A business in India requires a valid GST invoice that includes essential details such as the supplier's and recipient's GSTIN, invoice number, date, description of goods or services, HSN or SAC code, taxable value, and applicable GST rates and amounts. Supporting documents like purchase orders, delivery challans, and payment receipts help maintain transparency and verify transactions. Proper documentation ensures compliance with the GST regulations and facilitates smooth input tax credit claims.

What Documents Does a Business Need for GST-Compliant Invoicing in India?

| Number | Name | Description |

|---|---|---|

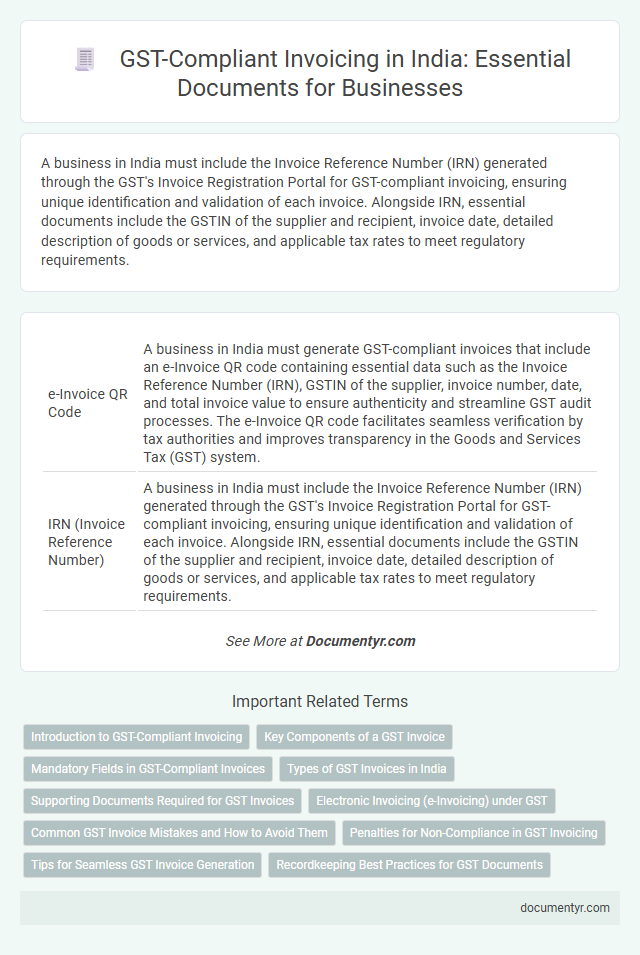

| 1 | e-Invoice QR Code | A business in India must generate GST-compliant invoices that include an e-Invoice QR code containing essential data such as the Invoice Reference Number (IRN), GSTIN of the supplier, invoice number, date, and total invoice value to ensure authenticity and streamline GST audit processes. The e-Invoice QR code facilitates seamless verification by tax authorities and improves transparency in the Goods and Services Tax (GST) system. |

| 2 | IRN (Invoice Reference Number) | A business in India must include the Invoice Reference Number (IRN) generated through the GST's Invoice Registration Portal for GST-compliant invoicing, ensuring unique identification and validation of each invoice. Alongside IRN, essential documents include the GSTIN of the supplier and recipient, invoice date, detailed description of goods or services, and applicable tax rates to meet regulatory requirements. |

| 3 | GST HSN Code Mapping Sheet | A GST HSN Code Mapping Sheet is essential for businesses to accurately classify goods and services under the Harmonized System of Nomenclature, ensuring compliance with GST regulations. This document helps streamline invoicing, minimize tax errors, and facilitates proper input tax credit claims by linking each product or service with the appropriate HSN code. |

| 4 | Dynamic QR for B2C Invoices | Businesses in India must include a dynamic QR code on B2C invoices to comply with GST regulations, enabling instant verification and seamless digital payment processing. This dynamic QR code contains detailed transaction data as mandated by the GST Council, enhancing transparency and reducing fraud. |

| 5 | GSTR-2B Matching Summary | For GST-compliant invoicing in India, businesses must maintain detailed documents such as tax invoices, debit/credit notes, and purchase summaries aligned with GSTR-2B matching data. The GSTR-2B matching summary provides a static auto-drafted input tax credit statement, enabling businesses to reconcile their purchase invoices with supplier filings for accurate GST credit claims. |

| 6 | Electronic Way Bill (E-Way Bill) | A GST-compliant invoice in India must include essential details such as the supplier's GSTIN, invoice number, date, description of goods or services, taxable value, and applicable GST rates. The Electronic Way Bill (E-Way Bill) is crucial for the transport of goods valued over INR 50,000, serving as mandatory documentation to track the movement of goods and ensure compliance with GST regulations. |

| 7 | Digital Signature Certificate (DSC) File | A Digital Signature Certificate (DSC) file is essential for GST-compliant invoicing in India as it ensures the authenticity and integrity of digital invoices by enabling electronic signing. Businesses must obtain a DSC from authorized certifying authorities to securely sign GST invoices, facilitating legal compliance and streamlined tax filing. |

| 8 | Reverse Charge Declaration Annexure | For GST-compliant invoicing in India under the reverse charge mechanism, businesses must include a Reverse Charge Declaration Annexure specifying the supplier's and recipient's GSTIN, the nature of goods or services, and the applicable tax rate. This annexure ensures accurate tax liability allocation and compliance with the Central Goods and Services Tax (CGST) rules. |

| 9 | Input Tax Credit (ITC) Reconciliation Report | Businesses in India must maintain a detailed Input Tax Credit (ITC) Reconciliation Report as part of their GST-compliant invoicing documentation, ensuring accurate matching of inward supplies with GST returns. This report plays a critical role in validating eligibility for ITC claims and preventing discrepancies during GST audits. |

| 10 | Self-Invoice for Unregistered Purchases | A self-invoice for unregistered purchases under GST in India must include the supplier's name, address, and GSTIN (if available), buyer's details, invoice number, date, description of goods or services, quantity, value, and applicable GST rates and amounts. Maintaining accurate self-invoices ensures compliance with GST regulations and facilitates proper input tax credit claims for businesses purchasing from unregistered vendors. |

Introduction to GST-Compliant Invoicing

Goods and Services Tax (GST) has transformed the invoicing process in India, making compliance a critical aspect for all businesses. A GST-compliant invoice must include specific details to ensure proper tax documentation and smooth processing during audits. You need to understand the mandatory components and documents required for creating valid GST invoices to avoid penalties and maintain transparent financial records.

Key Components of a GST Invoice

| Key Component | Description |

|---|---|

| Invoice Number | Unique and sequential number assigned to each invoice for tracking and compliance. |

| Invoice Date | Date on which the supply of goods or services is made or billed. |

| Supplier Details | Name, address, and GSTIN (Goods and Services Tax Identification Number) of the supplier issuing the invoice. |

| Recipient Details | Name, address, and GSTIN of the recipient or customer, especially for B2B transactions. |

| Description of Goods or Services | Details of the products or services supplied including quantity, unit, and nature of supply. |

| HSN/SAC Code | Harmonized System of Nomenclature (HSN) code for goods or Service Accounting Code (SAC) for services. |

| Taxable Value | Value of goods or services before applying GST. |

| GST Rate | Applicable rate(s) of IGST, CGST, and SGST based on the nature and location of supply. |

| Amount of Tax Charged | Separate value of CGST, SGST, and IGST charged on the taxable value. |

| Total Invoice Value | Final payable amount including taxable value and GST components. |

| Place of Supply | Location where the goods or services are supplied, important for determining applicable GST. |

| Signature or Digital Signature | Signature of the supplier or authorized signatory, mandatory for authentic GST invoices. |

Mandatory Fields in GST-Compliant Invoices

GST-compliant invoices in India must include specific mandatory fields as prescribed by the Goods and Services Tax law. These elements ensure the validity and authenticity of the invoice for both suppliers and recipients.

Key mandatory fields include the supplier's and recipient's GSTIN, invoice number, date of issue, and a detailed description of goods or services supplied. The invoice must also display the quantity, unit price, taxable value, applicable GST rates, and the amount of tax charged.

Types of GST Invoices in India

Businesses in India must issue specific types of GST invoices to comply with taxation laws, including Tax Invoice, Bill of Supply, and Debit or Credit Note. A Tax Invoice is mandatory for all supply of goods or services where GST is applicable, while a Bill of Supply is issued when GST is not charged, such as for exempted goods. Debit and Credit Notes are used to adjust the taxable value or tax amount after issuance of the original invoice, ensuring your records remain accurate and compliant.

Supporting Documents Required for GST Invoices

For GST-compliant invoicing in India, attaching the correct supporting documents is essential to ensure smooth tax credit claims and audit processes. You must maintain these documents accurately to comply with GST regulations.

- Purchase Order - A formal purchase order confirms the buyer's intent and agreement on the goods or services.

- Delivery Challan - This document validates the physical movement of goods from one place to another under GST norms.

- Payment Receipts - Payment proof supports the invoicing process and reconciles payments against issued GST invoices.

Electronic Invoicing (e-Invoicing) under GST

Businesses in India must comply with GST invoicing rules to ensure seamless tax processes and avoid penalties. Electronic Invoicing (e-Invoicing) under GST mandates generating invoices in a standardized digital format approved by the government.

- Invoice Reference Number (IRN) - A unique IRN is generated for each e-invoice by the Invoice Registration Portal (IRP) to authenticate the document.

- Digital Signature - The IRP digitally signs the e-invoice, ensuring authenticity and security of the transaction data.

- JSON Format - E-invoices must be prepared in the prescribed JSON format containing all mandatory GST details such as supplier and recipient GSTIN, invoice value, and tax amounts.

You must maintain these electronically generated documents securely to comply with GST audit requirements and streamline filing returns.

Common GST Invoice Mistakes and How to Avoid Them

GST-compliant invoicing in India requires specific documents such as a GST invoice, purchase order, delivery challan, and payment receipt. Ensuring these documents are accurate helps maintain compliance and smooth transaction records.

Common GST invoice mistakes include incorrect GSTIN, missing HSN/SAC codes, and mismatched invoice values. These errors can lead to penalties and delays in input tax credit claims. Verifying details against official records and using automated invoicing software can help you avoid these pitfalls effectively.

Penalties for Non-Compliance in GST Invoicing

Maintaining GST-compliant invoices is crucial for businesses in India to avoid penalties and ensure smooth tax operations. Non-compliance can lead to financial losses and legal complications that impact your business credibility.

- Penalty for Incorrect GST Invoices - Businesses may face fines up to Rs10,000 for issuing incorrect or incomplete GST invoices under the Central Goods and Services Tax Act.

- Interest on Delayed Tax Payment - Interest charges apply at 18% per annum for late payment of GST due to incorrect invoicing or reporting.

- Prosecution for Fraudulent Invoices - Legal prosecution, including imprisonment, can be enforced for issuing fake or fraudulent GST invoices as per Section 132 of the CGST Act.

Tips for Seamless GST Invoice Generation

What documents does a business need for GST-compliant invoicing in India? A business requires a valid GSTIN, customer details, and invoice number for seamless GST invoice generation. Accurate product descriptions, HSN codes, and tax rates ensure compliance and avoid discrepancies.

What Documents Does a Business Need for GST-Compliant Invoicing in India? Infographic