Validating an invoice for government contracts requires submitting purchase orders, delivery receipts, and signed contracts as primary documents. Detailed invoices must include itemized descriptions, quantities, unit prices, and total amounts aligned with contract terms. Supporting documents such as approval forms, certification of compliance, and expense reports are often necessary to ensure transparency and accuracy.

What Documents are Needed to Validate an Invoice for Government Contracts?

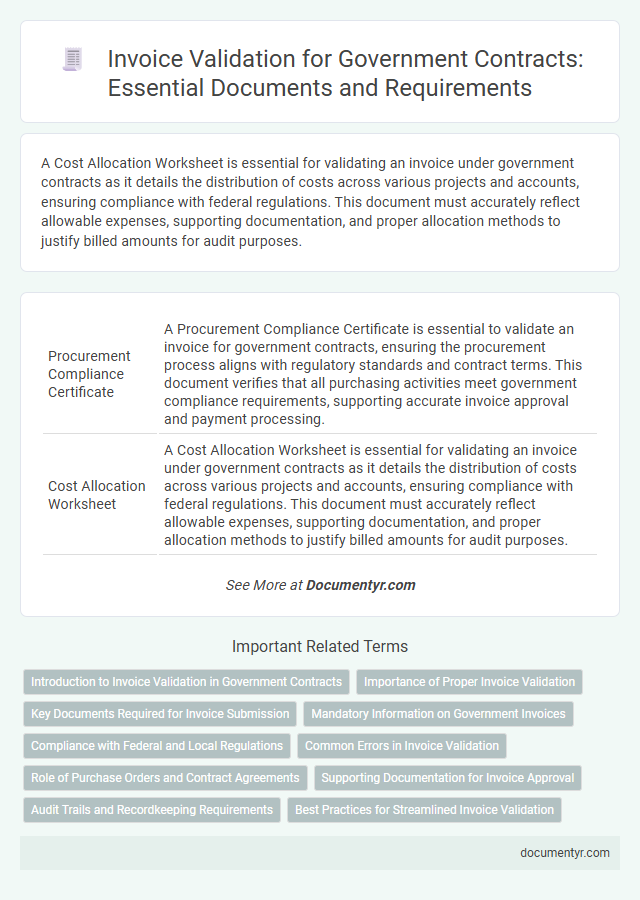

| Number | Name | Description |

|---|---|---|

| 1 | Procurement Compliance Certificate | A Procurement Compliance Certificate is essential to validate an invoice for government contracts, ensuring the procurement process aligns with regulatory standards and contract terms. This document verifies that all purchasing activities meet government compliance requirements, supporting accurate invoice approval and payment processing. |

| 2 | Cost Allocation Worksheet | A Cost Allocation Worksheet is essential for validating an invoice under government contracts as it details the distribution of costs across various projects and accounts, ensuring compliance with federal regulations. This document must accurately reflect allowable expenses, supporting documentation, and proper allocation methods to justify billed amounts for audit purposes. |

| 3 | Time-and-Materials Justification Form | To validate an invoice for government contracts, especially under Time-and-Materials (T&M) contracts, the Time-and-Materials Justification Form is essential as it details labor hours, material costs, and rate justifications required by contracting agencies. This form ensures compliance with Federal Acquisition Regulation (FAR) guidelines by providing transparent documentation of incurred costs and labor classifications linked to the invoice. |

| 4 | Contract Line Item Number (CLIN) Breakdown | Validating an invoice for government contracts requires a detailed Contract Line Item Number (CLIN) breakdown to ensure each billed item corresponds accurately to the contract specifications and pricing. Essential documents include the contract or purchase order highlighting CLIN details, delivery receipts, and any approved modifications or change orders directly linked to each CLIN. |

| 5 | eSRS (Electronic Subcontracting Reporting System) Acknowledgment | Validating an invoice for government contracts requires the eSRS (Electronic Subcontracting Reporting System) Acknowledgment to confirm compliance with subcontracting plans. This acknowledgment verifies that all subcontracting efforts meet federal requirements, ensuring the invoice's eligibility for payment. |

| 6 | Certified Payroll Documentation | Certified payroll documentation is essential to validate an invoice for government contracts, providing detailed records of employee wages, hours worked, and compliance with prevailing wage laws. These documents ensure transparency and adherence to Department of Labor requirements, facilitating accurate invoice approval and payment processing. |

| 7 | FAR (Federal Acquisition Regulation) Reference Sheet | To validate an invoice for government contracts, essential documents include a completed invoice form compliant with FAR Part 32.905, contract or purchase order referencing the specific FAR clauses, and certified time records or delivery receipts that align with FAR Subpart 4.7 requirements. Supporting documentation must demonstrate compliance with FAR clauses on allowable costs, payment terms, and invoice submission procedures to ensure accurate verification and prompt payment. |

| 8 | Small Business Subcontracting Plan Evidence | Validating an invoice for government contracts requires submitting the Small Business Subcontracting Plan Evidence, which includes approved subcontracting plans, flow-down clauses to subcontractors, and periodic compliance reports showing subcontracting goals are met. Documentation must verify adherence to negotiated small business participation targets, ensuring invoice approval aligns with federal acquisition regulations. |

| 9 | Prompt Payment Act Affidavit | To validate an invoice for government contracts, the Prompt Payment Act Affidavit is essential as it certifies compliance with timely payment requirements and verifies that all subcontractors have been paid accordingly. This affidavit, along with purchase orders, contracts, and proof of delivery, ensures the invoice meets federal regulations and facilitates prompt processing. |

| 10 | SAM.gov Registration Validation Report | The SAM.gov Registration Validation Report is essential to verify a vendor's eligibility and active status in federal contracting, ensuring compliance with government invoicing requirements. Alongside the invoice, supporting documents such as the valid SAM.gov report, contract award notices, and proper purchase orders are critical to validate government contract payments accurately. |

Introduction to Invoice Validation in Government Contracts

Invoice validation is a critical process in government contracts ensuring that submitted invoices meet all regulatory and contractual requirements. Accurate validation prevents payment delays and compliance issues.

To validate an invoice for government contracts, specific documents are required, such as the contract agreement, delivery receipts, and approval certifications. Your invoice must align with the terms outlined in these documents to be processed successfully. Proper documentation verifies that the goods or services billed were delivered and authorized according to government standards.

Importance of Proper Invoice Validation

What documents are needed to validate an invoice for government contracts? Proper invoice validation requires a purchase order, delivery receipt, and a signed contract to ensure compliance with government regulations. This process minimizes payment errors and accelerates approval times.

Why is proper invoice validation important in government contracts? Accurate validation protects your organization from fraud and financial discrepancies while maintaining transparency in public sector transactions. It also helps in meeting strict audit requirements and avoiding payment delays.

Key Documents Required for Invoice Submission

Validating an invoice for government contracts requires submitting specific key documents to ensure compliance and prompt payment. These documents confirm the accuracy of the billed amounts and the fulfillment of contract terms.

- Purchase Order (PO) - This document authorizes the purchase and specifies the contracted products or services.

- Delivery Receipt or Proof of Service - Evidence that goods or services were delivered or completed as agreed in the contract.

- Invoice Document - A detailed invoice showing itemized charges, payment terms, and contract references for proper verification.

Mandatory Information on Government Invoices

Validating an invoice for government contracts requires specific mandatory information to ensure compliance with regulations. Your invoice must include the contract number, detailed description of goods or services, and the exact payment amount. Proper inclusion of these details facilitates timely processing and approval by government agencies.

Compliance with Federal and Local Regulations

Validating an invoice for government contracts requires a set of specific documents to ensure compliance with federal and local regulations. These documents typically include a detailed invoice, purchase orders, and proof of delivery or service completion.

Invoices must also include tax identification numbers, contract numbers, and any required certifications or licenses relevant to the contract. Your submission should align with the Federal Acquisition Regulation (FAR) and any state or local procurement rules to guarantee payment approval.

Common Errors in Invoice Validation

To validate an invoice for government contracts, you must provide purchase orders, delivery receipts, and signed contracts. Common errors in invoice validation include mismatched invoice numbers, incorrect contract references, and missing approval signatures. Ensuring accuracy in these documents prevents delays and payment rejections.

Role of Purchase Orders and Contract Agreements

Validating an invoice for government contracts requires essential documents to ensure compliance and accuracy. The purchase order serves as a critical reference, confirming the approved goods or services and agreed pricing.

Contract agreements establish the terms, conditions, and obligations between parties, providing a foundational basis for invoice validation. Together, purchase orders and contract agreements verify the legitimacy of the invoice and support payment approval in government procurement processes.

Supporting Documentation for Invoice Approval

Validating an invoice for government contracts requires specific supporting documentation to ensure compliance and approval. These documents confirm the accuracy and legitimacy of the invoiced amounts and services provided.

- Purchase Order (PO) - The PO verifies the agreed-upon goods or services and the authorized contract terms.

- Delivery Receipts or Proof of Service - These validate that the contracted supplies or services were received or performed as specified.

- Timesheets or Work Logs - Required for labor-based contracts, these documents confirm the hours worked and personnel involved.

Your invoice approval depends on submitting complete and accurate supporting documentation that aligns with the government contract requirements.

Audit Trails and Recordkeeping Requirements

| Document Type | Description | Relevance to Audit Trails and Recordkeeping |

|---|---|---|

| Purchase Order | Official government-issued document authorizing the purchase. | Serves as primary evidence for contract terms and confirms scope of work, forming the base of the audit trail. |

| Invoice | Detailed bill submitted for payment including itemized charges and dates. | Central document in recordkeeping; must include invoice number, dates, and payment details for traceability. |

| Delivery Receipts and Acceptance Certificates | Proof of goods or services delivered and officially accepted by the government entity. | Essential to confirm fulfillment of contract obligations; part of audit trail validating invoice accuracy. |

| Timesheets and Labor Reports | Documents detailing labor hours worked by personnel on the contract. | Important for verifying labor costs charged on the invoice and maintaining compliance with recordkeeping policies. |

| Supporting Financial Records | Includes receipts, subcontractor invoices, and other cost documents. | Used to substantiate charges claimed; critical for transparent audit trails and compliance with government standards. |

| Contract Agreement | Formal legal document outlining terms, conditions, pricing, and compliance requirements. | Reference point for verifying invoice validity; mandatory for audit purposes to ensure contractual adherence. |

| Internal Approval Forms | Records of internal reviews and authorizations before invoice submission. | Supports accountability and audit readiness by maintaining detailed recordkeeping of validation steps. |

| Payment Records | Proof of received payments including bank statements and payment confirmations. | Critical for reconciling invoiced amounts and maintaining a complete audit trail. |

To validate an invoice for government contracts, your documentation must fulfill stringent audit trail and recordkeeping requirements. Accurate and complete records enable transparent verification, reduce risks of discrepancies, and ensure compliance with federal regulations.

What Documents are Needed to Validate an Invoice for Government Contracts? Infographic