A freelancer must include essential details such as full name, business address, and tax identification number on an invoice. The invoice should also list a clear description of services provided, date of delivery, payment terms, and the total amount due with applicable taxes. Including a unique invoice number and the client's information ensures the document is valid and easy to track for accounting purposes.

What Documents Does a Freelancer Need to Create a Valid Invoice?

| Number | Name | Description |

|---|---|---|

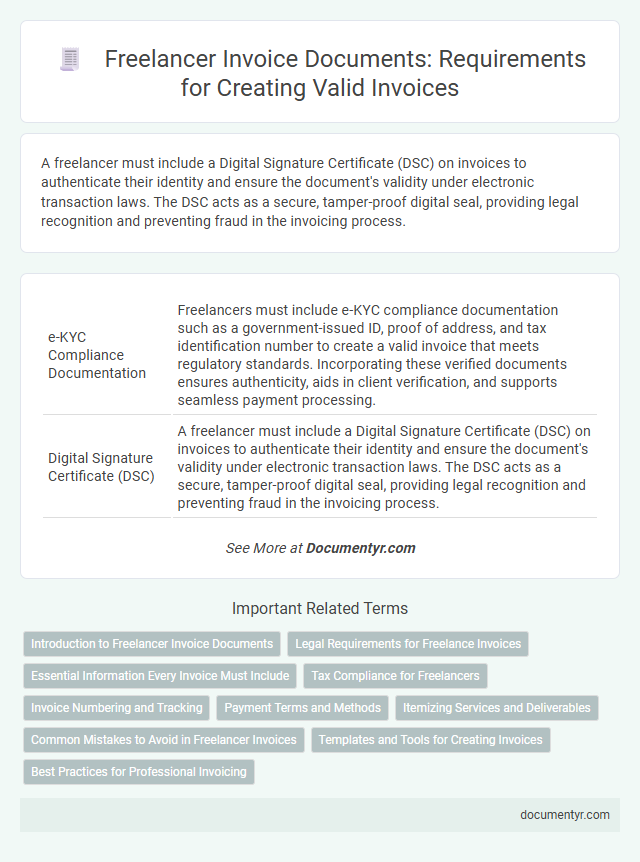

| 1 | e-KYC Compliance Documentation | Freelancers must include e-KYC compliance documentation such as a government-issued ID, proof of address, and tax identification number to create a valid invoice that meets regulatory standards. Incorporating these verified documents ensures authenticity, aids in client verification, and supports seamless payment processing. |

| 2 | Digital Signature Certificate (DSC) | A freelancer must include a Digital Signature Certificate (DSC) on invoices to authenticate their identity and ensure the document's validity under electronic transaction laws. The DSC acts as a secure, tamper-proof digital seal, providing legal recognition and preventing fraud in the invoicing process. |

| 3 | GSTIN Verification Proof | A freelancer must include a verified GSTIN (Goods and Services Tax Identification Number) on their invoice to ensure compliance with tax regulations and enable proper GST filing. Providing GSTIN verification proof alongside the invoice helps validate the freelancer's tax registration and facilitates seamless transactions with clients. |

| 4 | UPI Transaction Reference Sheet | A freelancer needs to include a UPI Transaction Reference Sheet as part of their invoice documentation to validate payment details and ensure transparent financial tracking. This sheet captures unique UPI transaction IDs, dates, and amounts, enabling accurate reconciliation and proof of receipt for both parties. |

| 5 | E-way Bill Integration Form | Freelancers must include the E-way Bill Integration Form when creating a valid invoice to ensure compliance with GST regulations for the transportation of goods exceeding prescribed limits. This document facilitates seamless tracking and verification of the movement of goods, thereby enhancing invoice authenticity and legal validity. |

| 6 | Self-attested Bank Account Statement | A self-attested bank account statement is a crucial document for freelancers to include when creating a valid invoice, as it verifies the authenticity of the payment details provided. This statement helps establish trust with clients by confirming the freelancer's bank information, ensuring smooth and secure transaction processing. |

| 7 | Unique Document Identification Number (UDIN) | A valid invoice created by a freelancer must include a Unique Document Identification Number (UDIN) to ensure authenticity and traceability of the document. The UDIN acts as a secure verification code issued by relevant professional bodies, preventing invoice tampering and enhancing credibility with clients and tax authorities. |

| 8 | Freelance Service Contract Receipt | Freelancers need a freelance service contract and a receipt to create a valid invoice, ensuring clear agreement on deliverables and payment terms. These documents provide legal proof of services rendered and payment received, supporting accurate financial records and client trust. |

| 9 | Invoice Metadata JSON File | Freelancers need an Invoice Metadata JSON file containing essential details such as invoice number, issue date, client and freelancer information, service descriptions, amounts, tax rates, and payment terms to create a valid invoice. Structured invoice metadata ensures compliance with accounting standards and facilitates seamless integration with accounting software and digital record-keeping systems. |

| 10 | QR Code Payment Proof | Freelancers must include a QR code payment proof on invoices to facilitate secure and efficient transaction verification, linking directly to payment confirmation data. This digital proof enhances transparency and compliance with financial regulations by providing verifiable evidence of payment. |

Introduction to Freelancer Invoice Documents

Freelancers must prepare specific documents to create a valid invoice, ensuring clear communication and proper payment processing. Understanding these essential components helps in maintaining professionalism and legal compliance.

Key documents include a detailed description of the services provided, payment terms, and client information. An accurate invoice must also feature a unique invoice number and the freelancer's contact details. These elements guarantee transparency and facilitate smooth financial transactions between freelancers and clients.

Legal Requirements for Freelance Invoices

What legal requirements must a freelancer meet to create a valid invoice? A valid freelance invoice must include specific details such as the freelancer's full name, business address, and tax identification number. It should also clearly state the invoice date, unique invoice number, a detailed description of services provided, and the total amount due including applicable taxes.

Essential Information Every Invoice Must Include

A valid invoice created by a freelancer must include essential information to ensure clarity and legal compliance. Key details include the freelancer's name and contact information, the client's details, a unique invoice number, and the date of issue. Additionally, the invoice should clearly describe the services provided, the payment terms, and the total amount due including taxes if applicable.

Tax Compliance for Freelancers

| Document | Purpose | Tax Compliance Details |

|---|---|---|

| Invoice Template | Standardizes information including services rendered, fees, and dates | Must include freelancer's tax identification number and payment terms to meet tax authority standards |

| Tax Identification Number (TIN) | Identifies the freelancer for tax reporting purposes | Required on all invoices to ensure transactions are properly recorded for tax assessments |

| Proof of Service Documents | Supports the validity of services billed (e.g., contracts or work summaries) | Helps validate expenses and income during tax audits and compliance reviews |

| Expense Receipts | Documents costs related to service delivery that may be deductible | Must be kept as evidence for tax deductions and maintaining accurate financial records |

| Payment Records | Tracks received payments and outstanding balances | Essential for reconciling income with tax returns and verifying taxable revenue |

| Tax Declaration Forms | Used to report income and calculate taxes owed | Must align with invoice totals to avoid discrepancies during tax filing |

Invoice Numbering and Tracking

A valid invoice requires proper documentation to ensure accurate billing and legal compliance. Invoice numbering and tracking play a crucial role in maintaining organized financial records.

- Unique Invoice Number - Each invoice must have a distinct number to avoid duplication and simplify reference.

- Sequential Ordering - Invoice numbers should follow a consistent, chronological sequence to facilitate clear tracking.

- Tracking System - Implementing an organized method for monitoring invoice issuance helps manage payments and historical data efficiently.

You can enhance your invoice credibility by adhering to structured numbering and effective tracking systems.

Payment Terms and Methods

Invoice payment terms clearly define the timeline within which the payment must be received, such as Net 30 or Due on Receipt. Including these terms ensures both parties are aware of when funds are expected, reducing potential disputes.

Specify accepted payment methods like bank transfer, PayPal, or credit card to streamline the transaction process. You should also indicate any late payment penalties or early payment discounts to set clear financial expectations.

Itemizing Services and Deliverables

A valid invoice for freelancers must clearly itemize all services and deliverables provided to ensure transparency and payment accuracy. Proper documentation helps avoid disputes and supports financial record-keeping.

- Detailed service description - Each service should be listed with a brief but precise explanation to clarify the work done.

- Deliverable specifications - Clearly outline the tangible or intangible outputs delivered to the client for validation.

- Quantity and rates - Include the number of hours, units, or projects along with their corresponding rates to justify the total amount charged.

Common Mistakes to Avoid in Freelancer Invoices

Freelancers need essential documents such as a detailed project description, proof of hours worked, and accurate client information to create a valid invoice. Common mistakes include missing invoice numbers, unclear payment terms, and incorrect tax identification details. Avoiding these errors ensures timely payments and maintains professional credibility.

Templates and Tools for Creating Invoices

Freelancers need several key documents to create a valid invoice, including a detailed invoice template that lists services rendered, payment terms, and client information. Utilizing invoice templates ensures consistency and professionalism, helping freelancers maintain clear financial records.

Tools such as online invoicing software and customizable templates simplify the invoice creation process. These tools often include features like automatic calculations, tax inclusion, and payment tracking, enhancing accuracy and efficiency for freelancers.

What Documents Does a Freelancer Need to Create a Valid Invoice? Infographic