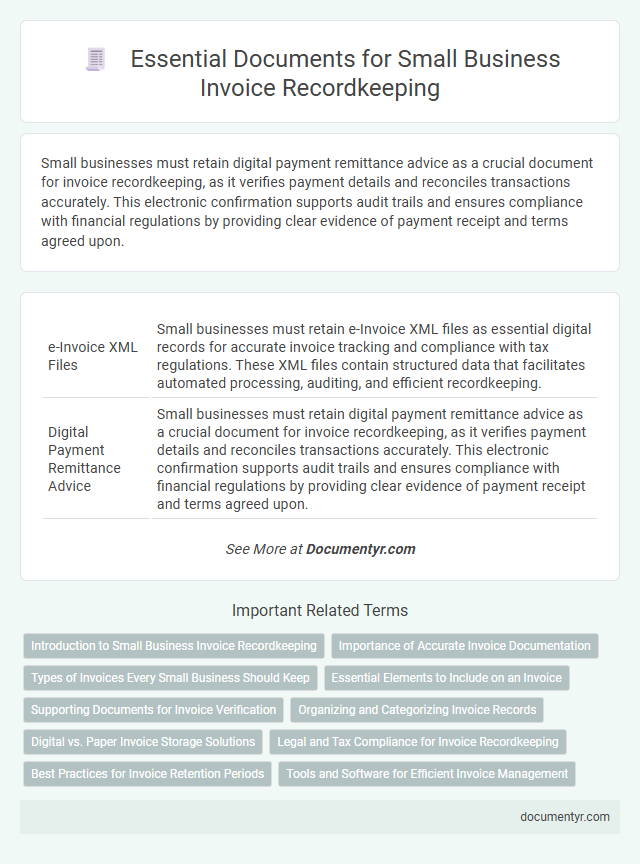

| 1 | e-Invoice XML Files | Small businesses must retain e-Invoice XML files as essential digital records for accurate invoice tracking and compliance with tax regulations. These XML files contain structured data that facilitates automated processing, auditing, and efficient recordkeeping. |

| 2 | Digital Payment Remittance Advice | Small businesses must retain digital payment remittance advice as a crucial document for invoice recordkeeping, as it verifies payment details and reconciles transactions accurately. This electronic confirmation supports audit trails and ensures compliance with financial regulations by providing clear evidence of payment receipt and terms agreed upon. |

| 3 | Automated Receipt Matching Reports | Small businesses need automated receipt matching reports to efficiently track and verify invoice payments, ensuring accurate financial records and reducing errors. These reports streamline the reconciliation process by automatically linking receipts to corresponding invoices, enhancing audit readiness and cash flow management. |

| 4 | Supplier Onboarding Compliance Docs | Small businesses must maintain supplier onboarding compliance documents such as signed contracts, tax identification forms, and proof of business licenses to ensure accurate invoice recordkeeping. These documents verify supplier legitimacy and facilitate audit readiness by linking invoices to authorized suppliers. |

| 5 | Blockchain-based Invoice Ledger | Small businesses need invoices, purchase orders, payment receipts, and digital proofs of transaction to ensure comprehensive invoice recordkeeping on a Blockchain-based invoice ledger. This secure, immutable ledger enhances transparency, reduces fraud, and facilitates real-time auditing by storing encrypted, time-stamped invoice data. |

| 6 | Dynamic Discounting Agreements | Small businesses need to maintain copies of dynamic discounting agreements along with corresponding invoices to accurately track payment terms and discount schedules. Proper recordkeeping ensures compliance with financial audits and optimizes cash flow management by documenting early payment incentives. |

| 7 | OCR-Scanned Expense Receipts | Small businesses require OCR-scanned expense receipts as vital documents for invoice recordkeeping, ensuring accurate extraction and digitization of payment details, dates, and vendor information. These digital records streamline expense tracking, reduce manual entry errors, and facilitate compliance with accounting standards and tax regulations. |

| 8 | Tax-compliant E-way Bills | Small businesses must retain tax-compliant E-way bills alongside invoices to ensure seamless GST audit trails and regulatory compliance. These documents validate the transportation of goods and are essential for accurate tax filing and dispute resolution. |

| 9 | AP (Accounts Payable) Audit Trail Logs | Small businesses need to maintain detailed AP audit trail logs, including original invoices, payment confirmations, vendor statements, and purchase orders, to ensure accurate and compliant invoice recordkeeping. These documents facilitate tracking invoice approvals, payment histories, and discrepancies during financial audits, enhancing transparency and accountability. |

| 10 | Real-time VAT Reconciliation Statements | Small businesses must maintain real-time VAT reconciliation statements alongside invoices, purchase receipts, and payment proofs to ensure accurate tax reporting and compliance. These documents provide a detailed, up-to-date account of VAT collected and paid, facilitating seamless audit processes and financial tracking. |

Introduction to Small Business Invoice Recordkeeping

Invoice recordkeeping is essential for small businesses to maintain accurate financial records and ensure smooth tax filing. Proper documentation helps track payments, manage cash flow, and support business decisions. Understanding which documents to keep protects your business during audits and improves overall financial management.

Importance of Accurate Invoice Documentation

Accurate invoice documentation is essential for a small business to maintain clear financial records and ensure compliance with tax regulations. Invoices serve as proof of transactions, aiding in auditing and financial analysis.

Key documents needed for effective invoice recordkeeping include original invoices, payment receipts, and purchase orders. Proper organization of these documents helps track payments, manage cash flow, and resolve disputes efficiently.

Types of Invoices Every Small Business Should Keep

Maintaining accurate invoice records is essential for small businesses to ensure proper financial management and compliance. Understanding the types of invoices to keep aids in efficient bookkeeping and tax preparation.

- Sales Invoices - Document sales transactions and serve as proof of revenue earned by the business.

- Purchase Invoices - Record goods and services bought by the business, important for expense tracking and tax deductions.

- Credit and Debit Invoices - Reflect returns, refunds, or adjustments made to original invoices, ensuring accurate financial records.

Retaining these invoice documents systematically supports small businesses in auditing processes and financial analysis.

Essential Elements to Include on an Invoice

Small businesses must keep accurate invoice records to ensure smooth financial management and compliance with tax regulations. Essential elements for invoice recordkeeping include clear documentation of transaction details to avoid discrepancies.

An invoice should include the seller's name, address, and contact information along with the buyer's details. Dates of issue, unique invoice numbers, itemized list of products or services, quantities, prices, and applicable taxes are critical for proper recordkeeping.

Supporting Documents for Invoice Verification

What supporting documents are essential for invoice verification in small business recordkeeping? Supporting documents such as purchase orders, delivery receipts, and payment confirmations play a crucial role in validating each invoice. These documents ensure accuracy and provide a clear audit trail for financial transactions.

Organizing and Categorizing Invoice Records

Organizing and categorizing invoice records is essential for efficient small business recordkeeping. Clear classification helps streamline financial management and simplifies tax preparation.

You need to maintain detailed copies of all invoices, sorted by date, client, or project. Use folders or digital software to categorize these records for quick retrieval. Proper organization prevents loss of important data and supports accurate bookkeeping.

Digital vs. Paper Invoice Storage Solutions

| Document Type | Small Business Invoice Recordkeeping Needs | Digital Storage Solutions | Paper Storage Solutions |

|---|---|---|---|

| Invoices | Copies of all issued and received invoices are essential for accurate financial tracking and tax compliance. | Cloud storage services like Google Drive, Dropbox, or dedicated accounting software with invoice modules enable easy access and organization. | Physical filing cabinets categorized by date or client ensure organized and accessible paper invoices for audits. |

| Payment Receipts | Proof of payment related to invoices confirms transaction completion and supports cash flow records. | Digital scans or PDFs stored with the corresponding invoice in accounting apps facilitate quick retrieval during financial reviews. | Paper receipts stored alongside invoices in labeled folders provide a physical audit trail. |

| Contracts and Purchase Orders | Documents supporting invoice details improve accuracy and resolve disputes. | Digitally stored contracts linked to invoice records enhance record integrity and streamline information retrieval. | Original contracts and purchase orders filed by client or project maintain a clear paper trail. |

| Tax Documents | Records such as VAT or sales tax returns associated with invoices are vital for regulatory compliance. | Tax documents stored digitally in secure platforms prevent loss and simplify tax filing processes. | Paper tax records kept in dedicated folders ensure availability during audits or financial reviews. |

| Benefits | Effective invoice recordkeeping protects against financial errors and facilitates regulatory compliance. | Digital storage reduces physical space needs, allows backup, supports search functions, and enhances sharing capabilities. | Paper storage maintains tangible proof of transactions but requires more physical space and manual organization. |

Legal and Tax Compliance for Invoice Recordkeeping

Small businesses must maintain accurate invoice records to ensure legal and tax compliance. Proper documentation supports audits, tax filings, and legal obligations effectively.

- Sales Invoices - These documents provide proof of transactions and are essential for revenue tracking and tax reporting.

- Purchase Receipts - Keep records of business expenses to validate deductions and comply with tax regulations.

- Tax Returns and Supporting Schedules - Store copies of filed tax returns and related documents to verify reported income and expenses during audits.

Best Practices for Invoice Retention Periods

Small businesses need to retain invoices along with related documents such as purchase orders, delivery receipts, and payment records to ensure accurate financial tracking and compliance. Best practices for invoice retention periods typically recommend keeping these records for at least seven years, aligning with tax regulations and audit requirements. Maintaining organized and accessible invoice documentation supports efficient accounting, legal protection, and streamlined business operations.

What Documents Does a Small Business Need for Invoice Recordkeeping? Infographic