Electronic invoice submission requires several key documents to ensure accurate processing and compliance. These include the original invoice in a compatible digital format, proof of delivery or service completion, and relevant purchase orders or contracts linked to the transaction. Supporting identification documents, such as tax registration certificates and authorization letters, are also necessary to validate the parties involved.

What Documents are Needed for Electronic Invoice Submission?

| Number | Name | Description |

|---|---|---|

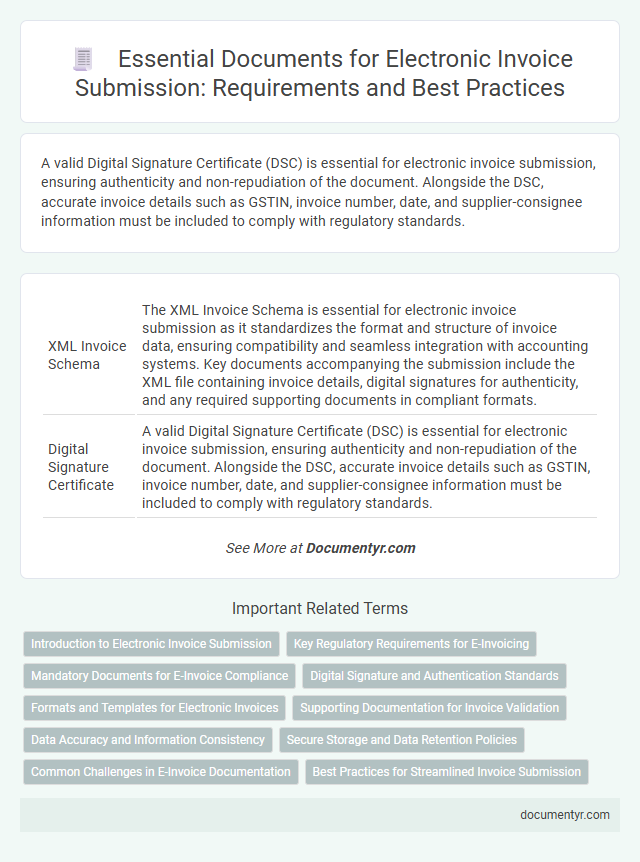

| 1 | XML Invoice Schema | The XML Invoice Schema is essential for electronic invoice submission as it standardizes the format and structure of invoice data, ensuring compatibility and seamless integration with accounting systems. Key documents accompanying the submission include the XML file containing invoice details, digital signatures for authenticity, and any required supporting documents in compliant formats. |

| 2 | Digital Signature Certificate | A valid Digital Signature Certificate (DSC) is essential for electronic invoice submission, ensuring authenticity and non-repudiation of the document. Alongside the DSC, accurate invoice details such as GSTIN, invoice number, date, and supplier-consignee information must be included to comply with regulatory standards. |

| 3 | EDI (Electronic Data Interchange) File | Electronic Invoice Submission through EDI requires a correctly formatted EDI file containing structured transaction sets such as the 810 invoice, which includes essential elements like invoice number, date, payment terms, and detailed product or service descriptions. Supporting documents such as purchase orders (PO 850) and acknowledgment receipts (997 Functional Acknowledgment) are often included or referenced within the EDI transmission to ensure complete and accurate invoice processing. |

| 4 | QR Code Compliance Sheet | The QR Code Compliance Sheet is essential for electronic invoice submission, ensuring the QR code on the invoice meets regulatory standards for accuracy and readability. This document verifies that the encoded data aligns with tax authority requirements, facilitating seamless validation and processing. |

| 5 | Unique Invoice Reference Number (IRN) | The Unique Invoice Reference Number (IRN) is a critical document required for electronic invoice submission, serving as a digital fingerprint that ensures the authenticity and integrity of the invoice. This 64-character alphanumeric code, generated by the Invoice Registration Portal (IRP), must be included alongside the digitally signed invoice JSON for successful submission and compliance with GST regulations. |

| 6 | JSON Payload for E-Invoice | The JSON payload for electronic invoice submission must include essential data fields such as invoice number, date, supplier and buyer details, item descriptions, quantities, prices, tax information, and total amounts to ensure compliance with tax authority requirements. Structured JSON formats enable seamless validation, automated processing, and integration with accounting systems, facilitating accurate and efficient e-invoice transmission. |

| 7 | Real-Time Invoice Validation Receipt | Electronic invoice submission requires uploading the invoice file along with the Real-Time Invoice Validation Receipt, which confirms the invoice has been verified by tax authorities instantly. This receipt includes essential data such as validation timestamp, unique invoice identification number, and approval status, ensuring compliance and facilitating seamless processing. |

| 8 | API Integration Checklist | Essential documents for electronic invoice submission include the API integration checklist detailing authentication credentials, endpoint URLs, data format specifications (XML/JSON), security protocols (OAuth, SSL), and error handling procedures to ensure seamless communication between systems. Compliance with local tax authority requirements and inclusion of mandatory fields such as invoice number, date, supplier details, and tax codes are critical for successful API-based invoicing. |

| 9 | GST E-Invoice Authentication Token | GST E-Invoice Authentication Token is essential for validating and submitting electronic invoices under the GST framework, ensuring compliance and authenticity. Required documents typically include the digitally signed e-invoice JSON, the GSTIN of the supplier, and the Authentication Token provided by the IRP (Invoice Registration Portal) for seamless invoice matching and reconciliation. |

| 10 | Peppol BIS Billing Documentation | Peppol BIS Billing Documentation requires electronic invoices to include standardized data elements such as invoice number, issue date, supplier and buyer identification, line item details, tax information, and payment terms to ensure compliance with e-invoicing regulations. Properly formatted XML files adhering to Peppol BIS standards facilitate seamless invoice processing and validation across participating organizations. |

Introduction to Electronic Invoice Submission

Electronic invoice submission streamlines the billing process by enabling digital transfer of invoice data. It reduces paper usage and accelerates payment cycles for businesses.

To ensure smooth submission, specific documents must be prepared and formatted according to regulatory standards. Proper documentation supports compliance and verification during electronic processing.

Key Regulatory Requirements for E-Invoicing

The key regulatory requirements for electronic invoice submission include the presence of a valid tax identification number, accurate transaction details, and compliance with the specific e-invoicing format mandated by tax authorities. Required documents often encompass the electronic invoice file itself, digital signatures for authentication, and supporting transaction records such as purchase orders or delivery notes. Ensuring these elements meet legal standards accelerates processing and reduces the risk of audit issues.

Mandatory Documents for E-Invoice Compliance

Submitting an electronic invoice requires specific mandatory documents to ensure compliance with legal and tax regulations. Proper documentation guarantees accurate processing and validation of the invoice data.

- Invoice Data File - Contains all transaction details including buyer, seller, item description, quantity, and price in a prescribed electronic format.

- Digital Signature - Certifies the authenticity of the invoice and secures the integrity of the document.

- Tax Identification Numbers - Valid tax IDs for both supplier and recipient must be included for regulatory verification.

Ensuring these mandatory documents are complete and accurate is essential for successful e-invoice submission and compliance.

Digital Signature and Authentication Standards

What documents are needed for electronic invoice submission regarding digital signature and authentication standards? You must provide a digitally signed invoice that complies with recognized authentication protocols such as XAdES, PAdES, or CAdES. These standards ensure the integrity and authenticity of your electronic invoice, preventing tampering and fraud.

Formats and Templates for Electronic Invoices

Electronic invoice submission requires specific documents to ensure compliance and smooth processing. These documents typically include the electronic invoice file in an accepted format and any related supporting documents.

Common formats for electronic invoices include XML, PDF, and EDI, with XML being the most widely used due to its structured data capabilities. Standard templates often follow industry or government specifications, such as UBL (Universal Business Language) or PEPPOL standards. You should ensure your electronic invoices adhere to the required format and template to avoid submission errors and delays.

Supporting Documentation for Invoice Validation

Electronic invoice submission requires accurate supporting documentation to ensure proper validation and processing. These documents verify the invoice details and confirm compliance with tax and regulatory standards.

- Purchase Order (PO) - A purchase order links the invoice to the original order, confirming the transaction's legitimacy and agreed terms.

- Delivery Receipt - Delivery receipts validate that goods or services were received as billed in the invoice.

- Tax Identification Documents - Tax IDs and related certificates verify the legal and tax status of the entities involved, ensuring proper tax reporting.

Data Accuracy and Information Consistency

| Required Documents for Electronic Invoice Submission |

|---|

| Invoice Document: The primary electronic invoice file must be accurately prepared, containing all necessary billing details such as invoice number, date, item descriptions, quantities, unit prices, and total amount. |

| Purchase Order: A matching purchase order reference ensures consistency between the buyer's request and the invoice details, reinforcing data accuracy. |

| Proof of Delivery or Service Completion: Documentation verifying that goods or services were delivered or performed confirms the legitimacy of the invoice entries. |

| Tax Documentation: Applicable tax identification numbers and tax calculation details must be consistent and compliant with local tax regulations. |

| Supplier Information: Correct and consistent supplier data such as registered company name, address, and contact information enhance the reliability of the submission. |

| Payment Terms and Conditions: Clearly stated terms support transparency and prevent discrepancies between payer and payee. |

| Compliance Certificates (if applicable): Certifications required by regulatory bodies or industry standards verify adherence to electronic invoicing rules. |

| Accurate Data Entry and Information Consistency remain critical throughout the documentation. Any mismatch or error can delay processing and payment. Ensure your electronic invoice matches all related documents precisely to facilitate smooth transaction flow. |

Secure Storage and Data Retention Policies

Electronic invoice submission requires essential documents such as the invoice itself, proof of delivery, and supplier information. Secure storage ensures these records remain protected against unauthorized access and data breaches. Your data retention policies must comply with legal regulations, maintaining invoice records for the required duration to support audits and financial reporting.

Common Challenges in E-Invoice Documentation

Submitting an electronic invoice requires precise documentation to ensure compliance and smooth processing. Common challenges often arise from missing or incorrect information that delays payment and verification.

- Incomplete Invoice Details - Missing invoice numbers, dates, or amounts can lead to rejection by the e-invoicing system.

- Inconsistent Data Formats - Variations in date formats or currency codes create processing errors in electronic submissions.

- Lack of Required Supporting Documents - Failure to include purchase orders or delivery confirmations hinders validation and approval workflows.

What Documents are Needed for Electronic Invoice Submission? Infographic