To issue a pro forma invoice for export, essential documents include a detailed product description, buyer and seller information, terms of sale, and payment conditions. Exporters must also provide shipment details such as quantity, price, and delivery schedule to ensure clarity and facilitate customs clearance. Accurate documentation helps prevent delays and ensures smooth international transactions.

What Documents are Needed for Issuing a Pro Forma Invoice for Export?

| Number | Name | Description |

|---|---|---|

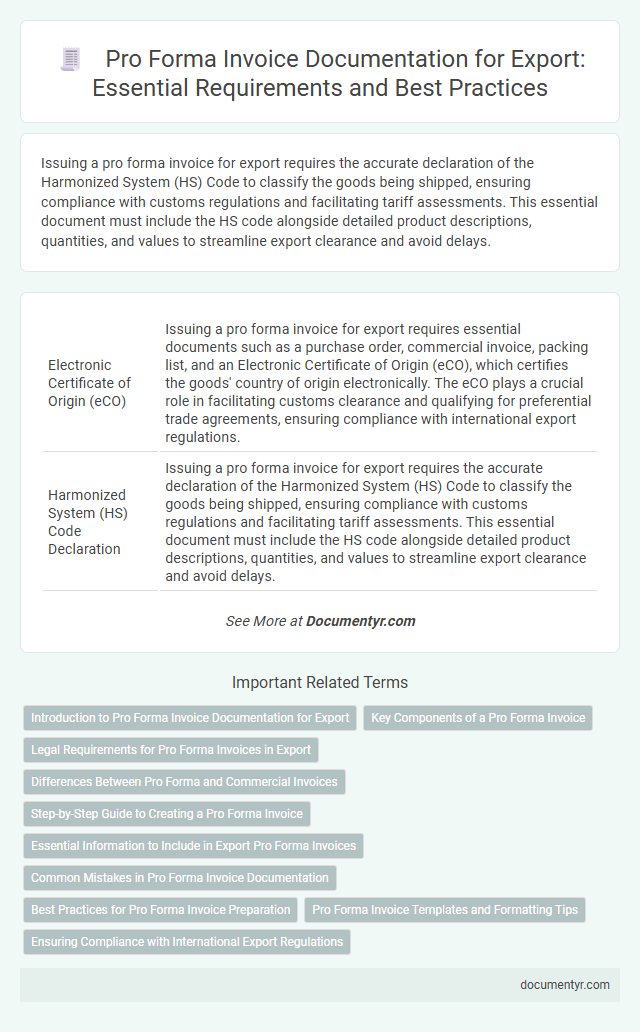

| 1 | Electronic Certificate of Origin (eCO) | Issuing a pro forma invoice for export requires essential documents such as a purchase order, commercial invoice, packing list, and an Electronic Certificate of Origin (eCO), which certifies the goods' country of origin electronically. The eCO plays a crucial role in facilitating customs clearance and qualifying for preferential trade agreements, ensuring compliance with international export regulations. |

| 2 | Harmonized System (HS) Code Declaration | Issuing a pro forma invoice for export requires the accurate declaration of the Harmonized System (HS) Code to classify the goods being shipped, ensuring compliance with customs regulations and facilitating tariff assessments. This essential document must include the HS code alongside detailed product descriptions, quantities, and values to streamline export clearance and avoid delays. |

| 3 | Export Control Classification Number (ECCN) | Issuing a pro forma invoice for export requires the Export Control Classification Number (ECCN) to ensure compliance with U.S. export regulations and identify controlled items under the Commerce Control List. Including the ECCN helps determine licensing requirements, prevents shipment delays, and supports accurate customs documentation during international trade transactions. |

| 4 | Digital KYC (Know Your Customer) Profile | Issuing a pro forma invoice for export requires a comprehensive Digital KYC profile, including verified identification documents, business registration certificates, and proof of address to ensure compliance with international trade regulations. Accurate digital documentation accelerates the invoicing process, reduces risks of fraud, and facilitates seamless customs clearance. |

| 5 | Automated Export System (AES) Filing Reference | Issuing a pro forma invoice for export requires the Automated Export System (AES) filing reference as a critical document to ensure compliance with U.S. export regulations. The AES filing reference confirms that the exporter has electronically submitted shipment details to U.S. Customs and Border Protection, facilitating accurate export control and statistical data reporting. |

| 6 | Blockchain-based Trade Credentials | Issuing a pro forma invoice for export requires blockchain-based trade credentials such as digital bills of lading, smart contract-enabled certificates of origin, and verifiable electronic export licenses to ensure authenticity and transparency. These documents enhance security and streamline the verification process by providing immutable proof of transaction details on the blockchain. |

| 7 | Digital Letter of Intent (LOI) | A Digital Letter of Intent (LOI) is essential for issuing a pro forma invoice for export, serving as a formal confirmation of the buyer's interest and outlining preliminary terms of the transaction. This document facilitates trust between parties and ensures that key export details such as product specifications, quantities, and payment terms are clearly communicated before final invoicing. |

| 8 | Goods Traceability Report | A Goods Traceability Report is essential for issuing a pro forma invoice for export as it verifies the origin and movement history of the goods, ensuring compliance with international trade regulations. This document supports accurate product descriptions, quantities, and quality standards, reducing the risk of customs delays and disputes. |

| 9 | Exporter’s Self-Certification Statement | The Exporter's Self-Certification Statement is essential for issuing a pro forma invoice for export, as it verifies the origin and compliance of goods without requiring third-party certification. This document typically includes exporter details, product descriptions, and declarations of conformity with export regulations, ensuring smoother customs processing and trade facilitation. |

| 10 | E-signature Authorization Letter | A valid E-signature Authorization Letter is required when issuing a pro forma invoice for export to verify the authorized signatory's legal empowerment to digitally sign the document. This letter must clearly state the representative's name, role, and scope of authority to ensure compliance with international trade and digital transaction regulations. |

Introduction to Pro Forma Invoice Documentation for Export

| Document Name | Purpose | Key Details |

|---|---|---|

| Pro Forma Invoice | Provides a preliminary bill of sale to the buyer before shipment | Contains description of goods, quantity, price, total cost, and payment terms |

| Commercial Invoice | Final document used for customs clearance and payment processing | Includes detailed product information, buyer and seller details, and invoice number |

| Packing List | Details packaging specifics and contents of each shipment package | Lists dimensions, weight, and itemized contents for customs and logistics |

| Export License | Authorization for exporting specific goods to certain countries | Issued by government export control authorities based on product and destination |

| Certificate of Origin | Certifies the country where the goods were manufactured | Required by customs to determine tariff rates and import eligibility |

| Buyer's Purchase Order | Confirms buyer's order details and acceptance of terms | Includes order quantity, product specifications, and agreed price |

| Letter of Credit or Payment Guarantee | Ensures seller will receive payment under agreed terms | Issued by the buyer's bank to support international trade transactions |

Key Components of a Pro Forma Invoice

What documents are needed for issuing a pro forma invoice for export? A pro forma invoice must include detailed descriptions of the goods, including quantity, price, and weight. Essential documentation also involves the buyer and seller information, shipment terms, and payment conditions.

Legal Requirements for Pro Forma Invoices in Export

A Pro Forma Invoice for export must comply with specific legal requirements to ensure international trade regulations are met. Essential documents include a detailed description of goods, quantities, prices, and terms of sale to avoid customs delays.

The invoice should contain accurate exporter and importer details, including tax identification numbers and contact information. Certifications such as export licenses or permits may be necessary depending on the destination country's regulations.

Differences Between Pro Forma and Commercial Invoices

Issuing a pro forma invoice for export requires specific documents that outline the preliminary transaction details. Understanding the differences between pro forma and commercial invoices is essential to ensure compliance and smooth processing.

- Pro Forma Invoice - A preliminary document providing estimated costs and terms before the actual sale occurs.

- Commercial Invoice - A final, legally binding document used for customs declaration and payment processing.

- Required Documents - Include the purchase order, export license, and detailed product description for issuing a pro forma invoice.

Your ability to distinguish these documents helps prevent delays in export transactions and customs clearance.

Step-by-Step Guide to Creating a Pro Forma Invoice

Creating a pro forma invoice for export requires specific documents to ensure accuracy and compliance. Essential documents include the commercial invoice, packing list, and export license.

Start by gathering detailed information about the buyer and seller, including contact details and addresses. List the description, quantity, and value of the goods clearly. Attach supporting documents such as the bill of lading and customs declaration to complete the pro forma invoice.

Essential Information to Include in Export Pro Forma Invoices

Issuing a pro forma invoice for export requires essential documents such as the buyer's purchase order, the seller's commercial registration, and export licenses if applicable. The pro forma invoice must include detailed item descriptions, quantities, unit prices, total amounts, and shipping terms to ensure clarity. Accurate inclusion of the exporter and importer information, payment terms, and delivery details is crucial for smooth customs clearance and transaction processing.

Common Mistakes in Pro Forma Invoice Documentation

Issuing a pro forma invoice for export requires accurate documentation such as a detailed product description, correct buyer and seller information, and precise pricing details. Common mistakes include incomplete or incorrect product specifications, missing payment terms, and failure to include necessary export compliance information. Ensuring all required documents are complete and accurate prevents delays in customs clearance and facilitates smooth international transactions.

Best Practices for Pro Forma Invoice Preparation

Proper documentation is essential for issuing a pro forma invoice for export to ensure smooth customs clearance and accurate quoting. Following best practices helps avoid delays and misunderstandings during international transactions.

- Commercial details - Include a detailed description of goods, quantities, unit prices, and total value for transparency.

- Buyer and seller information - Clearly state the names, addresses, and contact details to identify both parties involved.

- Payment and delivery terms - Specify Incoterms, payment method, and estimated shipment dates to align expectations.

Pro Forma Invoice Templates and Formatting Tips

Issuing a pro forma invoice for export requires precise documentation to ensure clarity and compliance with international trade regulations. Proper formatting and the use of reliable pro forma invoice templates simplify the process and enhance professionalism.

- Essential Documents - Include the buyer's purchase order, product description, quantity, price, and delivery terms to accurately draft the invoice.

- Pro Forma Invoice Templates - Use templates that clearly outline all necessary fields such as exporter and importer details, payment terms, and shipping information for completeness.

- Formatting Tips - Maintain a clean layout with consistent fonts, clear headings, and itemized listings to improve readability and reduce errors during export processing.

What Documents are Needed for Issuing a Pro Forma Invoice for Export? Infographic