Submitting invoices to government agencies requires specific documents to ensure compliance and prompt payment. Essential documents typically include the original invoice detailing services or products provided, a valid purchase order or contract number, and proof of delivery or completion. Agencies may also require tax identification information and certifications verifying vendor eligibility.

What Documents Are Necessary for Submitting Invoices to Government Agencies?

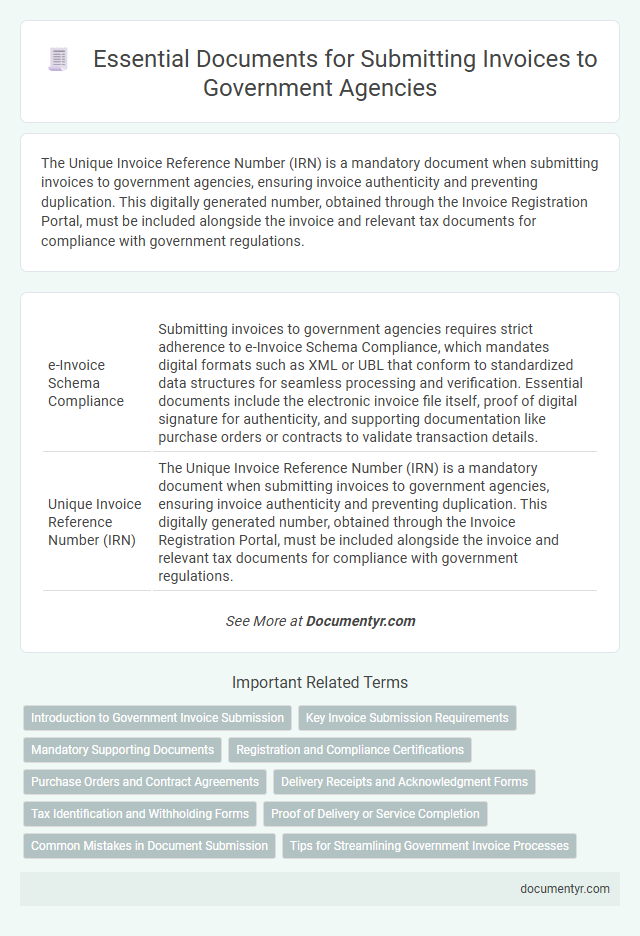

| Number | Name | Description |

|---|---|---|

| 1 | e-Invoice Schema Compliance | Submitting invoices to government agencies requires strict adherence to e-Invoice Schema Compliance, which mandates digital formats such as XML or UBL that conform to standardized data structures for seamless processing and verification. Essential documents include the electronic invoice file itself, proof of digital signature for authenticity, and supporting documentation like purchase orders or contracts to validate transaction details. |

| 2 | Unique Invoice Reference Number (IRN) | The Unique Invoice Reference Number (IRN) is a mandatory document when submitting invoices to government agencies, ensuring invoice authenticity and preventing duplication. This digitally generated number, obtained through the Invoice Registration Portal, must be included alongside the invoice and relevant tax documents for compliance with government regulations. |

| 3 | Digital Signature Certificate (DSC) | Submitting invoices to government agencies requires a valid Digital Signature Certificate (DSC) to authenticate the document and ensure compliance with legal standards. This electronic signature verifies the identity of the sender, guarantees invoice integrity, and supports secure digital transactions as mandated by regulatory authorities. |

| 4 | Government Vendor Registration (GeM Portal ID) | Submitting invoices to government agencies requires accurate Government Vendor Registration, typically verified through a valid GeM Portal ID, which serves as a mandatory identifier for vendors in official transactions. Ensuring the GeM Portal ID is active and linked to all requisite documents, such as purchase orders and tax identification numbers, streamlines invoice processing and compliance with government procurement policies. |

| 5 | GST Reconciliation Statement | Submitting invoices to government agencies requires a GST Reconciliation Statement that accurately matches the details between sales invoices and tax returns, ensuring compliance with tax regulations. This document verifies the consistency of reported Goods and Services Tax (GST) amounts, including invoice numbers, dates, and taxable values, to prevent discrepancies during audits. |

| 6 | E-Way Bill Annexure | Submitting invoices to government agencies requires attaching the E-Way Bill Annexure, which includes details such as the consignor, consignee, goods description, and transport information to comply with GST regulations. This document validates the movement of goods and ensures seamless verification during audits and tax assessments. |

| 7 | Udyam Registration Certificate | Submitting invoices to government agencies requires the Udyam Registration Certificate as a critical document to validate the supplier's MSME status and eligibility for benefits like priority payment and tax rebates. This certificate ensures compliance with regulatory frameworks and accelerates the verification process during invoice submission. |

| 8 | MSME Self-Declaration Form | The MSME Self-Declaration Form is essential for submitting invoices to government agencies as it validates the micro, small, and medium enterprise status of the vendor, enabling access to benefits like timely payments and priority processing. Accurate submission of this form alongside the invoice ensures compliance with regulatory requirements and facilitates smoother verification and approval by government authorities. |

| 9 | QR Code Embedded Invoice | Invoices submitted to government agencies must include a QR code embedded with key transaction details such as invoice number, date, seller and buyer information, and total amount to ensure compliance and facilitate automated verification processes. Essential supporting documents typically include purchase orders, delivery receipts, and tax identification numbers to validate the invoice's authenticity and accuracy. |

| 10 | Public Procurement Policy (PPP) Compliance Certificate | Invoices submitted to government agencies must include a valid Public Procurement Policy (PPP) Compliance Certificate to ensure adherence to regulatory standards and eligibility for contract awards. This certificate verifies that the supplier complies with government procurement guidelines, streamlining the validation process and facilitating timely invoice approval. |

Introduction to Government Invoice Submission

Submitting invoices to government agencies requires adherence to specific documentation standards to ensure prompt and accurate processing. Essential documents typically include a detailed invoice, proof of delivery or service completion, and relevant tax identification forms. Understanding these requirements helps businesses maintain compliance and avoid payment delays.

Key Invoice Submission Requirements

Government agencies require specific documents to process invoices efficiently and ensure compliance with financial regulations. Key documents include the original invoice, purchase order, and proof of delivery or service completion.

Invoices must contain essential details such as invoice number, date, vendor information, and itemized charges. Supporting documents like contracts, tax identification numbers, and payment authorization forms are often mandatory for approval.

Mandatory Supporting Documents

Submitting invoices to government agencies requires specific mandatory supporting documents to ensure compliance and facilitate timely processing. These documents validate the transaction and help verify the accuracy of the invoice details.

- Purchase Order - This document confirms the government's authorization of the goods or services rendered.

- Delivery Receipt - Provides proof that the products or services were delivered as agreed upon in the contract.

- Tax Clearance Certificate - Demonstrates that the supplier complies with tax regulations and is in good standing with tax authorities.

Providing all mandatory supporting documents with your invoice helps prevent delays and supports efficient government payment processes.

Registration and Compliance Certifications

Submitting invoices to government agencies requires specific documentation to ensure proper processing and compliance. Registration and compliance certifications validate your eligibility and adherence to regulations.

- Business Registration Certificate - Confirms your business is legally registered with relevant government authorities.

- Tax Identification Number (TIN) - Essential for tax reporting and verifying your tax compliance status.

- Compliance Certifications - Includes industry-specific permits or licenses proving adherence to government standards.

Purchase Orders and Contract Agreements

Purchase orders serve as official authorization for the goods or services provided and confirm the transaction details required by government agencies. These documents ensure alignment between the vendor and the agency on pricing, quantities, and delivery terms.

Contract agreements outline the scope, terms, and conditions governing the service or product delivery and establish legal obligations. They are essential for verifying compliance with government procurement regulations and facilitating invoice approval processes.

Delivery Receipts and Acknowledgment Forms

Submitting invoices to government agencies requires specific documentation to ensure compliance and smooth processing. Delivery receipts and acknowledgment forms are essential components that verify the receipt of goods or services.

Delivery receipts serve as proof that the ordered items have been delivered to the government entity. Acknowledgment forms confirm that the services rendered or products received meet the agreed-upon terms. These documents minimize disputes and expedite invoice approval within government procurement processes.

Tax Identification and Withholding Forms

Submitting invoices to government agencies requires specific documentation to ensure compliance with tax regulations. Key documents include tax identification and withholding forms that verify the legitimacy and tax obligations of the entity.

- Tax Identification Number (TIN) - This unique identifier is mandatory for all vendors to validate their tax status with government agencies.

- Withholding Tax Certificate - This form documents the taxes withheld at the source, which is essential for accurate tax reporting.

- Compliance with Tax Regulations - Proper submission of these documents prevents payment delays and ensures adherence to government fiscal policies.

Proof of Delivery or Service Completion

| Document | Description | Purpose |

|---|---|---|

| Proof of Delivery | Signed delivery receipts or electronic confirmation showing the goods were received by the government agency. | Verifies that the products were delivered as per the contract terms. |

| Service Completion Certificate | A formal document signed by the agency representative confirming that the contracted services were satisfactorily completed. | Ensures that services rendered meet the agreed-upon standards and are accepted by the agency. |

| Inspection Reports | Reports from government inspectors indicating that delivered goods or services comply with quality and regulatory requirements. | Acts as evidence for compliance and adherence to contract specifications. |

| Delivery Notes | Documentation provided at the time of delivery listing items or details of services delivered. | Supports the accuracy of the invoice and confirms transaction details. |

Common Mistakes in Document Submission

Submitting invoices to government agencies requires accurate documentation such as purchase orders, proof of delivery, and tax identification details. Common mistakes in document submission include missing signatures, incomplete forms, and incorrect invoice numbers. Ensuring your documents are thorough and error-free streamlines the approval process and prevents delays.

What Documents Are Necessary for Submitting Invoices to Government Agencies? Infographic