Vendors must attach purchase orders, receipts, and any contract agreements related to the transaction when submitting an invoice for reimbursement. Detailed expense reports and proof of payment may also be required to validate the charges. Ensuring all relevant documentation is included helps expedite the approval and payment process.

What Documents Does a Vendor Need to Attach to an Invoice for Reimbursement?

| Number | Name | Description |

|---|---|---|

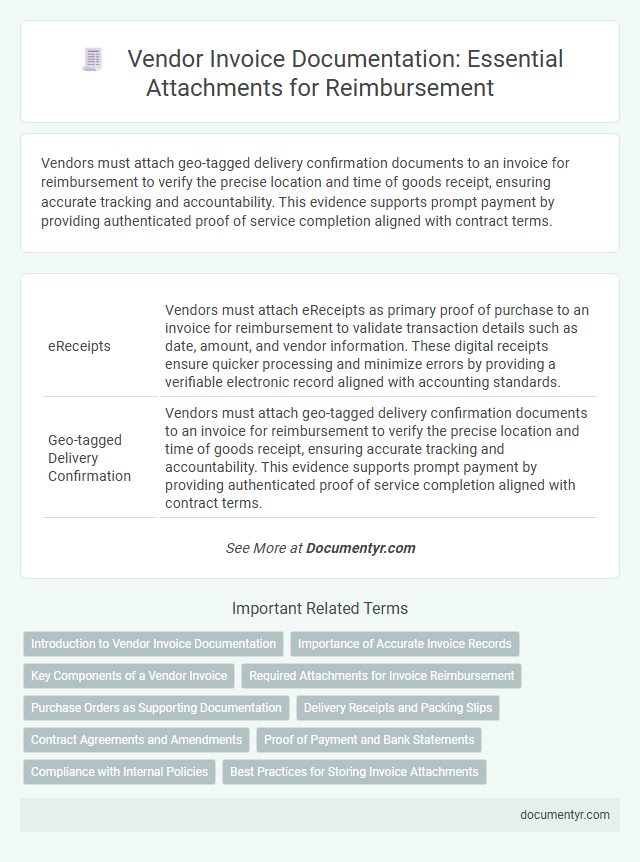

| 1 | eReceipts | Vendors must attach eReceipts as primary proof of purchase to an invoice for reimbursement to validate transaction details such as date, amount, and vendor information. These digital receipts ensure quicker processing and minimize errors by providing a verifiable electronic record aligned with accounting standards. |

| 2 | Geo-tagged Delivery Confirmation | Vendors must attach geo-tagged delivery confirmation documents to an invoice for reimbursement to verify the precise location and time of goods receipt, ensuring accurate tracking and accountability. This evidence supports prompt payment by providing authenticated proof of service completion aligned with contract terms. |

| 3 | Blockchain Authentication Certificate | A vendor must attach a Blockchain Authentication Certificate to an invoice to ensure secure and tamper-proof verification of transaction details for reimbursement. This certificate serves as a decentralized digital proof, enhancing authenticity and preventing fraud in the invoicing process. |

| 4 | Dynamic QR Code Approval | Vendors must attach a dynamically generated QR code approval document to invoices for reimbursement, which enables quick verification of transaction authenticity and payment authorization. This QR code contains encoded data such as invoice number, vendor details, and approval status, streamlining the validation process and reducing payment delays. |

| 5 | ESG Compliance Declaration | Vendors must attach an ESG Compliance Declaration to an invoice for reimbursement, demonstrating adherence to environmental, social, and governance standards as required by the client or regulatory body. This declaration ensures transparency and accountability in sustainable business practices, facilitating approval of the reimbursement process. |

| 6 | Digital Timesheet Logs | Vendors must attach accurate digital timesheet logs to an invoice for reimbursement, ensuring detailed records of hours worked are included to validate billing claims. These electronic logs facilitate efficient verification processes by providing timestamped entries aligned with project deliverables and service periods. |

| 7 | Smart Contract Reference ID | Vendors must attach the Smart Contract Reference ID to their invoice to ensure accurate verification and streamline reimbursement processing. Including this unique identifier links the invoice directly to the contractual agreement, reducing delays and errors in payment approval. |

| 8 | EDI 810 Integration File | Vendors must attach an EDI 810 Integration File, a standardized electronic invoice format, to ensure accurate and timely reimbursement processing. This file includes critical transaction details such as invoice number, purchase order reference, item descriptions, quantities, and payment terms to streamline vendor billing workflows. |

| 9 | Microservices Expense Breakdown | Vendors need to attach detailed microservices expense breakdowns, including itemized service descriptions, individual costs, timestamps, and any relevant service agreements to ensure accurate reimbursement. Supporting documents such as purchase orders, delivery receipts, and approval emails must also be included to validate each microservice charge on the invoice. |

| 10 | Automated Workflow Audit Trail | Vendors must attach supporting documents such as purchase orders, delivery receipts, and detailed expense reports to an invoice for reimbursement to ensure a transparent automated workflow audit trail. This audit trail enables accurate tracking and verification of each transaction within the invoice processing system, enhancing compliance and fraud prevention. |

Introduction to Vendor Invoice Documentation

What documents does a vendor need to attach to an invoice for reimbursement? Vendors must provide specific documentation to ensure accurate and timely payment. Proper invoice attachments verify the legitimacy and details of the transaction.

Importance of Accurate Invoice Records

Vendors must attach purchase orders, delivery receipts, and proof of payment to an invoice for reimbursement to ensure transparency and verification. Accurate invoice records support timely processing and reduce disputes, leading to faster reimbursement cycles. Maintaining precise documentation protects your financial interests and strengthens vendor relationships.

Key Components of a Vendor Invoice

When submitting an invoice for reimbursement, vendors must provide clear documentation to ensure smooth processing. Key components include a detailed invoice, proof of delivery, and any related purchase orders.

Your invoice should contain the vendor's name, date, unique invoice number, itemized charges, and payment terms. Attaching supporting documents like receipts, contracts, or signed delivery notes helps verify the transaction and expedites approval.

Required Attachments for Invoice Reimbursement

To ensure smooth invoice reimbursement, vendors need to attach essential supporting documents. These typically include the purchase order, delivery receipts, and proof of payment authorization.

Invoices without these required attachments may face delays or rejection. Keeping your documentation complete and accurate helps expedite the reimbursement process efficiently.

Purchase Orders as Supporting Documentation

Vendors must attach relevant documents to an invoice to ensure successful reimbursement. Purchase Orders serve as crucial supporting documentation by verifying the agreed-upon goods or services and terms. Providing Your Purchase Order along with the invoice expedites the approval and payment process.

Delivery Receipts and Packing Slips

Vendors must provide specific documents alongside an invoice to ensure proper reimbursement. Delivery receipts and packing slips are critical for verifying the shipment and receipt of goods.

- Delivery Receipts - Confirm the date and location where the goods were delivered to the purchaser.

- Packing Slips - Detail the contents of the shipment, including quantities and item descriptions.

- Invoice Matching - Both documents help validate the accuracy of the invoice against the actual delivery.

Submitting these attachments minimizes payment delays and supports transparent transaction records.

Contract Agreements and Amendments

Vendors must attach contract agreements and any related amendments to an invoice for reimbursement purposes. These documents verify the terms and conditions agreed upon, ensuring accurate validation of the charges.

Contract agreements outline the scope of work, payment terms, and deliverables, serving as the primary reference for invoice approval. Amendments reflect any changes or updates made after the original contract, clarifying adjustments in cost or timelines. Including these documents helps you avoid payment delays and ensures compliance with vendor management policies.

Proof of Payment and Bank Statements

| Document Type | Description | Purpose for Reimbursement |

|---|---|---|

| Proof of Payment | A receipt, canceled check, or payment confirmation showing that the vendor has settled the amount related to the invoice. | Confirms the vendor has completed the necessary payment, validating the expense for reimbursement processing. |

| Bank Statements | Official bank documents reflecting transactions and payments made by the vendor. | Verifies the transaction details and supports the authenticity of the payment related to the invoice. |

Attaching proof of payment and bank statements to your invoice ensures a smooth reimbursement process by providing clear evidence of financial transactions.

Compliance with Internal Policies

Vendors must attach specific documents to an invoice to ensure reimbursement aligns with internal policies. Proper documentation facilitates compliance and expedites payment processing.

- Purchase Orders - These confirm the authorization and details of the transaction as per company policy.

- Receipts or Proof of Delivery - Verifies that the goods or services were received in accordance with the invoice.

- Expense Reports - Provide detailed breakdowns supporting the costs claimed for reimbursement.

What Documents Does a Vendor Need to Attach to an Invoice for Reimbursement? Infographic