Freelancers need a valid identification document, such as a passport or national ID, and their tax identification number to issue an invoice. They should include detailed descriptions of the services provided, payment terms, and the client's information on the invoice. Some regions may require registration proof or specific business licenses to validate the invoice legally.

What Documents Does a Freelancer Need to Issue an Invoice?

| Number | Name | Description |

|---|---|---|

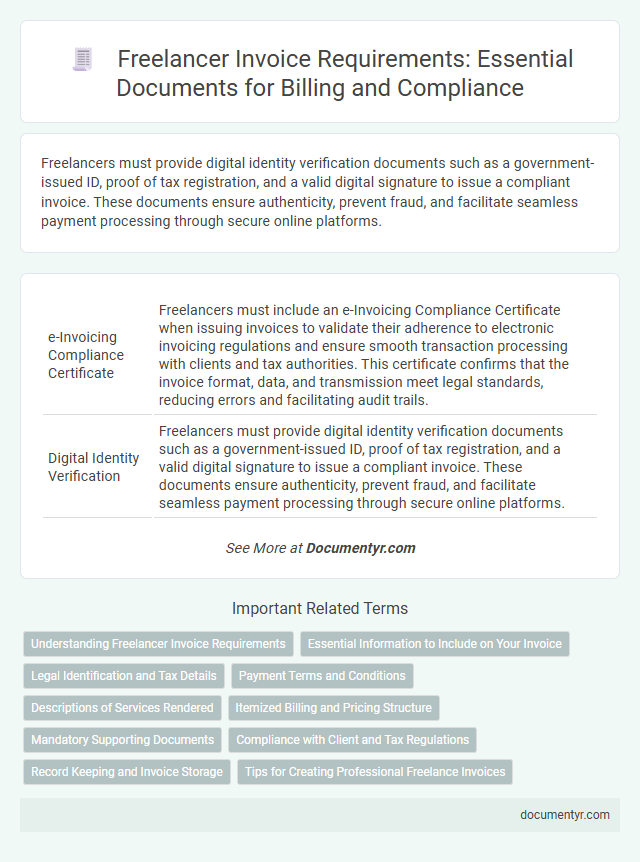

| 1 | e-Invoicing Compliance Certificate | Freelancers must include an e-Invoicing Compliance Certificate when issuing invoices to validate their adherence to electronic invoicing regulations and ensure smooth transaction processing with clients and tax authorities. This certificate confirms that the invoice format, data, and transmission meet legal standards, reducing errors and facilitating audit trails. |

| 2 | Digital Identity Verification | Freelancers must provide digital identity verification documents such as a government-issued ID, proof of tax registration, and a valid digital signature to issue a compliant invoice. These documents ensure authenticity, prevent fraud, and facilitate seamless payment processing through secure online platforms. |

| 3 | PEPPOL Registration Document | Freelancers must have their PEPPOL registration document to issue compliant electronic invoices within the PEPPOL network, ensuring seamless cross-border transactions and adherence to digital invoicing standards. This registration validates their identity and enables secure document exchange with government agencies and corporate clients, streamlining invoice processing and payment. |

| 4 | Business Structure Declaration | A freelancer needs to include a Business Structure Declaration on an invoice, specifying whether they operate as a sole proprietor, LLC, or corporation to ensure legal clarity and tax compliance. This declaration supports accurate identification by clients and tax authorities, streamlining payment processing and regulatory adherence. |

| 5 | KYC (Know Your Customer) Form | Freelancers need to complete a KYC (Know Your Customer) form as part of the documentation required to issue an invoice, ensuring client identity verification for compliance and payment processing. This form typically includes personal details, tax identification numbers, and proof of address, which safeguard against fraud and support legal invoicing standards. |

| 6 | Tax Residency Self-Certification | Freelancers must include a Tax Residency Self-Certification when issuing invoices to verify their tax jurisdiction and comply with international tax regulations. This document ensures proper withholding tax rates and prevents double taxation by confirming the freelancer's country of tax residence. |

| 7 | Eco-Friendly Invoicing Statement | Freelancers must include key documents such as a detailed service description, client information, payment terms, and tax identification numbers when issuing an invoice, ensuring compliance with local regulations. Incorporating an eco-friendly invoicing statement, like a note encouraging digital receipt usage or minimizing paper printouts, promotes sustainability and aligns with green business practices. |

| 8 | Cryptocurrency Payment Disclosure | Freelancers must include precise details in their invoices when accepting cryptocurrency payments, such as the type of cryptocurrency, transaction ID, wallet address, and the equivalent value in the agreed fiat currency at the time of payment. Clear disclosure of these elements ensures accurate tax reporting and compliance with financial regulations governing digital asset transactions. |

| 9 | PSD2 (Payment Services Directive 2) Authorization | Freelancers issuing invoices must ensure compliance with PSD2 Authorization, which governs secure payment services to enhance transparency and consumer protection. Including relevant payment details aligned with PSD2 standards helps validate transactions and supports seamless payment processing. |

| 10 | Invoice Factoring Agreement | Freelancers issuing invoices should include an Invoice Factoring Agreement when transferring receivables to a third party for immediate payment, ensuring clear terms on payment responsibilities and fees. This document outlines the assignment of invoice rights, protecting both freelancer and factoring company during the financing process. |

Understanding Freelancer Invoice Requirements

Freelancers must identify and include specific documents to issue a valid invoice. These ensure compliance with legal and tax regulations, protecting both the freelancer and the client.

Key documents include a valid tax identification number (TIN) and proof of the service agreement. Including detailed descriptions of services, payment terms, and dates is essential for accurate invoicing.

Essential Information to Include on Your Invoice

Freelancers must provide specific documents to issue a valid invoice, ensuring clarity and professionalism in financial transactions. An invoice typically includes details such as project description, service dates, and payment terms.

Essential information on your invoice includes your business name, address, and contact details, along with the client's information. Clear itemization of services rendered, invoice number, date of issue, and total amount due are crucial for smooth processing and record-keeping.

Legal Identification and Tax Details

Freelancers must include their legal identification, such as full name and business registration number, on an invoice to establish authenticity. Tax details like VAT or GST number are crucial for compliance with local tax regulations and ensure proper tax reporting. Including these elements helps validate the invoice for both the freelancer and the client, facilitating smooth financial transactions.

Payment Terms and Conditions

Payment terms and conditions are essential documents for freelancers when issuing an invoice. They clarify the expectations for timely payment and protect both parties from misunderstandings.

- Clear payment deadline - Specify the exact due date, such as "Net 30 days," to ensure prompt payment.

- Accepted payment methods - List options like bank transfer, PayPal, or credit card to offer convenience to your client.

- Late payment fees - Define any penalties or interest applied if the client misses the payment deadline.

Descriptions of Services Rendered

When issuing an invoice, including detailed descriptions of services rendered is essential for clarity and transparency. Clearly outline each task performed, the scope of work, and the time spent to avoid misunderstandings with clients. Your invoice should provide enough information for clients to understand the value of the services provided and to facilitate smooth payment processing.

Itemized Billing and Pricing Structure

Freelancers need to include itemized billing in their invoices to clearly outline each service provided and its corresponding cost. This transparency helps clients understand the pricing structure and reduces the likelihood of payment disputes.

Itemized billing breaks down tasks or deliverables with specific prices, hours worked, or quantities involved. Clear pricing structure ensures that clients see exactly what they are being charged for each service. Including details such as rates, taxes, and any discounts improves the professionalism and clarity of the invoice.

Mandatory Supporting Documents

Freelancers must provide specific documents to ensure their invoices are valid and comply with legal standards. These mandatory supporting documents verify the authenticity of the transaction and facilitate smooth payment processing.

- Copy of the Contract or Agreement - This document outlines the terms of work and confirms the freelancer-client relationship.

- Proof of Service Delivery - Examples include project files, completed work reports, or delivery receipts that validate service completion.

- Tax Identification Number (TIN) or VAT Registration - This document is required for tax reporting and compliance purposes.

Compliance with Client and Tax Regulations

What documents does a freelancer need to issue an invoice? A freelancer must have a valid tax identification number and a service agreement or contract with the client. These documents ensure compliance with both client requirements and tax regulations.

Record Keeping and Invoice Storage

| Document Type | Purpose | Record Keeping Importance |

|---|---|---|

| Invoice Copies | Proof of services delivered and payment terms | Essential for tracking payments, tax reporting, and client disputes |

| Contracts or Agreements | Defines project scope, deliverables, and agreed prices | Supports invoice validity and clarifies billing details in records |

| Payment Receipts | Confirms payment has been received from the client | Critical for financial reconciliation and audit trails |

| Expense Records | Documents costs related to the freelance projects | Important for accurate profit calculation and tax deductions |

| Tax Documents | Includes VAT numbers, tax registration certificates | Required for legal compliance and proper invoicing |

| Invoice Storage Solutions | Physical folders or digital cloud storage platforms | Ensures secure, organized, and easy retrieval of invoice data |

| Record Retention Period | Typically 5-7 years depending on jurisdiction | Complies with legal requirements and aids in potential audits |

What Documents Does a Freelancer Need to Issue an Invoice? Infographic