For invoice reimbursement in corporate travel, essential documents include the original invoice or receipt detailing the services or products purchased, proof of payment such as a credit card statement or bank transfer confirmation, and a completed expense report specifying the purpose of the travel. Supporting documentation like travel itineraries, approval emails, and company policy compliance forms may also be required to validate the expense. Accurate and complete documentation ensures a smooth reimbursement process and adherence to corporate financial policies.

What Documents are Needed for Invoice Reimbursement in Corporate Travel?

| Number | Name | Description |

|---|---|---|

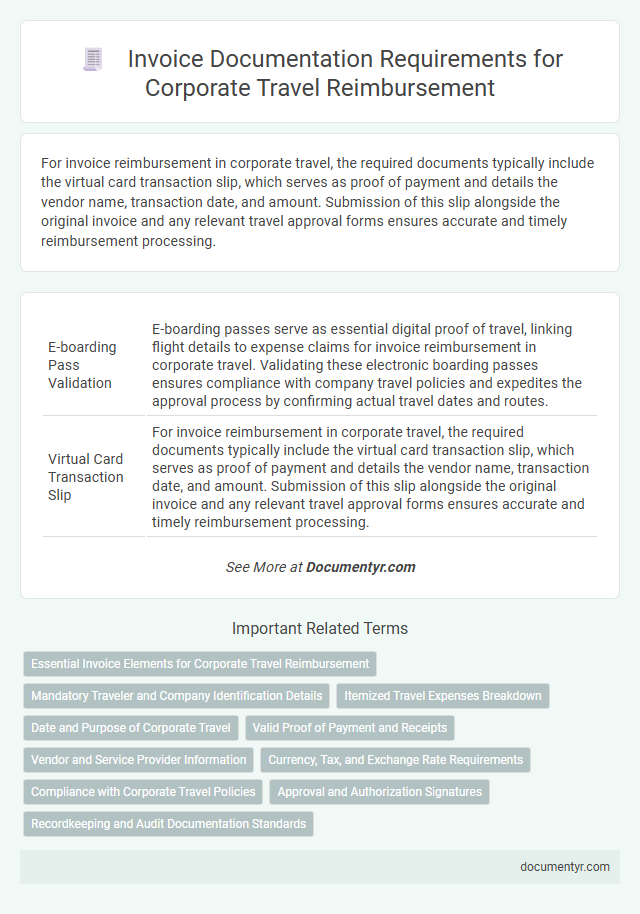

| 1 | E-boarding Pass Validation | E-boarding passes serve as essential digital proof of travel, linking flight details to expense claims for invoice reimbursement in corporate travel. Validating these electronic boarding passes ensures compliance with company travel policies and expedites the approval process by confirming actual travel dates and routes. |

| 2 | Virtual Card Transaction Slip | For invoice reimbursement in corporate travel, the required documents typically include the virtual card transaction slip, which serves as proof of payment and details the vendor name, transaction date, and amount. Submission of this slip alongside the original invoice and any relevant travel approval forms ensures accurate and timely reimbursement processing. |

| 3 | E-Receipt Authentication | E-receipt authentication for invoice reimbursement in corporate travel requires the submission of electronically generated receipts that include transaction details, vendor information, and digital signatures or QR codes for verification. These documents must comply with company policies and legal standards to ensure authenticity and prevent fraudulent claims. |

| 4 | Dynamic Expense Allocation Form | The Dynamic Expense Allocation Form is essential for invoice reimbursement in corporate travel, as it itemizes expenses and allocates costs accurately across multiple departments or projects. Supporting documents such as original receipts, travel itineraries, and approval signatures must accompany this form to ensure compliance and expedite processing. |

| 5 | Carbon Offset Certificate | A Carbon Offset Certificate is essential for invoice reimbursement in corporate travel to verify environmentally responsible expenditures and ensure compliance with sustainability policies. This document must include project details, unique certificate ID, emission reductions quantified, and the date of issuance to support accurate financial tracking and audit requirements. |

| 6 | Ride-Sharing Invoice Compliance | Ride-sharing invoice compliance for corporate travel reimbursement requires detailed receipts including the date, time, pick-up and drop-off locations, fare breakdown, and payment method to meet audit standards. These documents must clearly indicate the business purpose and employee details, ensuring alignment with company expense policies and IRS regulations. |

| 7 | Mobile Wallet Payment Proof | For invoice reimbursement in corporate travel, submitting a mobile wallet payment proof is essential, including transaction screenshots or digital receipts that display payment date, amount, and merchant details. These documents ensure valid verification of expenses and facilitate accurate and timely reimbursement. |

| 8 | Digital Itinerary Attachments | Digital itinerary attachments are essential for invoice reimbursement in corporate travel, providing verifiable proof of travel dates, destinations, and services rendered. These documents streamline expense verification by offering detailed, time-stamped records directly linked to the invoiced charges. |

| 9 | Foreign Exchange Rate Snapshot | For invoice reimbursement in corporate travel, providing a Foreign Exchange Rate Snapshot is essential to verify the currency conversion at the time of the transaction, ensuring accurate reimbursement amounts. This document must include the date, source of the exchange rate, and the specific rates applied to the expenses incurred abroad. |

| 10 | Automated Tax Recalculation Sheet | Automated Tax Recalculation Sheets must accompany invoice reimbursement requests in corporate travel to ensure precise VAT adjustments and compliance with tax regulations. These sheets integrate transaction data and tax rates, enabling accurate recalculation that supports audit-ready documentation and streamlines expense verification. |

Essential Invoice Elements for Corporate Travel Reimbursement

In corporate travel, accurate documentation is crucial for invoice reimbursement. Clear and complete invoices ensure a smooth approval process for travel expenses.

- Itemized Charges - Detailed breakdown of costs including transportation, accommodation, and meals is necessary for transparency.

- Invoice Date and Number - Unique identifiers establish the validity and traceability of the invoice for your records.

- Company Details - The invoice must include the name and address of the service provider and the billing company to authenticate the charges.

Ensuring these essential elements are present on your invoice protects your eligibility for prompt corporate travel reimbursement.

Mandatory Traveler and Company Identification Details

Invoice reimbursement in corporate travel requires specific documents to ensure accuracy and compliance. Mandatory traveler identification details include the full name, employee ID, and travel dates.

Company identification details must include the official company name, tax identification number, and billing address. These details are essential to validate the invoice and process reimbursement efficiently.

Itemized Travel Expenses Breakdown

What documents are needed for invoice reimbursement in corporate travel? An itemized travel expenses breakdown is essential for accurate reimbursement. You must provide detailed receipts and invoices reflecting each individual cost incurred during your trip.

Date and Purpose of Corporate Travel

Accurate documentation is essential for invoice reimbursement in corporate travel. Ensuring your invoice reflects the date and purpose of travel facilitates a smooth approval process.

- Date of Travel - The invoice must clearly indicate the specific dates during which the corporate travel occurred to verify the timeframe of expenses.

- Purpose of Travel - Stating the business reason or objective of the trip on the invoice supports justification for the expenses claimed.

- Supporting Documents - Travel itineraries, meeting agendas, or approval emails should accompany the invoice to corroborate the date and purpose details.

Valid Proof of Payment and Receipts

Valid proof of payment is essential for invoice reimbursement in corporate travel to verify that expenses were incurred and settled. Accepted documents include credit card statements, bank transaction records, or official payment confirmations.

Receipts must clearly display the vendor's name, date of purchase, itemized list of services or goods, and the total amount paid. Submitting both valid proof of payment and detailed receipts ensures compliance with company travel policies and expedites reimbursement processing.

Vendor and Service Provider Information

| Document Type | Description | Vendor and Service Provider Information Required |

|---|---|---|

| Invoice | Official billing document issued by the vendor or service provider. |

|

| Receipt | Proof of payment for travel-related expenses. |

|

| Contract or Agreement | Document outlining terms with the service provider. |

|

| Travel Itinerary or Booking Confirmation | Evidence of booked services with vendors such as airlines or hotels. |

|

Currency, Tax, and Exchange Rate Requirements

Invoice reimbursement in corporate travel requires precise documentation related to currency, tax, and exchange rates to ensure compliance and accurate processing. Properly detailed invoices help avoid delays and discrepancies in expense reports.

- Currency Specification - Invoices must clearly indicate the currency used for the transaction to enable proper conversion and reimbursement calculations.

- Tax Documentation - Valid tax invoices should include applicable VAT or GST identification numbers and clearly display the tax amount charged to comply with local tax regulations.

- Exchange Rate Details - When expenses involve foreign currencies, the invoice or accompanying documents must specify the exchange rate applied on the transaction date for accurate reimbursement.

Compliance with Corporate Travel Policies

Invoice reimbursement in corporate travel requires submission of original receipts, detailed expense reports, and approved travel authorization forms. Compliance with corporate travel policies ensures that all submitted documents meet company standards for eligibility and accuracy. You must verify that each document clearly reflects the expenses claimed to facilitate timely reimbursement.

Approval and Authorization Signatures

Invoice reimbursement in corporate travel requires proper approval and authorization signatures to ensure validity. These signatures confirm that expenses have been reviewed and authorized by designated personnel within your organization. Accurate documentation with signed approval supports compliance and accelerates the reimbursement process.

What Documents are Needed for Invoice Reimbursement in Corporate Travel? Infographic