Small businesses need to attach supporting documents such as purchase orders, delivery receipts, and expense receipts with invoices for tax purposes. These documents validate the transaction and help maintain accurate financial records for audits and tax filings. Clear documentation ensures compliance with tax regulations and simplifies the deduction process.

What Documents Does a Small Business Need to Attach With Invoices for Tax Purposes?

| Number | Name | Description |

|---|---|---|

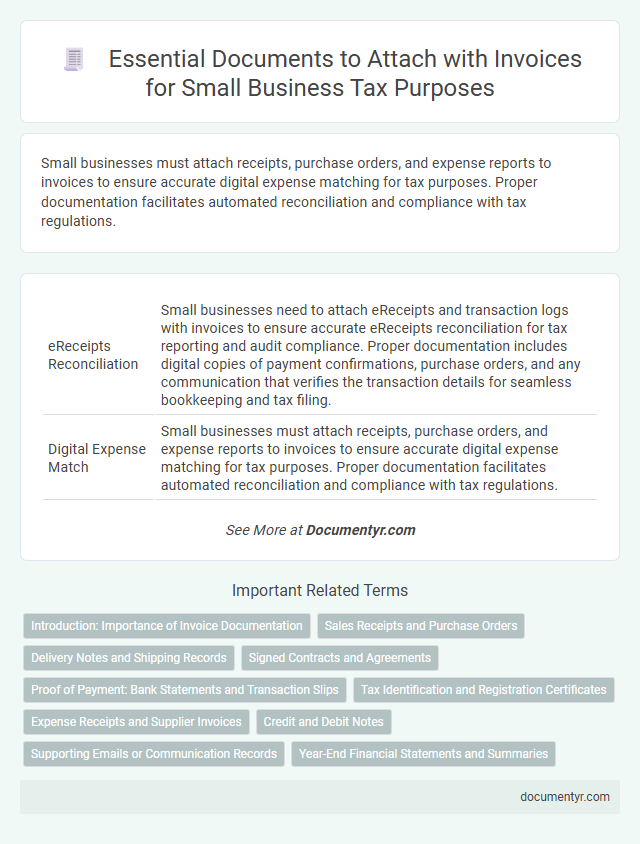

| 1 | eReceipts Reconciliation | Small businesses need to attach eReceipts and transaction logs with invoices to ensure accurate eReceipts reconciliation for tax reporting and audit compliance. Proper documentation includes digital copies of payment confirmations, purchase orders, and any communication that verifies the transaction details for seamless bookkeeping and tax filing. |

| 2 | Digital Expense Match | Small businesses must attach receipts, purchase orders, and expense reports to invoices to ensure accurate digital expense matching for tax purposes. Proper documentation facilitates automated reconciliation and compliance with tax regulations. |

| 3 | VAT Compliance Statement | Small businesses must attach a VAT Compliance Statement with invoices to ensure accurate tax reporting and legal adherence for VAT purposes. This document verifies the VAT number, details taxable and exempt items, and supports proper input VAT claims during tax audits. |

| 4 | E-signature Confirmation Page | Small businesses must attach an E-signature confirmation page with invoices to verify the authenticity and consent of the parties involved, ensuring compliance with tax regulations and reducing the risk of fraud. This document provides a legally binding record that supports the invoice's validity during tax audits and financial reviews. |

| 5 | Supplier Onboarding File | A small business must attach a Supplier Onboarding File with invoices for tax purposes, including completed W-9 forms, purchase orders, and supplier agreements to verify vendor information and compliance. This documentation ensures accurate tax reporting and supports audit readiness by establishing the legitimacy of supplier transactions. |

| 6 | Dynamic QR Payment Verification | Small businesses must attach invoices with dynamic QR payment verification to ensure seamless transaction tracking and tax compliance. This technology enables automated validation of payment details, reducing errors and facilitating accurate record-keeping for tax audits. |

| 7 | Tax Residency Self-Declaration | Small businesses must attach a Tax Residency Self-Declaration with invoices to confirm the tax status of clients and comply with cross-border tax regulations. This document helps establish the correct withholding tax rates and supports accurate reporting for tax authorities. |

| 8 | ESG Procurement Certificate | Small businesses should attach an ESG Procurement Certificate with invoices to demonstrate compliance with environmental, social, and governance standards for tax reporting and procurement audits. This certificate helps validate sustainable sourcing practices, supporting eligibility for tax incentives and enhancing transparency in financial documentation. |

| 9 | Blockchain Audit Trail Extract | Small businesses should attach a Blockchain Audit Trail Extract with invoices to provide an immutable, transparent record of all transaction details, ensuring compliance with tax authorities. This digital ledger document verifies invoice authenticity and transaction history, streamlining tax audits and reducing risks of discrepancies. |

| 10 | Real-time Invoice Validation Token | Small businesses must attach documents such as purchase orders, delivery receipts, and tax compliance certificates along with invoices to ensure accurate record-keeping and adherence to tax regulations. Including a Real-time Invoice Validation Token on the invoice enhances authenticity verification and streamlines tax audits by providing instant confirmation of invoice validity. |

Introduction: Importance of Invoice Documentation

Proper invoice documentation is essential for accurate tax reporting and compliance. You need to maintain detailed records to support your business transactions and deductions.

- Proof of Transaction - Include receipts or purchase orders to verify the sale recorded in the invoice.

- Tax Identification Information - Attach documents showing your business's tax ID and the customer's tax details for validation.

- Payment Records - Provide bank statements or payment confirmations to demonstrate invoice settlement.

Sales Receipts and Purchase Orders

| Document Type | Purpose | Importance for Tax Purposes |

|---|---|---|

| Sales Receipts | Provide proof of transactions and services rendered to customers. | Essential for verifying income reported on invoices, supporting accurate tax filings and audits. |

| Purchase Orders | Serve as official requests or approvals for goods and services ordered by your business. | Important for validating expenses, ensuring deductions claimed align with actual business purchases. |

Delivery Notes and Shipping Records

Small businesses must attach delivery notes with invoices to provide proof of goods or services delivered, ensuring accurate tax documentation. Shipping records are essential to verify the transportation details and confirm that the invoice matches the shipment. These documents help maintain compliance with tax regulations and support audit processes.

Signed Contracts and Agreements

Small businesses must attach signed contracts and agreements with their invoices to ensure clear documentation of the transaction terms for tax purposes. These documents serve as proof of the services or products provided, validating the invoice details.

Maintaining signed contracts helps your business comply with tax regulations and supports any claims during audits. It strengthens the legitimacy of the invoice and safeguards against disputes with clients or tax authorities.

Proof of Payment: Bank Statements and Transaction Slips

Small businesses must attach proof of payment documents with invoices for accurate tax reporting. Bank statements and transaction slips serve as essential evidence of payment completion.

Bank statements provide a comprehensive record of financial transactions, confirming the receipt of funds related to each invoice. Transaction slips, including receipts or payment confirmations, offer additional verification to support these claims. You should ensure these documents are clear, dated, and correspond exactly to the invoice amounts to avoid discrepancies during tax audits.

Tax Identification and Registration Certificates

Small businesses must attach tax identification and registration certificates with invoices for accurate tax reporting. These documents verify your business's legal status and enable proper tax calculation and compliance. Including them ensures transparency and helps avoid disputes with tax authorities.

Expense Receipts and Supplier Invoices

Expense receipts and supplier invoices are essential documents to attach with your invoices for accurate tax reporting. These documents help validate business expenses and ensure compliance with tax regulations.

- Expense Receipts - They provide proof of purchased goods or services related to business operations and support expense claims.

- Supplier Invoices - These documents detail amounts owed to suppliers and serve as evidence for deductible business expenses.

- Tax Compliance - Attaching these documents facilitates proper bookkeeping and audit readiness, reducing tax filing risks.

Credit and Debit Notes

What documents should a small business attach with invoices for tax purposes related to credit and debit notes? Credit notes and debit notes must be included to accurately reflect adjustments in sales and purchases. These documents help ensure proper tax reporting and compliance with local tax authorities.

Supporting Emails or Communication Records

Supporting emails or communication records play a crucial role in validating invoices for tax purposes. They provide evidence of agreements, approvals, and transaction details relevant to your small business.

- Proof of Agreement - Emails confirm the terms and conditions agreed upon between parties.

- Clarification of Services - Communication records help explain the scope and specifics of the services or products invoiced.

- Dispute Resolution - Email trails can resolve discrepancies or disputes related to invoiced amounts.

Including these documents ensures accurate tax reporting and supports your business' financial integrity.

What Documents Does a Small Business Need to Attach With Invoices for Tax Purposes? Infographic