Invoice auditing and compliance require key documents such as the original invoice, purchase order, and delivery receipts to verify transaction accuracy. Supporting documents like payment records, vendor contracts, and tax certificates ensure adherence to regulatory standards. Proper documentation streamlines the audit process and minimizes discrepancies in financial reporting.

What Documents are Needed for Invoice Auditing and Compliance?

| Number | Name | Description |

|---|---|---|

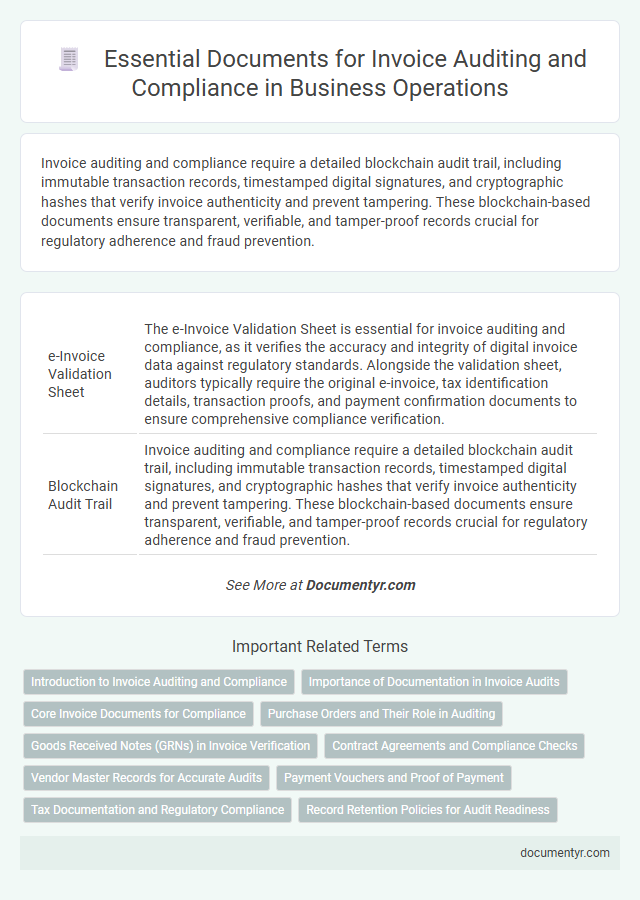

| 1 | e-Invoice Validation Sheet | The e-Invoice Validation Sheet is essential for invoice auditing and compliance, as it verifies the accuracy and integrity of digital invoice data against regulatory standards. Alongside the validation sheet, auditors typically require the original e-invoice, tax identification details, transaction proofs, and payment confirmation documents to ensure comprehensive compliance verification. |

| 2 | Blockchain Audit Trail | Invoice auditing and compliance require a detailed blockchain audit trail, including immutable transaction records, timestamped digital signatures, and cryptographic hashes that verify invoice authenticity and prevent tampering. These blockchain-based documents ensure transparent, verifiable, and tamper-proof records crucial for regulatory adherence and fraud prevention. |

| 3 | ESG Compliance Certificate | Invoice auditing and compliance require an ESG Compliance Certificate to verify adherence to environmental, social, and governance standards, ensuring ethical and sustainable business practices. This certificate must be accompanied by transaction records, purchase orders, and payment proofs to support transparent and accountable financial auditing. |

| 4 | Digital Signature Log | Digital Signature Logs are essential for invoice auditing and compliance, providing verifiable proof of document authenticity, integrity, and signer identity. These logs capture timestamped records of each signature event, ensuring traceability and adherence to regulatory standards such as eIDAS and HIPAA. |

| 5 | Tax Jurisdiction Mapping Document | Tax jurisdiction mapping documents are essential for invoice auditing and compliance as they accurately define the applicable tax rates and rules based on geographic locations and business activities. These documents ensure proper tax classification, helping organizations avoid discrepancies and penalties during tax reporting and audits. |

| 6 | Supplier Onboarding KYC Record | Supplier onboarding KYC records, including business registration certificates, tax identification numbers, and authorized signatory documents, are essential for invoice auditing and compliance. These documents verify supplier legitimacy and ensure adherence to regulatory requirements throughout the invoicing process. |

| 7 | Machine-Readable Invoice Extract | Machine-readable invoice extracts require digitally formatted documents such as XML, UBL, or EDI files, enabling automated data extraction for accurate auditing and compliance verification. These extracts must include essential elements like invoice number, date, vendor details, line-item descriptions, quantities, prices, taxes, and total amounts to ensure regulatory adherence and seamless integration with accounting systems. |

| 8 | Cross-border VAT Assessment File | Invoices undergoing cross-border VAT assessment require submission of the VAT assessment file, including detailed transaction records, supplier and customer VAT identification numbers, proof of goods or services delivery, and valid customs documentation to ensure compliance with international tax regulations. Proper documentation supports accurate VAT reconciliation and minimizes risks of audits and penalties. |

| 9 | AI-driven Duplicate Detection Report | Accurate invoice auditing and compliance require essential documents such as original invoices, purchase orders, payment receipts, and vendor contracts, with AI-driven Duplicate Detection Reports enhancing the process by identifying redundant or fraudulent entries to ensure financial integrity. Leveraging AI algorithms, these reports analyze vast invoice datasets, flagging duplicates and inconsistencies to streamline audits and maintain regulatory compliance effectively. |

| 10 | Dynamic QR Code Verification Sheet | The Dynamic QR Code Verification Sheet is essential for invoice auditing and compliance as it provides a secure, verifiable link to the invoice details, ensuring authenticity and preventing fraud. This document, combined with the original invoice, tax receipts, and payment records, enables auditors to efficiently validate transaction accuracy and regulatory adherence. |

Introduction to Invoice Auditing and Compliance

Invoice auditing and compliance are critical processes in financial management that ensure accuracy and legitimacy of billing documents. These processes help organizations detect discrepancies, prevent fraud, and maintain regulatory adherence.

Key documents required for invoice auditing include purchase orders, delivery receipts, and vendor contracts. Compliance also demands access to payment records, tax documents, and internal approval workflows to verify validity and alignment with company policies.

Importance of Documentation in Invoice Audits

What documents are needed for invoice auditing and compliance? Accurate invoice audits require essential documents such as purchase orders, delivery receipts, and payment records. Proper documentation ensures transparency and helps verify the validity of each transaction.

Why is documentation important in invoice audits? Strong documentation supports accurate financial reporting and compliance with regulatory standards. It helps identify discrepancies, prevent fraud, and protect your business from potential legal issues.

Core Invoice Documents for Compliance

Invoice auditing and compliance require a clear set of core documents to ensure accuracy and legal adherence. Proper documentation supports verification processes and reduces discrepancies.

- Original Invoice - This document contains detailed transaction information, including item descriptions, quantities, and prices.

- Purchase Order - It validates the requested goods or services and authorizes the transaction.

- Delivery Receipt - This proof confirms the goods or services were received as specified in the invoice.

Your compliance efforts depend on maintaining these essential documents for transparent and efficient invoice auditing.

Purchase Orders and Their Role in Auditing

| Document | Description | Role in Invoice Auditing and Compliance |

|---|---|---|

| Purchase Orders (POs) | Official documents issued by a buyer to a supplier specifying the products, quantities, and agreed prices. | Purchase Orders serve as a critical reference point during invoice auditing. They ensure that the invoiced items match the originally requested goods or services. Auditors verify POs to confirm the authenticity, accuracy, and approval of purchases. POs help prevent overbilling, duplicate payments, and unauthorized transactions, thus supporting compliance with internal controls and regulatory requirements. |

| Invoices | Statements provided by suppliers detailing the products or services delivered and the amount payable. | Invoices are cross-checked against purchase orders to validate transaction details and payment obligations. |

| Delivery Receipts | Documentation confirming the receipt of the ordered goods or services. | Delivery receipts corroborate the fulfillment of purchase orders and support invoice verification. |

| Payment Records | Proof of payment transactions including bank statements or payment confirmations. | Payment records confirm that payments correspond with approved invoices and POs, ensuring financial compliance. |

| Contract Agreements | Legal documents outlining the terms and conditions agreed upon by buyer and supplier. | Contracts provide a framework for validating pricing, delivery terms, and obligations reflected in purchase orders and invoices. |

Goods Received Notes (GRNs) in Invoice Verification

Goods Received Notes (GRNs) play a crucial role in invoice auditing and compliance by confirming the receipt of goods and verifying quantities against purchase orders. These documents help ensure that the invoiced amounts correspond accurately to the items delivered, reducing discrepancies and preventing payment errors. You must provide GRNs during invoice verification to support authenticity and maintain transparent financial records.

Contract Agreements and Compliance Checks

Accurate invoice auditing and compliance require a detailed examination of contract agreements and adherence to regulatory standards. These documents ensure that billing aligns with agreed terms and legal requirements.

- Contract Agreements - Serve as the foundational reference outlining payment terms, pricing, and deliverables essential for validating invoice accuracy.

- Compliance Checks - Verify that invoices meet industry regulations, tax laws, and audit standards to avoid legal and financial penalties.

- Supporting Documentation - Includes purchase orders and delivery receipts that corroborate the legitimacy of invoiced items as per the contract.

Vendor Master Records for Accurate Audits

Invoice auditing and compliance require precise documentation to ensure accuracy and prevent discrepancies. Key documents include purchase orders, delivery receipts, and payment confirmations.

Vendor Master Records play a crucial role in maintaining accurate audits by providing validated vendor details such as tax identification numbers, bank information, and contact data. These records help verify invoice authenticity and support regulatory compliance. Regular updates to Vendor Master Records minimize errors and facilitate seamless audit trails.

Payment Vouchers and Proof of Payment

Payment vouchers are essential documents that detail the authorization of payments, including information such as the amount, date, and recipient. They serve as a verification tool to confirm the legitimacy of transactions during invoice auditing.

Proof of payment, such as bank statements or receipts, provides concrete evidence that the invoice amount has been settled. These documents are crucial for compliance checks and help prevent discrepancies in financial records.

Tax Documentation and Regulatory Compliance

Invoice auditing and compliance require collecting essential tax documentation such as VAT invoices, tax registration certificates, and withholding tax certificates. Regulatory compliance mandates maintaining records aligned with local tax laws, including proof of tax payments and audit trails for each transaction. Accurate documentation ensures adherence to tax regulations and supports seamless audit processes in financial operations.

What Documents are Needed for Invoice Auditing and Compliance? Infographic