To register for e-invoicing in India, businesses must submit a valid GSTIN (Goods and Services Tax Identification Number), a PAN card, and proof of business registration. Additionally, a digital signature certificate (DSC) or an Aadhaar-based e-signature is required to authenticate the registration process. Accurate details of contact information and banking documents may also be requested to ensure seamless communication and compliance.

What Documents are Needed for E-Invoice Registration in India?

| Number | Name | Description |

|---|---|---|

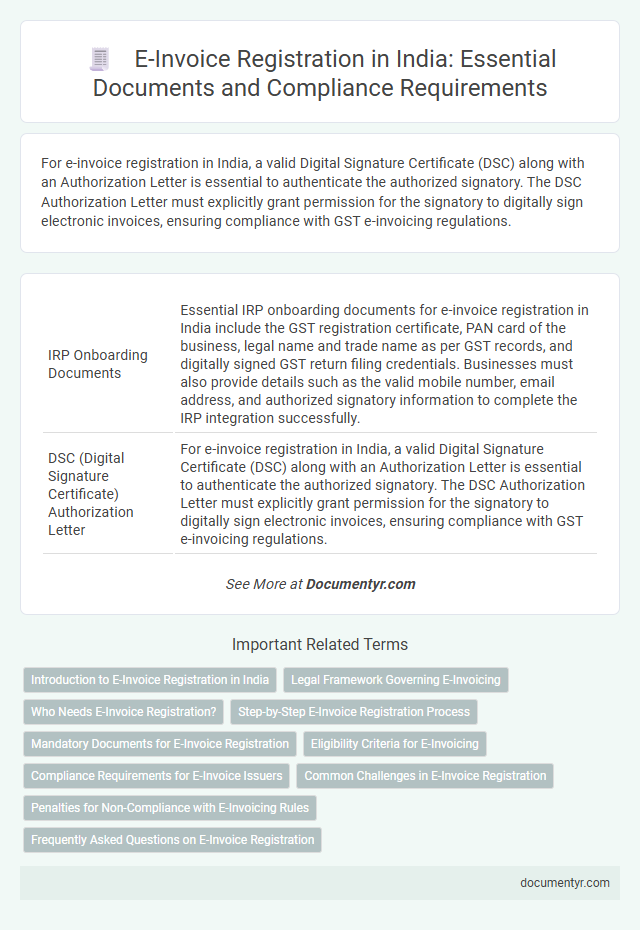

| 1 | IRP Onboarding Documents | Essential IRP onboarding documents for e-invoice registration in India include the GST registration certificate, PAN card of the business, legal name and trade name as per GST records, and digitally signed GST return filing credentials. Businesses must also provide details such as the valid mobile number, email address, and authorized signatory information to complete the IRP integration successfully. |

| 2 | DSC (Digital Signature Certificate) Authorization Letter | For e-invoice registration in India, a valid Digital Signature Certificate (DSC) along with an Authorization Letter is essential to authenticate the authorized signatory. The DSC Authorization Letter must explicitly grant permission for the signatory to digitally sign electronic invoices, ensuring compliance with GST e-invoicing regulations. |

| 3 | GSTIN-linked Bank Account Proof | For e-invoice registration in India, providing GSTIN-linked bank account proof such as a canceled cheque or bank statement is mandatory to verify the authenticity of the business. This document ensures that the GSTIN is accurately linked to the bank account used for financial transactions and compliance purposes. |

| 4 | ERP Integration Consent | To complete e-invoice registration in India, businesses must provide a valid GSTIN, PAN, and proof of business premises along with ERP integration consent to enable seamless automation and data exchange between the GST portal and their Enterprise Resource Planning system. ERP integration consent ensures accurate invoice generation, timely reporting, and compliance with the Goods and Services Tax Network (GSTN) requirements. |

| 5 | API User Registration Form | The API User Registration Form for e-invoice registration in India requires essential documents including the PAN card of the business, GSTIN details, and a digitally signed copy of the registration form. Accurate submission of these documents ensures seamless integration with the government's Invoice Registration Portal (IRP) for real-time e-invoicing compliance. |

| 6 | Organization PAN Verification | Organization PAN verification is a critical document required for e-invoice registration in India, ensuring the legal identity and tax compliance of the business entity. The Permanent Account Number (PAN) must be submitted and validated to authenticate the organization's eligibility under the Goods and Services Tax (GST) framework for seamless e-invoice integration. |

| 7 | QR Code Payload Sample | For e-invoice registration in India, essential documents include the GSTIN, legal business name, and PAN, while the QR code payload sample must contain key transaction details such as Invoice Number, Date, Supplier GSTIN, Invoice Value, and unique Invoice Reference Number (IRN) to ensure seamless verification and compliance. The QR code encodes this critical data in a standardized format, enabling quick scanning and validation by tax authorities and business partners. |

| 8 | E-Invoice Schema Mapping Sheet | The E-Invoice Schema Mapping Sheet is a crucial document required for e-invoice registration in India, detailing the alignment of business invoice fields with the government's standard e-invoice format. This sheet ensures accurate data integration, compliance with GST regulations, and facilitates seamless communication between taxpayer systems and the Invoice Registration Portal (IRP). |

| 9 | GSP (GST Suvidha Provider) Authorization | To complete e-invoice registration in India, businesses must submit documents such as GSTIN, PAN, and a valid GSP (GST Suvidha Provider) authorization letter to enable API integration and data exchange. The GSP authorization ensures secure communication with the Invoice Registration Portal (IRP) for seamless e-invoice generation and compliance. |

| 10 | Data Privacy Undertaking for IRN Generation | A signed Data Privacy Undertaking (DPU) is essential for e-invoice registration in India to ensure compliance with data protection regulations during IRN generation. This document guarantees that taxpayer information and invoice details are securely handled and processed by the Invoice Registration Portal (IRP), safeguarding confidential business data. |

Introduction to E-Invoice Registration in India

E-invoicing in India is a mandatory process for businesses to streamline tax compliance and enhance invoice authenticity. Registering for e-invoicing requires submitting specific documents to the government portal for verification and approval.

- GST Registration Certificate - Proof of the business's Goods and Services Tax registration required to link invoices with GST filings.

- PAN Card - Permanent Account Number (PAN) card of the business entity needed for tax identification and verification purposes.

- Active Mobile Number and Email ID - Contact details required for communication and OTP verification during the registration process.

- Digital Signature Certificate (DSC) - Required for authenticating the e-invoice submission electronically in certain cases.

- Bank Account Details - Information about the business's bank accounts to ensure accurate financial record matching and validation.

Legal Framework Governing E-Invoicing

The legal framework governing e-invoicing in India is primarily established under the Goods and Services Tax (GST) law, specifically through the Central Board of Indirect Taxes and Customs (CBIC) notifications. The E-Invoice system ensures standardization and authenticity of invoices by mandating unique Invoice Reference Numbers (IRN) generated from the Invoice Registration Portal (IRP).

For e-invoice registration, businesses must submit specific documents to comply with the legal requirements, including a valid GST registration certificate and a Permanent Account Number (PAN). Additional documents such as business address proof and bank account details are essential to validate the identity and authenticity of the taxpayer under the GST e-invoicing framework.

Who Needs E-Invoice Registration?

E-invoice registration in India is mandatory for businesses with an aggregate turnover exceeding Rs50 crore in any financial year from 2017-18 onwards. This system enhances tax compliance and reduces errors in GST filings.

Businesses required to register include manufacturers, suppliers, and e-commerce operators meeting the turnover threshold. Companies must provide documents such as GST registration certificate, PAN card, and bank account details during the registration process. The e-invoice system integrates with the Invoice Registration Portal (IRP) to streamline invoice generation and validation under the GST framework.

Step-by-Step E-Invoice Registration Process

Registering for e-invoice in India requires specific documents and a clear step-by-step process to ensure compliance. Proper submission of these documents facilitates smooth integration with the government e-invoicing portal.

- GSTIN Details - Provide the GST Identification Number issued to your business for tax compliance verification.

- PAN Card - Submit the Permanent Account Number card to establish the identity of the business entity.

- Business Incorporation Proof - Upload official registration documents such as Certificate of Incorporation or Partnership Deed.

- Authorized Signatory Details - Furnish details and identity proof of the person authorized to sign and manage the e-invoice account.

- Email and Contact Information - Ensure valid communication channels are provided for notifications and updates.

- Bank Account Information - Include bank details for financial verification and seamless transactions.

Following the step-by-step registration procedure with the required documents enables businesses to generate compliant e-invoices and integrate with the Indian government's invoicing system effectively.

Mandatory Documents for E-Invoice Registration

| Document Name | Description | Purpose |

|---|---|---|

| GSTIN (Goods and Services Tax Identification Number) | Unique identification number assigned to taxpayers registered under GST | Used to verify taxpayer identity and eligibility for e-invoice registration |

| PAN Card of the Business Entity | Permanent Account Number issued by the Income Tax Department | Validates the business entity's legal existence and tax compliance |

| Business Registration Proof | Certificate of Incorporation, Partnership Deed, or other official registration documents | Confirms the legal status and structure of the business entity |

| Aadhaar Card of Authorized Signatory | Unique identification number issued to Indian residents | Ensures verification and authentication of the person authorized to apply |

| Bank Account Details | Bank account number, IFSC code, and bank name linked to the business | Used for payment-related verification and correspondence |

| Contact Information | Mobile number and email address of the authorized signatory or business representative | For communication and OTP verification during registration process |

Eligibility Criteria for E-Invoicing

To register for e-invoicing in India, businesses must meet specific eligibility criteria based on their aggregate turnover exceeding Rs20 crores in any financial year from 2017-18 onwards. Key documents required include the GST registration certificate, PAN card of the business, and valid bank account details linked to the business entity. These documents ensure proper validation and compliance for seamless e-invoice generation under the Indian GST system.

Compliance Requirements for E-Invoice Issuers

To comply with e-invoice registration requirements in India, specific documents must be submitted. These documents ensure adherence to the Goods and Services Tax (GST) regulations for e-invoice issuers.

- GST Registration Certificate - Proof of your GST registration to link your business with the e-invoice system.

- PAN Card - Valid PAN card for identity verification of the business entity.

- Aadhaar Number of Authorized Signatory - Aadhaar for the person responsible for e-invoice compliance and signing.

Common Challenges in E-Invoice Registration

To complete e-invoice registration in India, you need essential documents such as your GSTIN, PAN, and a valid digital signature certificate (DSC). Proof of business address and bank account details are also required to verify your entity during the registration process.

Common challenges in e-invoice registration include mismatched data between documents and delays in DSC authentication. You may face technical issues such as system downtime or errors that complicate timely registration and compliance.

Penalties for Non-Compliance with E-Invoicing Rules

To register for E-Invoice in India, you need a valid GSTIN, a PAN card, and digital signature certificates. Non-compliance with E-Invoicing rules can lead to penalties such as late fees, interest on the outstanding GST amount, and potential blocking of your GST portal access. You must ensure timely and accurate E-Invoice generation to avoid these financial and operational disruptions.

What Documents are Needed for E-Invoice Registration in India? Infographic