To ensure invoice compliance with European Union VAT regulations, essential documents include a valid tax identification number, detailed description of goods or services, the invoice date, and the total VAT amount clearly specified. The invoice must also feature the seller's and buyer's names and addresses, and a unique sequential invoice number to maintain transparency and traceability. Accurate documentation supports proper VAT reporting and helps avoid penalties during tax audits.

What Documents are Necessary for Invoice Compliance in European Union VAT?

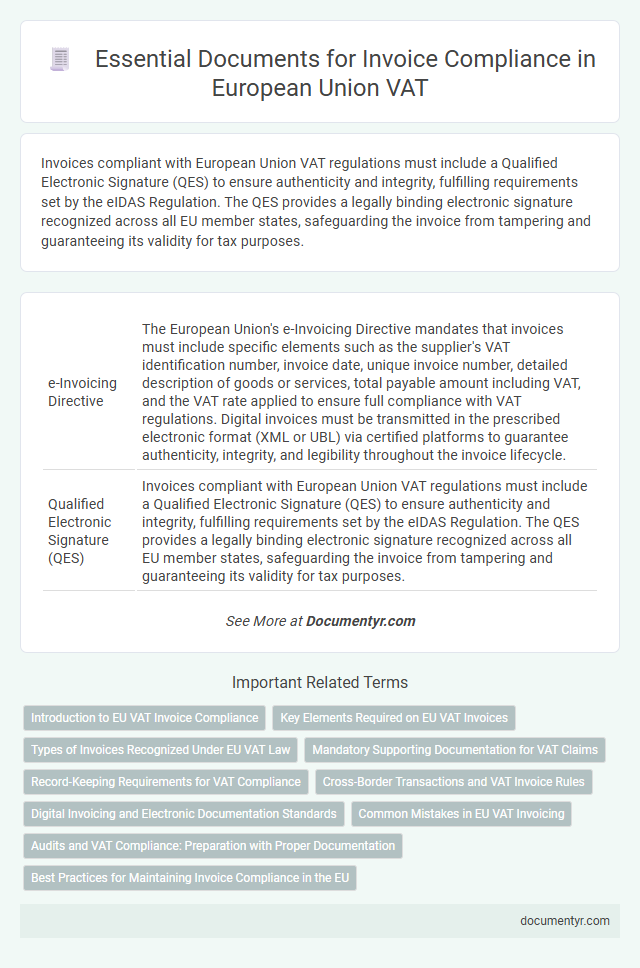

| Number | Name | Description |

|---|---|---|

| 1 | e-Invoicing Directive | The European Union's e-Invoicing Directive mandates that invoices must include specific elements such as the supplier's VAT identification number, invoice date, unique invoice number, detailed description of goods or services, total payable amount including VAT, and the VAT rate applied to ensure full compliance with VAT regulations. Digital invoices must be transmitted in the prescribed electronic format (XML or UBL) via certified platforms to guarantee authenticity, integrity, and legibility throughout the invoice lifecycle. |

| 2 | Qualified Electronic Signature (QES) | Invoices compliant with European Union VAT regulations must include a Qualified Electronic Signature (QES) to ensure authenticity and integrity, fulfilling requirements set by the eIDAS Regulation. The QES provides a legally binding electronic signature recognized across all EU member states, safeguarding the invoice from tampering and guaranteeing its validity for tax purposes. |

| 3 | Structured Data Format (EN 16931) | Invoice compliance in the European Union VAT requires including Structured Data Format compliant with the EN 16931 standard, ensuring standardized semantic elements for interoperability across member states. Essential documents must contain mandatory information such as supplier and customer identification, invoice date, VAT rates, and transaction totals encoded in a machine-readable format to facilitate automated VAT processing. |

| 4 | Continuous Transaction Controls (CTC) | Continuous Transaction Controls (CTC) in the European Union VAT framework require invoices to include detailed transactional data such as supplier and customer VAT identification numbers, invoice date, unique invoice number, taxable amount, VAT rate, and total VAT charged, ensuring real-time or near-real-time reporting to tax authorities. Compliance mandates digital submission of these invoice details through certified platforms or electronic channels enabling authorities to monitor and validate VAT transactions continuously. |

| 5 | Real-Time Reporting (RTR) | Real-Time Reporting (RTR) for invoice compliance in the European Union VAT requires the submission of digital invoices including detailed transaction data such as supplier and customer VAT numbers, invoice date, taxable amounts, and VAT rates directly to tax authorities in real-time or near real-time. Essential documents include electronic invoice data files formatted according to EU standards like XML or SAF-T, ensuring accuracy and enabling prompt tax authority validation and monitoring. |

| 6 | Self-Billing Agreement | A self-billing agreement in the European Union VAT framework requires a comprehensive invoice that includes the supplier's and buyer's VAT identification numbers, invoice date, sequential invoice number, description of goods or services, VAT rate, and total amount payable. Compliance mandates that both parties maintain clear records of the agreement and issued invoices to ensure proper VAT reporting and audit trails. |

| 7 | Digital Archiving Standards (eIDAS Compliance) | Invoices in the European Union must comply with eIDAS regulation by ensuring digital archiving standards that guarantee authenticity, integrity, and legibility of VAT-related documents for up to ten years. Digital archiving systems need to support advanced electronic signatures and timestamps to meet strict VAT audit requirements and facilitate seamless cross-border tax validations. |

| 8 | Reverse Charge Invoicing | For invoice compliance under the European Union VAT reverse charge mechanism, essential documents include a valid VAT identification number of both the supplier and the customer, a clear statement indicating the application of the reverse charge, and detailed descriptions of goods or services provided. Accurate invoicing must also contain the invoice date, unique invoice number, the VAT rate applied as zero percent, and the legal reference for reverse charge as outlined in EU VAT Directive 2006/112/EC. |

| 9 | Clearance Model Invoices | Clearance model invoices in the European Union require submission of detailed transactional data to tax authorities prior to issuance, including supplier and customer VAT identification numbers, invoice date, unique invoice number, description of goods or services, taxable amount, VAT rate, and total VAT charged. Compliance mandates electronic communication with authorized clearance platforms to ensure real-time validation, authentication, and storage of invoices according to country-specific VAT regulations. |

| 10 | Cross-Border VAT Identifier (VIES Validation) | Invoices in the European Union must include a valid VAT identification number verified through the VIES system to ensure cross-border VAT compliance, preventing fraudulent transactions and enabling accurate tax reporting. The VAT ID's validation via VIES confirms the buyer's legitimate business status within the EU, a critical requirement for applying the reverse charge mechanism and maintaining proper invoice documentation. |

Introduction to EU VAT Invoice Compliance

Invoice compliance under the European Union VAT regulations requires specific documentation to ensure proper tax reporting and validation. Essential documents include a VAT invoice containing the supplier's and recipient's details, VAT identification numbers, invoice date, and a clear description of goods or services provided. Understanding these requirements helps you maintain accurate records and avoid penalties across EU member states.

Key Elements Required on EU VAT Invoices

Invoice compliance in the European Union VAT system requires specific documents to ensure accurate tax reporting and verification. These documents primarily include the invoice itself, which must contain key elements mandated by EU VAT regulations.

Key elements required on EU VAT invoices include the supplier's name, address, and VAT identification number. The invoice must also show the invoice date, a unique invoice number, the quantity and description of goods or services supplied, and the unit price excluding VAT.

Types of Invoices Recognized Under EU VAT Law

What types of invoices are recognized under EU VAT law for compliance? EU VAT regulations mandate specific invoice types including standard invoices, simplified invoices, and self-billed invoices. Each type serves distinct purposes and must contain prescribed information to ensure your transactions comply with VAT requirements.

Mandatory Supporting Documentation for VAT Claims

Invoice compliance for VAT in the European Union requires specific documentation to support VAT claims accurately. Ensuring all mandatory documents are in place helps businesses avoid penalties and facilitates smooth tax audits.

- Valid VAT Invoice - A legally compliant invoice must include the supplier's and customer's VAT numbers, invoice date, unique invoice number, description of goods or services, and the VAT amount charged.

- Proof of Delivery or Service Completion - Documents such as delivery notes or service completion certificates confirm that the transaction occurred and support the validity of the VAT claim.

- Payment Evidence - Receipts, bank statements, or payment confirmations provide proof that the transaction has been financially settled in accordance with the invoice.

Maintaining these mandatory supporting documents is essential for successful VAT claim validation under EU regulations.

Record-Keeping Requirements for VAT Compliance

Maintaining accurate records is essential for invoice compliance under European Union VAT regulations. Proper documentation ensures businesses can substantiate VAT claims and meet legal obligations.

- Valid Invoice Documentation - Invoices must contain specific details such as the supplier's VAT number, invoice date, and a clear description of goods or services provided.

- Retention Period - Businesses are required to retain VAT-related documents for at least 10 years to comply with EU tax authorities' record-keeping requirements.

- Electronic Record-Keeping - Digital storage of invoices is permitted, provided the records remain accessible, legible, and unaltered throughout the retention period.

Cross-Border Transactions and VAT Invoice Rules

| Document Type | Description | Relevance for Cross-Border Transactions | VAT Invoice Rule Compliance |

|---|---|---|---|

| VAT Invoice | Official document issued by the supplier to the buyer detailing goods or services supplied, VAT amount, and total payable. | Mandatory for all cross-border B2B transactions within the EU to claim VAT deductions and verify tax obligations. | Must include supplier and customer VAT numbers, invoice date, unique invoice number, description of goods or services, quantity, unit price, VAT rate, VAT amount, and total amount including VAT. |

| Intrastat Declarations | Statistical declarations required for monitoring goods movements within the EU. | Required when the value of cross-border goods transactions exceeds the national threshold in any EU member state. | Supports VAT records but is not itself an invoice; accuracy important for VAT compliance and audit purposes. |

| Proof of Transport | Documents such as shipping contracts, CMR waybills, or transport invoices confirming goods movement from one EU country to another. | Essential to validate the place of supply and confirm that goods have left the supplier's country. | Helps establish zero-rated VAT for intra-EU supplies by proving goods have been transported across borders. |

| Customer VAT Confirmation | Verification of the customer's valid VAT identification number, typically via the EU VIES system. | Required to apply the reverse charge mechanism or zero VAT rating on cross-border B2B supplies. | Invoice must reference the customer's VAT number to meet EU VAT invoicing rules and avoid VAT payment errors. |

| Credit and Debit Notes | Documents issued to correct or adjust previously issued invoices. | Essential for modifying cross-border transaction amounts and VAT calculations. | Must comply with the same VAT invoicing requirements as original invoices, including referencing the original invoice. |

Digital Invoicing and Electronic Documentation Standards

Invoice compliance under EU VAT regulations requires adherence to specific documentation standards, especially for digital invoicing. Electronic documentation must meet legal and technical criteria to ensure authenticity, integrity, and legibility throughout the storage period.

- Digital Invoice Format Compliance - Invoices must be issued in formats such as XML or PDF/A that support long-term readability and auditability.

- Authentication of Origin and Integrity - Use of advanced electronic signatures or electronic data interchange (EDI) ensures the authenticity of the seller and the integrity of invoice content.

- Storage and Archiving Regulations - Digital invoices must be stored in a secure, accessible manner for at least 10 years, complying with EU VAT Directive requirements and national laws.

Common Mistakes in EU VAT Invoicing

Invoice compliance in European Union VAT requires essential documents such as a valid VAT identification number, an invoice date, and a clear description of the goods or services provided. Common mistakes in EU VAT invoicing include missing VAT numbers, incorrect tax rates, and incomplete invoice details that can lead to compliance issues and penalties. Ensuring accuracy and completeness in these documents is critical for businesses to meet EU VAT regulations and avoid audit risks.

Audits and VAT Compliance: Preparation with Proper Documentation

Invoices in the European Union must include specific documents to ensure VAT compliance during audits. Proper documentation helps avoid penalties and supports transparent tax records.

Essential documents include a valid VAT invoice showing supplier and customer details, VAT number, invoice date, and itemized goods or services with VAT rates applied. Backup records such as purchase orders, delivery notes, and payment receipts are also critical. These documents demonstrate transaction authenticity and facilitate smooth audit processes, reinforcing your compliance with EU VAT regulations.

What Documents are Necessary for Invoice Compliance in European Union VAT? Infographic