To submit an e-invoice in the EU, essential documents include a valid invoice containing supplier and buyer details, a unique invoice number, and a clear description of goods or services provided. The invoice must comply with the EU's electronic invoicing standards, such as EN 16931, ensuring data accuracy and legal validity. Supporting documents like purchase orders and delivery receipts may also be required to validate the transaction and facilitate seamless processing.

What Documents are Necessary for E-Invoice Submission in the EU?

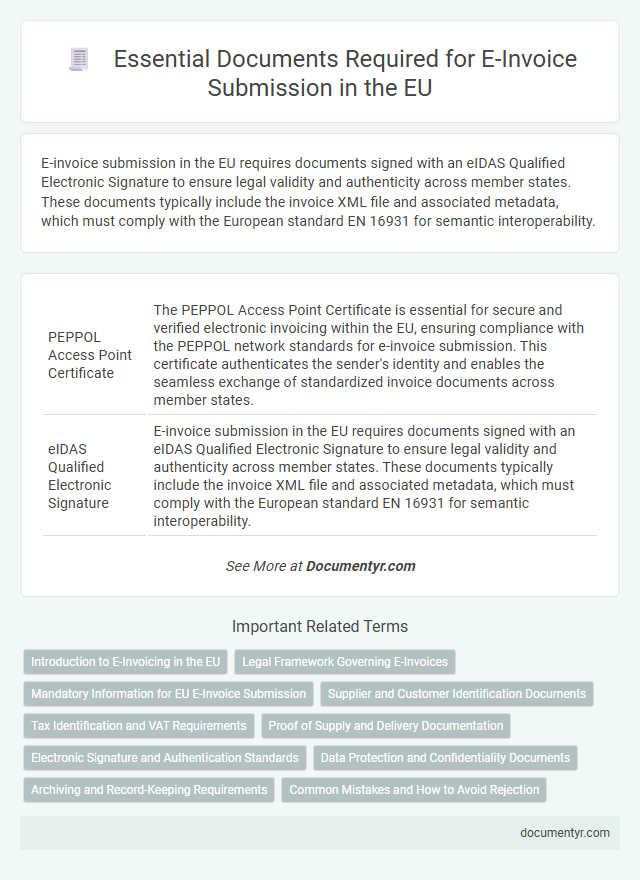

| Number | Name | Description |

|---|---|---|

| 1 | PEPPOL Access Point Certificate | The PEPPOL Access Point Certificate is essential for secure and verified electronic invoicing within the EU, ensuring compliance with the PEPPOL network standards for e-invoice submission. This certificate authenticates the sender's identity and enables the seamless exchange of standardized invoice documents across member states. |

| 2 | eIDAS Qualified Electronic Signature | E-invoice submission in the EU requires documents signed with an eIDAS Qualified Electronic Signature to ensure legal validity and authenticity across member states. These documents typically include the invoice XML file and associated metadata, which must comply with the European standard EN 16931 for semantic interoperability. |

| 3 | Structured UBL/XML Invoice File | The essential document for E-Invoice submission in the EU is a structured UBL/XML invoice file, which ensures standardized data exchange and compliance with electronic invoicing regulations. This file must include key invoice details such as supplier and buyer information, invoice number, date, tax amounts, and line item descriptions formatted according to the EU's electronic invoicing schemas. |

| 4 | EN 16931-Compliant Invoice | For E-invoice submission in the EU, an EN 16931-compliant invoice must include standardized electronic formats such as XML or UBL, detailing essential data elements like supplier and buyer identification, invoice number, date, tax information, and payment terms. Compliance with this European standard ensures interoperability and legal acceptance across member states for seamless cross-border invoicing processes. |

| 5 | Continuous Transaction Controls (CTC) Registration | For E-Invoice submission under the EU Continuous Transaction Controls (CTC) framework, businesses must provide a valid VAT identification number, digital signature certificates, and proof of registration with the national tax authority's CTC system. Submission also requires detailed transactional data including invoice number, date, supplier and buyer tax details, and product or service codes in the prescribed XML or structured electronic format. |

| 6 | VAT Interchange Document (VID) | The VAT Interchange Document (VID) is a crucial component for e-invoice submission in the EU, containing essential information such as VAT identification numbers, transaction details, and tax amounts to ensure compliance with EU VAT regulations. Accurate VID data enables seamless validation and cross-border VAT reporting within the EU's digital invoicing framework. |

| 7 | Real-Time Reporting Acknowledgement | Real-time reporting acknowledgement in EU e-invoice submission requires the invoice document itself, including detailed supplier and buyer information, VAT identification numbers, invoice date, and unique invoice number. Accurate transmission of digital signatures and metadata ensures compliance with mandatory tax authority validation for successful electronic invoicing. |

| 8 | QR Code Embedded Metadata | E-invoice submission in the EU requires invoices to include QR code embedded metadata containing essential information such as invoice number, date, supplier and buyer tax identification numbers, total amounts, and VAT details to ensure compliance and facilitate automated processing. This standardized digital format enhances data accuracy, reduces errors, and streamlines validation across member states. |

| 9 | EORI Number Validation Sheet | Submitting an e-invoice in the EU requires the EORI Number Validation Sheet to confirm the Economic Operators Registration and Identification number's authenticity, which ensures compliance with customs and tax authorities. This document acts as a crucial verification tool linking the recipient and sender to their respective economic activities within the EU e-invoicing framework. |

| 10 | Supplier Master Data Synchronization Form | The Supplier Master Data Synchronization Form is essential for e-invoice submission in the EU, as it ensures accurate alignment of supplier information with the invoicing system, preventing discrepancies and delays. This document typically includes supplier identification details, VAT numbers, and contact information, facilitating compliance with EU e-invoicing regulations and the integration of electronic invoicing platforms. |

Introduction to E-Invoicing in the EU

What documents are necessary for e-invoice submission in the EU? E-invoicing in the EU requires specific documentation to ensure compliance with legal and tax regulations. Your submission must include the invoice, a clear breakdown of taxes, and proof of delivery or service completion.

Legal Framework Governing E-Invoices

The legal framework governing e-invoices in the EU ensures compliance with standardized electronic document exchange. You must adhere to specific documentation requirements to validate your e-invoice submissions effectively.

- Directive 2014/55/EU - Establishes the mandatory adoption of electronic invoicing in public procurement across EU member states.

- EN 16931 Standard - Defines the semantic data model for e-invoices to guarantee interoperability and legal acceptance.

- National Legal Requirements - Require inclusion of specific data elements such as VAT identification, invoice date, and payment terms to comply with local regulations.

Mandatory Information for EU E-Invoice Submission

For EU e-invoice submission, including all mandatory information ensures compliance with legal standards. The required documents must contain specific data elements to validate the transaction and support auditing processes.

Your e-invoice must include the supplier and buyer's VAT identification numbers, total invoice amount, and a clear description of goods or services provided. The invoice date and a unique invoice number are critical for tracking and verification. Including payment terms and the currency used further ensures clarity and adherence to EU regulations.

Supplier and Customer Identification Documents

Invoice submission in the EU requires precise supplier and customer identification documents to ensure compliance with e-invoicing regulations. Your supplier's VAT identification number and legal business name must be clearly included in the e-invoice metadata.

Customer identification also demands accurate VAT numbers and registered business names to validate the transaction within EU standards. These essential documents facilitate seamless tax reporting and cross-border invoice processing.

Tax Identification and VAT Requirements

Submitting an e-invoice in the EU requires specific documents to ensure compliance with tax regulations. Tax identification and VAT details are crucial components for accurate and legal invoice processing.

- Tax Identification Number (TIN) - The supplier's and customer's TIN must be included to validate tax obligations and identify entities involved in the transaction.

- VAT Number - The VAT registration number is required to confirm the status of both parties under EU VAT rules and facilitate VAT reporting.

- Invoice Data Compliance - The e-invoice must contain essential fields such as VAT amounts, tax codes, and supplier identification to meet EU e-invoicing standards.

Proof of Supply and Delivery Documentation

For E-invoice submission in the EU, proof of supply is essential to validate the transaction. This includes delivery notes, shipment tracking, or signed proof of receipt to confirm goods or services have been provided.

Delivery documentation also plays a critical role by detailing the date, location, and nature of the delivery. Such documents ensure compliance with VAT regulations and support the accuracy of the e-invoice data.

Electronic Signature and Authentication Standards

Submitting an e-invoice in the EU requires specific documents to meet regulatory and security standards. Electronic signature and authentication are critical to ensure the integrity and authenticity of your invoice.

- Qualified Electronic Signature (QES) - Provides the highest level of security and legal validity across EU member states.

- Advanced Electronic Signature (AES) - Ensures data integrity and is linked uniquely to the signatory for non-repudiation.

- Authentication Certificates - Used to verify the identity of the sender and prevent unauthorized access during submission.

Ensuring your e-invoice complies with these standards facilitates smooth processing and legal acceptance across the EU.

Data Protection and Confidentiality Documents

For e-invoice submission in the EU, essential documents include the e-invoice file itself, authorization certificates, and data protection compliance statements. Your submission must comply with GDPR regulations, ensuring all personal and financial data is securely encrypted and confidential. Providing documents that demonstrate adherence to data protection and confidentiality standards safeguards your business and customer information during the electronic invoicing process.

Archiving and Record-Keeping Requirements

| Document Type | Description | Archiving Requirement |

|---|---|---|

| Electronic Invoice (E-Invoice) | Digitally created invoice compliant with EU e-invoicing standards such as EN 16931. | Must be stored in original electronic format for a minimum of 10 years to ensure authenticity and integrity. |

| Certification and Validation Reports | Proof of compliance and validation conducted by authorized service providers or tax authorities. | Retention period aligns with invoice archiving requirements; typically 10 years per EU tax regulations. |

| Communication Records | Logs of invoice dispatch and receipt confirmations between trading partners. | Maintain records for the duration of the invoice storage period to provide audit trails and evidence of transaction. |

| Tax Declaration Documents | Relevant VAT returns and related tax filings connected to the e-invoice transactions. | Store copies alongside e-invoices to support tax audits; retention periods commonly extend to 10 years. |

| Backup Files | Secure copies of e-invoices stored in secondary locations or cloud storage complying with EU data protection rules. | Backups must be accessible and preserved for the entire legal retention period for data recovery and compliance. |

What Documents are Necessary for E-Invoice Submission in the EU? Infographic