Invoice payment processing requires key documents such as the original invoice, purchase order, and proof of delivery or service completion. These documents verify the transaction details and ensure accuracy before payment is released. Maintaining organized records of these files streamlines approvals and supports audit compliance.

What Documents are Needed for Invoice Payment Processing?

| Number | Name | Description |

|---|---|---|

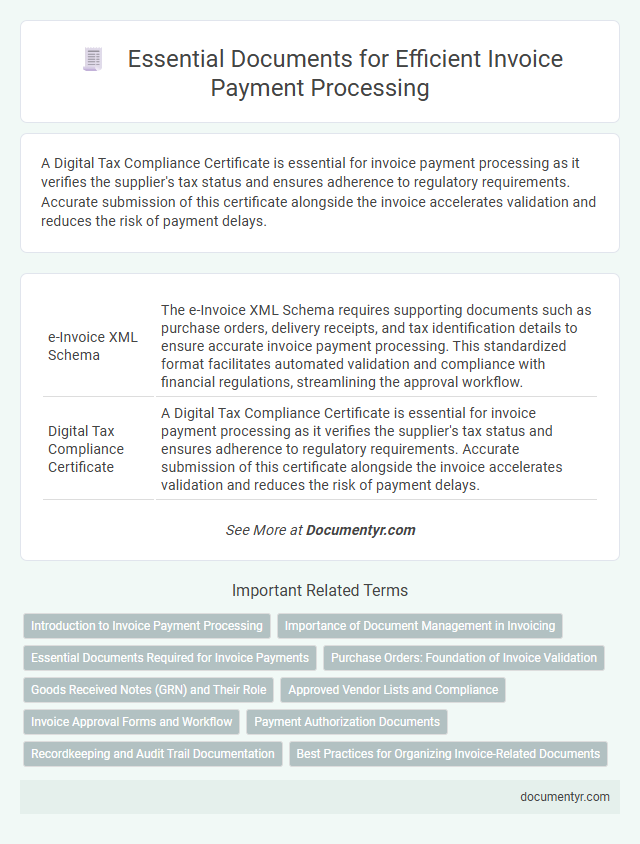

| 1 | e-Invoice XML Schema | The e-Invoice XML Schema requires supporting documents such as purchase orders, delivery receipts, and tax identification details to ensure accurate invoice payment processing. This standardized format facilitates automated validation and compliance with financial regulations, streamlining the approval workflow. |

| 2 | Digital Tax Compliance Certificate | A Digital Tax Compliance Certificate is essential for invoice payment processing as it verifies the supplier's tax status and ensures adherence to regulatory requirements. Accurate submission of this certificate alongside the invoice accelerates validation and reduces the risk of payment delays. |

| 3 | Dynamic Discounting Agreement | Dynamic Discounting Agreement is essential for invoice payment processing, ensuring terms for early payment discounts are clearly defined and mutually accepted. This document, along with the original invoice, purchase order, and payment authorization, enables accurate and timely payment while maximizing cost savings. |

| 4 | Payment Reconciliation Statement | A Payment Reconciliation Statement is essential for invoice payment processing as it details the matching of payments received against outstanding invoices, ensuring accurate financial tracking. This document includes invoice numbers, payment dates, amounts settled, and any discrepancies, facilitating efficient audit trails and dispute resolution. |

| 5 | Automated Clearing House (ACH) Authorization Form | The Automated Clearing House (ACH) Authorization Form is essential for invoice payment processing as it authorizes electronic payments directly from the payer's bank account, ensuring secure and efficient transactions. This form must include accurate bank details, account holder information, and the authorized signature to facilitate seamless ACH payments. |

| 6 | Electronic Remittance Advice (ERA) | Electronic Remittance Advice (ERA) is essential for invoice payment processing as it provides detailed information about the payment, including transaction specifics and adjustments, enabling accurate reconciliation between invoices and payments. Submitting an ERA alongside the original invoice and purchase order ensures faster verification and reduces errors during accounts payable processing. |

| 7 | Third-Party Payee Consent Letter | A Third-Party Payee Consent Letter is crucial for invoice payment processing as it authorizes payment to a party other than the original payee, ensuring compliance with company policies and preventing fraud. This document must clearly state the consent and details of the third-party payee to facilitate seamless verification and payment authorization. |

| 8 | PO Flip Documentation | Purchase order (PO) flip documentation is essential for invoice payment processing, as it converts the PO into a valid invoice by capturing key details such as item descriptions, quantities, prices, and payment terms. This documentation ensures accuracy, streamlines approval workflows, and reduces discrepancies by linking purchase orders directly to corresponding invoices. |

| 9 | Blockchain Transaction Ledger | Invoice payment processing requires a verified blockchain transaction ledger that records immutable payment details, timestamps, and transaction hashes to ensure transparency and fraud prevention. Essential documents include the invoice itself, payment authorization, and the corresponding blockchain ledger entry to validate the transaction's authenticity and completion. |

| 10 | Real-Time Payment (RTP) Confirmation | Accurate Real-Time Payment (RTP) confirmation requires submission of the original invoice, the payment authorization form, and the RTP transaction receipt which includes the unique payment identifier and timestamp. These documents ensure automatic reconciliation and verification within financial systems, expediting payment processing and reducing errors. |

Introduction to Invoice Payment Processing

Invoice payment processing is a critical financial procedure that ensures suppliers receive timely payments for goods or services rendered. Understanding the necessary documents helps streamline this process and prevents delays.

- Invoice - A detailed bill from the supplier outlining the goods or services provided along with payment terms.

- Purchase Order (PO) - An authorization document issued by the buyer confirming the order details and agreed prices.

- Delivery Receipt - Proof that the ordered goods or services were received as specified in the invoice and purchase order.

Importance of Document Management in Invoicing

What documents are needed for invoice payment processing? Accurate invoice payments require essential documents such as the original invoice, purchase order, and delivery receipt. Proper document management ensures these files are organized and easily accessible, reducing errors and payment delays.

Essential Documents Required for Invoice Payments

Invoice payment processing requires several essential documents to ensure accuracy and authorization. These documents help verify the details and facilitate timely payment.

The primary documents include the original invoice, purchase order, and delivery receipt or proof of service. The invoice must detail the goods or services provided, pricing, and payment terms. Purchase orders authorize the transaction, while delivery receipts confirm fulfillment, minimizing discrepancies in payment processing.

Purchase Orders: Foundation of Invoice Validation

Purchase orders serve as the foundation of invoice validation during payment processing. They provide essential details such as item descriptions, quantities, and agreed prices, ensuring accuracy and accountability.

Your invoice must reference the corresponding purchase order to confirm that goods or services were authorized and received. This document connection helps streamline approvals and prevents payment errors or fraud.

Goods Received Notes (GRN) and Their Role

Goods Received Notes (GRN) serve as a critical document in invoice payment processing. They verify the receipt of goods, ensuring that the items ordered match what has been delivered.

Your invoice payment cannot proceed without an accurate GRN, as it confirms the supplier fulfilled the order requirements. This document links purchase orders to invoices for effective audit and payment tracking.

Approved Vendor Lists and Compliance

| Document Type | Description | Importance for Invoice Payment Processing |

|---|---|---|

| Approved Vendor List (AVL) | A verified and authorized list of vendors eligible for payment within an organization. | Ensures only recognized vendors receive payments, reducing fraud risks and maintaining compliance with procurement policies. |

| Vendor Registration Documents | Includes tax identification, business licenses, and insurance certificates submitted during vendor onboarding. | Confirms vendor legitimacy and supports compliance with regulatory requirements during invoice approval. |

| Invoice | Detailed billing document submitted by vendors stating goods or services provided. | Serves as the primary document for payment requests, requiring verification against purchase orders and AVL. |

| Purchase Order (PO) | Official authorization document confirming the buyer's intent to purchase specific goods or services. | Facilitates matching invoices to approved orders, validating payment legitimacy and adherence to budgeting rules. |

| Compliance Certificates | Documents verifying adherence to legal, environmental, or industry-specific standards. | Ensures vendor compliance with contractual obligations and regulatory standards prior to payment release. |

| Payment Authorization Form | Internal document approved by designated personnel to authorize invoice payments. | Acts as a control checkpoint to verify invoice accuracy and compliance before processing payment. |

Invoice Approval Forms and Workflow

Invoice payment processing requires specific documentation to ensure accuracy and authorization. Understanding the role of invoice approval forms and workflow is essential for smooth financial operations.

- Invoice Approval Forms - These forms provide documented authorization from relevant departments confirming invoice validity and payment approval.

- Workflow Automation Tools - These tools streamline the approval process by routing invoices through predefined steps to reduce delays and errors.

- Supporting Documentation - Purchase orders, delivery receipts, and contracts accompany invoices to verify amounts and contract terms for accurate payment processing.

Payment Authorization Documents

Payment authorization documents are essential for invoice payment processing to ensure accuracy and compliance. Common authorization documents include purchase orders, signed contracts, and approval emails confirming the payment amount and terms. You must provide these documents to validate and expedite the payment process efficiently.

Recordkeeping and Audit Trail Documentation

Accurate recordkeeping is essential for efficient invoice payment processing and maintaining a clear audit trail. Proper documentation supports transparency and compliance during financial reviews.

- Invoice Copy - Contains details of the transaction, including amounts, dates, and vendor information, necessary for verifying payment legitimacy.

- Purchase Order - Provides authorization and approval details that link the purchase to the invoice, ensuring the validity of the expense.

- Payment Receipt - Confirms that the payment was completed and serves as proof for financial reconciliation and audits.

Maintaining comprehensive documentation ensures accountability and facilitates smooth audit processes.

What Documents are Needed for Invoice Payment Processing? Infographic