Freelancers need essential documents such as a valid tax identification number, proof of business registration, and detailed project or service descriptions to generate an accurate invoice. Clear client information, including contact details and payment terms, is crucial for proper invoicing. Including these documents ensures compliance with tax regulations and smooth payment processing.

What Documents Does a Freelancer Need to Generate an Invoice?

| Number | Name | Description |

|---|---|---|

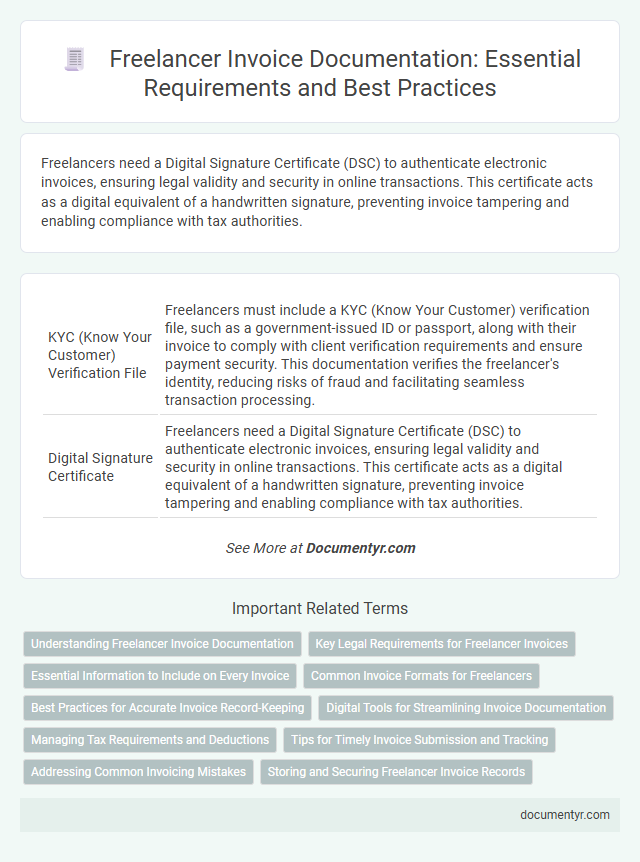

| 1 | KYC (Know Your Customer) Verification File | Freelancers must include a KYC (Know Your Customer) verification file, such as a government-issued ID or passport, along with their invoice to comply with client verification requirements and ensure payment security. This documentation verifies the freelancer's identity, reducing risks of fraud and facilitating seamless transaction processing. |

| 2 | Digital Signature Certificate | Freelancers need a Digital Signature Certificate (DSC) to authenticate electronic invoices, ensuring legal validity and security in online transactions. This certificate acts as a digital equivalent of a handwritten signature, preventing invoice tampering and enabling compliance with tax authorities. |

| 3 | e-Invoicing QR Code | Freelancers need a completed invoice template including essential items such as service description, payment terms, and client information, with the e-Invoicing QR code embedded to ensure compliance and facilitate digital verification. The e-Invoicing QR code encodes invoice data, enabling automated processing by tax authorities and enhancing accuracy and efficiency in transactions. |

| 4 | GSTIN (Goods and Services Tax Identification Number) | Freelancers must include their GSTIN (Goods and Services Tax Identification Number) on invoices if registered under GST to ensure legal compliance and facilitate tax credit for clients. The invoice should clearly display the GSTIN along with itemized details, tax rates, and the total amount to validate the transaction under GST regulations. |

| 5 | Retainer Agreement Copy | A freelancer needs a retainer agreement copy to outline the terms, scope of work, and payment schedule before generating an invoice. This document ensures clarity in billing and protects both parties by specifying agreed-upon services and retainment fees. |

| 6 | Scope of Work (SOW) Document | A Scope of Work (SOW) document is essential for freelancers to clearly outline project deliverables, timelines, and payment terms, ensuring transparency when generating an invoice. This document helps validate invoice details by specifying agreed-upon tasks and milestones, reducing the risk of payment disputes. |

| 7 | Payment Milestone Tracker | Freelancers need a Payment Milestone Tracker to accurately document agreed payment stages, ensuring each invoice reflects completed project phases and corresponding amounts. This tracker serves as a critical reference for generating invoices that align with client-approved milestones, facilitating transparent and timely payments. |

| 8 | Unique Invoice Reference ID | A freelancer needs a Unique Invoice Reference ID to ensure each invoice is easily identifiable and traceable for accounting and tax purposes. This alphanumeric code prevents duplication, facilitates efficient record-keeping, and supports compliance with financial regulations. |

| 9 | Timesheet Validation Report | Freelancers need a Timesheet Validation Report to accurately track billable hours and ensure transparent client communication when generating an invoice. This report serves as essential documentation for verifying work duration and justifying the total invoiced amount. |

| 10 | Crypto Wallet Address (for blockchain payments) | Freelancers generating invoices for blockchain payments must include their crypto wallet address to ensure seamless transaction tracking and verification. Incorporating the wallet address alongside standard invoice details facilitates transparent and efficient payment processing in cryptocurrency. |

Understanding Freelancer Invoice Documentation

Freelancers need essential documents to generate an accurate invoice, including a contractual agreement or work order outlining the scope of services. Detailed time sheets or project logs provide a clear record of hours worked and tasks completed. Payment terms, tax identification numbers, and client contact information are also necessary to ensure compliance and facilitate smooth transactions.

Key Legal Requirements for Freelancer Invoices

| Document Type | Description | Key Legal Requirements |

|---|---|---|

| Freelancer Identification | Official identification or business registration details of the freelancer. | Include full name or business name, tax identification number (TIN), and address. |

| Client Information | Details about the client for whom the invoice is generated. | Client's full name or business name, address, and tax identification number if applicable. |

| Invoice Number | Unique sequential identification number for each invoice. | Must be consecutive and non-repetitive to ensure traceability and legal compliance. |

| Date of Issue | The date the invoice is created and sent to the client. | Include the exact date to establish payment terms and compliance with tax regulations. |

| Description of Services | A detailed breakdown of the services provided by the freelancer. | Clear, precise description with quantities, hours worked, or milestones achieved. |

| Payment Terms | Instructions and deadlines for payment submission. | Specify due date, accepted payment methods, and any late fees or discounts. |

| Tax Information | Details about applicable taxes on the invoice amount. | Include tax rates, amounts charged, and references to legal tax regulations (e.g., VAT, GST). |

| Total Amount Due | The complete sum payable by the client. | Calculation must reflect itemized costs plus applicable taxes and adjustments. |

| Freelancer Signature or Digital Authentication | Proof of authenticity and approval of the invoice contents. | Either handwritten signature or secure digital signature compliant with e-invoice standards. |

Essential Information to Include on Every Invoice

Generating an invoice requires specific documents and details to ensure clear communication and timely payment. Essential information on every invoice supports professionalism and legal compliance.

- Contact Information - Include your full name or business name, address, phone number, and email for clear identification.

- Invoice Number and Date - Assign a unique invoice number and issue date to track payments efficiently.

- Detailed Services Provided - Describe each service or product with quantity, rate, and total cost for transparency.

Common Invoice Formats for Freelancers

Freelancers require specific documents to generate accurate and professional invoices. Understanding common invoice formats helps streamline the billing process.

- Basic Invoice Template - A simple format including client details, services rendered, and total amount due.

- Itemized Invoice - Breaks down charges by individual service or product for transparent billing.

- Timesheet-Based Invoice - Incorporates hours worked and hourly rates, ideal for hourly freelancers.

Choosing the right invoice format ensures clear communication and timely payments for freelance projects.

Best Practices for Accurate Invoice Record-Keeping

Freelancers need essential documents such as client contact information, detailed descriptions of services provided, and agreed payment terms to generate an accurate invoice. Maintaining organized records including contracts, timesheets, and receipts ensures transparency and simplifies dispute resolution. Best practices for invoice record-keeping involve consistent documentation, digital backups, and clear labeling for easy retrieval during tax preparation or audits.

Digital Tools for Streamlining Invoice Documentation

Freelancers require key documents like project agreements, time logs, and expense receipts to generate accurate invoices. Digital tools simplify the organization and retrieval of these essential documents.

Cloud-based accounting software integrates contract details and tracks billable hours seamlessly. Expense management apps capture and categorize receipts automatically, reducing manual input. This streamlines invoice preparation and ensures all necessary documentation is readily available when billing clients.

Managing Tax Requirements and Deductions

Freelancers must include key documents when generating an invoice to ensure compliance with tax regulations. These documents typically include a valid tax identification number and proof of any applicable tax deductions.

Properly managing tax requirements helps avoid penalties and streamlines the deduction process. You should also keep records of expenses and receipts to support any claimed deductions on your invoice.

Tips for Timely Invoice Submission and Tracking

What documents does a freelancer need to generate an invoice? Essential documents include a detailed work contract and accurate time tracking records. You should also have proof of expenses related to the project and agreed-upon payment terms.

How can timely invoice submission be ensured? Create a standardized invoice template to avoid delays in formatting. Set reminders aligned with project milestones and payment cycles for prompt dispatch.

What methods help in tracking invoices efficiently? Use invoicing software with automated tracking features for real-time status updates. Maintain a spreadsheet backup to monitor due dates and payment progress.

Addressing Common Invoicing Mistakes

Freelancers must gather key documents to generate accurate invoices and avoid common invoicing mistakes. Proper documentation ensures clarity, timely payments, and professional communication with clients.

- Client Information - Collect the full legal name, billing address, and contact details of the client to prevent payment delays caused by incomplete or incorrect client data.

- Work Agreement or Contract - Reference the agreed-upon terms and payment conditions to avoid disputes related to scope, rates, or deadlines during invoicing.

- Proof of Service Delivery - Include detailed records such as timesheets, project milestones, or deliverables to validate the invoiced amount and minimize client queries or rejections.

What Documents Does a Freelancer Need to Generate an Invoice? Infographic