Exporters need a commercial invoice that includes detailed product descriptions, quantities, unit prices, total value, and terms of sale for compliance. Supporting documents such as packing lists, certificates of origin, and export licenses may be required to verify accuracy and facilitate customs clearance. Proper documentation ensures smooth international transactions and adherence to regulatory standards.

What Documents Does an Exporter Need for Commercial Invoice Compliance?

| Number | Name | Description |

|---|---|---|

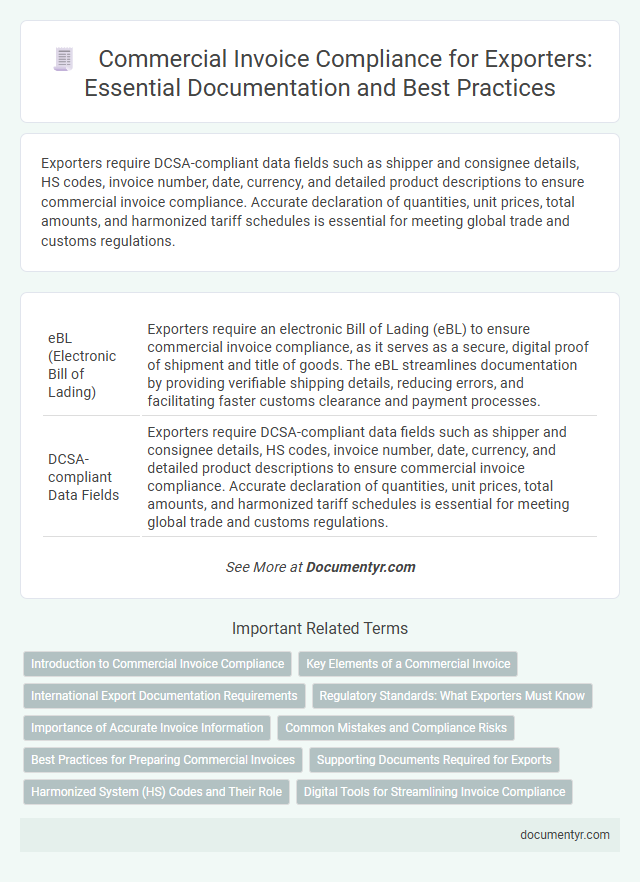

| 1 | eBL (Electronic Bill of Lading) | Exporters require an electronic Bill of Lading (eBL) to ensure commercial invoice compliance, as it serves as a secure, digital proof of shipment and title of goods. The eBL streamlines documentation by providing verifiable shipping details, reducing errors, and facilitating faster customs clearance and payment processes. |

| 2 | DCSA-compliant Data Fields | Exporters require DCSA-compliant data fields such as shipper and consignee details, HS codes, invoice number, date, currency, and detailed product descriptions to ensure commercial invoice compliance. Accurate declaration of quantities, unit prices, total amounts, and harmonized tariff schedules is essential for meeting global trade and customs regulations. |

| 3 | Proof of Preferential Origin (REX System) | Exporters require a Proof of Preferential Origin under the REX system to verify the origin of goods for customs compliance and preferential tariff treatment. This document ensures eligibility for reduced duties by certifying that products meet specific criteria outlined in trade agreements. |

| 4 | Blockchain-verified Certificate of Origin | Exporters require a blockchain-verified Certificate of Origin to ensure commercial invoice compliance, as it provides secure and tamper-proof authentication of the product's origin. This blockchain verification facilitates customs clearance, enhances trust among trading partners, and supports accurate tariff classification. |

| 5 | Dual-use Export Declaration | Exporters must provide a Dual-use Export Declaration when commercial invoices involve goods classified under dual-use items, which have both civilian and military applications. This declaration ensures compliance with international export control regulations and facilitates customs clearance by detailing product specifications and end-use certifications. |

| 6 | e-Invoice UBL (Universal Business Language) Format | Exporters require specific documents such as purchase orders, shipping details, and customs declarations to ensure commercial invoice compliance, with the e-Invoice UBL (Universal Business Language) format standardizing the data exchange for accuracy and interoperability. The UBL format facilitates seamless integration with customs and accounting systems by using structured XML-based electronic invoicing, enhancing compliance and reducing processing errors. |

| 7 | HS6 Global Harmonized Classification Alignment | Exporters require a commercial invoice that includes an accurate Harmonized System (HS) 6-digit code to ensure global classification alignment and customs compliance. This classification code facilitates standardized tariff application and smooth international trade documentation processing. |

| 8 | Digital ATA Carnet | Exporters require a digital ATA Carnet as a critical document for commercial invoice compliance, facilitating temporary duty-free and tax-free importation of goods. This electronic certificate streamlines customs procedures by providing detailed shipment information, ensuring seamless international trade operations. |

| 9 | Sanctions Screening End-Use Certificate | Exporters must include a sanctions screening report and an end-use certificate with the commercial invoice to ensure compliance with international trade regulations and verify the legitimacy of the buyer's intended use. These documents help prevent prohibited transactions and demonstrate adherence to export control laws governing restricted goods and regions. |

| 10 | QR-coded Commercial Invoice | Exporters require a QR-coded commercial invoice, which must include detailed shipment data, product descriptions, HS codes, origin details, and compliance certifications to ensure smooth customs clearance and trade verification. This digital enhancement facilitates faster data retrieval, reduces errors, and aligns with e-invoicing mandates in many international markets. |

Introduction to Commercial Invoice Compliance

A commercial invoice is a critical document in international trade, serving as a bill of sale between the exporter and importer. Proper compliance with commercial invoice requirements ensures smooth customs clearance and accurate duty assessments.

Exporters must understand the essential documents needed to meet commercial invoice compliance standards. These documents verify transaction details, product descriptions, and terms of sale, reducing the risk of shipment delays or penalties.

Key Elements of a Commercial Invoice

A commercial invoice is a critical document for exporters to ensure compliance with international shipping regulations. Understanding the key elements helps you prepare accurate and effective documentation.

- Exporter and Importer Details - This includes the full name, address, and contact information of both parties to identify who is sending and receiving the goods.

- Description of Goods - A detailed description of the items being shipped, including quantity, unit price, and total value, is necessary for customs clearance and valuation.

- Invoice Number and Date - A unique invoice number and the issuance date enable proper tracking and reference for both parties and regulatory authorities.

International Export Documentation Requirements

Exporters must comply with specific documentation requirements to ensure commercial invoice accuracy and smooth international trade processes. Proper records facilitate customs clearance and legal compliance in global shipments.

- Commercial Invoice - A detailed document outlining the goods, value, and terms of sale essential for customs authorities.

- Packing List - Provides a breakdown of the shipment's contents for verification and inventory control.

- Certificate of Origin - Confirms the origin of the goods, often required by customs to apply preferential tariffs or comply with trade agreements.

Regulatory Standards: What Exporters Must Know

Exporters must ensure their commercial invoices comply with international regulatory standards to avoid shipment delays and penalties. Key documents required include a detailed commercial invoice, packing list, and certificates of origin.

Regulatory standards mandate that commercial invoices contain precise information such as product descriptions, Harmonized System (HS) codes, and the invoice value. These documents must align with customs requirements in both the exporting and importing countries. Understanding and adhering to these standards ensures smooth customs clearance and legal compliance.

Importance of Accurate Invoice Information

An exporter must ensure all commercial invoice details are accurate to comply with international trade regulations. Precise information on product descriptions, quantities, and prices prevents customs delays and potential fines. Accurate invoices facilitate smooth clearance and maintain strong trade relationships.

Common Mistakes and Compliance Risks

What documents does an exporter need for commercial invoice compliance? Exporters must prepare accurate shipping documents, including the commercial invoice, packing list, and export licenses. Failure to provide these can lead to customs delays and financial penalties.

What are common mistakes exporters make with commercial invoices? Errors often include incorrect product descriptions, missing signatures, and inaccurate values. Such mistakes increase the risk of shipment rejection and regulatory non-compliance.

How can exporters reduce compliance risks related to commercial invoices? Ensuring detailed and truthful invoice information along with proper documentation is essential. Regular reviews and updates of export regulations help maintain compliance and avoid costly disruptions.

Best Practices for Preparing Commercial Invoices

| Document | Description | Best Practices |

|---|---|---|

| Commercial Invoice | Primary document detailing the transaction between exporter and importer, including product description, quantity, price, and terms of sale. | Ensure accuracy in product descriptions and pricing. Use standardized terms to avoid disputes. Clearly state Incoterms to define responsibilities. |

| Packing List | Details the contents, packaging type, weight, and dimensions of each package in the shipment. | Cross-check packing details with the commercial invoice. Include precise weight and measurement data to facilitate customs clearance. |

| Export License | Government-issued document authorizing the export of certain goods. | Verify license requirements based on product and destination country. Attach the license copy to support the commercial invoice. |

| Certificate of Origin | Certifies the country where the goods were manufactured or produced. | Obtain certification from authorized bodies. Ensure the certificate matches invoice details to qualify for preferential tariff treatments. |

| Bill of Lading or Airway Bill | Transport document issued by the carrier confirming receipt of goods for shipment. | Match consignee and shipper details with the commercial invoice. Verify shipment dates and transport method for accuracy. |

| Tax Identification Number | Exporter's and importer's tax ID used for customs and tax compliance. | Include accurate tax identification numbers to avoid delays. Confirm local customs requirements regarding tax documentation. |

| Payment Terms Documentation | Defines agreed payment methods and deadlines between exporter and importer. | Clearly specify payment terms on the invoice. Use internationally recognized payment terms such as L/C, T/T, or D/P. |

Supporting Documents Required for Exports

Exporters must prepare several supporting documents to ensure commercial invoice compliance. Key documents include the bill of lading, packing list, and certificates of origin, which verify shipment details and product authenticity. You should also maintain export licenses and customs declarations to meet regulatory requirements and facilitate smooth international trade.

Harmonized System (HS) Codes and Their Role

Exporters must ensure strict compliance with commercial invoice requirements to avoid shipment delays and penalties. Harmonized System (HS) Codes are crucial for accurate product classification and customs clearance.

- HS Codes Determine Tariffs - Correct HS Codes help calculate applicable duties and taxes efficiently.

- HS Codes Facilitate Customs Processing - Accurate coding streamlines customs inspections and approvals.

- HS Codes Enhance Trade Statistics - Proper classification supports reliable international trade data reporting.

Your commercial invoice should always include precise HS Codes to ensure seamless export operations.

What Documents Does an Exporter Need for Commercial Invoice Compliance? Infographic