Government contract billing requires specific invoice documents such as a detailed invoice including contract number, billing period, and itemized costs. Supporting documents like timesheets, receipts, and delivery confirmations must be attached to verify expenses. Compliance with government standards and submission guidelines ensures timely payment and audit readiness.

What Invoice Documents Are Required for Government Contract Billing?

| Number | Name | Description |

|---|---|---|

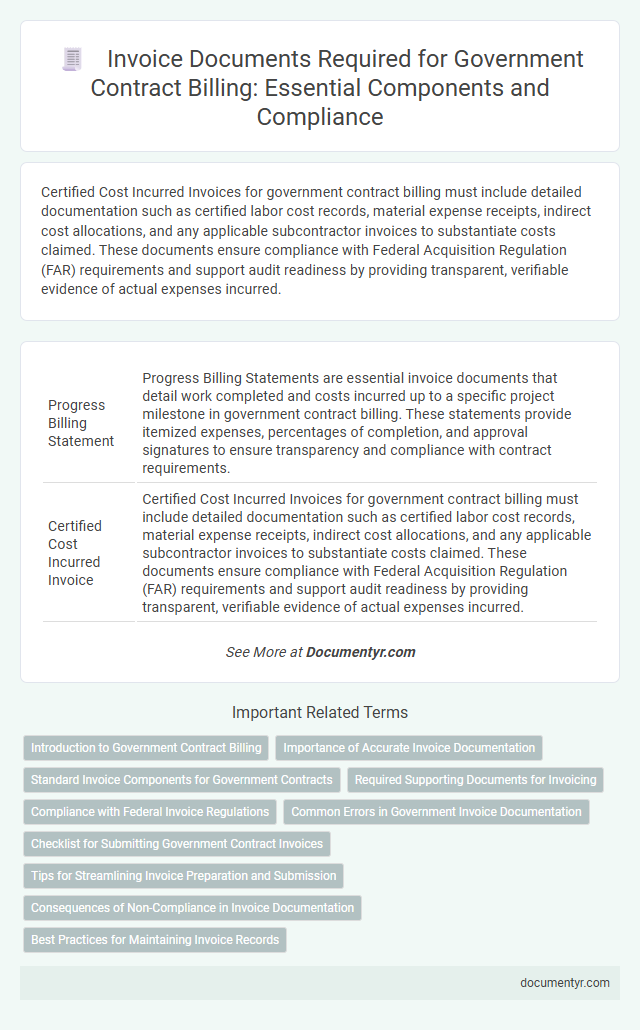

| 1 | Progress Billing Statement | Progress Billing Statements are essential invoice documents that detail work completed and costs incurred up to a specific project milestone in government contract billing. These statements provide itemized expenses, percentages of completion, and approval signatures to ensure transparency and compliance with contract requirements. |

| 2 | Certified Cost Incurred Invoice | Certified Cost Incurred Invoices for government contract billing must include detailed documentation such as certified labor cost records, material expense receipts, indirect cost allocations, and any applicable subcontractor invoices to substantiate costs claimed. These documents ensure compliance with Federal Acquisition Regulation (FAR) requirements and support audit readiness by providing transparent, verifiable evidence of actual expenses incurred. |

| 3 | SF 1034 Public Voucher | The SF 1034 Public Voucher serves as a crucial invoice document required for government contract billing, detailing authorized payments and ensuring compliance with federal regulations. Accurate completion of SF 1034 facilitates prompt payment processing by providing the government agency with necessary contract identifiers, payment amounts, and certification of goods or services delivered. |

| 4 | Indirect Rate Backup Documentation | Indirect rate backup documentation for government contract billing must include detailed supporting schedules, allocation methods, and calculations that justify the indirect cost rates applied on invoices. Accurate records of labor distribution, overhead expenses, and fringe benefits ensure compliance with federal regulations and facilitate proper reimbursement. |

| 5 | Time & Materials Breakdown Sheet | Government contract billing requires a detailed Time & Materials Breakdown Sheet that itemizes labor hours, hourly rates, and material costs aligned with contract terms. This document ensures transparent verification of charges and compliance with audit standards, facilitating accurate invoice processing and payment authorization. |

| 6 | Defense Contract Audit Agency (DCAA) Compliance Invoice | Invoice documents required for government contract billing under Defense Contract Audit Agency (DCAA) compliance include a detailed cost breakdown, labor hours documentation, subcontractor invoices, and supporting receipts aligned with Federal Acquisition Regulation (FAR) standards. Accurate and timely submission of DCAA-compliant invoices ensures audit readiness and proper reimbursement for defense contracts. |

| 7 | Service Contract Line Item Number (CLIN) Billing | Service Contract Line Item Number (CLIN) billing requires detailed invoice documents including a valid purchase order, a breakdown of services rendered per CLIN, labor hours, and approved rates, along with evidence of deliverables or milestones met. Accurate submission of these documents ensures compliance with government contract terms and timely payment processing. |

| 8 | Incurred Cost Submission (ICS) Worksheet | The Incurred Cost Submission (ICS) Worksheet is a critical Invoice document required for government contract billing, detailing all allowable indirect costs incurred during the contract period. Accurate completion of the ICS Worksheet ensures compliance with federal regulations and supports the verification of costs for proper reimbursement. |

| 9 | Task Order-Specific Billing Reconciliation | Task order-specific billing reconciliation for government contracts requires detailed invoice documents including the approved task order, itemized labor and material costs, and compliance verification reports. Accurate documentation ensures alignment with contract terms, facilitating prompt payment and audit readiness. |

| 10 | Government Purchase Order Modification Invoice | Government contract billing requires submitting a Government Purchase Order Modification Invoice that accurately reflects changes in contract terms, pricing, and deliverables. This document must include detailed descriptions, updated amounts, contract numbers, and official signatures to ensure compliance with federal regulations and prompt payment processing. |

Introduction to Government Contract Billing

Government contract billing requires precise documentation to ensure compliance and prompt payment. Understanding which invoice documents are necessary helps you streamline the billing process effectively.

- Invoice Form - The primary document outlining the billed amount, contract details, and payment terms.

- Timesheets or Labor Records - Proof of hours worked or services rendered under the contract.

- Supporting Receipts and Reports - Additional evidence of expenses or deliverables tied to the contract.

Submitting complete and accurate invoice documents is essential for successful government contract billing.

Importance of Accurate Invoice Documentation

Accurate invoice documentation is essential for government contract billing to ensure compliance with federal regulations and facilitate timely payments. Required documents typically include a detailed invoice, contract reference, proof of delivery or service completion, and any necessary certifications or approvals. Properly prepared invoices reduce the risk of audit issues and payment delays, safeguarding the financial integrity of government projects.

Standard Invoice Components for Government Contracts

Invoice documents required for government contract billing must adhere to strict standards to ensure compliance and facilitate timely payments. Standard invoice components include detailed information that verifies the authenticity and accuracy of the billed amounts.

Key elements of government contract invoices include the contract number, invoice date, and billing period. Each invoice must clearly list the description of goods or services provided, quantities, unit prices, and total amount due. Supporting documentation such as time sheets or delivery receipts may also be required to substantiate the charges.

Required Supporting Documents for Invoicing

Invoice documents required for government contract billing include a detailed invoice form, a purchase order, and proof of delivery. These documents ensure accurate verification and compliance with contractual terms.

Required supporting documents for invoicing consist of timesheets, receipts, and payment certifications. Your submission must include these to facilitate timely and accurate payment processing.

Compliance with Federal Invoice Regulations

Government contract billing requires precise invoice documentation to ensure compliance with federal regulations. Your invoice must include detailed information such as contract number, billing period, itemized costs, and authorized signatures. Adhering to requirements set by the Federal Acquisition Regulation (FAR) prevents delays and auditing issues during the payment process.

Common Errors in Government Invoice Documentation

Government contract billing requires specific invoice documents to ensure compliance and prompt payment. These typically include a detailed invoice, purchase order, delivery receipts, and compliance certificates.

Common errors in government invoice documentation include incorrect contract numbers, missing approval signatures, and inaccurate billing rates. Such mistakes often lead to payment delays and increased audit scrutiny.

Checklist for Submitting Government Contract Invoices

| Required Invoice Documents | Description |

|---|---|

| Invoice Cover Sheet | Title, invoice number, billing period, and contract number clearly stated to identify the document. |

| Government Contract Number | Exact contract reference to link the invoice with the government agreement. |

| Detailed Billing Statement | List of services or products delivered, quantity, unit cost, and total amount in compliance with contract terms. |

| Supporting Time Records | Timesheets or labor hour documentation showing work performed under the contract for labor-based billing. |

| Expense Receipts and Documentation | Receipt copies and approval documentation for reimbursable expenses claimed. |

| Certification of Invoice Accuracy | Signed statement confirming the correctness and compliance of the invoice with contract requirements. |

| Authorized Signature | Signature of an authorized individual verifying the invoice contents. |

| Payment Instructions | Bank details, payment terms, and instructions aligned with government billing policies. |

| Compliance Attachments | Any additional certifications, reports, or regulatory documents as required by the government agency. |

Tips for Streamlining Invoice Preparation and Submission

Accurate invoice documents are essential for successful government contract billing, ensuring timely payment and compliance. Understanding the required documentation helps streamline your preparation and submission process.

- Detailed Billing Statements - Include itemized charges that clearly correlate with contract deliverables to avoid payment delays.

- Proper Authorization Signatures - Ensure all invoices are signed by authorized personnel to validate the billing request.

- Compliance with Contract Terms - Verify that your invoice matches the contract's billing guidelines and formats to prevent rejections.

Consequences of Non-Compliance in Invoice Documentation

What invoice documents are required for government contract billing? Proper documentation typically includes a detailed invoice, contract reference, proof of delivery or service completion, and authorization signatures. These documents ensure transparency and compliance with government regulations.

What are the consequences of non-compliance in invoice documentation? Failure to provide complete and accurate invoice documents can result in delayed payments, contract disputes, and potential legal penalties. You risk damaging your reputation and losing future government contracting opportunities due to non-compliance.

What Invoice Documents Are Required for Government Contract Billing? Infographic