Invoice audit trails require key documents such as the original invoice, purchase orders, delivery receipts, and payment records to ensure accuracy and compliance. These documents provide a clear, verifiable chain of transactions, facilitating transparent financial tracking and dispute resolution. Maintaining organized records supports regulatory adherence and streamlines internal auditing processes.

What Documents are Necessary for Invoice Audit Trails?

| Number | Name | Description |

|---|---|---|

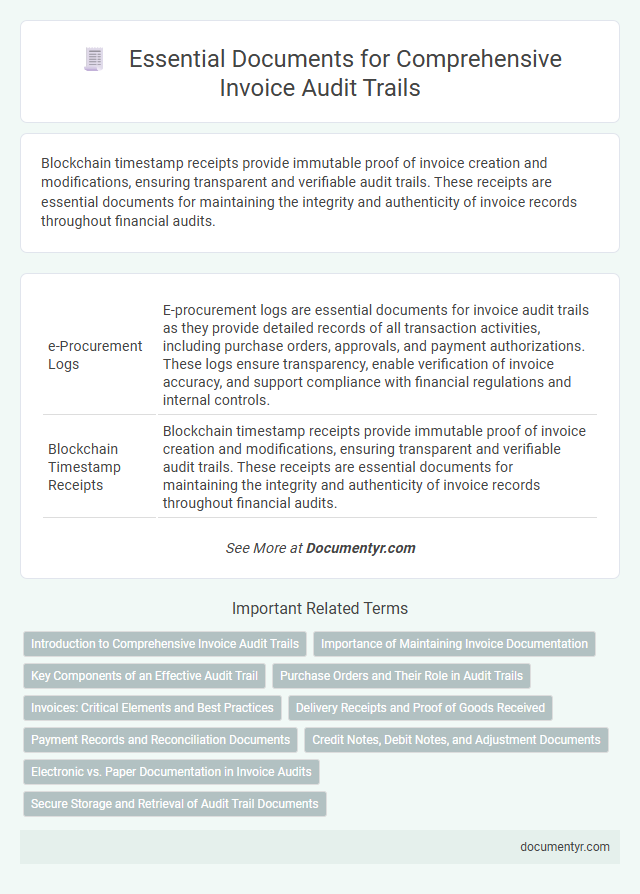

| 1 | e-Procurement Logs | E-procurement logs are essential documents for invoice audit trails as they provide detailed records of all transaction activities, including purchase orders, approvals, and payment authorizations. These logs ensure transparency, enable verification of invoice accuracy, and support compliance with financial regulations and internal controls. |

| 2 | Blockchain Timestamp Receipts | Blockchain timestamp receipts provide immutable proof of invoice creation and modifications, ensuring transparent and verifiable audit trails. These receipts are essential documents for maintaining the integrity and authenticity of invoice records throughout financial audits. |

| 3 | OCR-Extracted Data Sheets | OCR-extracted data sheets are essential for invoice audit trails as they provide a digitized and searchable record of invoice details such as vendor information, invoice number, date, and line-item descriptions. These documents facilitate accurate verification, reconciliation, and compliance by ensuring all extracted data matches original physical or digital invoices. |

| 4 | Digital Signature Certificates | Digital Signature Certificates (DSCs) play a crucial role in maintaining secure and verifiable invoice audit trails by authenticating the identity of the signer and ensuring data integrity. Essential documents for invoice audit trails include digitally signed invoices, DSC issuance details, certificate revocation lists, and transaction logs that record each step of the digital signature application process. |

| 5 | API Transaction Ledgers | API transaction ledgers provide a detailed record of all invoice-related activities, including timestamps, user actions, and data changes essential for audit trails. These documents ensure transparency, enable verification of invoice accuracy, and support compliance with regulatory standards in financial auditing processes. |

| 6 | Machine Learning Anomaly Reports | Machine Learning Anomaly Reports are essential documents for invoice audit trails as they automatically detect irregularities and flag suspicious transactions by analyzing patterns and deviations in invoice data. These reports support compliance and accuracy by providing detailed insights into potential errors, fraud, or duplications within the invoice processing system. |

| 7 | IoT Device Delivery Confirmations | Invoice audit trails require delivery confirmations from IoT devices to validate shipment times and receipt accuracy. These digital delivery records ensure traceability and compliance by capturing timestamps, geographic location, and recipient signatures automatically. |

| 8 | Smart Contract Compliance Files | Smart contract compliance files are essential for invoice audit trails, as they provide verifiable records of contract execution and transaction authenticity on the blockchain. These documents include transaction logs, digital signatures, and compliance verification reports, ensuring transparency and regulatory adherence throughout the invoicing process. |

| 9 | Automated Reconciliation Statements | Automated reconciliation statements, essential for invoice audit trails, require detailed transaction logs, payment confirmations, and vendor communication records to verify accuracy and ensure compliance. These documents enable seamless tracking of invoice statuses and discrepancies, optimizing financial transparency and audit efficiency. |

| 10 | Cloud-based Version Control Records | Cloud-based version control records are essential for invoice audit trails, providing time-stamped, immutable logs of document changes that ensure transparency and accountability. These records include detailed history of edits, user access, and approvals, facilitating accurate verification and compliance in financial audits. |

Introduction to Comprehensive Invoice Audit Trails

Comprehensive invoice audit trails are essential for maintaining accurate financial records and ensuring compliance with regulatory standards. Understanding the necessary documents for these audit trails helps streamline your auditing process effectively.

- Original Invoices - These provide the primary evidence of transactions and details such as date, amount, and parties involved.

- Payment Receipts - Receipts confirm the completion of payments and validate the financial exchange documented in the invoice.

- Approval Records - Records of authorizations and approvals verify that invoices have been reviewed and authorized by the responsible personnel.

Proper documentation creates a transparent and verifiable invoice audit trail that supports financial accuracy and compliance.

Importance of Maintaining Invoice Documentation

Maintaining accurate invoice documentation is crucial for establishing a reliable audit trail. Essential documents include the original invoice, purchase orders, payment receipts, and delivery confirmations.

These records ensure transparency and facilitate verification during financial audits or compliance checks. Proper documentation helps prevent discrepancies, fraud, and supports effective financial management.

Key Components of an Effective Audit Trail

An effective invoice audit trail requires specific documents to ensure transparency and accuracy. Key components include original invoices, payment records, and approval authorizations.

Supporting documents such as purchase orders and delivery receipts strengthen the audit trail by providing verification at each transaction stage. A clear chronological record of these documents helps detect discrepancies and supports financial compliance.

Purchase Orders and Their Role in Audit Trails

Invoice audit trails require specific documents to ensure accuracy, accountability, and compliance. Purchase orders play a critical role in linking invoices to approved transactions and verifying payment legitimacy.

- Purchase Orders Serve as Verification Tools - They confirm the authorization and details of a transaction for the invoiced goods or services.

- Audit Trails Depend on Matching Documents - Matching purchase orders with invoices ensures that payments correspond to approved purchases.

- Purchase Orders Provide Transaction Transparency - They create a clear record of the procurement process, aiding in accountability and audit compliance.

Invoices: Critical Elements and Best Practices

Invoice audit trails require essential documents such as the original invoice, proof of delivery or service completion, and payment records. Critical elements on the invoice include the supplier details, invoice number, date, itemized list of goods or services, quantities, unit prices, total amount, and tax information. Best practices involve maintaining accurate, complete, and securely stored records to ensure transparency, compliance, and efficient auditing processes.

Delivery Receipts and Proof of Goods Received

Delivery receipts play a critical role in invoice audit trails by providing verified records of goods dispatched to the recipient. Proof of goods received confirms the receipt and condition of items, ensuring the accuracy and legitimacy of the invoiced amount.

These documents establish a transparent link between the supplier's delivery and the purchaser's acceptance, helping to prevent disputes and errors. Delivery receipts typically include details such as shipment date, item descriptions, and quantities delivered. Proof of goods received is often signed by authorized personnel upon inspection, serving as definitive evidence for audit purposes.

Payment Records and Reconciliation Documents

| Document Type | Description | Importance in Invoice Audit Trails |

|---|---|---|

| Payment Records | Detailed documentation of payments made, including dates, amounts, payment methods, and transaction references. | Essential for verifying that invoices were paid correctly and on time, helping to confirm the accuracy of financial transactions and prevent discrepancies. |

| Reconciliation Documents | Reports and statements used to match invoice records against actual payments received, highlighting any discrepancies or outstanding balances. | Critical for maintaining accurate financial records. Supports the validation of invoice entries, ensures completeness, and aids in identifying errors or fraudulent activities. |

Credit Notes, Debit Notes, and Adjustment Documents

Invoice audit trails require comprehensive documentation to validate every financial transaction accurately. Credit notes, debit notes, and adjustment documents are essential components for establishing a clear and traceable audit history.

- Credit Notes - These documents record the reduction in the amount payable by the buyer due to returns, discounts, or billing errors, providing proof of adjustments in the invoice amount.

- Debit Notes - Issued by the buyer or seller, debit notes specify additional charges or corrections to the original invoice, ensuring transparency in accounting records.

- Adjustment Documents - These papers detail any modifications made to invoices after issuance, supporting reconciliation and accurate financial reporting during audits.

Electronic vs. Paper Documentation in Invoice Audits

Invoice audit trails require specific documentation to verify transaction authenticity and compliance. Electronic documentation includes digital invoices, email correspondence, and system-generated logs, ensuring traceability and ease of access. Paper documentation involves physical invoices, signed delivery receipts, and handwritten approvals, which may present challenges in storage and retrieval during audits.

What Documents are Necessary for Invoice Audit Trails? Infographic