An exporter needs several key documents for commercial invoice verification, including the commercial invoice itself, packing list, bill of lading, and certificate of origin. Customs authorities also require export permits and relevant insurance certificates to ensure compliance with regulations. Accurate documentation ensures smooth customs clearance and prevents delays in the shipping process.

What Documents Does an Exporter Need for Commercial Invoice Verification?

| Number | Name | Description |

|---|---|---|

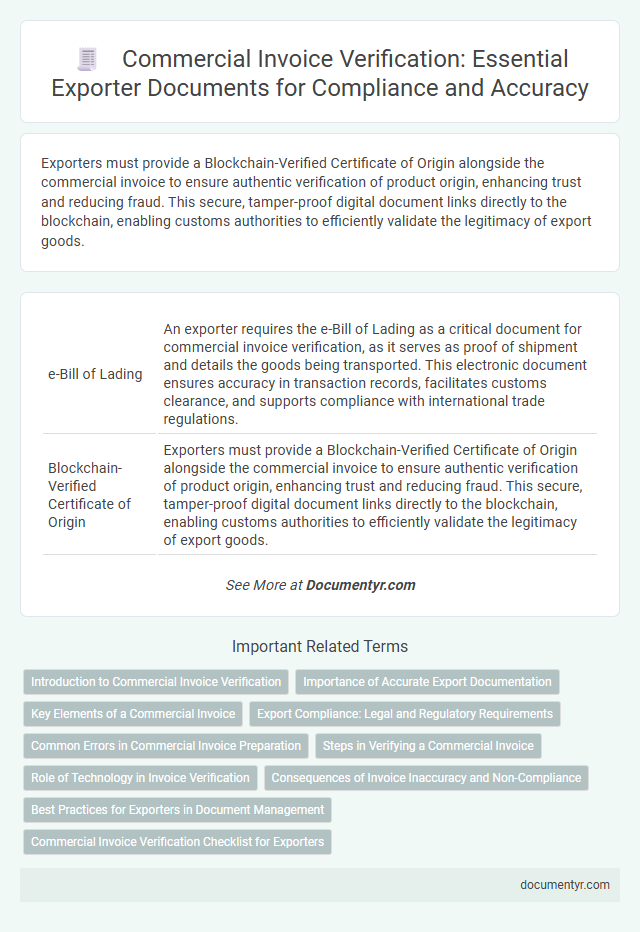

| 1 | e-Bill of Lading | An exporter requires the e-Bill of Lading as a critical document for commercial invoice verification, as it serves as proof of shipment and details the goods being transported. This electronic document ensures accuracy in transaction records, facilitates customs clearance, and supports compliance with international trade regulations. |

| 2 | Blockchain-Verified Certificate of Origin | Exporters must provide a Blockchain-Verified Certificate of Origin alongside the commercial invoice to ensure authentic verification of product origin, enhancing trust and reducing fraud. This secure, tamper-proof digital document links directly to the blockchain, enabling customs authorities to efficiently validate the legitimacy of export goods. |

| 3 | Electronic Export Information (EEI) Filing Receipt | Exporters must provide the Electronic Export Information (EEI) Filing Receipt as a crucial document for commercial invoice verification, ensuring compliance with U.S. Census Bureau regulations. The EEI Filing Receipt confirms that export data has been accurately submitted through the Automated Export System (AES), facilitating customs clearance and shipment processing. |

| 4 | Digital Letter of Credit | Exporters require the digital letter of credit along with the commercial invoice to ensure secure and accurate verification under international trade protocols, as it electronically guarantees payment terms between buyer and seller. Supporting documents such as the packing list, bill of lading, and certificates of origin are frequently cross-referenced during this digital verification process to meet compliance and customs regulations. |

| 5 | Advance Cargo Information (ACI) Certificate | Exporters require the Advance Cargo Information (ACI) Certificate for commercial invoice verification to comply with customs regulations and ensure accurate cargo documentation. This certificate provides detailed shipment data, facilitating the validation of invoice particulars and preventing clearance delays. |

| 6 | e-Manifest Declaration | For commercial invoice verification, exporters must provide the e-Manifest Declaration, which contains detailed cargo information required by customs authorities to ensure compliance and facilitate smooth clearance. This electronically submitted document aligns shipment details with the commercial invoice, enabling accurate validation of goods and preventing discrepancies during export processing. |

| 7 | Automated Commercial Environment (ACE) Entry Summary | Exporters require accurate documentation such as the Automated Commercial Environment (ACE) Entry Summary to ensure commercial invoice verification aligns with U.S. Customs and Border Protection regulations. The ACE Entry Summary provides detailed shipment data, including tariff classifications, quantities, and values, critical for validating invoice accuracy and compliance. |

| 8 | Harmonized System (HS) Code Audit Trail | Exporters must provide the commercial invoice along with shipping documents, packing lists, and the Harmonized System (HS) Code audit trail to ensure accurate tariff classification and customs compliance. The HS Code audit trail includes prior declarations, product descriptions, and classification decisions that validate the consistency and correctness of the HS codes used in the commercial invoice verification process. |

| 9 | Smart Customs Declaration Form | Exporters must submit the Smart Customs Declaration Form along with their commercial invoice to ensure accurate verification and compliance with customs regulations. This form facilitates electronic data exchange, streamlining the validation of invoice details such as product description, quantity, and declared value. |

| 10 | Digital Proforma Invoice Validation | Digital proforma invoice validation requires exporters to provide a verified copy of the digital proforma invoice, accompanied by authenticated shipping documents, customs declarations, and payment confirmation records to ensure commercial invoice accuracy and compliance. Integration with electronic data interchange (EDI) systems enhances verification efficiency by cross-referencing transaction details with regulatory databases. |

Introduction to Commercial Invoice Verification

What documents does an exporter need for commercial invoice verification? The commercial invoice verification process ensures that all transaction details comply with international trade regulations. Exporters must prepare accurate and complete documentation to facilitate smooth customs clearance and payment processing.

Importance of Accurate Export Documentation

Accurate export documentation is crucial for the successful verification of commercial invoices in international trade. Proper documentation ensures compliance with customs regulations and smooth transaction processing.

- Commercial Invoice - Serves as the primary document detailing the sale transaction between the exporter and importer.

- Packing List - Provides itemized shipment information, aiding customs officials in verifying the contents of the shipment.

- Export License - Authorizes the legal export of restricted goods, ensuring adherence to trade regulations.

Key Elements of a Commercial Invoice

| Key Elements of a Commercial Invoice | Description |

|---|---|

| Exporter and Importer Information | Names, addresses, and contact details of the exporter and importer are essential for identifying the transaction parties. |

| Invoice Number and Date | A unique invoice number and the date of issuance provide a reference for tracking and auditing purposes. |

| Detailed Description of Goods | A precise description including quantity, unit of measure, weight, and packaging details is necessary to verify the shipment contents. |

| Unit Price and Total Value | The price per unit and total invoice value must be clearly stated to validate the commercial transaction's worth. |

| Currency of Transaction | The currency in which the invoice amount is denominated ensures clarity for customs valuation and payment terms. |

| Terms of Sale (Incoterms) | Specifying Incoterms clarifies responsibilities for shipping, insurance, and risk transfer between buyer and seller. |

| Country of Origin | Indicates where the goods were manufactured or produced, important for customs and trade compliance. |

| Signature and Authorization | Your commercial invoice often requires a signature or authorized stamp to verify its authenticity and legal validity. |

Export Compliance: Legal and Regulatory Requirements

Exporters must provide accurate commercial invoices to comply with international trade regulations and customs requirements. These invoices serve as proof of transaction value and must include detailed descriptions of goods, quantities, and prices.

Supporting documents such as export licenses, certificates of origin, and packing lists are essential for commercial invoice verification. Ensuring adherence to export compliance laws prevents delays, fines, and legal penalties during cross-border shipments.

Common Errors in Commercial Invoice Preparation

Exporters must submit accurate documents for commercial invoice verification to avoid shipment delays and customs issues. Common errors in commercial invoice preparation often lead to rejections or fines.

- Incorrect Product Description - Vague or inaccurate product descriptions can cause customs clearance problems and misclassification of goods.

- Inconsistent Pricing Details - Discrepancies between invoice prices and purchase orders raise suspicion and may result in additional scrutiny or penalties.

- Missing Shipping Information - Omitting essential details such as country of origin or consignee information delays verification and shipment processing.

Steps in Verifying a Commercial Invoice

Verifying a commercial invoice is a critical step for exporters to ensure smooth customs clearance and accurate transaction records. Proper documentation supports compliance with trade regulations and prevents shipment delays.

- Review the Purchase Order - Confirm that the commercial invoice details match the purchase order regarding product descriptions, quantities, and prices.

- Validate Shipping Documents - Cross-check the invoice against the bill of lading and packing list to ensure consistency of shipment details.

- Confirm Compliance Certificates - Verify inclusion of necessary certificates such as certificate of origin or export licenses required by the destination country.

Accurate verification of the commercial invoice and related documents is essential for exporting compliance and efficient customs processing.

Role of Technology in Invoice Verification

Exporters need essential documents such as the commercial invoice, packing list, bill of lading, and certificates of origin for accurate commercial invoice verification. Technology plays a crucial role by automating data validation, reducing manual errors, and speeding up the verification process. Your use of advanced software tools ensures compliance and enhances the efficiency of cross-border trade transactions.

Consequences of Invoice Inaccuracy and Non-Compliance

Exporters must provide accurate commercial invoices along with supporting documents such as packing lists, certificates of origin, and export licenses for verification. These documents ensure compliance with customs regulations and facilitate smooth cross-border transactions.

Invoice inaccuracies or non-compliance can lead to shipment delays, fines, and possible seizure of goods by customs authorities. Errors in pricing, product description, or missing documentation increase the risk of audits and legal penalties. Your failure to meet verification standards damages business reputation and incurs additional operational costs.

Best Practices for Exporters in Document Management

Exporters must prepare several key documents for commercial invoice verification, including the original commercial invoice, packing list, and bill of lading. Accurate documentation ensures smooth customs clearance and reduces the risk of shipment delays or fines. Implementing best practices in document management, such as organizing digital copies and maintaining clear records, will streamline the verification process and enhance compliance.

What Documents Does an Exporter Need for Commercial Invoice Verification? Infographic