A freelancer must include specific documents to send a valid invoice, such as a detailed description of services provided, the agreed-upon payment terms, and accurate tax identification numbers. Proper documentation also includes the freelancer's contact information, invoice number, and date of issue to ensure clarity and legal compliance. Including these elements helps prevent payment delays and maintains professional business records.

What Documents Does a Freelancer Need to Send a Valid Invoice?

| Number | Name | Description |

|---|---|---|

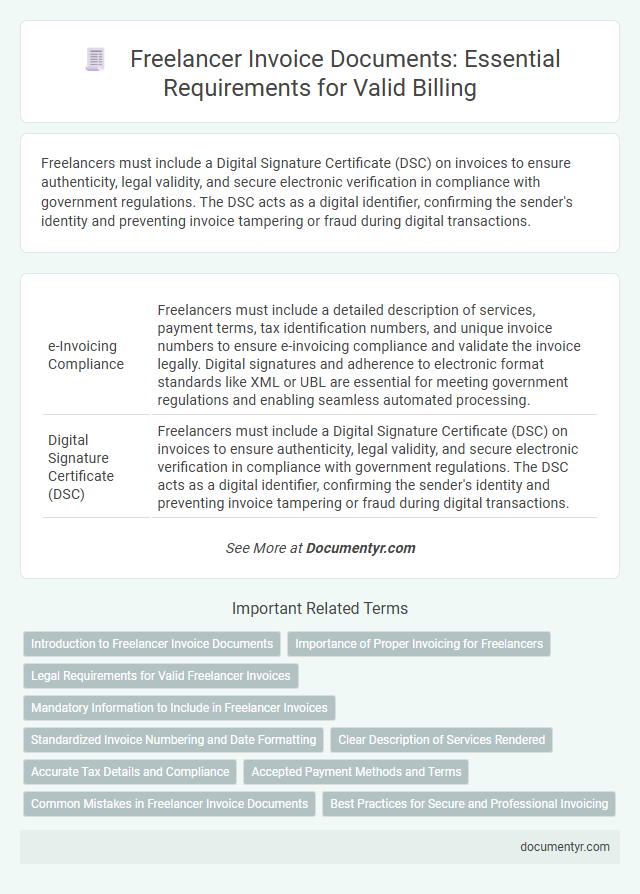

| 1 | e-Invoicing Compliance | Freelancers must include a detailed description of services, payment terms, tax identification numbers, and unique invoice numbers to ensure e-invoicing compliance and validate the invoice legally. Digital signatures and adherence to electronic format standards like XML or UBL are essential for meeting government regulations and enabling seamless automated processing. |

| 2 | Digital Signature Certificate (DSC) | Freelancers must include a Digital Signature Certificate (DSC) on invoices to ensure authenticity, legal validity, and secure electronic verification in compliance with government regulations. The DSC acts as a digital identifier, confirming the sender's identity and preventing invoice tampering or fraud during digital transactions. |

| 3 | Self-Billing Agreement | A freelancer needs a Self-Billing Agreement signed by the client to send a valid invoice, allowing the client to generate invoices on behalf of the freelancer while ensuring compliance with tax regulations. This agreement must clearly outline invoicing responsibilities, payment terms, and VAT details to maintain transparency and legal validity. |

| 4 | Reverse Charge Mechanism Invoice | A freelancer issuing a reverse charge mechanism invoice must include the buyer's VAT identification number, a clear indication of the reverse charge application, and a detailed description of the services provided to comply with tax regulations. The invoice should also specify the total amount excluding VAT and a statement such as "Reverse charge - VAT to be accounted for by the recipient" to ensure validity under EU VAT rules. |

| 5 | Proforma Invoice Template | A freelancer needs to send a proforma invoice template that includes essential details such as the client's information, description of services, payment terms, and total amount due to ensure the invoice is valid. This document serves as a formal quote and helps establish clear expectations before issuing the final invoice for completed work. |

| 6 | Gig Economy Tax Form | Freelancers must include a completed Gig Economy Tax Form, such as a 1099-NEC in the US, alongside their invoice to ensure tax compliance and proper reporting of income. This document verifies the freelancer's tax identification and income details, making the invoice valid for both payment processing and tax purposes. |

| 7 | eReceipts Integration | Freelancers need to include essential documents such as detailed service descriptions, accurate payment terms, and client information to send a valid invoice, with eReceipts integration streamlining the process by automatically attaching proof of transactions and ensuring compliance with digital record-keeping standards. This integration enhances invoice accuracy, reduces errors, and accelerates payment cycles by providing clients with immediate access to verified electronic receipts. |

| 8 | VAT MOSS Declaration | Freelancers must include a VAT MOSS declaration on invoices when supplying digital services to clients within the EU, ensuring compliance with VAT Mini One Stop Shop regulations. The invoice should clearly state the VAT MOSS identification number, the VAT rate applied, and the total VAT amount charged to validate the transaction. |

| 9 | Payment Terms Disclosure | Freelancers must include clear payment terms on their invoices, specifying due dates, acceptable payment methods, and any late payment penalties to ensure transparency and prompt payment. Explicit disclosure of payment terms helps prevent disputes and accelerates cash flow management for freelance services. |

| 10 | Anti-Fraud Watermarking | Freelancers must include essential documents such as a detailed service description, payment terms, and tax identification numbers alongside an anti-fraud watermark on their invoices to ensure authenticity and prevent unauthorized alterations. Incorporating secure watermarking technology enhances invoice security by deterring fraud and providing verifiable proof of originality. |

Introduction to Freelancer Invoice Documents

Freelancers must provide specific documents to ensure their invoices are valid and professional. These documents verify your identity, clarify payment terms, and support financial records. Understanding the necessary components helps streamline the billing process and fosters trust with clients.

Importance of Proper Invoicing for Freelancers

Proper invoicing is essential for freelancers to ensure timely payment and maintain professional credibility. A valid invoice must include specific documents that confirm the services provided and the agreed payment terms.

- Detailed Service Description - Clearly outlines the services rendered to avoid payment disputes and provide transparency.

- Payment Terms and Conditions - Specifies deadlines, methods, and penalties to safeguard the freelancer's financial interests.

- Legal and Tax Information - Includes tax identification numbers and business registration to comply with legal requirements and enable proper record-keeping.

Legal Requirements for Valid Freelancer Invoices

Freelancers must include specific legal details to ensure their invoices are valid. Essential information includes the freelancer's full name, address, tax identification number, and a unique invoice number. The invoice must also clearly state the date, a detailed description of services provided, the payment terms, and the total amount due including applicable taxes.

Mandatory Information to Include in Freelancer Invoices

What mandatory information must a freelancer include in a valid invoice? A valid freelancer invoice must contain the freelancer's name, contact details, and tax identification number. It should also include the client's information, a unique invoice number, the invoice date, and a clear breakdown of services or products provided.

Standardized Invoice Numbering and Date Formatting

| Document Requirement | Description |

|---|---|

| Standardized Invoice Numbering | Freelancers must assign a unique, sequential invoice number to each invoice. This numbering system ensures traceability and compliance with accounting standards. A typical format includes a combination of letters and numbers, such as INV-2024-001. |

| Date Formatting | The invoice must clearly display the issuance date using a standardized format, commonly YYYY-MM-DD. Consistent date formatting prevents misunderstandings and facilitates accurate financial record keeping. |

Clear Description of Services Rendered

A valid invoice from a freelancer must include a clear description of the services rendered to avoid confusion and ensure prompt payment. Detailing the tasks performed increases transparency and serves as a reference for both parties.

- Specific service details - Clearly list each service provided with concise explanations to prevent misunderstandings.

- Quantity or hours worked - Specify the amount of work done, such as hours spent or units delivered, for accurate billing.

- Project or task identification - Include any project names or task references to link the invoice to the agreed work scope.

Providing a precise description of services on an invoice strengthens accountability and facilitates smooth financial transactions.

Accurate Tax Details and Compliance

Accurate tax details are essential for a freelancer to send a valid invoice that complies with legal requirements. Ensuring compliance helps prevent payment delays and potential tax issues.

- Tax Identification Number (TIN) - Include your TIN to authenticate your tax status and enable proper tax reporting.

- Correct Tax Rates - Apply the appropriate tax rates based on local regulations to calculate the tax amount accurately.

- Invoice Date and Payment Terms - Clearly state the invoice date and payment deadlines to maintain compliance and facilitate timely payments.

Accepted Payment Methods and Terms

To send a valid invoice, a freelancer needs to include accepted payment methods such as bank transfers, credit cards, PayPal, or other digital wallets. Clear payment terms specifying deadlines, late fees, and currency are essential to avoid disputes.

You must ensure the invoice outlines payment options and terms in detail, making it easier for clients to process payments promptly. Transparency in these elements strengthens trust and facilitates smooth financial transactions.

Common Mistakes in Freelancer Invoice Documents

Freelancers must include essential information such as client details, invoice number, description of services, payment terms, and tax identification numbers on their invoices. Missing or incorrect data can invalidate the invoice and delay payments.

Common mistakes include omitting the invoice date, failing to specify the payment deadline, and neglecting to add applicable taxes or VAT. Using unclear descriptions for services and forgetting to attach supporting documents like contracts can also cause disputes. Ensuring all required elements are present helps maintain professionalism and facilitates timely payments.

What Documents Does a Freelancer Need to Send a Valid Invoice? Infographic