Accurate invoice reconciliation requires essential documents such as the original purchase order, the supplier invoice, and the goods received note. These documents verify that the quantities and prices billed match what was ordered and received. Having these records organized facilitates efficient dispute resolution and payment processing.

What Documents are Needed for Invoice Reconciliation?

| Number | Name | Description |

|---|---|---|

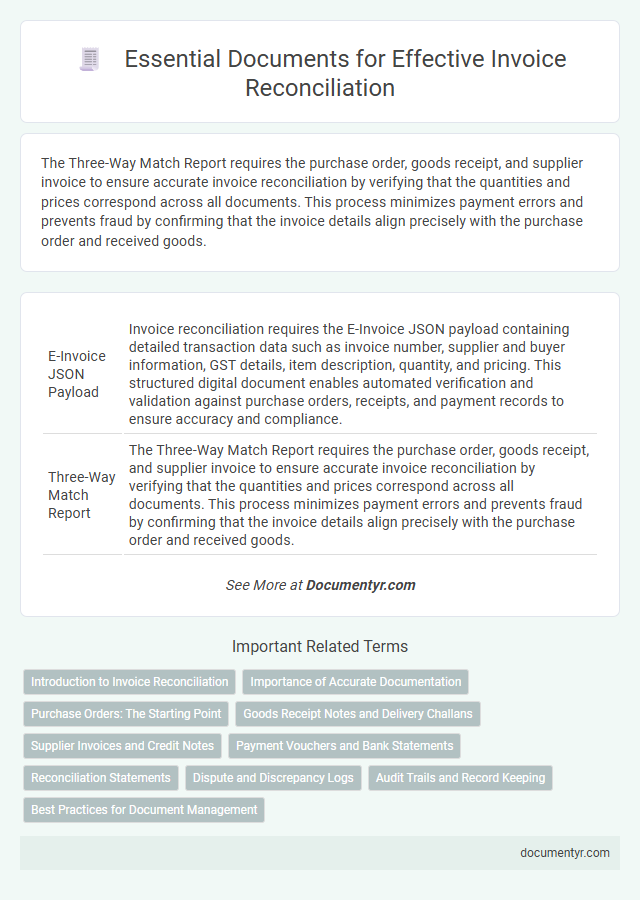

| 1 | E-Invoice JSON Payload | Invoice reconciliation requires the E-Invoice JSON payload containing detailed transaction data such as invoice number, supplier and buyer information, GST details, item description, quantity, and pricing. This structured digital document enables automated verification and validation against purchase orders, receipts, and payment records to ensure accuracy and compliance. |

| 2 | Three-Way Match Report | The Three-Way Match Report requires the purchase order, goods receipt, and supplier invoice to ensure accurate invoice reconciliation by verifying that the quantities and prices correspond across all documents. This process minimizes payment errors and prevents fraud by confirming that the invoice details align precisely with the purchase order and received goods. |

| 3 | Supplier Onboarding Certificate | Supplier Onboarding Certificates are essential documents for invoice reconciliation as they verify the legitimacy and compliance of the supplier with company policies and regulatory standards. This certificate, along with purchase orders, delivery receipts, and payment records, ensures accurate matching of invoices for audit and payment processing. |

| 4 | Tax Compliance Verification Sheet | The Tax Compliance Verification Sheet is essential for invoice reconciliation as it verifies the accuracy of tax amounts and ensures compliance with regulatory requirements. This document helps cross-check tax calculations against applicable laws, reducing the risk of discrepancies and penalties during audits. |

| 5 | PO Flip Transaction Log | Invoice reconciliation requires the PO Flip Transaction Log to verify matching purchase orders, invoices, and receipt details. This log ensures accurate validation of quantities, prices, and billing information to facilitate error-free invoice processing. |

| 6 | Blockchain-Stamped Audit Trail | Blockchain-stamped audit trails require verified transaction records, digital signatures, and timestamped invoices to ensure authenticity and transparency in invoice reconciliation. Supporting documents such as purchase orders, delivery receipts, and payment confirmations must be linked within the immutable blockchain ledger to enable accurate cross-verification. |

| 7 | Dynamic Discounting Agreement | Invoice reconciliation requires the Dynamic Discounting Agreement to verify the terms for early payment discounts and confirm the accuracy of discount rates applied. Supporting documents include the original invoice, purchase order, and proof of payment, ensuring compliance with agreed-upon discount conditions. |

| 8 | Automated Data Capture Sheet | Automated Data Capture Sheets require accurate extraction of key invoice details such as vendor information, invoice number, date, line items, and total amounts to ensure seamless invoice reconciliation. These documents streamline data validation by minimizing manual errors and enhancing the accuracy of matching invoices with purchase orders and payment records. |

| 9 | AI-Powered Discrepancy Flagging Report | Invoice reconciliation requires key documents such as purchase orders, delivery receipts, and vendor invoices to verify transaction accuracy. AI-powered discrepancy flagging reports enhance this process by automatically identifying mismatches and anomalies, reducing manual errors and accelerating resolution times. |

| 10 | QR Code Validation Record | Invoice reconciliation requires a comprehensive review of documents such as the original invoice, purchase order, delivery receipts, and the QR Code Validation Record, which confirms the authenticity and compliance of the transaction. The QR Code Validation Record is crucial for verifying the invoice's integrity against tax regulations and preventing fraudulent claims during the reconciliation process. |

Introduction to Invoice Reconciliation

Invoice reconciliation is the process of verifying and matching invoices with corresponding purchase orders and payment records. This ensures accuracy in financial transactions and prevents discrepancies that could impact accounting and vendor relationships. Proper documentation is essential for efficient invoice reconciliation.

Importance of Accurate Documentation

Accurate documentation plays a crucial role in invoice reconciliation by ensuring all financial records are correctly matched and verified. Properly organized documents help prevent errors and discrepancies during the reconciliation process.

- Purchase Orders - These documents confirm the authorized request for goods or services and provide a baseline for invoice verification.

- Delivery Receipts - Proof of goods or services received, delivery receipts validate that the transaction was completed as agreed.

- Invoices - Detailed invoices serve as the primary record for amount verification and payment processing.

Purchase Orders: The Starting Point

Purchase orders serve as the foundational document for invoice reconciliation, outlining agreed-upon terms, quantities, and prices between buyer and seller. Accurate matching of invoices to purchase orders ensures verification of goods or services delivered against what was requested. This alignment minimizes discrepancies and facilitates efficient payment processing within accounts payable systems.

Goods Receipt Notes and Delivery Challans

Invoice reconciliation requires specific documents to verify the accuracy of billed items. Goods Receipt Notes and Delivery Challans are essential for confirming the receipt and delivery of goods.

- Goods Receipt Notes (GRNs) - These documents confirm that the goods received match the purchase order in quantity and quality.

- Delivery Challans - They provide proof of delivery, detailing the items handed over by the supplier.

- Verification Process - Cross-checking GRNs and Delivery Challans against invoices ensures accurate payment and prevents discrepancies.

Supplier Invoices and Credit Notes

| Document Type | Description | Purpose in Invoice Reconciliation |

|---|---|---|

| Supplier Invoice | Official billing document issued by the supplier detailing products or services provided, quantities, prices, and total amount payable. | Serves as the primary reference for verifying charges, quantities, and prices against purchase orders and delivery receipts. |

| Credit Note | Document issued by the supplier to correct or adjust previously issued invoices, reflecting refunds, discounts, or returned goods. | Used to reconcile discrepancies, reduce outstanding balances, and ensure accurate financial records. |

Payment Vouchers and Bank Statements

What documents are needed for invoice reconciliation? Payment vouchers provide detailed proof of issued payments, confirming the transaction legitimacy. Bank statements verify these payments by reflecting the actual money movement in accounts, ensuring accuracy.

Reconciliation Statements

Invoice reconciliation requires accurate documentation to verify transaction details and ensure payment accuracy. Reconciliation statements play a crucial role by summarizing discrepancies between invoices and payments.

Reconciliation statements provide a clear overview of outstanding balances and adjustments. Supporting documents such as purchase orders, delivery receipts, and payment records complement these statements. You should maintain these documents to streamline the reconciliation process and resolve issues promptly.

Dispute and Discrepancy Logs

Invoice reconciliation requires accurate documentation to verify transactions and resolve discrepancies. Key documents include the original invoice, purchase order, and proof of payment.

Dispute and discrepancy logs play a crucial role in tracking and managing invoice inconsistencies. These logs provide detailed records of any conflicts or irregularities for efficient resolution.

Audit Trails and Record Keeping

Invoice reconciliation requires a clear audit trail to verify all financial transactions, ensuring accuracy and compliance. Essential documents include original invoices, purchase orders, and payment receipts to establish a transparent record.

Maintaining detailed record keeping supports tracking discrepancies and resolving disputes promptly. You must keep digital or physical copies organized, reflecting each stage of the invoice lifecycle for effective auditing.

What Documents are Needed for Invoice Reconciliation? Infographic