Submitting invoices to government contracts requires several key documents to ensure compliance and timely payment. Essential documents typically include a detailed invoice outlining services or products provided, a signed contract or purchase order confirming agreement terms, and proof of delivery or completion of work. Accurate tax forms, such as W-9 or VAT certificates, and any required certifications or compliance reports must also accompany the invoice to meet government procurement standards.

What Documents are Necessary for Submitting Invoices to Government Contracts?

| Number | Name | Description |

|---|---|---|

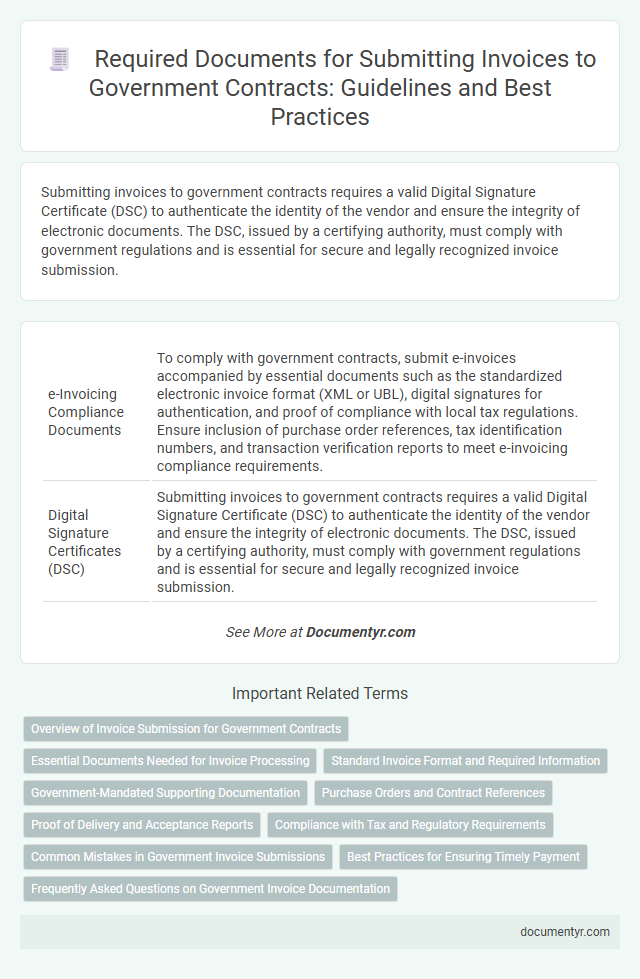

| 1 | e-Invoicing Compliance Documents | To comply with government contracts, submit e-invoices accompanied by essential documents such as the standardized electronic invoice format (XML or UBL), digital signatures for authentication, and proof of compliance with local tax regulations. Ensure inclusion of purchase order references, tax identification numbers, and transaction verification reports to meet e-invoicing compliance requirements. |

| 2 | Digital Signature Certificates (DSC) | Submitting invoices to government contracts requires a valid Digital Signature Certificate (DSC) to authenticate the identity of the vendor and ensure the integrity of electronic documents. The DSC, issued by a certifying authority, must comply with government regulations and is essential for secure and legally recognized invoice submission. |

| 3 | Unique Invoice Reference Number (IRN) Sheets | Unique Invoice Reference Number (IRN) sheets are essential documents required for submitting invoices to government contracts, as they ensure each invoice is uniquely identified and traceable within the government's financial system. Properly formatted IRN sheets must include detailed invoice data such as supplier information, transaction date, contract reference, and itemized billing codes to comply with regulatory standards and facilitate seamless validation and payment processing. |

| 4 | Endorsement of e-Procurement Platform | Submission of invoices for government contracts requires an endorsement from the authorized e-Procurement platform, verifying compliance with contract terms and payment schedules. This endorsement ensures the invoice's authenticity and eligibility for processing within the government's financial system. |

| 5 | GST e-Way Bill Attachments | Submitting invoices for government contracts requires attaching GST-compliant e-Way Bills that detail the movement of goods, ensuring tax validation and transport authorization. Essential documents include the invoice itself, GST e-Way Bill, delivery challan, and proof of dispatch to comply with government procurement and taxation regulations. |

| 6 | Central Public Procurement Portal (CPPP) Receipts | Submission of invoices for government contracts via the Central Public Procurement Portal (CPPP) requires key documents including the original invoice, delivery challan, tax receipts, and proof of service completion. CPPP receipts serve as essential verification for transaction authenticity and compliance with procurement guidelines. |

| 7 | Form 26AS Reconciliation Statements | Form 26AS Reconciliation Statements are crucial documents for submitting invoices to government contracts, as they provide detailed tax credit information and validate the authenticity of tax deductions claimed. Ensuring these statements are accurate and up-to-date helps in verifying the tax compliances and streamlines the approval process for government invoice payments. |

| 8 | MSME Acknowledgement Certificate | Submitting invoices for government contracts requires the inclusion of the MSME Acknowledgement Certificate to validate the registered micro, small, and medium enterprise status of the vendor. This certificate ensures preferential treatment under government procurement policies and facilitates timely payment processing. |

| 9 | GeM (Government e-Marketplace) Transaction Logs | Submitting invoices for government contracts through GeM requires accurate GeM transaction logs that detail order confirmations, delivery receipts, and payment acknowledgments. These transaction logs serve as critical documents ensuring compliance with government procurement policies and facilitating timely invoice processing. |

| 10 | Payment Advice Generated from PFMS (Public Financial Management System) | Payment Advice generated from the Public Financial Management System (PFMS) serves as a critical document required for submitting invoices under government contracts, providing detailed confirmation of fund disbursement and transaction authenticity. This electronic record ensures compliance with government financial regulations and supports the validation process for payment claims linked to contract execution. |

Overview of Invoice Submission for Government Contracts

Submitting invoices for government contracts requires specific documentation to ensure compliance with regulatory standards. Essential documents typically include a detailed invoice outlining services or products delivered, a purchase order reference, and proof of delivery or performance. Your invoice must align with government contract terms to facilitate timely payment and avoid processing delays.

Essential Documents Needed for Invoice Processing

Submitting invoices for government contracts requires specific documents to ensure smooth processing and compliance. Understanding these essential documents helps avoid delays or rejections during invoice approval.

- Purchase Order (PO) - The PO confirms the agreed-upon goods or services and authorizes the invoice.

- Invoice Document - The invoice must clearly detail the amounts, descriptions, and payment terms as per the contract.

- Delivery or Service Completion Proof - Proof such as delivery receipts or completion certificates verifies that the contractual obligations were met.

Your invoice submission will be processed efficiently when all required documents are accurately provided and aligned with contract terms.

Standard Invoice Format and Required Information

Submitting invoices for government contracts requires adhering to a standard invoice format to ensure timely processing. This format includes specific details mandated by government agencies to maintain accuracy and compliance.

Your invoice must include essential information such as the contractor's name, contract number, invoice date, and a detailed description of goods or services provided. It should also specify the total amount due, payment terms, and any applicable tax identification numbers. Proper documentation supports validation, reduces processing delays, and ensures your payment aligns with contract requirements.

Government-Mandated Supporting Documentation

| Document Type | Description | Government Requirement |

|---|---|---|

| Invoice | Official bill listing goods or services provided, including detailed costs and payment terms. | Must align with contract specifications and include purchase order numbers. |

| Purchase Order (PO) | Authorization document issued by the government confirming products or services ordered. | Required to verify the validity of the invoice. |

| Delivery Receipts or Proof of Performance | Documentation confirming completion of service or delivery of goods as specified. | Essential for validating the invoice amount and contract compliance. |

| Contract or Agreement Copy | Official contract outlining terms, conditions, pricing, and deliverables. | Needed to ensure the invoice corresponds to the agreed terms. |

| Tax Documentation | Tax identification numbers and any applicable tax exemption certificates. | Important for tax compliance and accurate financial processing. |

| Payment Remittance Information | Bank details or payment instructions for processing payments. | Required for timely and accurate payment by the government agency. |

| Compliance Certifications | Certificates proving adherence to relevant federal regulations or standards. | May be mandatory depending on contract nature and government policies. |

| Supporting Time Records (if applicable) | Timesheets or logs documenting labor hours worked on the contract. | Required for service contracts billed on an hourly basis. |

Ensuring Your invoice submission includes all government-mandated supporting documentation speeds up approval and payment processing.

Purchase Orders and Contract References

Submitting invoices for government contracts requires accurate documentation to ensure compliance and prompt payment. Two critical documents include the purchase order and the contract reference number.

The purchase order serves as official authorization for goods or services and must match the invoice details. The contract reference links the invoice to the specific government agreement, verifying the terms and scope of work.

Proof of Delivery and Acceptance Reports

When submitting invoices for government contracts, providing the correct documentation is essential for payment approval. Proof of Delivery and Acceptance Reports are critical documents that verify the completion and acceptance of contracted goods or services.

Proof of Delivery confirms that the items have reached the designated government facility or recipient. Acceptance Reports demonstrate that the delivered goods or services meet contractual specifications and have been officially approved by the government agency.

Compliance with Tax and Regulatory Requirements

What documents are necessary for submitting invoices to government contracts? Compliance with tax and regulatory requirements mandates the inclusion of accurate tax identification numbers and detailed billing information. You must also provide proof of business registration and any relevant certifications to meet government standards.

Common Mistakes in Government Invoice Submissions

Submitting invoices for government contracts requires specific documentation to ensure compliance and prompt payment. Understanding common mistakes can help avoid delays and disputes in your invoice submissions.

- Incomplete Documentation - Missing purchase orders, contract numbers, or detailed descriptions often lead to invoice rejection.

- Incorrect Billing Information - Using wrong vendor details or government agency codes can cause processing errors and payment delays.

- Failure to Follow Submission Guidelines - Not adhering to the prescribed format or submission method results in non-compliance and potential invoice denial.

Best Practices for Ensuring Timely Payment

Submitting invoices for government contracts requires specific documents such as a detailed invoice, proof of delivery or completion, and a valid government contract or purchase order. Ensuring accuracy and completeness in these documents helps prevent delays in payment processing. Maintaining organized records and adhering to submission guidelines improves your chances of timely payment.

What Documents are Necessary for Submitting Invoices to Government Contracts? Infographic