To ensure international invoice compliance, key documents such as a commercial invoice, packing list, and bill of lading are essential. These documents must include detailed descriptions of goods, accurate quantities, value declarations, and the correct Harmonized System (HS) codes. Properly completed certificates of origin and export licenses further support customs clearance and regulatory adherence.

What Documents are Necessary for International Invoice Compliance?

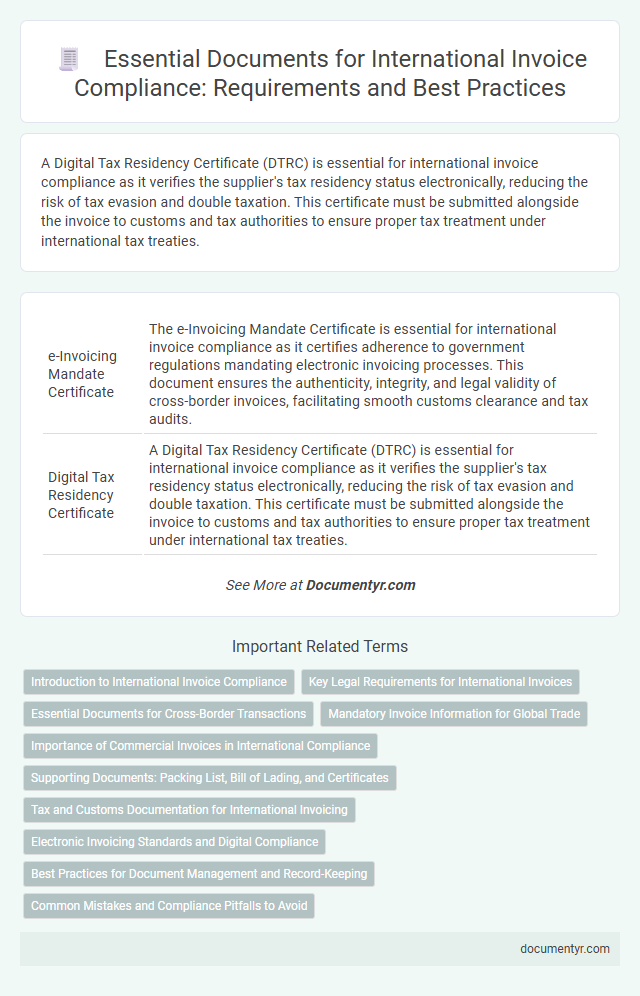

| Number | Name | Description |

|---|---|---|

| 1 | e-Invoicing Mandate Certificate | The e-Invoicing Mandate Certificate is essential for international invoice compliance as it certifies adherence to government regulations mandating electronic invoicing processes. This document ensures the authenticity, integrity, and legal validity of cross-border invoices, facilitating smooth customs clearance and tax audits. |

| 2 | Digital Tax Residency Certificate | A Digital Tax Residency Certificate (DTRC) is essential for international invoice compliance as it verifies the supplier's tax residency status electronically, reducing the risk of tax evasion and double taxation. This certificate must be submitted alongside the invoice to customs and tax authorities to ensure proper tax treatment under international tax treaties. |

| 3 | Blockchain-Stamped Invoice Record | A Blockchain-Stamped Invoice Record ensures tamper-proof verification and enhances transparency by securely embedding transaction data on a decentralized ledger. Essential documents for international invoice compliance include the blockchain-stamped invoice, shipping documents, customs declarations, and tax certificates to validate authenticity and meet cross-border regulatory requirements. |

| 4 | Electronic Export Declaration (EED) | The Electronic Export Declaration (EED) is a critical document for international invoice compliance, ensuring accurate customs data and export control in global trade transactions. Proper submission of the EED facilitates smooth customs clearance, reduces shipment delays, and aligns with regulatory requirements across export countries. |

| 5 | Invoice Reference Number (IRN) | Invoice Reference Number (IRN) is essential for international invoice compliance as it provides a unique identifier for each transaction, ensuring traceability and preventing duplication in cross-border trade. This number is typically generated through a government online portal or invoicing system, verifying the authenticity and legal validity of the invoice. |

| 6 | Importer Security Filing (ISF) Document | The Importer Security Filing (ISF) document is a critical requirement for international invoice compliance, mandating importers to submit detailed shipment data to U.S. Customs at least 24 hours before cargo loading. This ensures accurate risk assessment and timely customs clearance, reducing delays and penalties in cross-border trade. |

| 7 | UBL 2.3 Compliant Invoice | A UBL 2.3 compliant invoice must include essential documents such as the Invoice, Purchase Order, Delivery Note, and Customs Declarations to ensure international invoice compliance. These documents facilitate accurate data exchange, meet global regulatory requirements, and support seamless cross-border trade processes. |

| 8 | VAT Cross-Border Compliance Statement | Accurate VAT cross-border compliance requires including a detailed VAT Cross-Border Compliance Statement on international invoices, specifying the applicable VAT rates, tax identification numbers, and compliance with each country's tax regulations. Essential documents such as the commercial invoice, proof of export, and any required customs declarations must accompany the invoice to ensure seamless VAT validation and avoid penalties. |

| 9 | Country-Specific Compliance QR Code | Country-specific compliance QR codes on international invoices must meet each country's regulatory standards, such as Mexico's CFDI or Italy's FatturaPA system, ensuring authenticity and tax authority validation. Accurate integration of these QR codes with required invoice details like tax identification numbers, transaction dates, and amounts facilitates seamless cross-border customs clearance and audit processes. |

| 10 | Peppol ID Accreditation Document | Peppol ID Accreditation Document is essential for international invoice compliance as it verifies the sender's identity within the Peppol network, ensuring secure and standardized electronic invoicing. This document facilitates seamless cross-border transactions by guaranteeing that invoices meet regulatory requirements and are accepted by participating countries' tax authorities. |

Introduction to International Invoice Compliance

What documents are necessary for international invoice compliance? International invoice compliance requires specific documents to ensure smooth cross-border transactions and adherence to legal regulations. Proper documentation helps prevent delays, fines, and customs issues when shipping goods globally.

Key Legal Requirements for International Invoices

International invoice compliance requires specific documents to meet legal standards, including a proforma invoice, commercial invoice, and packing list. Key legal requirements for international invoices entail accurate product descriptions, clear payment terms, and the inclusion of the seller's and buyer's tax identification numbers. Ensuring Your invoice contains these elements helps avoid customs delays and supports smooth cross-border transactions.

Essential Documents for Cross-Border Transactions

International invoice compliance requires specific documents to ensure smooth cross-border transactions. These essential documents verify the legitimacy and details of your shipment.

- Commercial Invoice - Serves as the primary proof of sale and details the products, quantities, and prices involved.

- Packing List - Provides detailed information about the shipment's contents, aiding customs inspections and inventory management.

- Certificate of Origin - Confirms the country where the goods were manufactured, which can impact tariffs and trade agreements.

Mandatory Invoice Information for Global Trade

Mandatory invoice information for global trade ensures smooth customs clearance and regulatory adherence. Key documents include the commercial invoice, packing list, certificate of origin, and any required export licenses. Providing accurate details such as buyer and seller information, description of goods, quantity, price, and shipping terms is essential for Your international invoice compliance.

Importance of Commercial Invoices in International Compliance

Commercial invoices serve as a critical document in international trade, ensuring your shipments meet regulatory standards. Accurate commercial invoices facilitate customs clearance and verify the value and nature of goods.

- Proof of Transaction - The commercial invoice details the buyer, seller, and terms of sale, confirming the legitimacy of the international transaction.

- Customs Valuation - It provides essential information for customs authorities to assess duties and taxes based on the declared value of the goods.

- Compliance Verification - Customs and border agencies rely on commercial invoices to verify that shipments comply with import/export regulations and trade agreements.

Supporting Documents: Packing List, Bill of Lading, and Certificates

International invoice compliance requires specific supporting documents to ensure smooth customs clearance and legal accuracy. Key documents include the packing list, bill of lading, and various certificates that verify shipment details and product standards.

- Packing List - Details the contents, dimensions, and weight of each package in the shipment.

- Bill of Lading - Acts as a contract of carriage and proof of shipment between the exporter and carrier.

- Certificates - Include certificates of origin, inspection, and compliance to validate product standards and origin.

Proper documentation supports international trade transactions and helps avoid customs delays or penalties.

Tax and Customs Documentation for International Invoicing

International invoice compliance requires specific tax and customs documentation to ensure smooth cross-border transactions. Essential documents include commercial invoices, export declarations, and tax identification numbers that verify the legitimacy of the transaction.

Accurate customs documentation helps prevent delays and additional fees by providing necessary information for tariff classifications and duty calculations. Tax documents like VAT invoices and certificates of origin are crucial to meet regulatory requirements and facilitate tax refunds or exemptions.

Electronic Invoicing Standards and Digital Compliance

| Document Type | Description | Relevance to Electronic Invoicing Standards |

|---|---|---|

| Invoice Document | Digital invoice containing detailed billing information including product description, quantity, price, and tax details. | Must comply with XML or UBL formats to ensure interoperability and automatic processing in international transactions. |

| Tax Compliance Certificates | Proof of VAT or GST registration and tax identification relevant to the seller and buyer locations. | Required to validate tax calculations embedded within the electronic invoice for cross-border compliance. |

| Digital Signature | Electronic verification tool that authenticates the invoice origin and ensures document integrity. | Mandatory in many jurisdictions to meet e-invoicing legal frameworks and reduce fraud risks. |

| Electronic Transmission Receipt | Confirmation of successful invoice delivery through secure digital channels. | Supports proof of compliance with data exchange protocols such as PEPPOL or local e-invoicing networks. |

| Audit Trail Documentation | Digital record tracking invoice creation, modification, and approval steps. | Ensures transparency and supports regulatory requirements for electronic document lifecycle management. |

Best Practices for Document Management and Record-Keeping

International invoice compliance requires specific documents to ensure smooth customs clearance and payment processing. Key documents include the commercial invoice, packing list, bill of lading, and Certificates of Origin.

Best practices for document management emphasize accurate record-keeping and timely submission of all necessary paperwork. Maintaining digital copies in organized folders helps prevent data loss and facilitates quick retrieval during audits. Regular audits and updates to documentation practices reduce compliance risks and improve overall efficiency in international trade operations.

What Documents are Necessary for International Invoice Compliance? Infographic