Small businesses submitting invoices internationally need to include a detailed invoice document specifying the products or services provided, quantities, prices, and total amount due. Essential supporting documents often include a purchase order, shipping documentation like bills of lading or airway bills, and customs declarations to ensure compliance with cross-border regulations. Accurate tax information such as VAT or GST identification numbers and currency details must also be included to facilitate smooth transactions and timely payments.

What Documents Do Small Businesses Need to Submit Invoices Internationally?

| Number | Name | Description |

|---|---|---|

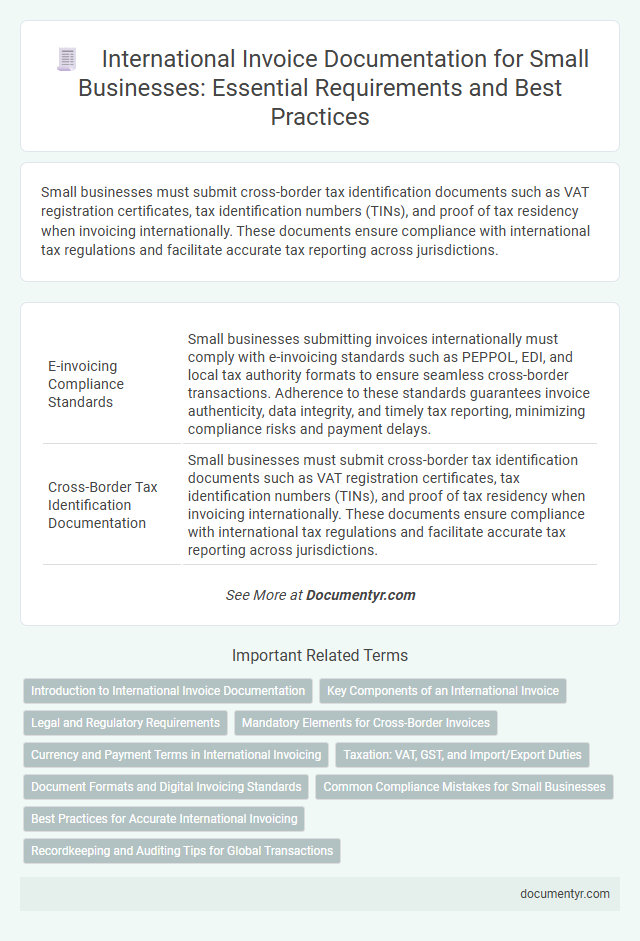

| 1 | E-invoicing Compliance Standards | Small businesses submitting invoices internationally must comply with e-invoicing standards such as PEPPOL, EDI, and local tax authority formats to ensure seamless cross-border transactions. Adherence to these standards guarantees invoice authenticity, data integrity, and timely tax reporting, minimizing compliance risks and payment delays. |

| 2 | Cross-Border Tax Identification Documentation | Small businesses must submit cross-border tax identification documents such as VAT registration certificates, tax identification numbers (TINs), and proof of tax residency when invoicing internationally. These documents ensure compliance with international tax regulations and facilitate accurate tax reporting across jurisdictions. |

| 3 | Electronic Data Interchange (EDI) Certificates | Small businesses submitting invoices internationally must include Electronic Data Interchange (EDI) certificates to ensure compliance with global trading standards and secure data exchange. EDI certificates authenticate the sender's identity, facilitate seamless integration with partners' systems, and help prevent invoice disputes and delays in international transactions. |

| 4 | Invoice Authentication Codes | Small businesses submitting invoices internationally must include Invoice Authentication Codes (IACs) to ensure compliance with cross-border tax regulations and enhance invoice verification accuracy. These unique codes verify the legitimacy of the invoice, facilitating seamless customs clearance and reducing the risk of fraud in international transactions. |

| 5 | Digital Signature Mandates | Small businesses submitting invoices internationally must ensure compliance with digital signature mandates, which vary by country but generally require secure electronic authentication to validate invoice authenticity and prevent fraud. Adopting standardized e-invoicing platforms that support legally recognized digital signatures helps streamline cross-border transactions and meet regulatory requirements efficiently. |

| 6 | Foreign Currency Invoice Declarations | Small businesses submitting invoices internationally must include foreign currency invoice declarations specifying the currency used, exchange rates applied, and the equivalent amount in the seller's home currency to ensure compliance with international trade regulations. Accurate documentation of currency details prevents payment delays and facilitates transparent cross-border financial transactions. |

| 7 | VAT Exemption Certificates | Small businesses submitting invoices internationally must include VAT exemption certificates to validate tax-free transactions when applicable within specific countries or trade agreements. Proper documentation ensures compliance with international tax regulations and facilitates smooth cross-border invoicing processes. |

| 8 | Outsourced Billing Provider Agreements | Small businesses submitting invoices internationally must include Outsourced Billing Provider Agreements to verify authorization and ensure compliance with cross-border payment regulations. These agreements facilitate accurate representation of billing rights, mitigate fraud risks, and streamline reconciliation processes with international clients. |

| 9 | Multi-jurisdictional Remittance Instructions | Small businesses submitting invoices internationally must include multi-jurisdictional remittance instructions detailing currency specifications, tax identification numbers, and compliance with local tax regulations to ensure seamless cross-border payments. Accurate incorporation of bank details, international payment codes such as IBAN and SWIFT, and relevant tax documentation like VAT or GST certificates is crucial for global transaction processing. |

| 10 | PEPPOL Network Access Proof | Small businesses submitting invoices internationally must provide documentation proving their access to the PEPPOL network, including a PEPPOL Access Point certificate and signed agreement with a certified Access Point provider. This proof ensures compliance with e-invoicing standards and enables seamless cross-border invoice exchange within the PEPPOL framework. |

Introduction to International Invoice Documentation

What documents do small businesses need to submit invoices internationally? Small businesses must provide specific documentation to ensure smooth cross-border transactions. Proper invoice documentation helps comply with international trade regulations and avoids payment delays.

Key Components of an International Invoice

Small businesses must include key components when submitting international invoices to ensure clear communication and prompt payment. Essential details include the invoice number, date of issue, and detailed descriptions of goods or services provided. You should also specify the currency, payment terms, and the buyer's and seller's complete contact information.

Legal and Regulatory Requirements

Small businesses submitting invoices internationally must comply with the legal and regulatory requirements of both the exporting and importing countries. This includes accurate documentation such as commercial invoices, tax identification numbers, and proof of shipment.

Invoices must detail product descriptions, quantities, prices, and currency to meet customs regulations. Compliance with international trade agreements and tax laws like VAT or GST ensures smooth cross-border transactions and legal validation.

Mandatory Elements for Cross-Border Invoices

Small businesses must meet specific requirements when submitting invoices internationally to ensure compliance and facilitate smooth transactions. Understanding the mandatory elements of cross-border invoices is essential to avoid delays and financial penalties.

- Invoice Number - A unique identifier that ensures traceability and audit compliance across different tax jurisdictions.

- Seller and Buyer Details - Complete information including names, addresses, and tax identification numbers to verify parties involved.

- Currency and Payment Terms - Clearly stated currency and payment deadlines to avoid confusion and promote timely settlements.

Including these mandatory elements helps small businesses streamline international invoicing and maintain legal and financial accuracy.

Currency and Payment Terms in International Invoicing

Small businesses must clearly state the currency on international invoices to avoid payment delays and currency conversion issues. Accurate currency indication ensures both parties understand the transaction value and financial expectations.

Payment terms are crucial in international invoicing, outlining the due date, acceptable payment methods, and any late payment penalties. Specifying terms such as net 30 or net 60 helps manage cash flow and legal compliance across borders. Clear payment terms reduce disputes and streamline the collection process.

Taxation: VAT, GST, and Import/Export Duties

Small businesses submitting invoices internationally must include tax details such as VAT, GST, and import/export duties to comply with cross-border regulations. These taxes vary by country and directly impact the invoice's total amount and payment processing.

VAT (Value-Added Tax) applies in many countries and requires a registered VAT number on the invoice for tax authorities. GST (Goods and Services Tax) is relevant in regions like Australia and Canada, often mandating detailed tax breakdowns on invoices.

Document Formats and Digital Invoicing Standards

Submitting invoices internationally requires small businesses to adhere to specific document formats and digital invoicing standards. Proper formatting ensures compliance and smooth processing across borders.

- PDF Format - Universally accepted for its fixed layout and ease of sharing without alteration.

- XML Format - Enables structured data exchange and integration with accounting systems worldwide.

- e-Invoicing Standards - Compliance with standards like PEPPOL and UBL facilitates automated processing and legal recognition in different countries.

Common Compliance Mistakes for Small Businesses

Small businesses submitting invoices internationally often overlook essential documentation such as accurate purchase orders, customs declarations, and proof of delivery. Failure to comply with specific country regulations on invoice content, including tax identification numbers and currency details, can lead to payment delays or legal penalties. Understanding and adhering to these requirements ensures smoother cross-border transactions and avoids common compliance mistakes.

Best Practices for Accurate International Invoicing

Submitting invoices internationally requires careful attention to detail and compliance with various regulations to ensure prompt payment. Best practices help maintain accuracy and avoid delays or disputes in cross-border transactions.

- Include Complete and Clear Information - Provide your business name, address, tax identification numbers, and the buyer's details to meet international standards.

- Specify Currency and Payment Terms - Clearly state the invoice currency, exchange rates if applicable, and payment deadlines to prevent confusion.

- Comply with Legal and Tax Requirements - Adhere to customs, VAT, and export regulations based on the countries involved in the transaction.

What Documents Do Small Businesses Need to Submit Invoices Internationally? Infographic