Submitting invoices to insurance companies requires a clear and detailed invoice outlining the services provided, along with any relevant medical reports or treatment documentation. Proof of payment and the insured pet's identification, such as vaccination records or registration papers, are often necessary to validate the claim. Accurate and complete documentation ensures faster processing and reduces the likelihood of claim denial.

What Documents are Necessary for Submitting Invoices to Insurance Companies?

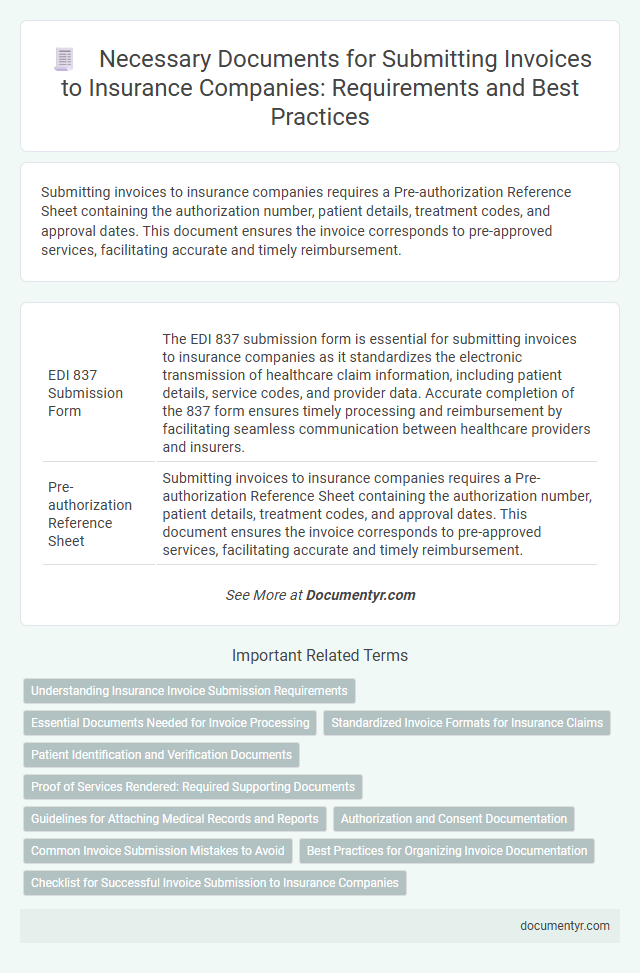

| Number | Name | Description |

|---|---|---|

| 1 | EDI 837 Submission Form | The EDI 837 submission form is essential for submitting invoices to insurance companies as it standardizes the electronic transmission of healthcare claim information, including patient details, service codes, and provider data. Accurate completion of the 837 form ensures timely processing and reimbursement by facilitating seamless communication between healthcare providers and insurers. |

| 2 | Pre-authorization Reference Sheet | Submitting invoices to insurance companies requires a Pre-authorization Reference Sheet containing the authorization number, patient details, treatment codes, and approval dates. This document ensures the invoice corresponds to pre-approved services, facilitating accurate and timely reimbursement. |

| 3 | Explanation of Benefits (EOB) Synchronization | Submitting invoices to insurance companies requires accurate synchronization with the Explanation of Benefits (EOB) documents to verify the services billed and payments made by the insurer. Proper alignment of the invoice details with the EOB ensures faster claim processing, reduces disputes, and facilitates accurate reimbursement tracking. |

| 4 | Claim Attachment Cover Sheet | A Claim Attachment Cover Sheet is essential when submitting invoices to insurance companies, as it organizes and identifies all supporting documents related to the claim. This cover sheet ensures accurate processing by including details like claimant information, invoice numbers, service descriptions, and claim reference codes. |

| 5 | Diagnosis Code Verification Log | The Diagnosis Code Verification Log is essential for submitting invoices to insurance companies as it ensures that all medical procedure codes accurately correspond to the patient's diagnosis, reducing claim denials. This documentation supports compliance with medical billing standards and streamlines the verification process, facilitating timely reimbursement. |

| 6 | Digital Signature Authentication Certificate | Submitting invoices to insurance companies requires a Digital Signature Authentication Certificate to verify the authenticity and integrity of the electronic documents. This certificate ensures compliance with legal standards and prevents fraud, facilitating faster approval and payment processes. |

| 7 | HIPAA Compliant Data Transfer Proof | Submitting invoices to insurance companies requires including proof of HIPAA-compliant data transfer such as encrypted electronic transmission logs or secure fax confirmations. These documents ensure patient information privacy and compliance with regulatory standards during invoice submission. |

| 8 | Invoice Itemization Matrix | Invoice submission to insurance companies requires a detailed Invoice Itemization Matrix listing all services, quantities, unit prices, and total costs for each item. This matrix ensures transparent billing, facilitates claim verification, and accelerates reimbursement by providing clear, itemized documentation aligned with insurance policy requirements. |

| 9 | Proof of Medical Necessity Statement | A Proof of Medical Necessity statement is essential when submitting invoices to insurance companies, as it justifies the prescribed treatment or service from a clinical perspective. This document typically includes detailed medical diagnoses, treatment plans, and physician signatures to validate the claim's legitimacy and ensure reimbursement compliance. |

| 10 | Blockchain Timestamp Record | Submitting invoices to insurance companies requires a detailed billing statement, proof of services rendered, patient information, and a blockchain timestamp record to ensure data integrity and verify the exact time the invoice was created. The blockchain timestamp record provides an immutable, transparent audit trail that helps prevent fraud and accelerates claim processing by confirming the authenticity of the invoice submission. |

Understanding Insurance Invoice Submission Requirements

What documents are necessary for submitting invoices to insurance companies? Insurance companies typically require a detailed invoice, proof of service, and patient information to process claims accurately. Understanding these requirements ensures timely reimbursement and minimizes claim denials.

Essential Documents Needed for Invoice Processing

Essential documents required for submitting invoices to insurance companies include the original invoice, proof of service or delivery, and the insured party's policy details. These documents verify the transaction and ensure the claim aligns with the insurance coverage terms. Proper submission with complete documentation facilitates timely invoice processing and payment by the insurance provider.

Standardized Invoice Formats for Insurance Claims

Standardized invoice formats are essential for submitting invoices to insurance companies to ensure accuracy and faster processing. These formats typically include clearly defined sections for patient information, services rendered, and payment details.

Your invoice must follow the insurance provider's specified template, often compliant with industry standards like HIPAA X12 837 for healthcare claims. Including all required fields such as diagnosis codes, procedure codes, and provider identification helps prevent delays in claim approval. Proper documentation aligned with these standards facilitates smoother communication between your billing department and insurance companies.

Patient Identification and Verification Documents

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Official identification such as driver's license or passport. | Confirms the patient's identity to prevent fraud and ensure accurate billing. |

| Insurance Card | The patient's valid health insurance card containing policy number and provider details. | Verifies coverage eligibility and links the invoice to the correct insurance plan. |

| Patient Registration Form | Completed form capturing personal and contact information. | Ensures all patient details are up to date for claims processing. |

| Authorization or Referral Documents | Documents issued by insurance companies or referring physicians. | Validates that the procedure or treatment is approved under the insurance plan. |

| Medical Records or Treatment Notes | Records that verify the services provided to the patient. | Supports the invoice with proof of treatment and justifies the charges. |

Providing accurate patient identification and verification documents ensures smooth processing of your invoices with insurance companies, reducing delays and claim denials.

Proof of Services Rendered: Required Supporting Documents

Proof of services rendered is essential when submitting invoices to insurance companies. These documents validate the work performed and support the billing details provided.

Common required supporting documents include detailed service reports, signed contracts, and delivery receipts. You should also provide timesheets, client authorizations, and any correspondence confirming service acceptance.

Guidelines for Attaching Medical Records and Reports

Submitting invoices to insurance companies requires attaching precise medical records and detailed reports to validate the billed services. Medical documentation must include patient history, treatment details, diagnosis codes, and physician notes to ensure accurate claims processing. Properly organized and legible records prevent claim denials and expedite reimbursement from insurance providers.

Authorization and Consent Documentation

Authorization and consent documentation are essential when submitting invoices to insurance companies. These documents confirm that you have permission to bill the insurer for medical or service costs incurred by the insured party.

Proof of patient consent and authorization forms must accompany your invoice to ensure claim approval. Insurance companies require clear evidence that the services billed were approved by the patient or their legal representative.

Common Invoice Submission Mistakes to Avoid

Submitting accurate invoices to insurance companies requires careful preparation of necessary documents. Understanding common mistakes can help ensure faster processing and reimbursement.

- Missing or Incomplete Documentation - Failing to include all required forms such as claim forms, treatment records, and provider credentials can delay invoice approval.

- Incorrect Patient Information - Errors in patient identification details like name, insurance ID, or date of birth can result in claim denials or rejections.

- Lack of Clear Service Descriptions - Providing vague or incomplete descriptions of services rendered often leads to confusion and additional requests for information.

Ensuring all documents are complete, accurate, and clearly detailed prevents common submission errors and expedites insurance invoice processing.

Best Practices for Organizing Invoice Documentation

Submitting invoices to insurance companies requires thorough documentation to ensure smooth processing and timely payments. Organizing these documents according to best practices minimizes errors and enhances claim approval rates.

- Itemized Invoice - Clearly list all services, products, and costs to provide transparency and facilitate accurate insurance assessment.

- Proof of Service - Include signed service agreements, delivery receipts, or completion certificates to validate the billed items.

- Insurance Claim Forms - Attach all required claim forms filled out correctly to comply with the insurer's submission protocols.

What Documents are Necessary for Submitting Invoices to Insurance Companies? Infographic