For e-invoice submission in India, the essential documents include the purchase order, delivery challan, and the tax invoice itself, which must be digitally generated and contain a unique Invoice Reference Number (IRN). Businesses must also ensure that GST details, such as the supplier and recipient GSTIN, invoice date, and taxable value, are accurately mentioned. Proper digital signatures and compliance with the Invoice Registration Portal (IRP) guidelines are mandatory for the validity of the e-invoice.

What Documents are Necessary for E-Invoice Submission in India?

| Number | Name | Description |

|---|---|---|

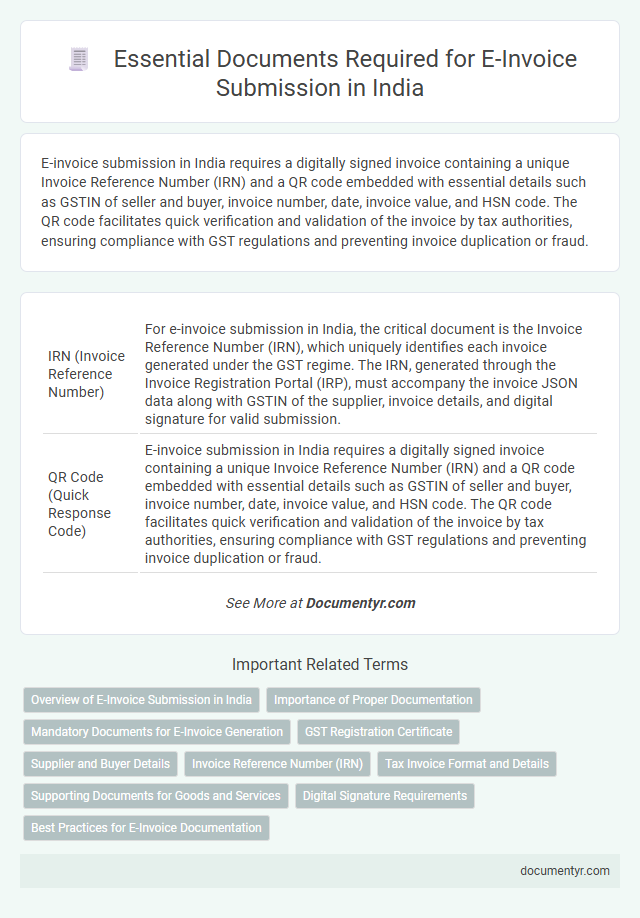

| 1 | IRN (Invoice Reference Number) | For e-invoice submission in India, the critical document is the Invoice Reference Number (IRN), which uniquely identifies each invoice generated under the GST regime. The IRN, generated through the Invoice Registration Portal (IRP), must accompany the invoice JSON data along with GSTIN of the supplier, invoice details, and digital signature for valid submission. |

| 2 | QR Code (Quick Response Code) | E-invoice submission in India requires a digitally signed invoice containing a unique Invoice Reference Number (IRN) and a QR code embedded with essential details such as GSTIN of seller and buyer, invoice number, date, invoice value, and HSN code. The QR code facilitates quick verification and validation of the invoice by tax authorities, ensuring compliance with GST regulations and preventing invoice duplication or fraud. |

| 3 | GSTR-1 Data | The necessary documents for e-invoice submission in India primarily include the GSTR-1 data, which contains detailed information about outward supplies such as invoice number, date, buyer and seller GSTIN, taxable value, and tax details. Accurate and timely submission of GSTR-1 data ensures compliance with GST regulations and seamless reconciliation of e-invoices in the government's Invoice Registration Portal (IRP). |

| 4 | EWB (E-Way Bill) Integration | E-invoice submission in India mandates the integration of the E-Way Bill (EWB) system, requiring the inclusion of essential documents such as the e-invoice JSON file, the EWB number, and detailed shipment information for seamless GST compliance. Accurate synchronization between e-invoice data and EWB generation ensures real-time validation and reduces discrepancies during transportation of goods. |

| 5 | Digital Signature Certificate (DSC) | A valid Digital Signature Certificate (DSC) is mandatory for authenticated e-invoice submission in India, ensuring secure and legally binding electronic transactions. It acts as a digital identity proof for the authorized signatory, facilitating the validation and verification process of the invoice data within the Government Invoice Registration Portal (IRP). |

| 6 | JSON Schema Invoice Format | E-invoice submission in India requires the JSON Schema Invoice Format, which includes mandatory fields such as supplier details, buyer details, invoice number, invoice date, GSTIN, HSN/SAC codes, item descriptions, quantities, rates, and tax values, ensuring compliance with the Goods and Services Tax Network (GSTN) standards. Accurate and complete JSON data adhering to this schema enables seamless validation, generation of IRN (Invoice Reference Number), and integration with GST returns for seamless tax filing. |

| 7 | GSTIN Validation Sheet | The GSTIN Validation Sheet is a critical document for e-invoice submission in India, ensuring all GSTINs mentioned in the invoice are verified against the GST portal to prevent errors and mismatches. Proper validation of supplier and recipient GSTINs streamlines compliance and helps avoid invoice rejection or subsequent tax discrepancies. |

| 8 | B2B Supply Annexure | For B2B supply annexure e-invoice submission in India, essential documents include the detailed invoice containing GSTIN of supplier and recipient, invoice number, date, HSN code, taxable value, and tax rates. Supporting annexures must accurately reflect the supply details, place of supply, and any applicable reverse charge mechanism to ensure compliance with the GST e-invoicing system. |

| 9 | SAC/HSN Code Mapping | E-invoice submission in India requires accurate mapping of SAC (Service Accounting Code) or HSN (Harmonized System of Nomenclature) codes to ensure compliance with GST regulations. These codes must be listed correctly in the invoice documents to facilitate seamless validation and integration with the Invoice Registration Portal (IRP). |

| 10 | Vendor API Authentication Token | Vendor API Authentication Token is essential for secure access and submission of e-invoices in India, ensuring authorized communication between the vendor system and the government's Invoice Registration Portal (IRP). This token validates the vendor's identity, enabling seamless exchange of invoice data and reducing risks of fraud during the e-invoice submission process. |

Overview of E-Invoice Submission in India

| Overview of E-Invoice Submission in India | |

|---|---|

| E-Invoice Definition | An electronic document generated on a government-approved portal containing invoice details in a standardized format. |

| Key Regulatory Body | Goods and Services Tax Network (GSTN) and Invoice Registration Portal (IRP) |

| Mandatory for | Businesses with annual turnover exceeding Rs20 crore (higher threshold for some states) |

| Purpose of E-Invoice Submission | Reduce tax evasion, improve invoice data authenticity, and streamline GST compliance. |

| Essential Documents Required |

|

| Submission Process | You need to prepare invoice details in JSON format and upload to the Invoice Registration Portal (IRP) to obtain a unique Invoice Reference Number (IRN). |

| Validation Time | IRP validates and returns digitally signed e-invoice within seconds. |

Importance of Proper Documentation

Proper documentation is crucial for accurate e-invoice submission in India to ensure compliance with the Goods and Services Tax (GST) regulations. Essential documents include the invoice itself, GSTIN details of both supplier and recipient, and details of the supply such as item description, quantity, and value. Maintaining accurate records prevents discrepancies, facilitates smooth audits, and supports seamless GST credit claims.

Mandatory Documents for E-Invoice Generation

For e-invoice submission in India, certain mandatory documents are required to ensure compliance with the Goods and Services Tax (GST) regulations. These documents facilitate accurate verification and seamless integration of e-invoices into the government systems.

The primary mandatory documents include the taxpayer's GSTIN, invoice details such as invoice number, date, and value, along with the buyer's GSTIN if applicable. Details of goods or services supplied, including HSN codes and quantity, must also be included. These documents are essential to generate a valid e-invoice under the Invoice Registration Portal (IRP) guidelines.

GST Registration Certificate

Submitting an e-invoice in India requires specific documents to ensure compliance with GST regulations. Your GST Registration Certificate is a crucial document for authenticating your business details during the submission process.

- GST Registration Certificate - This certificate verifies your business's GSTIN and is mandatory for e-invoice generation and submission.

- Purchase Order and Delivery Challan - These documents support the transaction details included in the e-invoice and ensure accuracy.

- Taxpayer Identification Documents - Documents like PAN card or business license help in cross-verifying the legal identity of the business submitting the e-invoice.

Supplier and Buyer Details

Accurate supplier and buyer details are essential for successful e-invoice submission in India. These details ensure compliance with the Goods and Services Tax Network (GSTN) requirements and facilitate seamless tax processing.

- Supplier Details - Includes supplier's legal name, GSTIN, address, and contact information required for proper identification and verification.

- Buyer Details - Comprises buyer's legal name, GSTIN or UIN (if applicable), billing address, and contact details for accurate invoice matching.

- Invoice Metadata - Contains invoice number, date, value, and HSN/SAC codes to properly link supplier and buyer information within the e-invoice system.

Verification of all supplier and buyer details before e-invoice submission minimizes errors and compliance issues with the GST authorities.

Invoice Reference Number (IRN)

Submitting an e-invoice in India requires specific documents to ensure compliance with GST regulations. The Invoice Reference Number (IRN) plays a crucial role in authenticating the invoice in the government system.

- Invoice Reference Number (IRN) Generation - Your invoice must have a unique IRN generated through the GST portal or API to validate the transaction.

- Signed Invoice Copy - The digitally signed e-invoice including the IRN is necessary for submission and future verification.

- GST Details and Tax Information - Accurate GSTIN of supplier and recipient along with detailed tax breakups must accompany the IRN for a valid e-invoice.

Tax Invoice Format and Details

For e-invoice submission in India, the primary document required is the Tax Invoice, which must comply with the prescribed format under the GST regime. The invoice should include critical details such as the supplier's GSTIN, invoice number, date, recipient's details, description of goods or services, HSN/SAC codes, quantity, taxable value, tax rates, and tax amounts. Proper adherence to these specifications ensures seamless integration with the Goods and Services Tax Network (GSTN) for validation and compliance.

Supporting Documents for Goods and Services

For e-invoice submission in India, essential documents include the purchase order, delivery challan, and tax invoices. These documents ensure accurate transaction recording and compliance with GST regulations.

Supporting documents for goods involve the packing list and delivery receipt, confirming the quantity and condition of items delivered. Service-related submissions require service contracts and job completion reports to validate service details.

Digital Signature Requirements

What documents are necessary for e-invoice submission in India focusing on digital signature requirements? You must have your digital signature certificate (DSC) readily available, issued by a Certifying Authority approved by the Controller of Certifying Authorities (CCA). The DSC ensures the authenticity and integrity of your e-invoice submissions under the GST regime.

What Documents are Necessary for E-Invoice Submission in India? Infographic